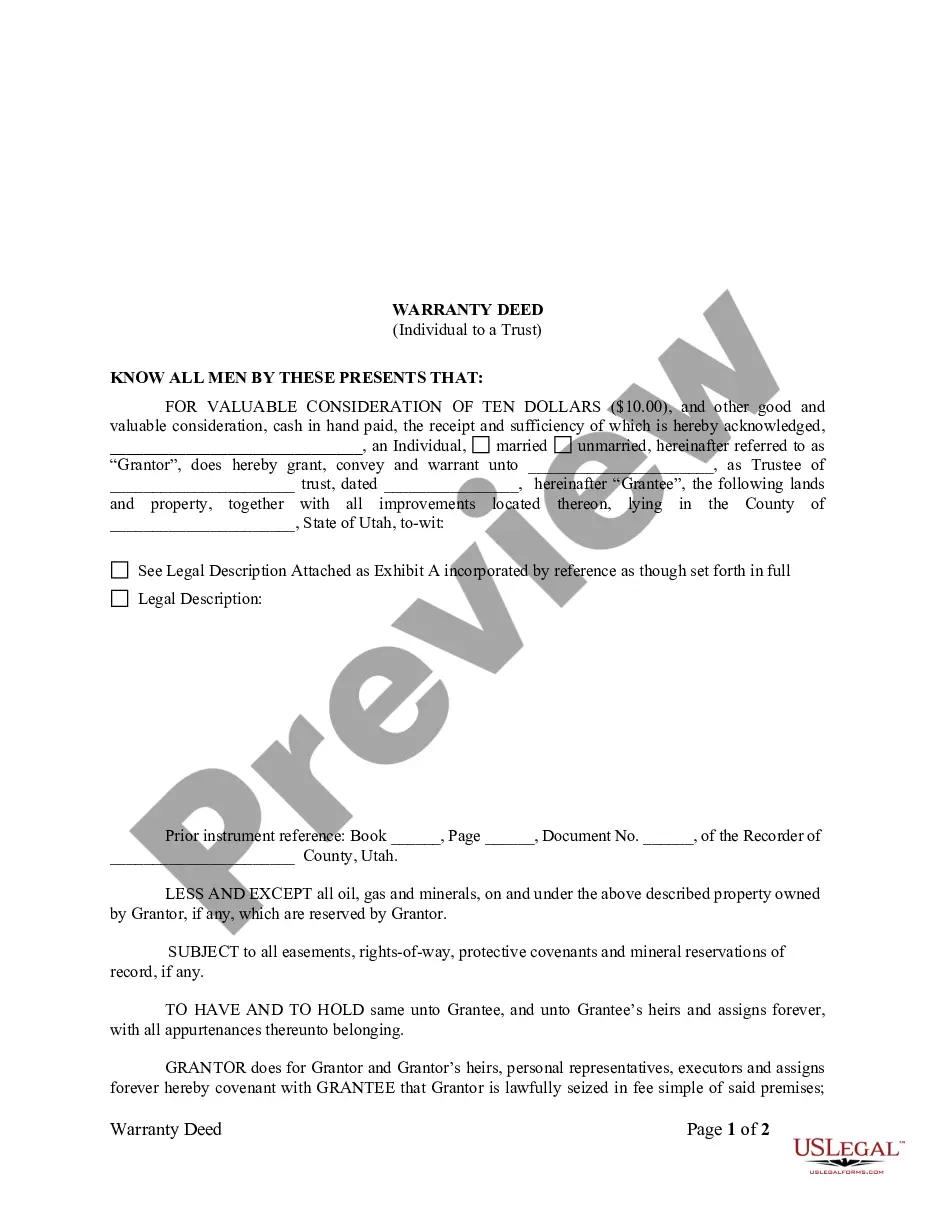

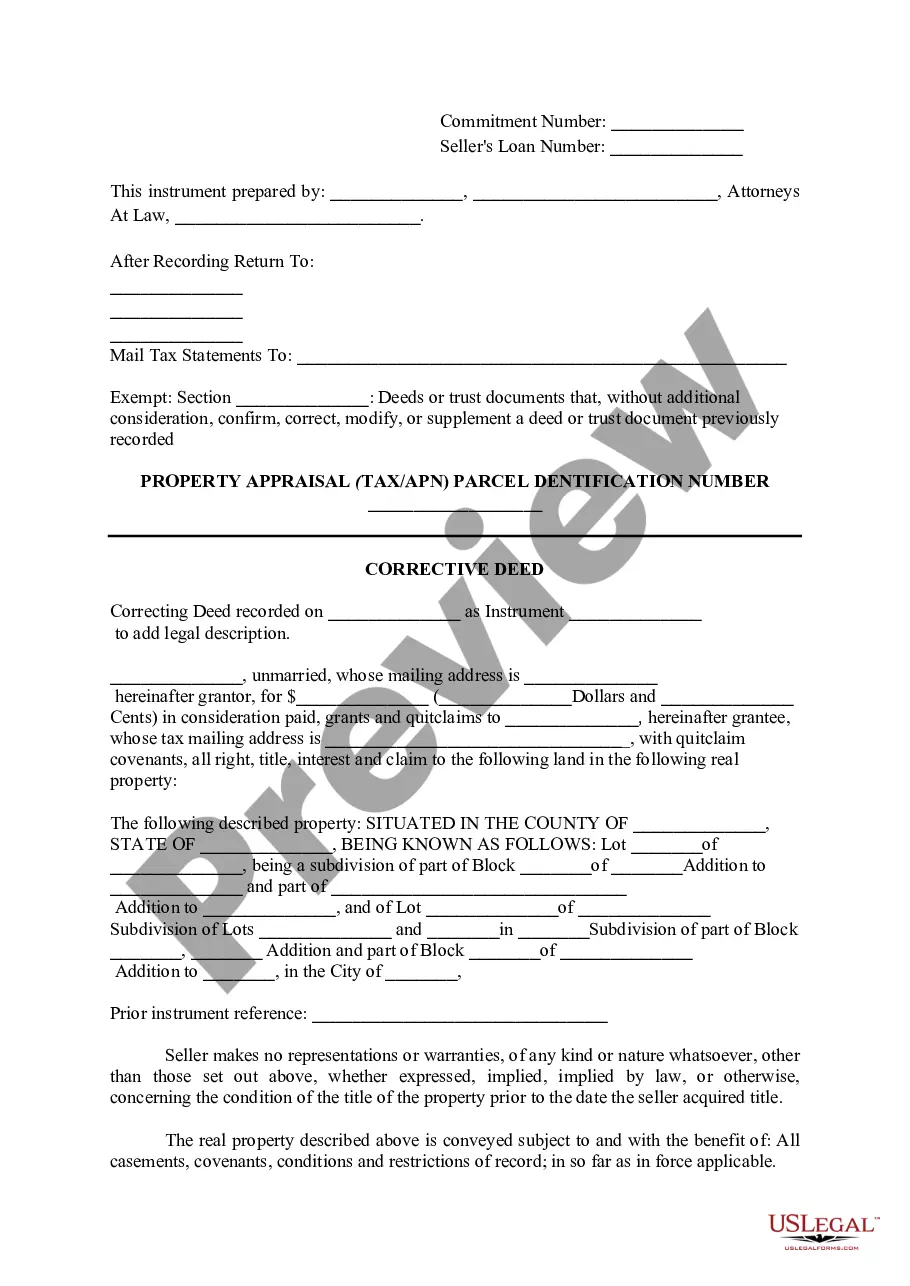

This form is a Correction Deed whereby the Grantor and Grantee correct a matter of "mutual" mistake in the legal description in a prior deed. This deed complies with all state statutory laws.

Salt Lake Utah Correction Deed - Trust to an Individual

Description

How to fill out Utah Correction Deed - Trust To An Individual?

We consistently aim to reduce or avert legal complications when handling intricate legal or financial issues.

To achieve this, we opt for legal services that, typically, are quite costly.

Nevertheless, not every legal issue is of equal intricacy.

Many of them can be managed on our own.

Utilize US Legal Forms whenever you need to quickly and securely find and download the Salt Lake Utah Correction Deed - Trust to an Individual or any other document. Simply Log In to your account and click the Get button beside it. If you happen to misplace the form, you can always re-download it from the My documents section. The procedure is just as straightforward if you’re new to the platform! You can set up your account in a few minutes.

- US Legal Forms is an online repository of current DIY legal documents covering a range of topics including wills and powers of attorney, articles of incorporation, and petitions for dissolution.

- Our platform enables you to manage your affairs independently without hiring an attorney.

- We provide access to legal document templates that may not always be available to the public.

- Our templates are tailored to specific states and regions, which greatly simplifies the search process.

Form popularity

FAQ

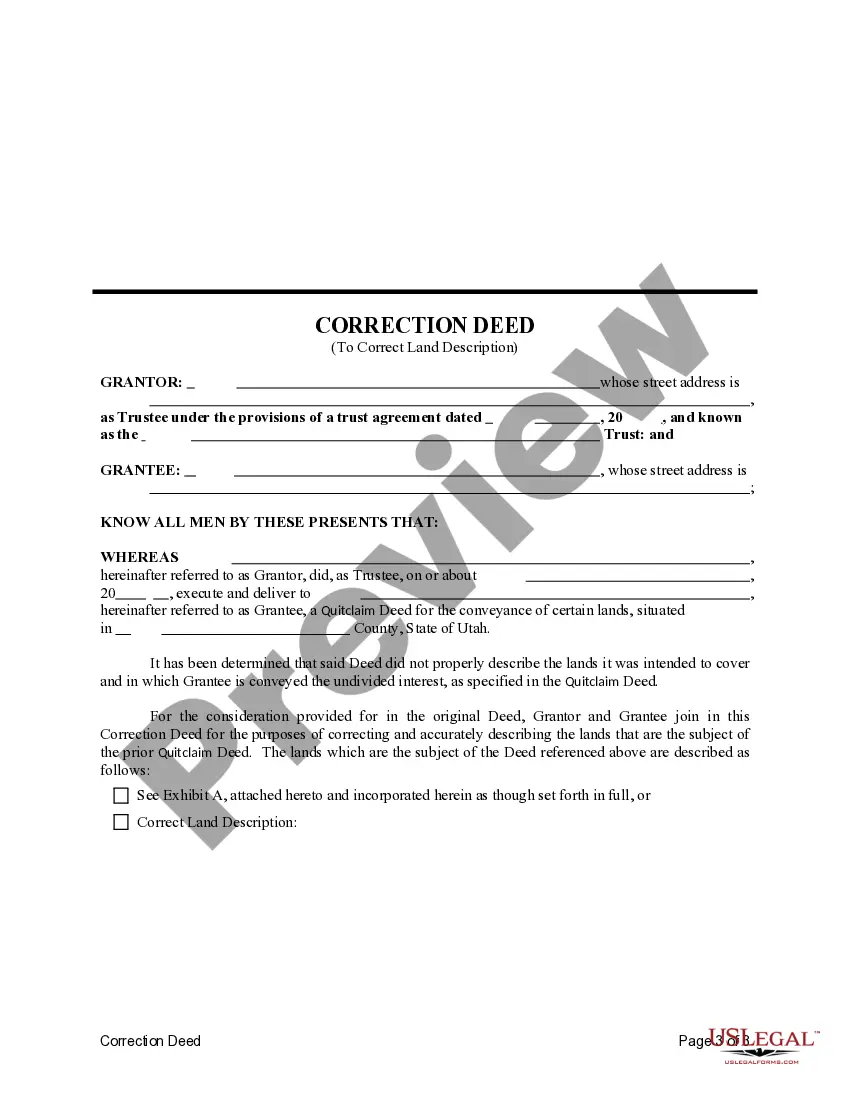

To fill out trust paperwork, begin by gathering necessary information about the property, trustor, and beneficiary. Clearly identify each party and the specific terms of the trust. Once you have all the details, you can carefully complete the forms on platforms like uslegalforms, making the process smoother for your Salt Lake Utah Correction Deed - Trust to an Individual.

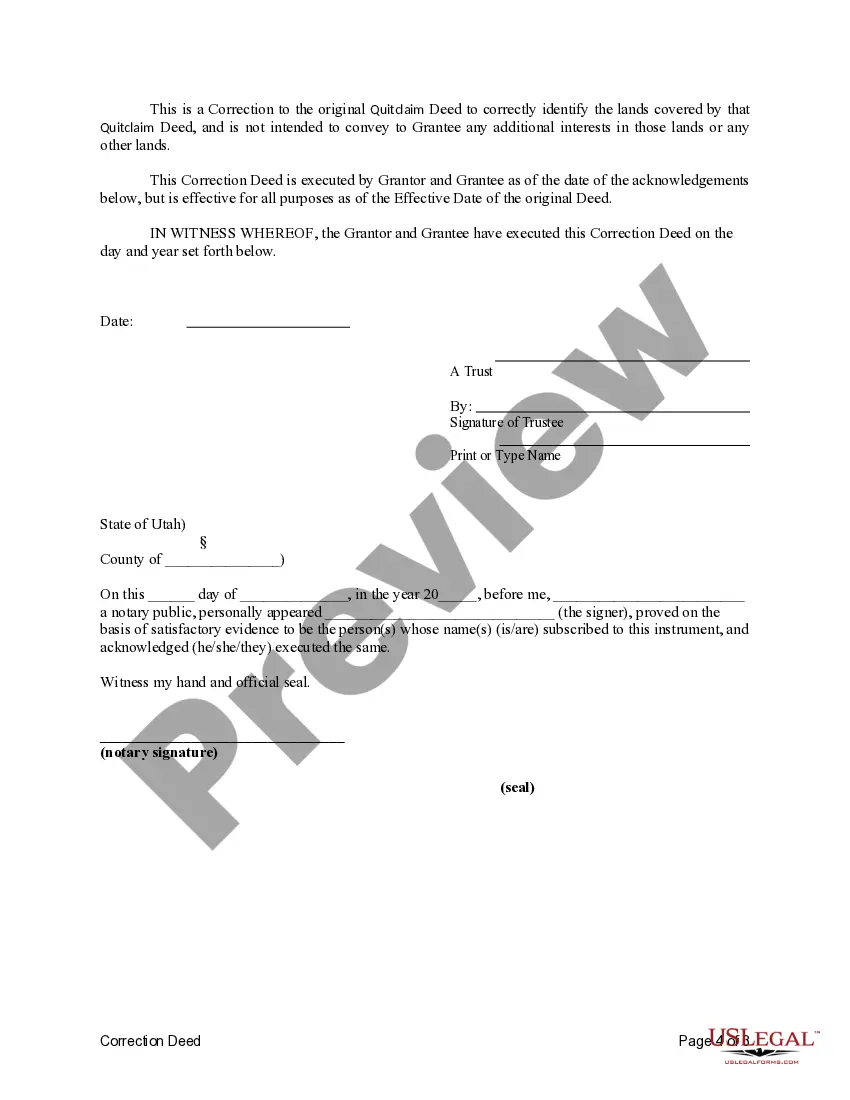

To transfer your property into a trust in Utah, start by drafting a trust agreement that defines its terms and objectives. Then, complete a Salt Lake Utah Correction Deed - Trust to an Individual to officially transfer the title. It is advisable to consult legal professionals to navigate the paperwork and ensure everything is done correctly. Once transferred, your property will be managed according to your trust’s guidelines.

To place a house in a trust in Utah, you must create the trust document that outlines the terms, beneficiaries, and trustee. Next, you'll need to execute a Salt Lake Utah Correction Deed - Trust to an Individual to transfer the property's legal title into the trust. It’s often beneficial to seek guidance from a legal professional to ensure all details are properly handled. Once completed, the property is officially owned by the trust.

Transferring property to a trust can streamline the management of your assets and provide greater control over how they are distributed. A Salt Lake Utah Correction Deed - Trust to an Individual allows for a smooth transition of ownership, especially during estate planning. Furthermore, this approach can help avoid probate, making the process easier for your heirs. Overall, it provides peace of mind knowing that your wishes will be honored.

While placing your property in a trust can offer benefits, there are some downsides to consider. One major drawback is the potential loss of control; once a Salt Lake Utah Correction Deed - Trust to an Individual is established, you may limit your ability to make quick changes. Additionally, setting up a trust can involve legal fees and added administrative costs. These factors are essential to weigh against the advantages of asset protection and avoiding probate.

Many states in the U.S. allow deeds of trust, including California, Texas, and Washington. These states use this mechanism for securing loans, similar to Utah. Knowing whether your state recognizes a deed of trust can influence your property transactions. For those operating in Salt Lake, Utah, understanding the Salt Lake Utah Correction Deed - Trust to an Individual is key for effective property management.

Yes, you can transfer property from a trust to an individual in Utah. This transfer often involves executing a Salt Lake Utah Correction Deed - Trust to an Individual, which legally reassigns property ownership from the trust to the specified individual. It’s crucial to follow proper legal procedures to ensure the transfer is valid and documented correctly. Using resources from platforms like uslegalforms can help streamline this process.