Register a foreign corporation in Utah.

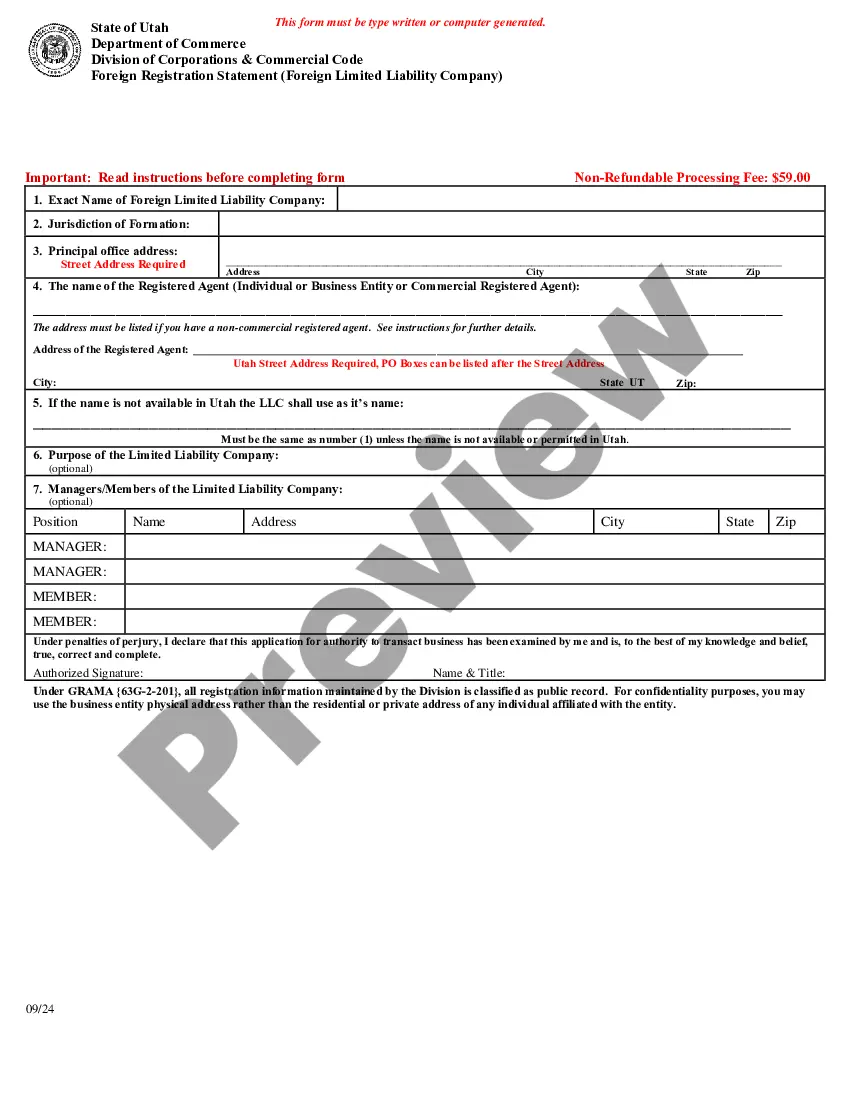

Salt Lake City, Utah Registration of Foreign Corporation: A Detailed Description Salt Lake City, Utah welcomes businesses from outside the state lines to register as a foreign corporation in order to conduct business within its jurisdiction. The registration process ensures that foreign corporations comply with the state's regulations, laws, and tax requirements. This comprehensive guide aims to outline the necessary steps, requirements, and important information regarding the Salt Lake City, Utah Registration of Foreign Corporation. Foreign corporations looking to expand into Salt Lake City, Utah must initiate the registration process with the Utah Division of Corporations and Commercial Code (CCC). Upon successful registration, the foreign corporation can legally operate in the state while gaining access to the vibrant business environment that Salt Lake City offers. Here are the key steps involved in the Salt Lake City, Utah Registration of Foreign Corporation: Step 1: Name Availability Check To begin the registration process, foreign corporations need to ensure that their proposed business name is distinguishable and available for use in Utah. It is advisable to conduct a name availability search through the Utah CCC website or contact them directly to verify the availability of the desired name. Step 2: Certificate of Good Standing Foreign corporations must obtain a Certificate of Good Standing or a similar document from their home state. This document verifies that the foreign corporation is duly formed, validly existing, and in good standing with its home state's regulatory authorities. Step 3: Registered Agent Salt Lake City, Utah requires foreign corporations to appoint a registered agent who will serve as the main point of contact and receive official documents, lawsuits, and service of process on behalf of the foreign corporation. The registered agent must have a physical address within Utah. Step 4: Required Filings Foreign corporations must file the necessary paperwork with the Utah CCC, which includes completing the "Application for Certificate of Authority to Transact Business in Utah" form. The completed form should provide accurate information regarding the foreign corporation's name, principal place of business, registered agent details, and other essential information. Step 5: Filing Fee Foreign corporations are required to pay a filing fee, which is subject to change. The fee must be submitted along with the completed application. Different Types of Salt Lake City, Utah Registration of Foreign Corporation: 1. Regular Foreign Corporation: This type of registration applies to foreign corporations looking to conduct their regular business operations within Salt Lake City, Utah. 2. Non-Profit Foreign Corporation: Non-profit foreign corporations intending to engage in charitable, religious, educational, or other non-profit activities in Salt Lake City, Utah must follow a slightly different registration process. 3. Professional Foreign Corporation: Professionals, such as doctors, lawyers, accountants, architects, and other licensed individuals who wish to extend their services to Salt Lake City, Utah, must register their professional foreign corporation with the appropriate licensing board or agency. In conclusion, the Salt Lake City, Utah Registration of Foreign Corporation presents an opportunity for businesses from outside the state to expand their operations and tap into the thriving business community the city boasts. By following the prescribed steps and fulfilling the requirements, foreign corporations can establish their presence legally and benefit from the diverse opportunities Salt Lake City, Utah offers.