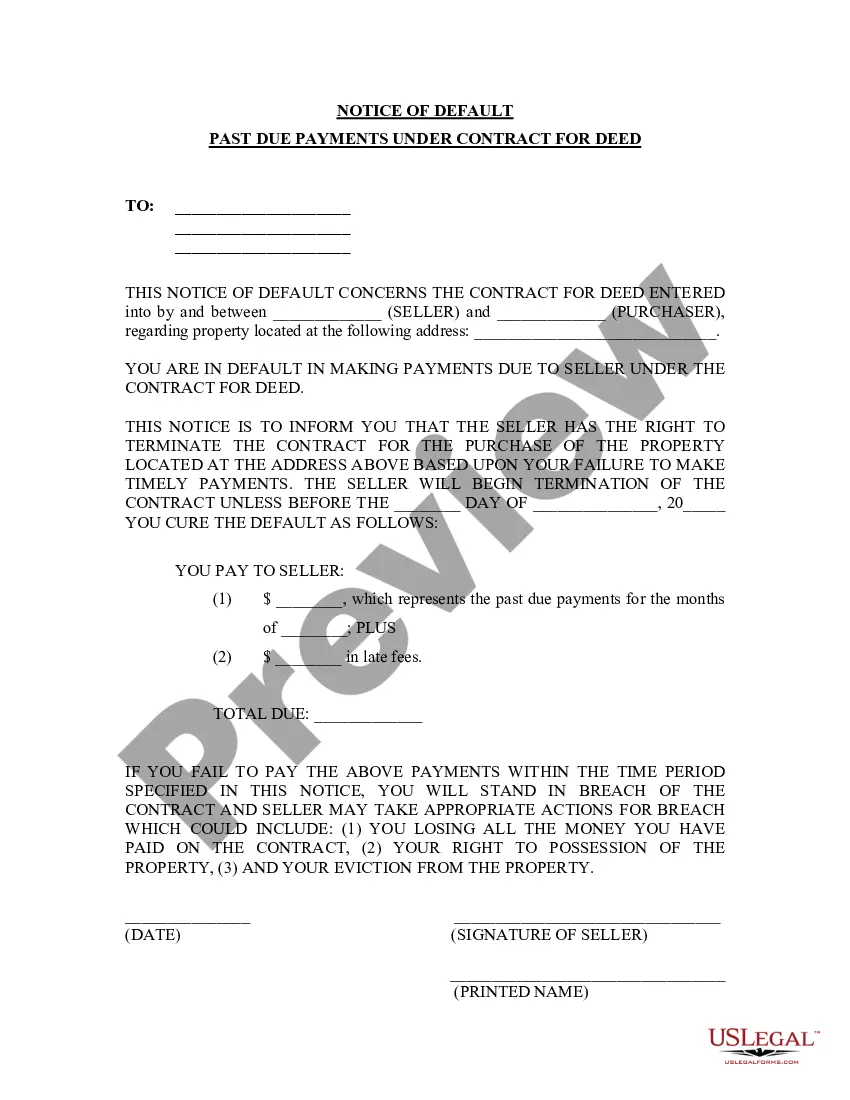

This Notice of Default Past Due Payments for Contract for Deed form acts as the Seller's initial notice to Purchaser of late payment toward the purchase price of the contract for deed property. Seller will use this document to provide the necessary notice to Purchaser that payment terms have not been met in accordance with the contract for deed, and failure to timely comply with demands of notice will result in default of the contract for deed.

Title: Understanding the Salt Lake City, Utah Notice of Default for Past Due Payments in Connection with Contract for Deed Introduction: If you are involved in a Contract for Deed agreement in Salt Lake City, Utah, it is important to understand the implications of falling behind on your payments. In such cases, a Notice of Default may be issued, indicating the buyer's failure to meet the contractual payment obligations. This comprehensive guide explores the intricacies of Salt Lake City, Utah Notice of Default for Past Due Payments in connection with Contract for Deed, shedding light on its definition, consequences, and potential resolution options. Key Points: 1. Defining a Salt Lake City, Utah Notice of Default for Past Due Payments: — A Notice of Default is a formal written communication sent by the seller to the buyer when the latter fails to make the required payments stipulated in a Contract for Deed agreement in Salt Lake City, Utah. — This notice generally outlines the specifics of the missed payments, the total amount due, and sets a deadline for the buyer to rectify the problem. 2. Consequences of a Notice of Default: — Legal implications: A Notice of Default puts the buyer on notice that their failure to meet the payment obligations may result in legal action being taken against them. — Possibility of contract termination: If the buyer fails to remedy the default within the given timeframe, the seller has the right to terminate the Contract for Deed. — Potential loss of equity: Defaulting on payments may result in the buyer losing any equity they have built up over time in the property. 3. Different Types of Salt Lake City, Utah Notices of Default: — Notice of Default for Late Payment: This type of notice is issued when the buyer fails to make a payment on time as specified in the Contract for Deed agreement. — Notice of Default for Missed Payment: This notice is sent when the buyer completely neglects to make a payment as scheduled. — Notice of Default for Partial Payment: If the buyer pays an amount that is less than the agreed-upon installment, the seller may issue this notice highlighting the deficit. 4. Resolving a Notice of Default: — Communication and negotiation: It is essential for the buyer to promptly communicate with the seller upon receiving a Notice of Default in order to explore possible resolution options, such as payment plans or loan modifications. — Curing the default: The buyer should aim to rectify the default by making the required payment, including any applicable late fees or penalties, before the stipulated deadline. — Seeking legal help: In complex situations, it might be beneficial for the buyer to consult an attorney specializing in real estate law to protect their rights and explore potential legal remedies. Conclusion: When dealing with a Salt Lake City, Utah Notice of Default for Past Due Payments in connection with a Contract for Deed, it is crucial to take immediate action to remedy the situation. Understanding the consequences and various types of notices will enable you to navigate this potentially complex process effectively. Open communication, negotiation, and expert guidance can often help resolve the issue, allowing both parties to move forward while protecting their interests.Title: Understanding the Salt Lake City, Utah Notice of Default for Past Due Payments in Connection with Contract for Deed Introduction: If you are involved in a Contract for Deed agreement in Salt Lake City, Utah, it is important to understand the implications of falling behind on your payments. In such cases, a Notice of Default may be issued, indicating the buyer's failure to meet the contractual payment obligations. This comprehensive guide explores the intricacies of Salt Lake City, Utah Notice of Default for Past Due Payments in connection with Contract for Deed, shedding light on its definition, consequences, and potential resolution options. Key Points: 1. Defining a Salt Lake City, Utah Notice of Default for Past Due Payments: — A Notice of Default is a formal written communication sent by the seller to the buyer when the latter fails to make the required payments stipulated in a Contract for Deed agreement in Salt Lake City, Utah. — This notice generally outlines the specifics of the missed payments, the total amount due, and sets a deadline for the buyer to rectify the problem. 2. Consequences of a Notice of Default: — Legal implications: A Notice of Default puts the buyer on notice that their failure to meet the payment obligations may result in legal action being taken against them. — Possibility of contract termination: If the buyer fails to remedy the default within the given timeframe, the seller has the right to terminate the Contract for Deed. — Potential loss of equity: Defaulting on payments may result in the buyer losing any equity they have built up over time in the property. 3. Different Types of Salt Lake City, Utah Notices of Default: — Notice of Default for Late Payment: This type of notice is issued when the buyer fails to make a payment on time as specified in the Contract for Deed agreement. — Notice of Default for Missed Payment: This notice is sent when the buyer completely neglects to make a payment as scheduled. — Notice of Default for Partial Payment: If the buyer pays an amount that is less than the agreed-upon installment, the seller may issue this notice highlighting the deficit. 4. Resolving a Notice of Default: — Communication and negotiation: It is essential for the buyer to promptly communicate with the seller upon receiving a Notice of Default in order to explore possible resolution options, such as payment plans or loan modifications. — Curing the default: The buyer should aim to rectify the default by making the required payment, including any applicable late fees or penalties, before the stipulated deadline. — Seeking legal help: In complex situations, it might be beneficial for the buyer to consult an attorney specializing in real estate law to protect their rights and explore potential legal remedies. Conclusion: When dealing with a Salt Lake City, Utah Notice of Default for Past Due Payments in connection with a Contract for Deed, it is crucial to take immediate action to remedy the situation. Understanding the consequences and various types of notices will enable you to navigate this potentially complex process effectively. Open communication, negotiation, and expert guidance can often help resolve the issue, allowing both parties to move forward while protecting their interests.