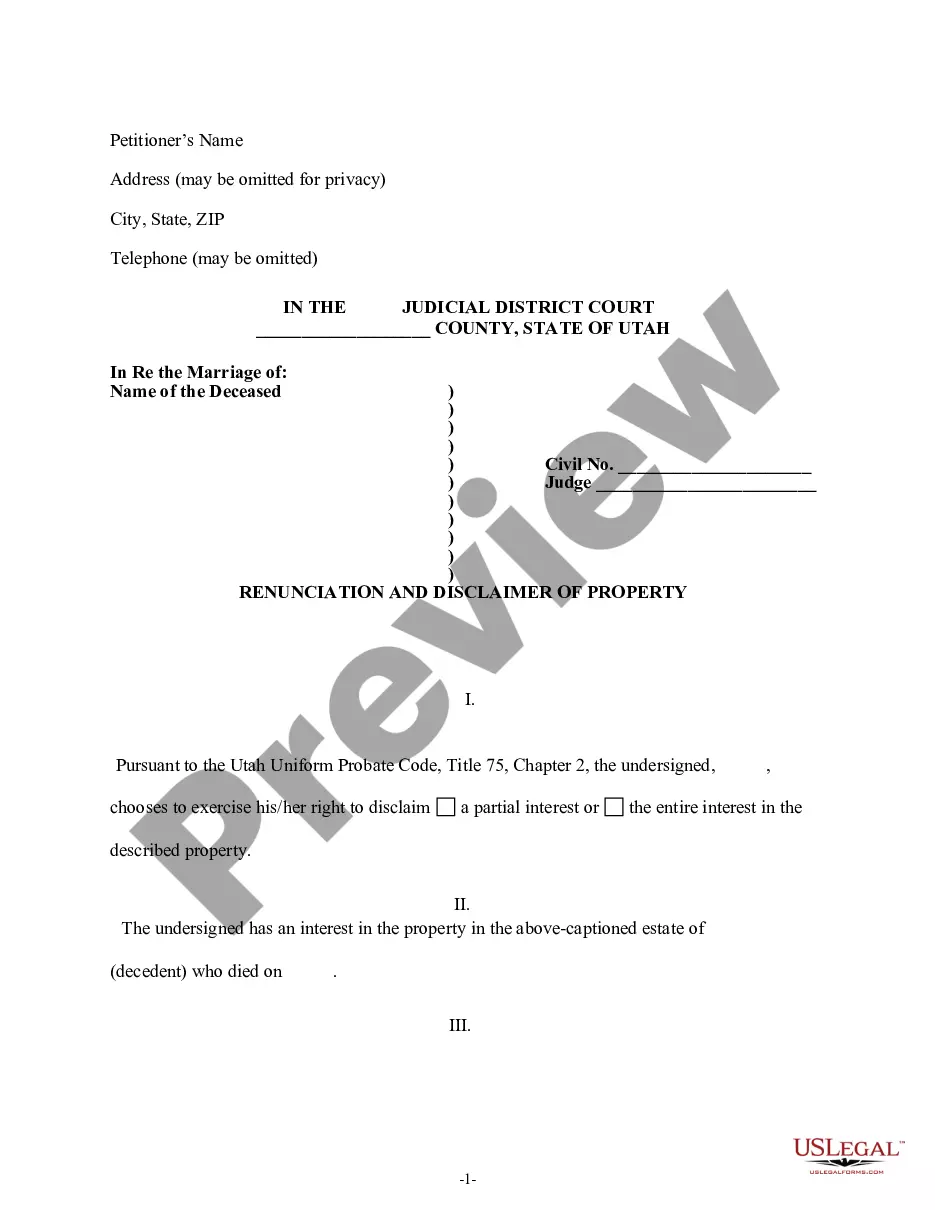

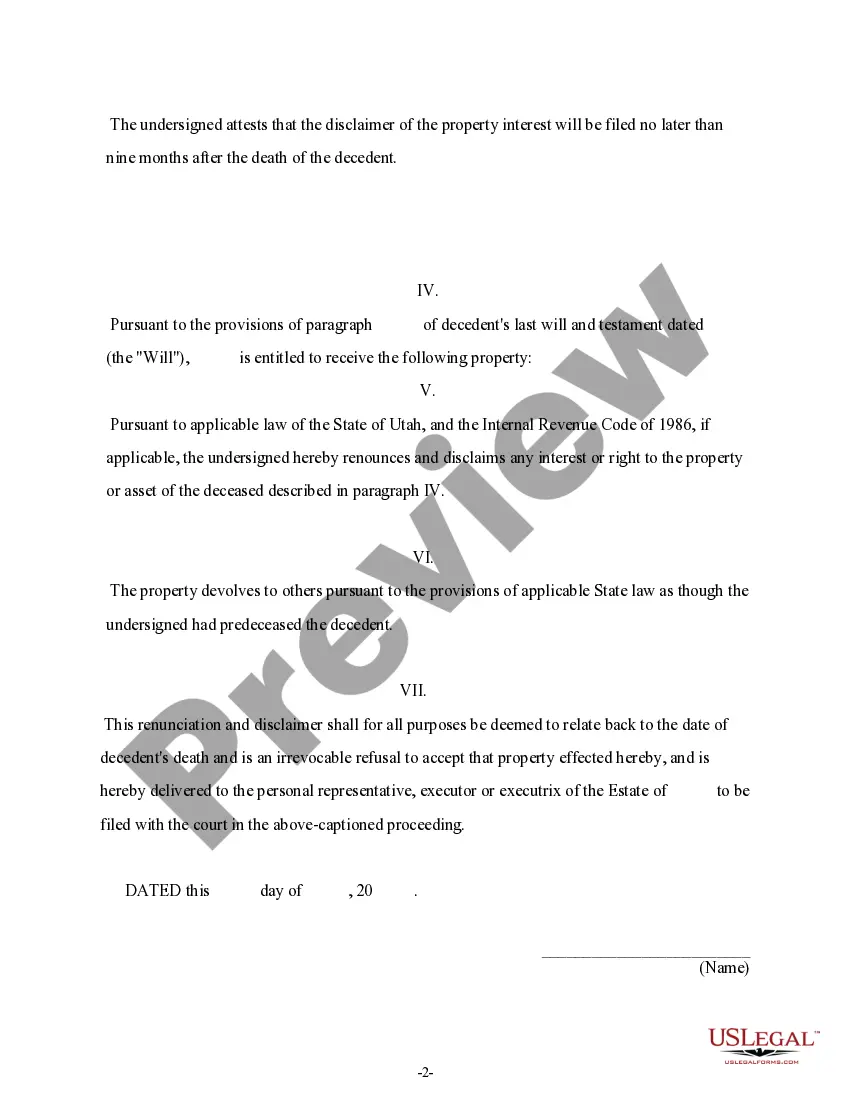

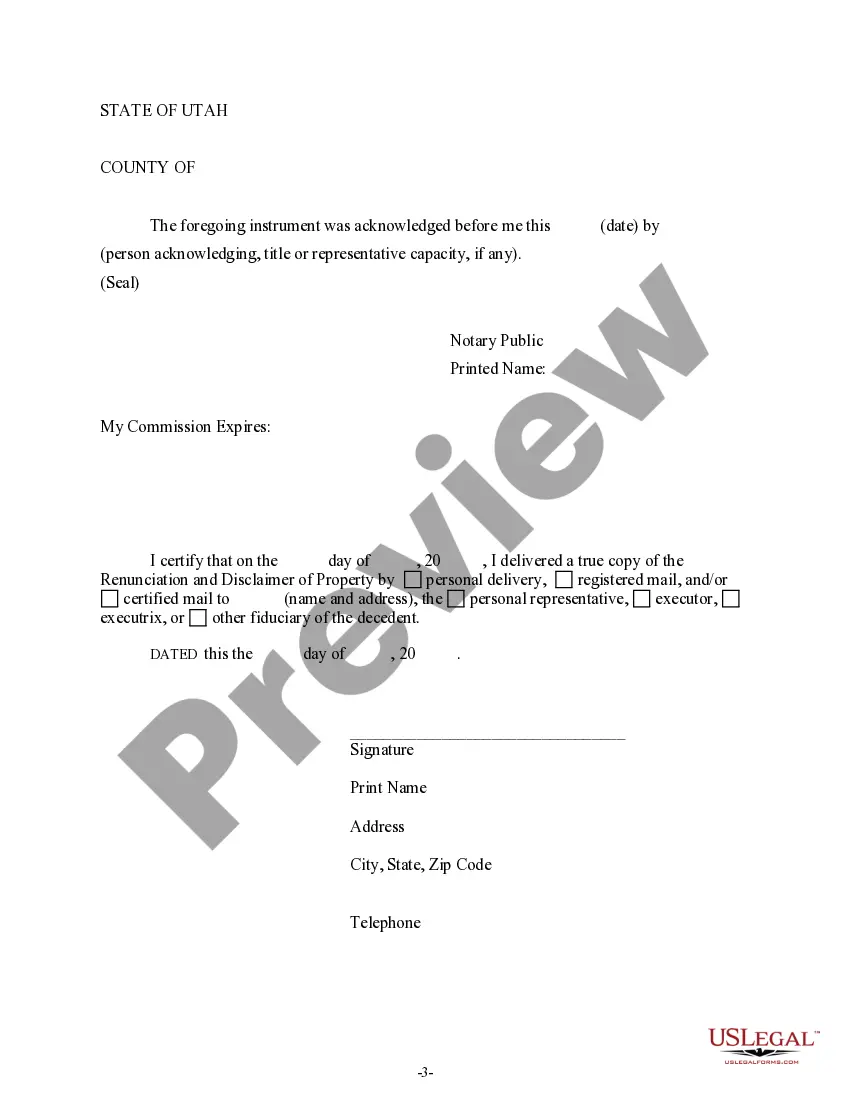

This form is a Renunciation and Disclaimer of Property acquired by the beneficiary through the last will and testament of the decedent, where the beneficiary gained an interest in the property upon the death of the decedent, but, pursuant to the Utah Uniform Probate Code, Title 75, Chapter 2, has chosen to disclaim a portion of or the entire interest in the property. The property will now pass to others as though the beneficiary predeceased the decedent. The form also contains a state specific acknowledgment and a certificate to verify delivery of the document.

Salt Lake Utah Renunciation And Disclaimer of Property from Will by Testate, also known as renunciation of property through a will, is a legal process where a beneficiary willingly gives up their rights to inherit property or assets specified in a deceased person's will. There are different types and scenarios that may require renunciation or disclaimer of property in Salt Lake Utah. 1. Outright Renunciation: This type of renunciation occurs when a beneficiary chooses to completely disclaim their inheritance rights from the will. By renouncing the property, the beneficiary ensures that they will not receive any portion of the assets, and it will pass to the next eligible beneficiary determined by the probate court. 2. Partial Renunciation: In some cases, a beneficiary may wish to renounce only a portion of their inheritance. This allows them to disclaim specific assets while retaining their rights to other portions of the estate as outlined in the will. 3. Renunciation in Favor of Another Beneficiary: Occasionally, a beneficiary may choose to renounce their inheritance in favor of another named beneficiary. This option allows them to redirect their share of the property to someone else named in the will who may need it more or have a higher priority under the provisions of the will. 4. Renunciation by Legal Guardian/Conservator: In situations where a minor or legally incompetent individual is named as a beneficiary, their appointed legal guardian or conservator may renounce their ward's inheritance on their behalf. This ensures that the estate is managed in the best interest of the individual in need of care. 5. Voluntary Renunciation: Sometimes, a beneficiary may voluntarily renounce their inheritance for various personal or financial reasons. This can be done without any legal obligation or pressure, but it is crucial to follow the proper legal procedures to ensure the renunciation is valid and enforceable. Salt Lake Utah Renunciation And Disclaimer of Property from Will by Testate provides an opportunity for beneficiaries to voluntarily give up their inheritance rights. It is essential to consult with an experienced attorney specializing in estate planning and probate matters to understand the legal implications, deadlines, and procedures involved in the renunciation process. Proper legal guidance can ensure that the renunciation is done correctly and in compliance with Utah state laws.

Salt Lake Utah Renunciation And Disclaimer of Property from Will by Testate, also known as renunciation of property through a will, is a legal process where a beneficiary willingly gives up their rights to inherit property or assets specified in a deceased person's will. There are different types and scenarios that may require renunciation or disclaimer of property in Salt Lake Utah. 1. Outright Renunciation: This type of renunciation occurs when a beneficiary chooses to completely disclaim their inheritance rights from the will. By renouncing the property, the beneficiary ensures that they will not receive any portion of the assets, and it will pass to the next eligible beneficiary determined by the probate court. 2. Partial Renunciation: In some cases, a beneficiary may wish to renounce only a portion of their inheritance. This allows them to disclaim specific assets while retaining their rights to other portions of the estate as outlined in the will. 3. Renunciation in Favor of Another Beneficiary: Occasionally, a beneficiary may choose to renounce their inheritance in favor of another named beneficiary. This option allows them to redirect their share of the property to someone else named in the will who may need it more or have a higher priority under the provisions of the will. 4. Renunciation by Legal Guardian/Conservator: In situations where a minor or legally incompetent individual is named as a beneficiary, their appointed legal guardian or conservator may renounce their ward's inheritance on their behalf. This ensures that the estate is managed in the best interest of the individual in need of care. 5. Voluntary Renunciation: Sometimes, a beneficiary may voluntarily renounce their inheritance for various personal or financial reasons. This can be done without any legal obligation or pressure, but it is crucial to follow the proper legal procedures to ensure the renunciation is valid and enforceable. Salt Lake Utah Renunciation And Disclaimer of Property from Will by Testate provides an opportunity for beneficiaries to voluntarily give up their inheritance rights. It is essential to consult with an experienced attorney specializing in estate planning and probate matters to understand the legal implications, deadlines, and procedures involved in the renunciation process. Proper legal guidance can ensure that the renunciation is done correctly and in compliance with Utah state laws.