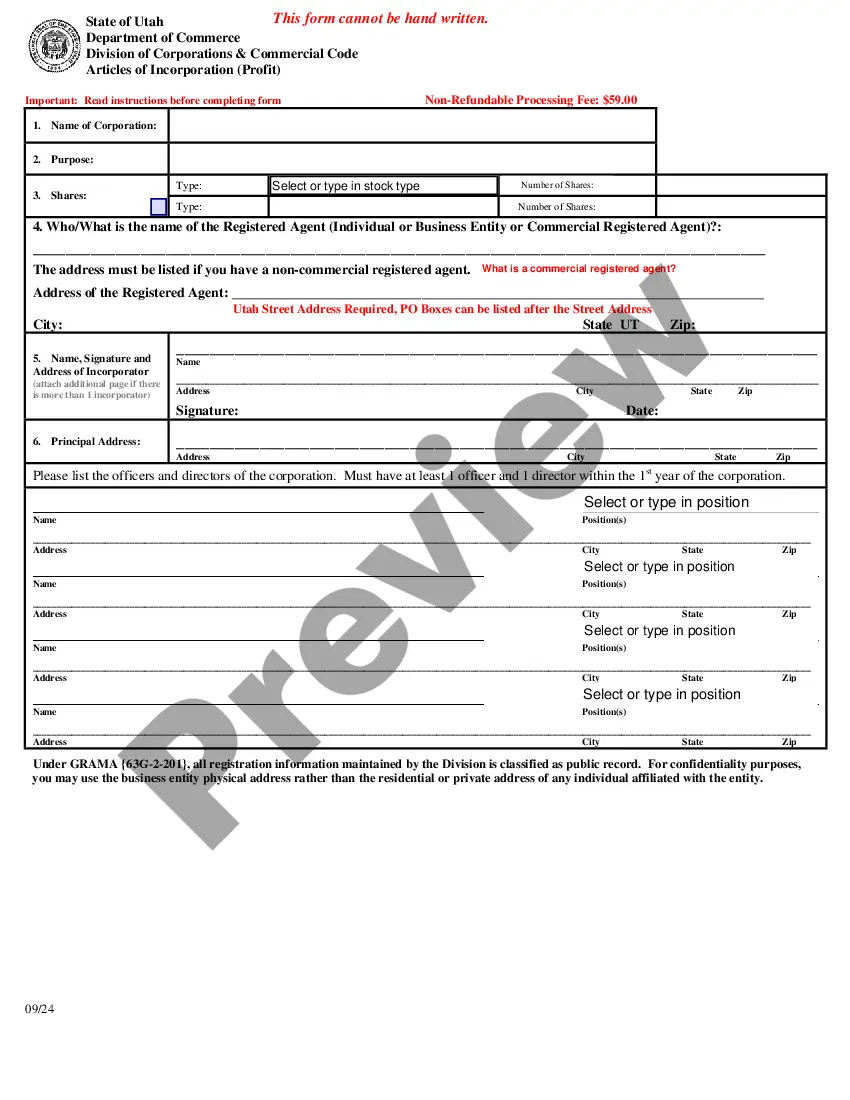

This state-specific form must be filed with the appropriate state agency in compliance with state law in order to create a new non-profit corporation. The form contains basic information concerning the corporation, normally including the corporate name, names of the incorporators, directors and/or officers, purpose of the corporation, corporate address, registered agent, and related information.

The Salt Lake Utah Articles of Incorporation for Domestic Nonprofit Corporation is a legal document that outlines the establishment and operation of a nonprofit organization in the state of Utah. It serves as a formal application to the Utah Department of Commerce, Division of Corporations and Commercial Code for incorporating a nonprofit entity. The Articles of Incorporation for Domestic Nonprofit Corporation in Salt Lake, Utah must include certain key information to comply with state laws and ensure proper establishment of the nonprofit organization. These crucial details typically include: 1. Name and Purpose: The desired name of the nonprofit corporation must be stated, along with a clear description of its purpose and mission. This description should portray the organization's objectives and the specific activities it will undertake to achieve these goals. 2. Duration: The intended duration of the nonprofit corporation must be stated, whether it is perpetual or for a specific period. 3. Registered Agent and Office: The name and address of the registered agent, who will act as the main contact for legal and official notices, must be provided. Additionally, a physical address within Utah serving as the corporation's principal office must be designated. 4. Members and Directors: The number of initial directors should be specified, along with their names and addresses. Details regarding membership requirements and qualifications, if applicable, should also be included in this section. 5. Dissolution Provisions: The Articles of Incorporation must outline the process and provisions for dissolution or the disposition of assets in the event that the nonprofit corporation ceases to exist or is dissolved. It is important to note that while these elements are essential in all Articles of Incorporation for Domestic Nonprofit Corporation, additional clauses and provisions can be included based on the specific requirements and goals of the nonprofit organization. In Salt Lake, Utah, there may not be different types of Articles of Incorporation specific to nonprofit corporations. However, there might be variations depending on the organizational structure or tax-exempt status sought by the nonprofit. It is recommended to consult with an attorney or seek professional advice to ensure compliance with state laws and the IRS regulations for nonprofit organizations.The Salt Lake Utah Articles of Incorporation for Domestic Nonprofit Corporation is a legal document that outlines the establishment and operation of a nonprofit organization in the state of Utah. It serves as a formal application to the Utah Department of Commerce, Division of Corporations and Commercial Code for incorporating a nonprofit entity. The Articles of Incorporation for Domestic Nonprofit Corporation in Salt Lake, Utah must include certain key information to comply with state laws and ensure proper establishment of the nonprofit organization. These crucial details typically include: 1. Name and Purpose: The desired name of the nonprofit corporation must be stated, along with a clear description of its purpose and mission. This description should portray the organization's objectives and the specific activities it will undertake to achieve these goals. 2. Duration: The intended duration of the nonprofit corporation must be stated, whether it is perpetual or for a specific period. 3. Registered Agent and Office: The name and address of the registered agent, who will act as the main contact for legal and official notices, must be provided. Additionally, a physical address within Utah serving as the corporation's principal office must be designated. 4. Members and Directors: The number of initial directors should be specified, along with their names and addresses. Details regarding membership requirements and qualifications, if applicable, should also be included in this section. 5. Dissolution Provisions: The Articles of Incorporation must outline the process and provisions for dissolution or the disposition of assets in the event that the nonprofit corporation ceases to exist or is dissolved. It is important to note that while these elements are essential in all Articles of Incorporation for Domestic Nonprofit Corporation, additional clauses and provisions can be included based on the specific requirements and goals of the nonprofit organization. In Salt Lake, Utah, there may not be different types of Articles of Incorporation specific to nonprofit corporations. However, there might be variations depending on the organizational structure or tax-exempt status sought by the nonprofit. It is recommended to consult with an attorney or seek professional advice to ensure compliance with state laws and the IRS regulations for nonprofit organizations.