Register a foreign corporation in Utah.

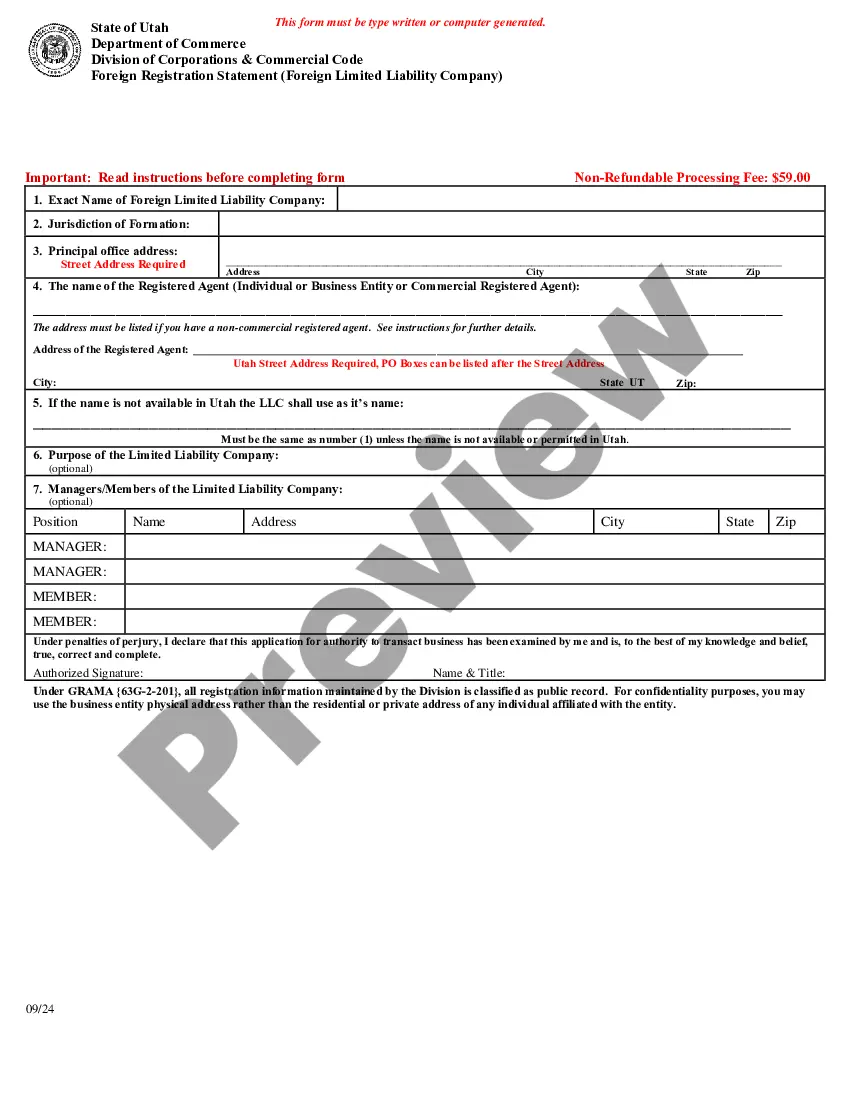

Salt Lake Utah Registration of Foreign Corporation The Salt Lake Utah Registration of Foreign Corporation is a legal requirement for any corporation that was formed outside the state of Utah, but wishes to conduct business activities within the state. This process allows the state to keep a record of foreign corporations operating within its jurisdiction and ensures compliance with state laws and regulations. Foreign corporations need to file the appropriate documents and fees with the Secretary of State's office in order to register. The registration process helps protect the interests of both the state and the corporation, as it establishes a legal presence and provides the corporation with certain rights and obligations. Some key information and documents required for Salt Lake Utah Registration of Foreign Corporation include: 1. Name of the Corporation: The foreign corporation must provide its legal name, which should be available for use in the state of Utah and not already in use by another corporation. 2. Registered Agent: A registered agent must be appointed who is a resident of Utah or a corporation authorized to do business in Utah. This individual or entity will act as a point of contact for the corporation and receive legal and official documents on its behalf. 3. Certificate of Good Standing: A certificate of good standing must be obtained from the home state of the corporation. This document certifies that the corporation is validly existing and in compliance with the laws of its home state. 4. Certificate of Incorporation/Formation: The foreign corporation must generally provide a copy of its certificate of incorporation or formation, which verifies its legal existence. 5. Business Purpose: A clear statement of the corporation's business purpose is required, outlining the activities it intends to engage in within the state of Utah. 6. Duration: The expected duration of the corporation's activities within Utah should be stated. Types of Salt Lake Utah Registration of Foreign Corporation: 1. Domestic Corporation — A foreign corporation that wishes to establish a permanent presence and conduct regular business activities in Utah can opt for this type of registration. It allows the corporation to operate similarly to a domestic corporation, with all the rights, privileges, and obligations that come with it. 2. Foreign Qualified Corporation — This type of registration is suitable for foreign corporations that wish to conduct limited, specific, or temporary activities within the state of Utah. It provides the corporation with the legal authorization to undertake these activities while remaining subject to certain restrictions and limitations. It is important for foreign corporations to understand and adhere to the registration requirements set forth by the state of Utah to avoid any legal complications. Completing the Salt Lake Utah Registration of Foreign Corporation process accurately and in a timely manner is crucial for a foreign corporation's operations within the state.

Salt Lake Utah Registration of Foreign Corporation The Salt Lake Utah Registration of Foreign Corporation is a legal requirement for any corporation that was formed outside the state of Utah, but wishes to conduct business activities within the state. This process allows the state to keep a record of foreign corporations operating within its jurisdiction and ensures compliance with state laws and regulations. Foreign corporations need to file the appropriate documents and fees with the Secretary of State's office in order to register. The registration process helps protect the interests of both the state and the corporation, as it establishes a legal presence and provides the corporation with certain rights and obligations. Some key information and documents required for Salt Lake Utah Registration of Foreign Corporation include: 1. Name of the Corporation: The foreign corporation must provide its legal name, which should be available for use in the state of Utah and not already in use by another corporation. 2. Registered Agent: A registered agent must be appointed who is a resident of Utah or a corporation authorized to do business in Utah. This individual or entity will act as a point of contact for the corporation and receive legal and official documents on its behalf. 3. Certificate of Good Standing: A certificate of good standing must be obtained from the home state of the corporation. This document certifies that the corporation is validly existing and in compliance with the laws of its home state. 4. Certificate of Incorporation/Formation: The foreign corporation must generally provide a copy of its certificate of incorporation or formation, which verifies its legal existence. 5. Business Purpose: A clear statement of the corporation's business purpose is required, outlining the activities it intends to engage in within the state of Utah. 6. Duration: The expected duration of the corporation's activities within Utah should be stated. Types of Salt Lake Utah Registration of Foreign Corporation: 1. Domestic Corporation — A foreign corporation that wishes to establish a permanent presence and conduct regular business activities in Utah can opt for this type of registration. It allows the corporation to operate similarly to a domestic corporation, with all the rights, privileges, and obligations that come with it. 2. Foreign Qualified Corporation — This type of registration is suitable for foreign corporations that wish to conduct limited, specific, or temporary activities within the state of Utah. It provides the corporation with the legal authorization to undertake these activities while remaining subject to certain restrictions and limitations. It is important for foreign corporations to understand and adhere to the registration requirements set forth by the state of Utah to avoid any legal complications. Completing the Salt Lake Utah Registration of Foreign Corporation process accurately and in a timely manner is crucial for a foreign corporation's operations within the state.