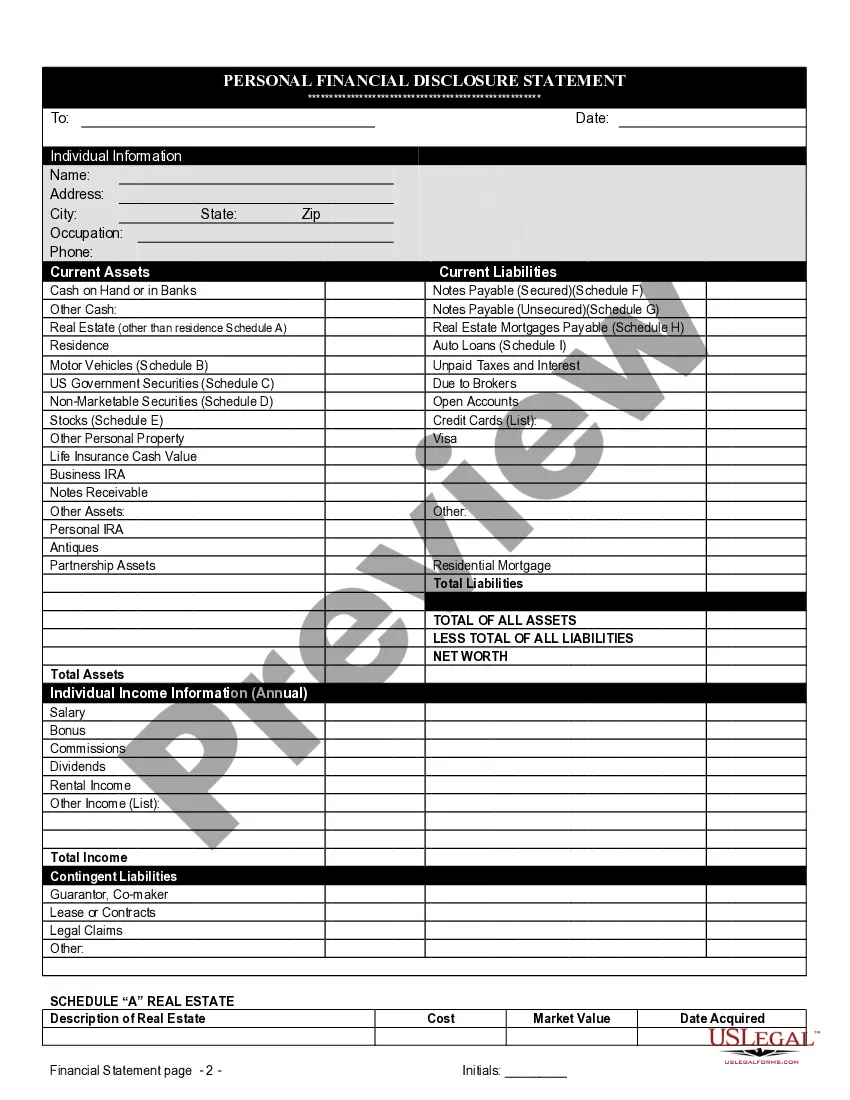

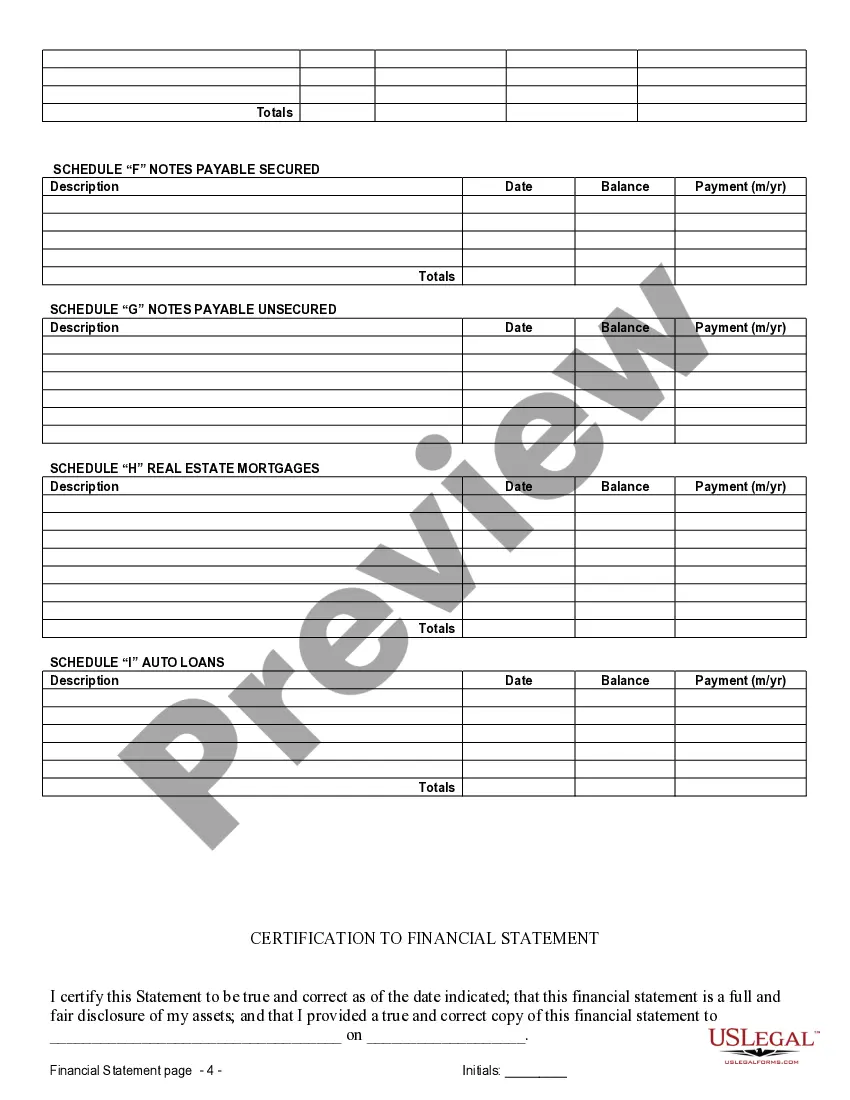

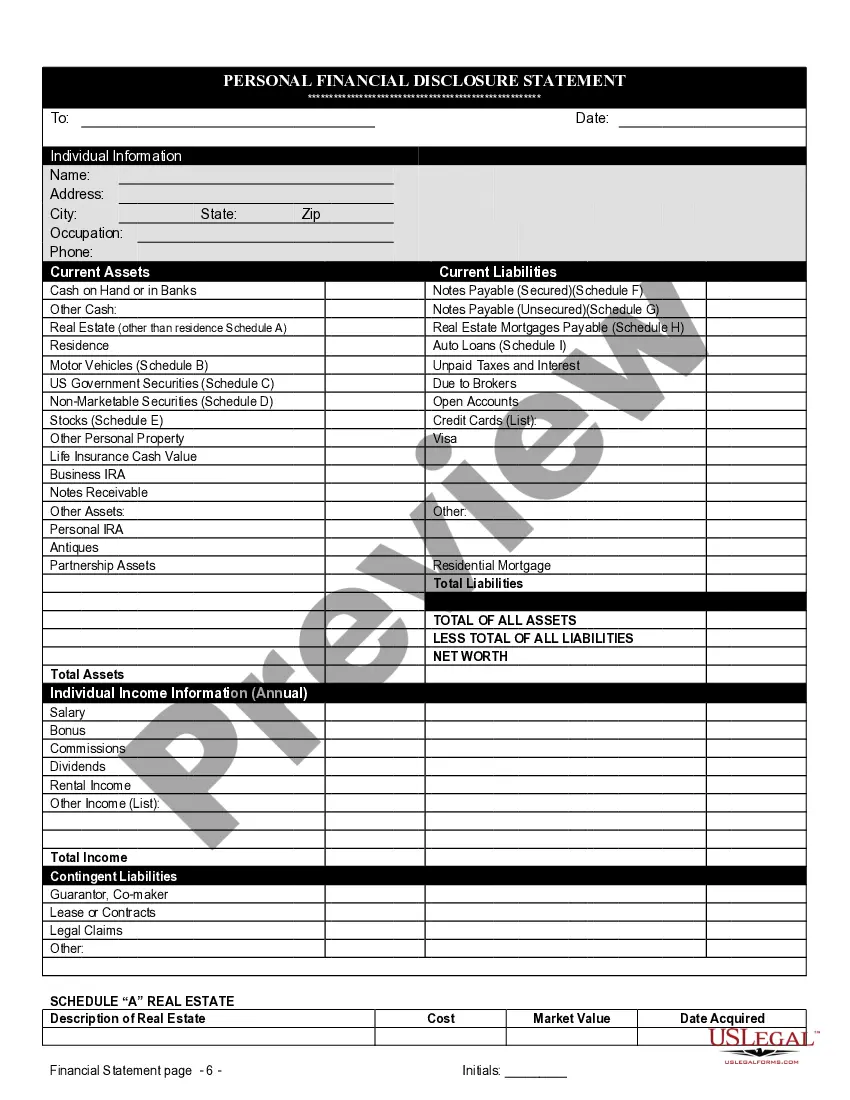

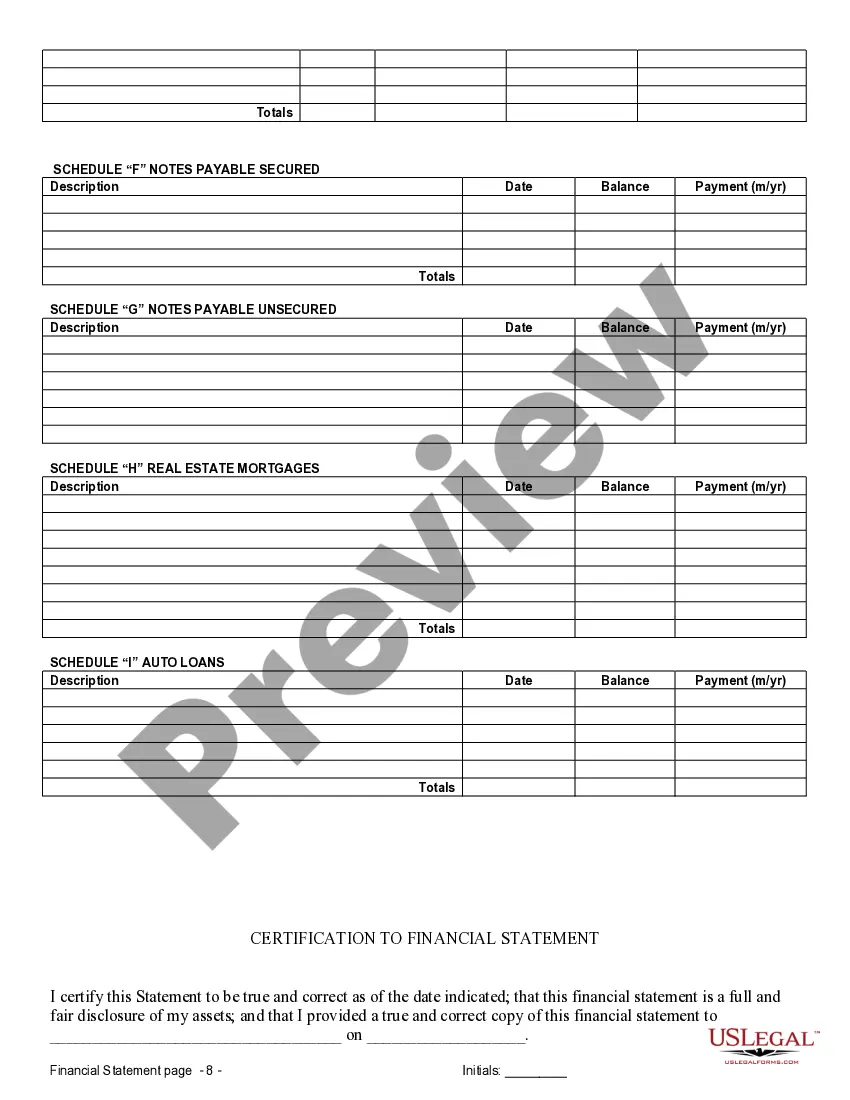

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

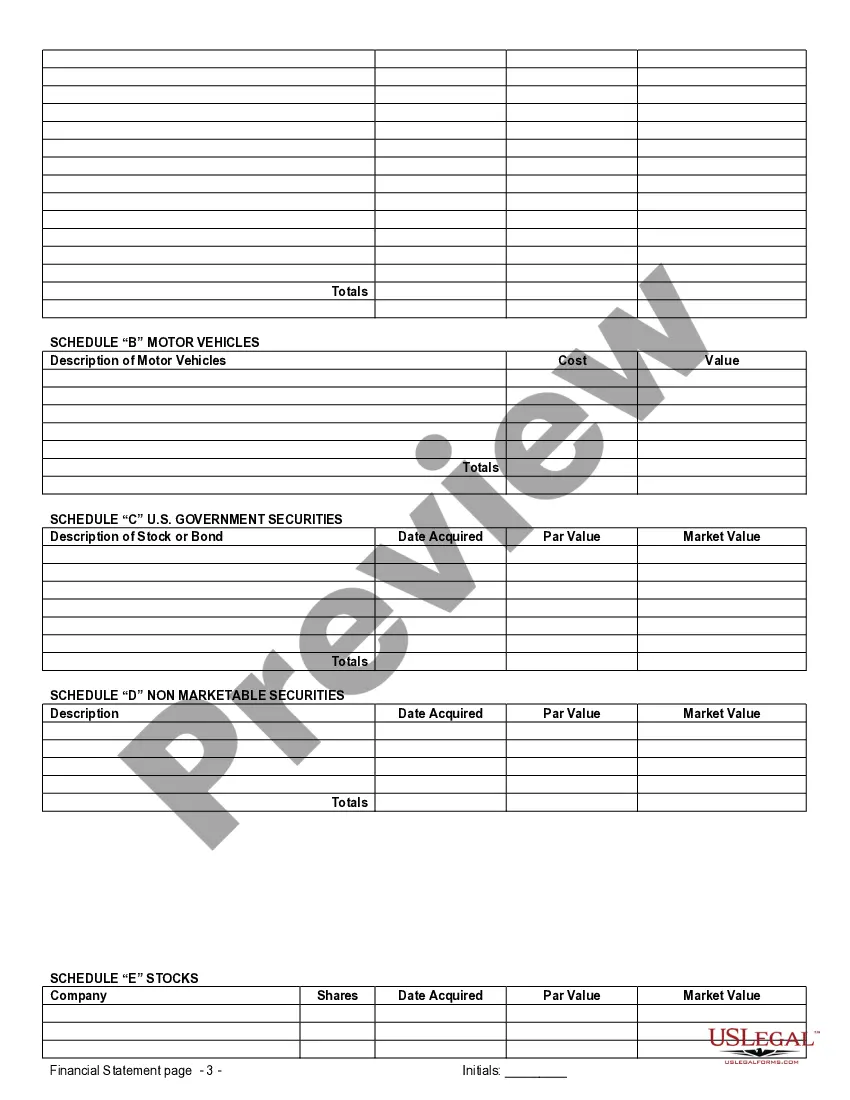

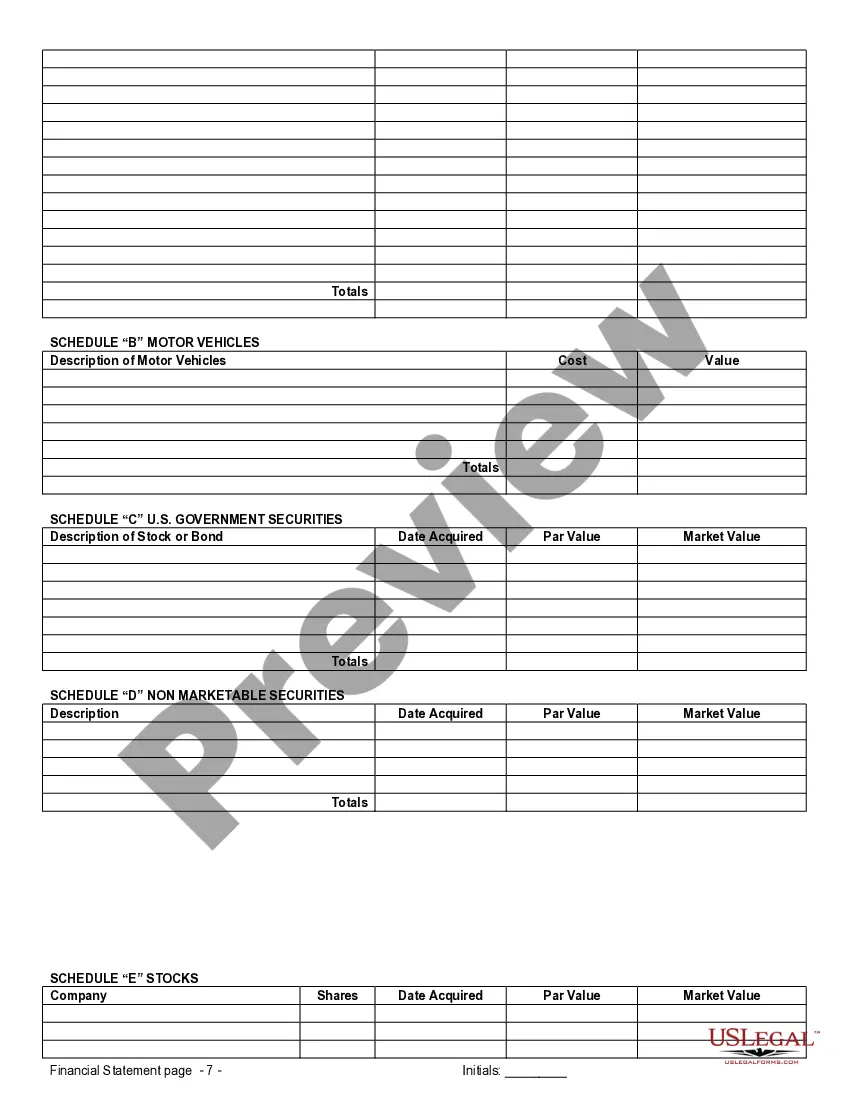

West Valley City Utah Financial Statements only in Connection with Prenuptial Premarital Agreement: When entering into a prenuptial or premarital agreement in West Valley City, Utah, financial statements play a crucial role in protecting the interests of both parties involved. These statements accurately document the financial status and assets of each individual and are considered a vital component in building a solid foundation for a successful marriage. Understanding the different types of financial statements used in connection with a prenuptial agreement is important to ensure transparency, fairness, and protection for both spouses. Let's delve into the various types of financial statements that are typically included in a West Valley City Utah prenuptial agreement: 1. Personal Income Statement: This financial statement outlines the individual's income, expenses, and debt obligations. It provides a comprehensive overview of the individual's financial health, showcasing their earning potential, spending habits, and existing financial responsibilities. 2. Personal Balance Sheet: The personal balance sheet presents a snapshot of the individual's net worth by listing their assets, liabilities, and equity. It includes details about real estate properties, investment accounts, retirement accounts, vehicles, debts, and any other significant financial holdings. 3. Bank Statements: Bank statements exhibit the individual's financial activity in their various bank accounts. They reveal income deposits, expenditures, and other transactions, ensuring transparency and revealing any financial commitments. 4. Tax Returns: Tax returns provide a detailed record of income, deductions, and tax obligations for a specific period. They are essential for determining an individual's historical financial situation and can be used as supporting evidence when evaluating any future claims or disputes. 5. Business Financial Statements: If either party owns a business or holds shares in a company, additional financial statements related to the business's operations, revenues, expenses, and assets may be necessary. These statements give insight into the financial standing of the business and its potential impact on the individual's overall financial status. By including these various financial statements in a prenuptial agreement, both parties can establish a clear understanding of each other's financial circumstances. This understanding helps to protect their individual assets, ensure fair division of property and debts in case of divorce, and minimize conflicts related to financial matters throughout the marriage. It's important to consult with legal professionals specializing in family law and financial matters to ensure that the financial statements accurately represent both individuals' assets and liabilities. Additionally, updating the financial statements periodically throughout the marriage can help maintain transparency and protect the interests of both parties.West Valley City Utah Financial Statements only in Connection with Prenuptial Premarital Agreement: When entering into a prenuptial or premarital agreement in West Valley City, Utah, financial statements play a crucial role in protecting the interests of both parties involved. These statements accurately document the financial status and assets of each individual and are considered a vital component in building a solid foundation for a successful marriage. Understanding the different types of financial statements used in connection with a prenuptial agreement is important to ensure transparency, fairness, and protection for both spouses. Let's delve into the various types of financial statements that are typically included in a West Valley City Utah prenuptial agreement: 1. Personal Income Statement: This financial statement outlines the individual's income, expenses, and debt obligations. It provides a comprehensive overview of the individual's financial health, showcasing their earning potential, spending habits, and existing financial responsibilities. 2. Personal Balance Sheet: The personal balance sheet presents a snapshot of the individual's net worth by listing their assets, liabilities, and equity. It includes details about real estate properties, investment accounts, retirement accounts, vehicles, debts, and any other significant financial holdings. 3. Bank Statements: Bank statements exhibit the individual's financial activity in their various bank accounts. They reveal income deposits, expenditures, and other transactions, ensuring transparency and revealing any financial commitments. 4. Tax Returns: Tax returns provide a detailed record of income, deductions, and tax obligations for a specific period. They are essential for determining an individual's historical financial situation and can be used as supporting evidence when evaluating any future claims or disputes. 5. Business Financial Statements: If either party owns a business or holds shares in a company, additional financial statements related to the business's operations, revenues, expenses, and assets may be necessary. These statements give insight into the financial standing of the business and its potential impact on the individual's overall financial status. By including these various financial statements in a prenuptial agreement, both parties can establish a clear understanding of each other's financial circumstances. This understanding helps to protect their individual assets, ensure fair division of property and debts in case of divorce, and minimize conflicts related to financial matters throughout the marriage. It's important to consult with legal professionals specializing in family law and financial matters to ensure that the financial statements accurately represent both individuals' assets and liabilities. Additionally, updating the financial statements periodically throughout the marriage can help maintain transparency and protect the interests of both parties.