This form is a Warranty Deed where the Grantor is a Trust and the Grantee is an individual. Grantor conveys and warrants the described property to the Grantee. This deed complies with all state statutory laws.

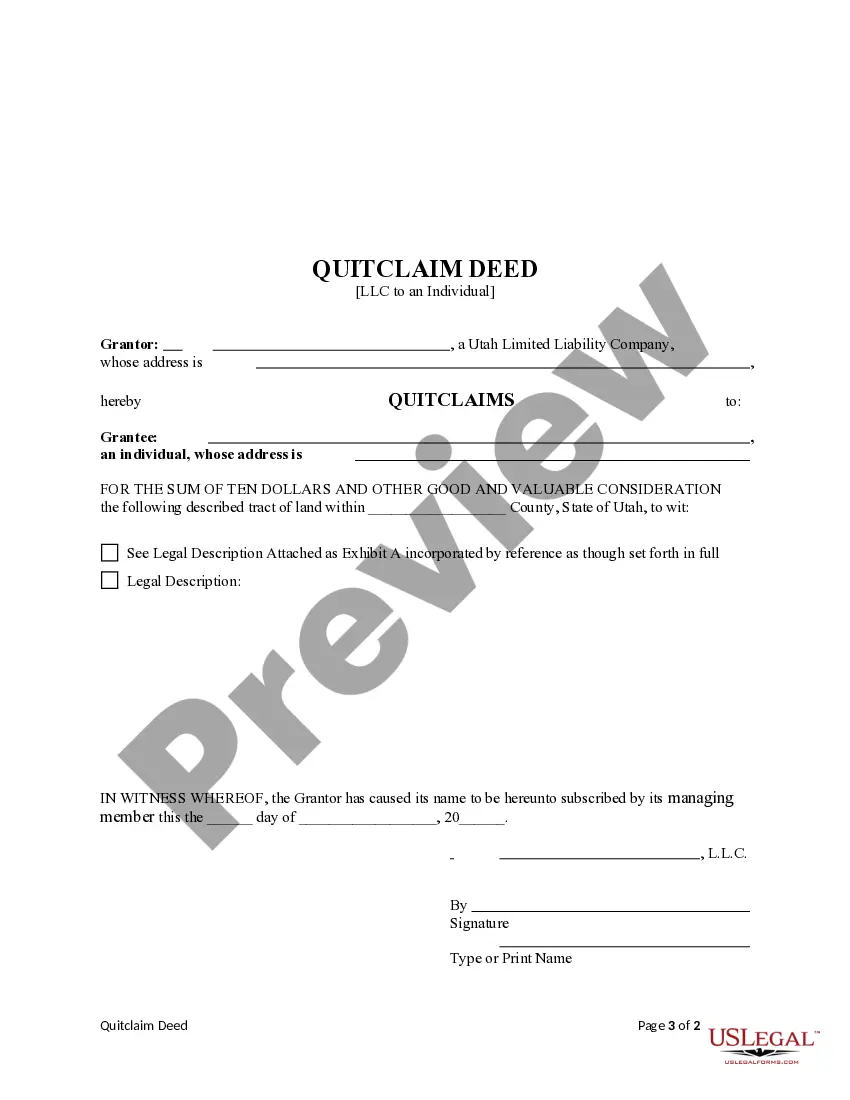

A warranty deed is a legal document used to transfer real estate property rights from one party, known as the granter, to another party, known as the grantee. Specifically, a Salt Lake Utah Warranty Deed from a Trust to an Individual refers to the transfer of property ownership from a trust to an individual in Salt Lake City, Utah. In Salt Lake City, Utah, there are different types of warranty deeds that can be used when transferring property from a trust to an individual. These include: 1. General Warranty Deed: A general warranty deed provides the highest level of protection to the grantee. It guarantees that the granter has the legal right to transfer the property and ensures that the property is free from any potential defects, both known and unknown. 2. Special Warranty Deed: A special warranty deed also provides certain guarantees to the grantee, but with limitations. It only guarantees that the granter has not incurred any defects or encumbrances during their ownership of the property. It does not cover any previous defects or issues that may have existed before the granter's ownership. 3. Quitclaim Deed: A quitclaim deed, although not technically a warranty deed, is another type of property transfer document that can be utilized in Salt Lake City, Utah. This deed transfers the granter's interest in the property without making any guarantees about the title's validity or any potential defects. When a trust holds property in Salt Lake City, Utah, and the decision is made to transfer ownership to an individual, a warranty deed must be prepared. This legal document will include relevant details such as the names of the granter (the trust) and the grantee (the individual), a description of the property being transferred, and any specific terms or conditions agreed upon during the transfer process. It is crucial for both parties involved in the transaction to consult with an experienced real estate attorney and ensure that all legal requirements for the transfer are met. This will help protect the rights and interests of both the trust and the individual acquiring the property.A warranty deed is a legal document used to transfer real estate property rights from one party, known as the granter, to another party, known as the grantee. Specifically, a Salt Lake Utah Warranty Deed from a Trust to an Individual refers to the transfer of property ownership from a trust to an individual in Salt Lake City, Utah. In Salt Lake City, Utah, there are different types of warranty deeds that can be used when transferring property from a trust to an individual. These include: 1. General Warranty Deed: A general warranty deed provides the highest level of protection to the grantee. It guarantees that the granter has the legal right to transfer the property and ensures that the property is free from any potential defects, both known and unknown. 2. Special Warranty Deed: A special warranty deed also provides certain guarantees to the grantee, but with limitations. It only guarantees that the granter has not incurred any defects or encumbrances during their ownership of the property. It does not cover any previous defects or issues that may have existed before the granter's ownership. 3. Quitclaim Deed: A quitclaim deed, although not technically a warranty deed, is another type of property transfer document that can be utilized in Salt Lake City, Utah. This deed transfers the granter's interest in the property without making any guarantees about the title's validity or any potential defects. When a trust holds property in Salt Lake City, Utah, and the decision is made to transfer ownership to an individual, a warranty deed must be prepared. This legal document will include relevant details such as the names of the granter (the trust) and the grantee (the individual), a description of the property being transferred, and any specific terms or conditions agreed upon during the transfer process. It is crucial for both parties involved in the transaction to consult with an experienced real estate attorney and ensure that all legal requirements for the transfer are met. This will help protect the rights and interests of both the trust and the individual acquiring the property.