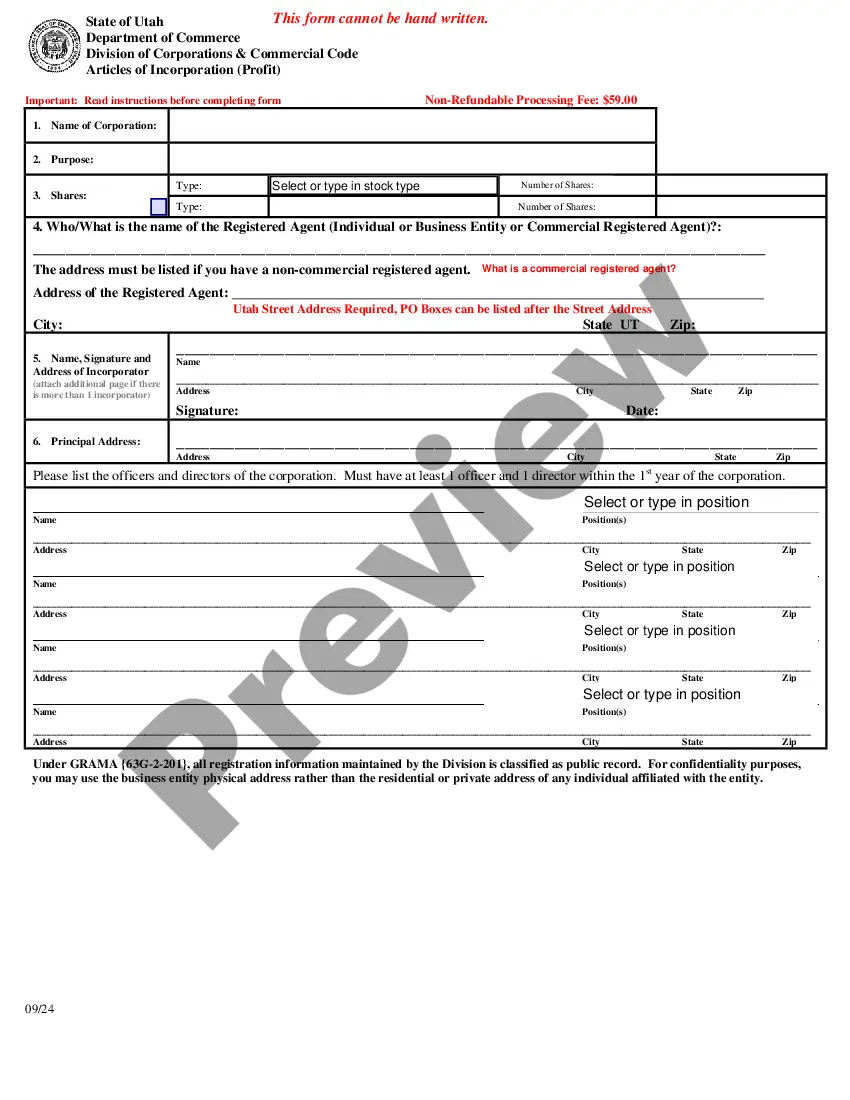

This state-specific form must be filed with the appropriate state agency in compliance with state law in order to create a new non-profit corporation. The form contains basic information concerning the corporation, normally including the corporate name, names of the incorporators, directors and/or officers, purpose of the corporation, corporate address, registered agent, and related information.

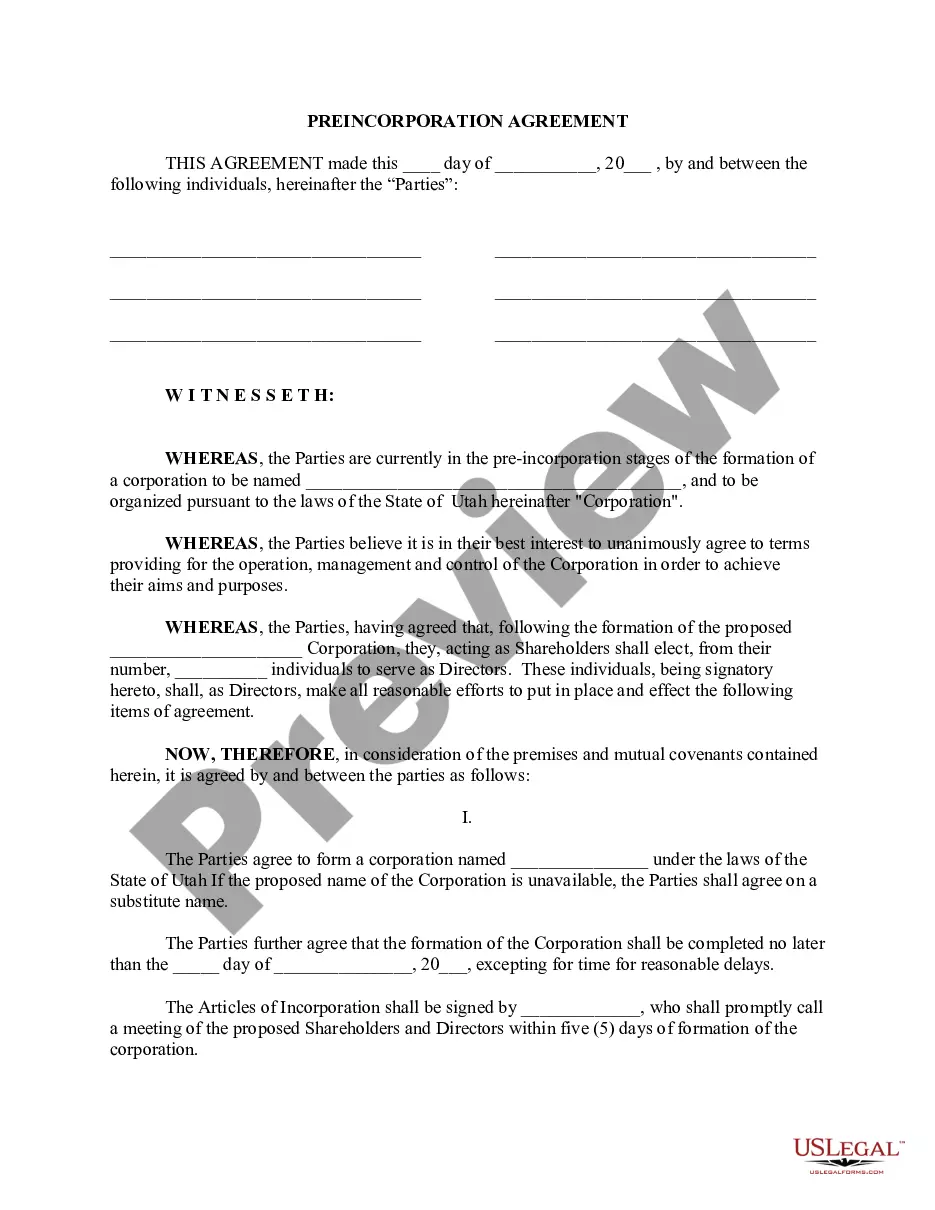

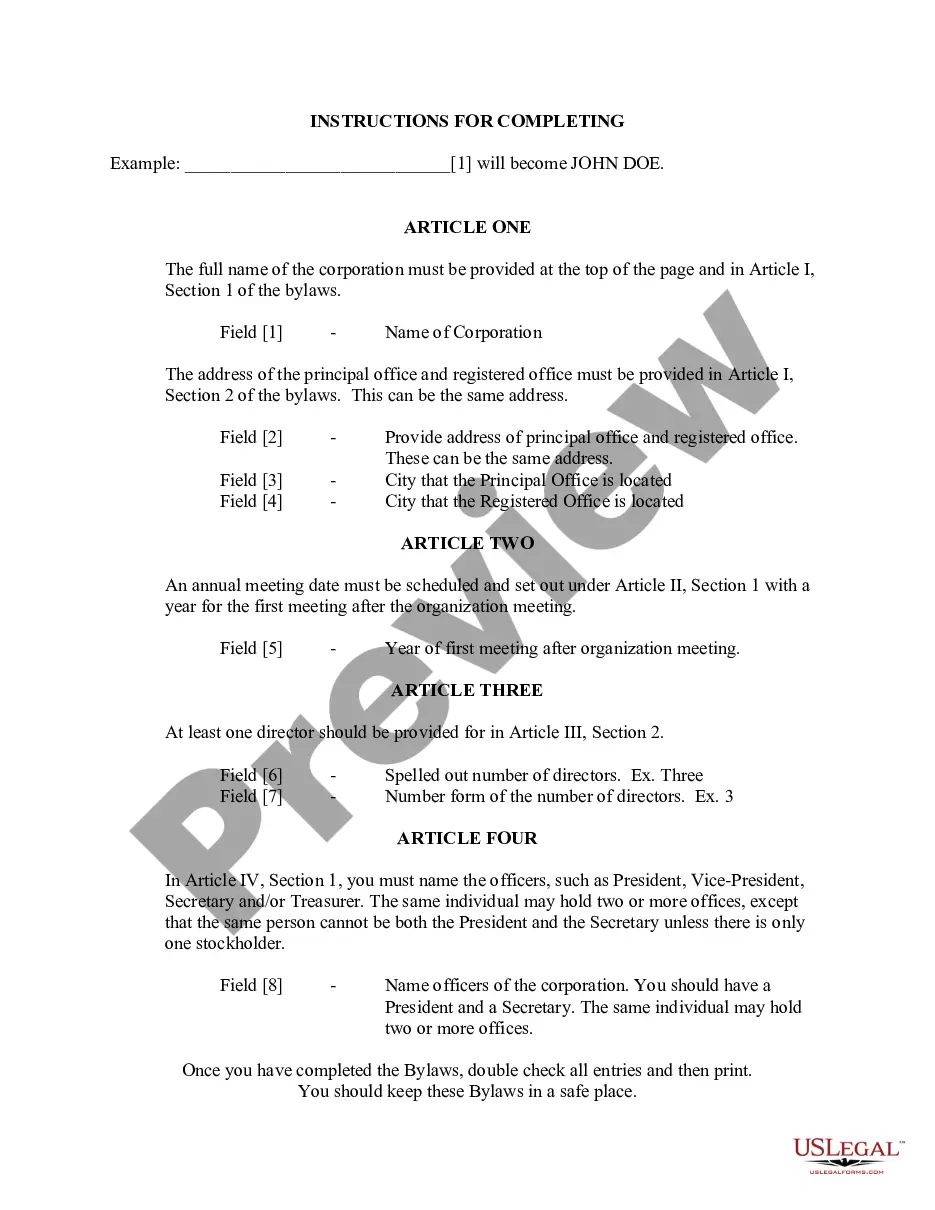

The Salt Lake City Utah Articles of Incorporation for Domestic Nonprofit Corporation is a legal document that outlines the formation and operation of a nonprofit organization within the state of Utah. It serves as the foundational document for the corporation and is filed with the Utah Division of Corporations and Commercial Code. The Articles of Incorporation include various sections that provide crucial information about the nonprofit organization. These sections typically include: 1. Name and Purpose: The document will specify the name of the corporation, ensuring it is unique and does not conflict with any existing entities. Additionally, it will outline the purpose and mission of the nonprofit, describing the activities it intends to undertake in order to fulfill its charitable objectives. 2. Registered Agent and Office: The Articles of Incorporation require the corporation to designate a registered agent — an individual or entity responsible for accepting legal documents on behalf of the corporation. The registered agent's contact information and physical office address must be provided. 3. Duration: This section specifies the duration of the nonprofit corporation. It can be perpetual or for a specific period, but most nonprofits choose the perpetual option to ensure their ongoing existence. 4. Membership: Nonprofit organizations may have members or be memberless. If they choose to have members, this section will define the rights and responsibilities of members, and any specific qualifications or limitations for membership. 5. Board of Directors: The Articles of Incorporation will provide information on the initial board of directors, including their names and addresses. It may also outline the required number of directors and any qualifications or restrictions on board membership. 6. Dissolution: This section outlines the procedure for dissolving the nonprofit corporation. It may specify that the assets will be distributed to another tax-exempt organization upon dissolution, ensuring compliance with state regulations. There are no different types of Salt Lake City Utah Articles of Incorporation for Domestic Nonprofit Corporation. However, it's important to note that the specific requirements and provisions within the Articles of Incorporation may vary depending on the unique circumstances and goals of the nonprofit organization. Creating and filing the Articles of Incorporation is one of the first steps in establishing a nonprofit corporation in Salt Lake City, Utah. It is a crucial document that provides legal recognition to the organization and grants it certain rights and privileges. Nonprofits should consult with an attorney or utilize templates provided by the Utah Division of Corporations to ensure compliance with all relevant laws and regulations.The Salt Lake City Utah Articles of Incorporation for Domestic Nonprofit Corporation is a legal document that outlines the formation and operation of a nonprofit organization within the state of Utah. It serves as the foundational document for the corporation and is filed with the Utah Division of Corporations and Commercial Code. The Articles of Incorporation include various sections that provide crucial information about the nonprofit organization. These sections typically include: 1. Name and Purpose: The document will specify the name of the corporation, ensuring it is unique and does not conflict with any existing entities. Additionally, it will outline the purpose and mission of the nonprofit, describing the activities it intends to undertake in order to fulfill its charitable objectives. 2. Registered Agent and Office: The Articles of Incorporation require the corporation to designate a registered agent — an individual or entity responsible for accepting legal documents on behalf of the corporation. The registered agent's contact information and physical office address must be provided. 3. Duration: This section specifies the duration of the nonprofit corporation. It can be perpetual or for a specific period, but most nonprofits choose the perpetual option to ensure their ongoing existence. 4. Membership: Nonprofit organizations may have members or be memberless. If they choose to have members, this section will define the rights and responsibilities of members, and any specific qualifications or limitations for membership. 5. Board of Directors: The Articles of Incorporation will provide information on the initial board of directors, including their names and addresses. It may also outline the required number of directors and any qualifications or restrictions on board membership. 6. Dissolution: This section outlines the procedure for dissolving the nonprofit corporation. It may specify that the assets will be distributed to another tax-exempt organization upon dissolution, ensuring compliance with state regulations. There are no different types of Salt Lake City Utah Articles of Incorporation for Domestic Nonprofit Corporation. However, it's important to note that the specific requirements and provisions within the Articles of Incorporation may vary depending on the unique circumstances and goals of the nonprofit organization. Creating and filing the Articles of Incorporation is one of the first steps in establishing a nonprofit corporation in Salt Lake City, Utah. It is a crucial document that provides legal recognition to the organization and grants it certain rights and privileges. Nonprofits should consult with an attorney or utilize templates provided by the Utah Division of Corporations to ensure compliance with all relevant laws and regulations.