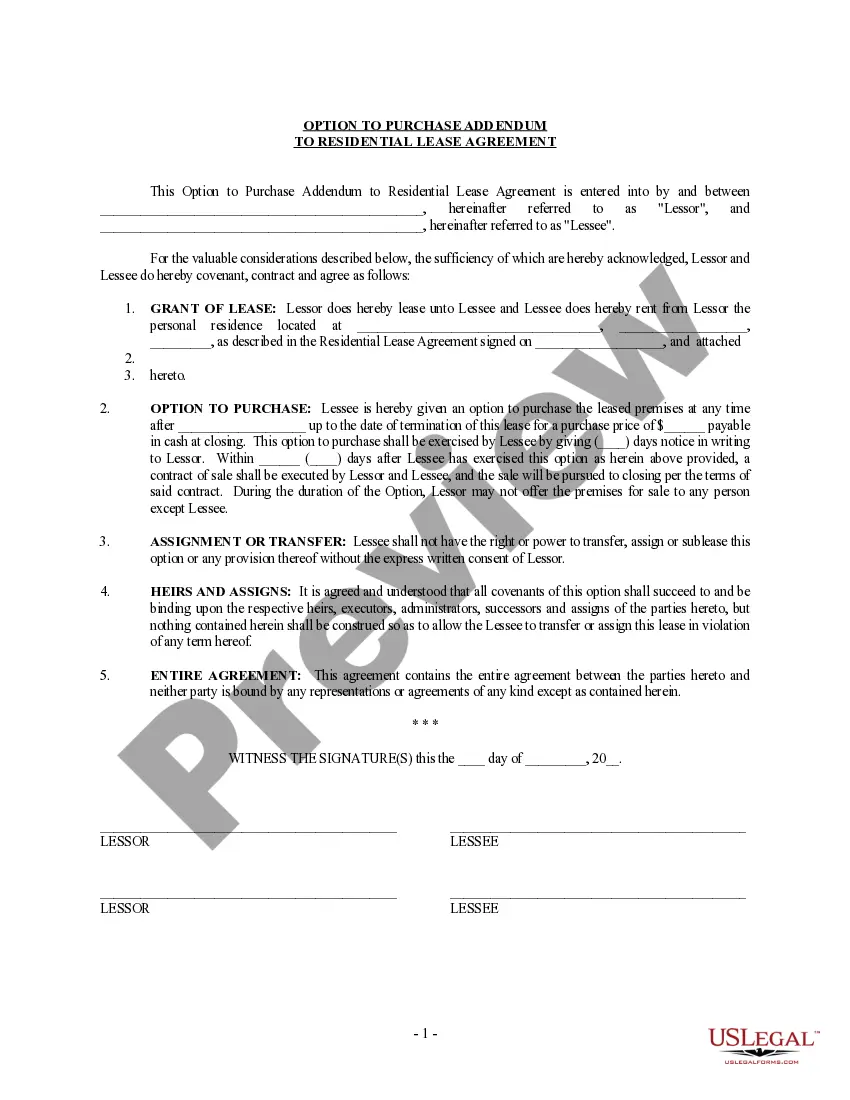

This Option to Purchase Addendum to Residential and Lease Agreement is entered into by and between the lessor and the lessee. The lessor agrees not to offer the residence for sale to anyone during the term of the lease, and to give the lessee (tenant) the option to purchase the residence at any time prior to the expiration of the lease, provided the lessee gives notice of intent to purchase in accordance with the provisions of the Addendum. At that point, a separate contract of sale will be executed and the sale will proceed as any sale would.

Please note: This Addendum form is NOT a lease agreement. You will need a separate Residential Lease Agreement. The Addendum would be attached to that Agreement

West Jordan Utah Option to Purchase Addendum to Residential Lease — Lease or Rent to Own is a legal document that provides tenants the opportunity to potentially purchase the property they are currently leasing. This addendum acts as an extension or attachment to the existing lease agreement, outlining the terms and conditions of the lease-to-own arrangement. In West Jordan, Utah, there are several types of Option to Purchase Addendum to Residential Lease — Lease or Rent to Own agreements available, each catering to different circumstances and needs. These may include: 1. Fixed Purchase Price: This type of addendum specifies a predetermined purchase price for the property, which will remain unchanged throughout the lease term. This offers stability and eliminates any potential confusion about the property's price in the future. 2. Adjustable Purchase Price: In contrast to fixed purchase price agreements, an adjustable purchase price addendum allows for price adjustments based on factors such as market fluctuations or property appraisals. This provides more flexibility for both the tenant and landlord to negotiate the final purchase price. 3. Lease Option Term: This addendum addresses the length of the lease option period, during which the tenant has the right to buy the property. It outlines the specific start and end dates, giving both parties a clear understanding of the timeframe in which the purchase can be made. 4. Option Fee: An option fee may be included in the addendum, which is a non-refundable payment made by the tenant to secure the right to purchase the property within the agreed-upon timeframe. This fee is typically credited towards the purchase price if the tenant decides to buy the property. 5. Maintenance Responsibilities: The addendum may delineate the maintenance responsibilities of the tenant during the lease period. This clarifies who is responsible for repairs, upgrades, and general upkeep of the property. It is essential for both parties to understand and agree upon these terms. 6. Rights and Obligations: This section outlines the rights and obligations of both the tenant and the landlord in the lease-to-own agreement. It ensures that both parties have a clear understanding of their roles and responsibilities throughout the option period. By using a West Jordan Utah Option to Purchase Addendum to Residential Lease — Lease or Rent to Own agreement, tenants have the opportunity to evaluate the property, test the neighborhood, and consider whether they want to become homeowners. This type of arrangement can provide flexibility and potential future benefits while giving tenants a chance to save for a down payment or improve their credit score before making a long-term commitment. It is advisable for tenants to consult with a real estate attorney or a qualified professional to understand the legal and financial implications of entering into such an agreement.West Jordan Utah Option to Purchase Addendum to Residential Lease — Lease or Rent to Own is a legal document that provides tenants the opportunity to potentially purchase the property they are currently leasing. This addendum acts as an extension or attachment to the existing lease agreement, outlining the terms and conditions of the lease-to-own arrangement. In West Jordan, Utah, there are several types of Option to Purchase Addendum to Residential Lease — Lease or Rent to Own agreements available, each catering to different circumstances and needs. These may include: 1. Fixed Purchase Price: This type of addendum specifies a predetermined purchase price for the property, which will remain unchanged throughout the lease term. This offers stability and eliminates any potential confusion about the property's price in the future. 2. Adjustable Purchase Price: In contrast to fixed purchase price agreements, an adjustable purchase price addendum allows for price adjustments based on factors such as market fluctuations or property appraisals. This provides more flexibility for both the tenant and landlord to negotiate the final purchase price. 3. Lease Option Term: This addendum addresses the length of the lease option period, during which the tenant has the right to buy the property. It outlines the specific start and end dates, giving both parties a clear understanding of the timeframe in which the purchase can be made. 4. Option Fee: An option fee may be included in the addendum, which is a non-refundable payment made by the tenant to secure the right to purchase the property within the agreed-upon timeframe. This fee is typically credited towards the purchase price if the tenant decides to buy the property. 5. Maintenance Responsibilities: The addendum may delineate the maintenance responsibilities of the tenant during the lease period. This clarifies who is responsible for repairs, upgrades, and general upkeep of the property. It is essential for both parties to understand and agree upon these terms. 6. Rights and Obligations: This section outlines the rights and obligations of both the tenant and the landlord in the lease-to-own agreement. It ensures that both parties have a clear understanding of their roles and responsibilities throughout the option period. By using a West Jordan Utah Option to Purchase Addendum to Residential Lease — Lease or Rent to Own agreement, tenants have the opportunity to evaluate the property, test the neighborhood, and consider whether they want to become homeowners. This type of arrangement can provide flexibility and potential future benefits while giving tenants a chance to save for a down payment or improve their credit score before making a long-term commitment. It is advisable for tenants to consult with a real estate attorney or a qualified professional to understand the legal and financial implications of entering into such an agreement.