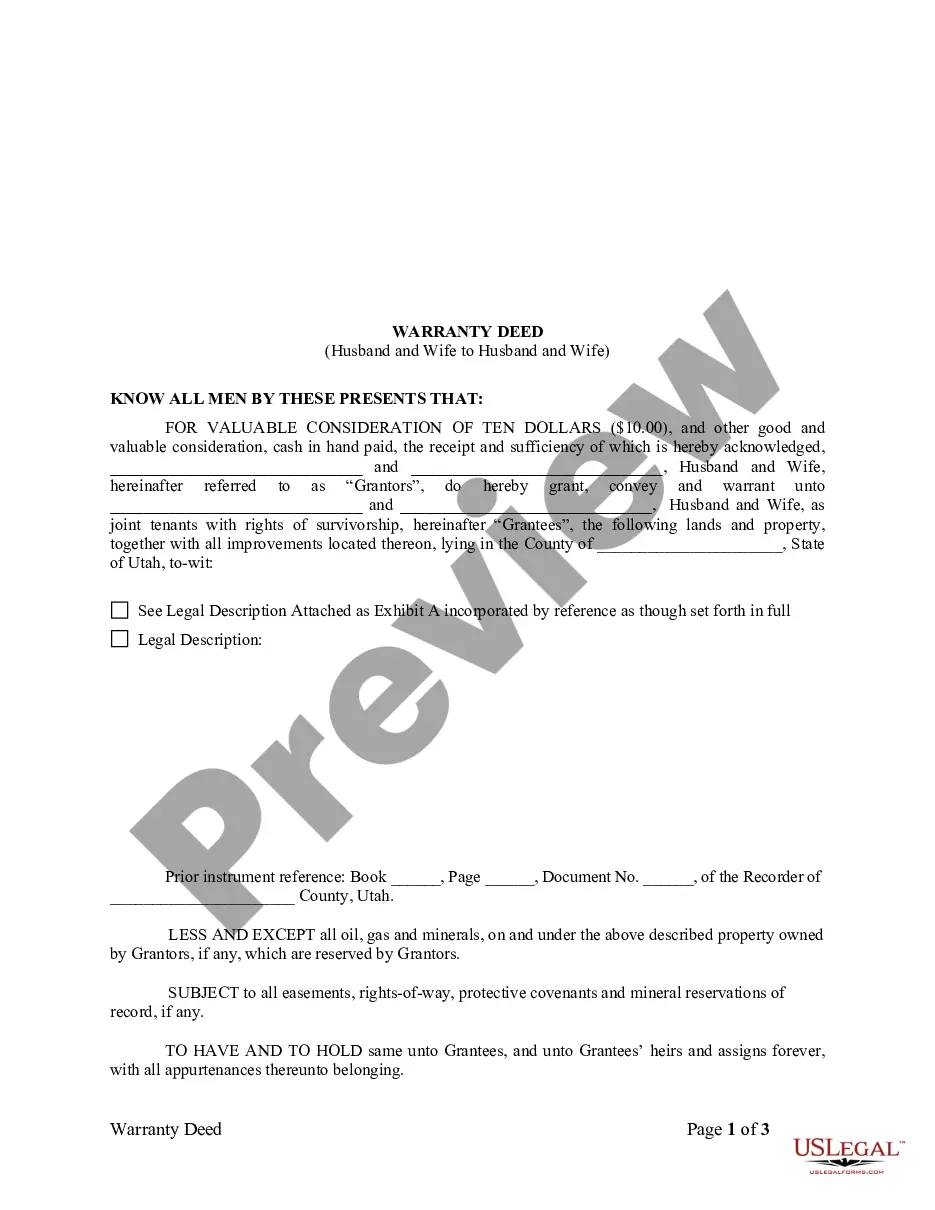

This form is a Warranty Deed where the grantors are husband and wife and the grantees are husband and wife. Grantors convey and warrant the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors. This deed complies with all state statutory laws.

A warranty deed is a legal document used in real estate transactions to transfer ownership and protection of the property from one party to another. In the context of Salt Lake City, Utah, a warranty deed from husband and wife to husband and wife signifies the transfer of property ownership between married couples. In Salt Lake City, Utah, there are various types of warranty deeds that can be executed between husband and wife. These include: 1. General Warranty Deed from Husband and Wife to Husband and Wife: This type of warranty deed provides the highest level of protection to the buyer (the husband and wife receiving the property). It guarantees that the property is free from any liens, encumbrances, or defects, both prior to and during the ownership by the husband and wife. 2. Special Warranty Deed from Husband and Wife to Husband and Wife: With this type of warranty deed, the husband and wife selling the property, known as the granters, warrant and defend the title against any claims arising during their ownership. However, they do not guarantee against any encumbrances or defects that may have existed prior to their ownership. 3. Quitclaim Deed from Husband and Wife to Husband and Wife: Unlike warranty deeds, quitclaim deeds do not provide any warranties or guarantees. By using a quitclaim deed, the husband and wife (the granters) simply transfer whatever interest they have in the property to the husband and wife (the grantees), without assuming any responsibility for potential defects or encumbrances. When executing a Salt Lake City, Utah warranty deed from husband and wife to husband and wife, it is important to consult with a qualified real estate attorney or title company to ensure compliance with local laws and regulations. Additionally, it is advisable for the parties involved to conduct a thorough title search and obtain title insurance to protect against any unforeseen issues that may arise during or after the transfer of ownership.A warranty deed is a legal document used in real estate transactions to transfer ownership and protection of the property from one party to another. In the context of Salt Lake City, Utah, a warranty deed from husband and wife to husband and wife signifies the transfer of property ownership between married couples. In Salt Lake City, Utah, there are various types of warranty deeds that can be executed between husband and wife. These include: 1. General Warranty Deed from Husband and Wife to Husband and Wife: This type of warranty deed provides the highest level of protection to the buyer (the husband and wife receiving the property). It guarantees that the property is free from any liens, encumbrances, or defects, both prior to and during the ownership by the husband and wife. 2. Special Warranty Deed from Husband and Wife to Husband and Wife: With this type of warranty deed, the husband and wife selling the property, known as the granters, warrant and defend the title against any claims arising during their ownership. However, they do not guarantee against any encumbrances or defects that may have existed prior to their ownership. 3. Quitclaim Deed from Husband and Wife to Husband and Wife: Unlike warranty deeds, quitclaim deeds do not provide any warranties or guarantees. By using a quitclaim deed, the husband and wife (the granters) simply transfer whatever interest they have in the property to the husband and wife (the grantees), without assuming any responsibility for potential defects or encumbrances. When executing a Salt Lake City, Utah warranty deed from husband and wife to husband and wife, it is important to consult with a qualified real estate attorney or title company to ensure compliance with local laws and regulations. Additionally, it is advisable for the parties involved to conduct a thorough title search and obtain title insurance to protect against any unforeseen issues that may arise during or after the transfer of ownership.