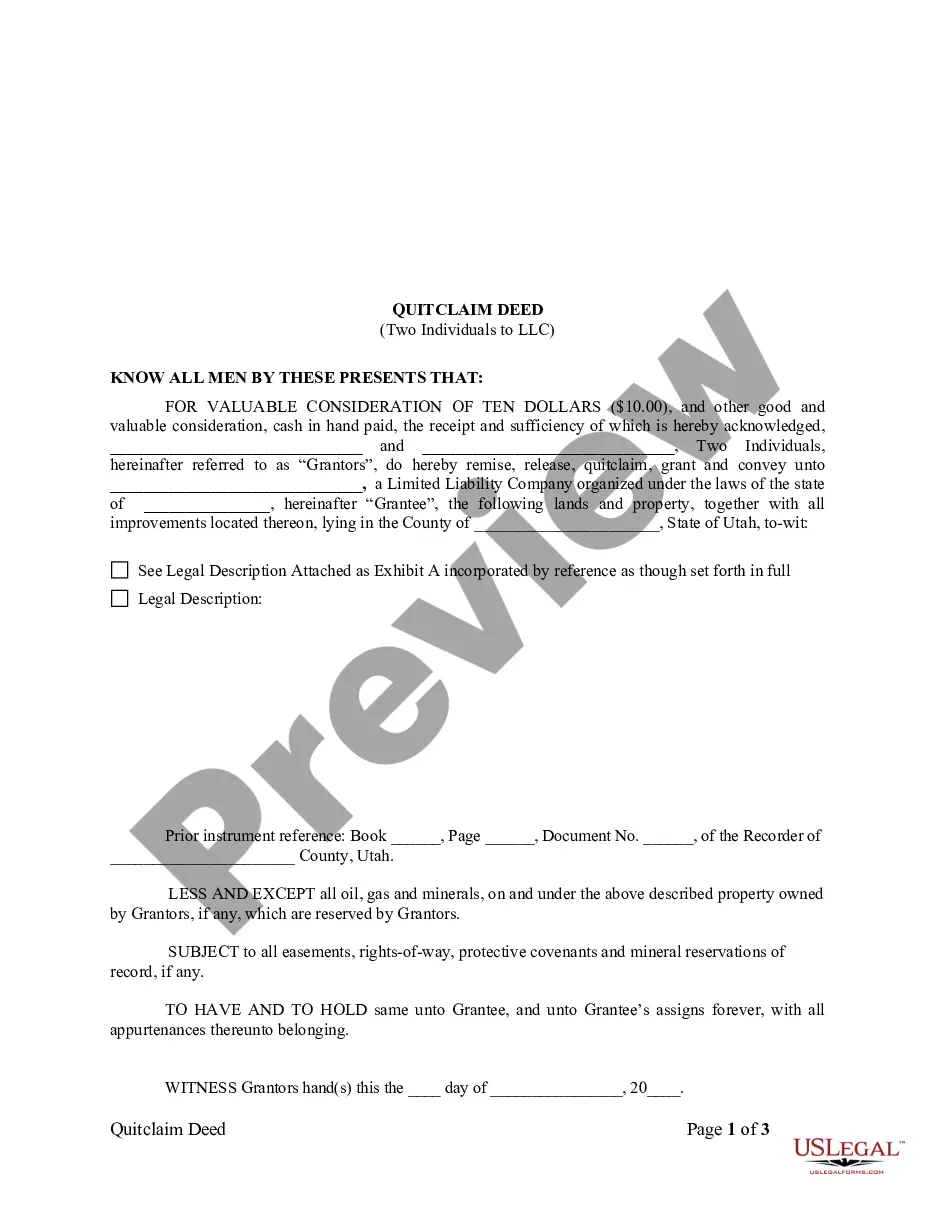

This Quitclaim Deed is used where the Grantors are two individuals and the Grantee is a limited liability company. Grantors convey and quitclaim the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors. This form complies with all state statutory laws.

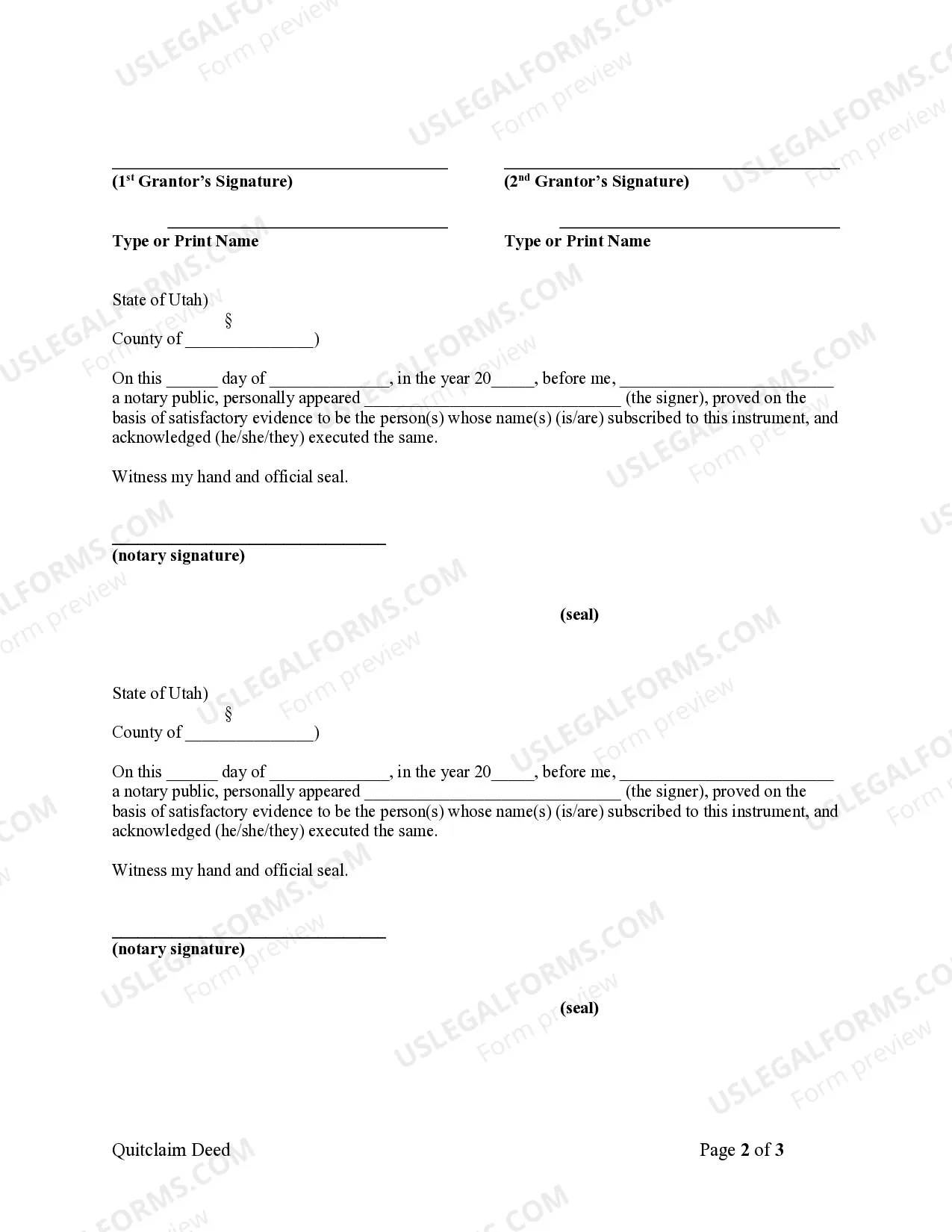

A West Valley City Utah Quitclaim Deed by Two Individuals to LLC is a legally binding document that facilitates the transfer of property ownership rights from two individuals to a limited liability company (LLC) in West Valley City, Utah. This type of deed serves as a means of conveying property without any warranties or guarantees for the grantee (LLC). It is commonly used in situations where the transfer of property is between parties who have a pre-existing relationship, such as family members or business partners. The West Valley City Utah Quitclaim Deed by Two Individuals to LLC holds several key components. Firstly, it includes the names and contact information of the granters (individuals transferring the property) and the grantee (LLC). The legal description of the property, including the parcel number and address, is also provided to ensure clarity. Additionally, this type of quitclaim deed outlines the consideration involved in the transfer, which can be in the form of money or other valuable assets. It is crucial to note that the deed often includes a statement confirming that the granters have full ownership rights and the authority to transfer the property to the LLC. This helps protect the grantee from any potential claims or disputes arising from third parties. Furthermore, West Valley City Utah Quitclaim Deed by Two Individuals to LLC may vary depending on their specific purposes or conditions. Examples of these include: 1. West Valley City Utah Quitclaim Deed by Two Individuals to LLC for Real Estate Investment: This type of quitclaim deed is commonly used when two individuals want to transfer ownership of a property to an LLC for investment purposes. It allows the LLC to hold and manage the property, potentially benefiting from tax advantages and liability protection. 2. West Valley City Utah Quitclaim Deed by Two Individuals to LLC for Business Operations: When two individuals wish to transfer ownership of a property to an LLC to be utilized specifically for business operations, this type of quitclaim deed is relevant. The LLC can then utilize the property for office space, warehousing, or other commercial activities. 3. West Valley City Utah Quitclaim Deed by Two Individuals to LLC for Estate Planning: This type of quitclaim deed is used when individuals want to transfer property ownership to an LLC as part of their estate planning strategy. It allows them to retain control over the property during their lifetime while ensuring a seamless transfer of ownership to the LLC upon their passing. In conclusion, a West Valley City Utah Quitclaim Deed by Two Individuals to LLC serves as a legal instrument for transferring property ownership rights from two individuals to an LLC. It is a flexible tool that can be customized to suit various purposes such as real estate investment, business operations, or estate planning. However, it is advisable to consult with a legal professional or real estate attorney to ensure all legal requirements are met and to address any unique circumstances of the property transfer.A West Valley City Utah Quitclaim Deed by Two Individuals to LLC is a legally binding document that facilitates the transfer of property ownership rights from two individuals to a limited liability company (LLC) in West Valley City, Utah. This type of deed serves as a means of conveying property without any warranties or guarantees for the grantee (LLC). It is commonly used in situations where the transfer of property is between parties who have a pre-existing relationship, such as family members or business partners. The West Valley City Utah Quitclaim Deed by Two Individuals to LLC holds several key components. Firstly, it includes the names and contact information of the granters (individuals transferring the property) and the grantee (LLC). The legal description of the property, including the parcel number and address, is also provided to ensure clarity. Additionally, this type of quitclaim deed outlines the consideration involved in the transfer, which can be in the form of money or other valuable assets. It is crucial to note that the deed often includes a statement confirming that the granters have full ownership rights and the authority to transfer the property to the LLC. This helps protect the grantee from any potential claims or disputes arising from third parties. Furthermore, West Valley City Utah Quitclaim Deed by Two Individuals to LLC may vary depending on their specific purposes or conditions. Examples of these include: 1. West Valley City Utah Quitclaim Deed by Two Individuals to LLC for Real Estate Investment: This type of quitclaim deed is commonly used when two individuals want to transfer ownership of a property to an LLC for investment purposes. It allows the LLC to hold and manage the property, potentially benefiting from tax advantages and liability protection. 2. West Valley City Utah Quitclaim Deed by Two Individuals to LLC for Business Operations: When two individuals wish to transfer ownership of a property to an LLC to be utilized specifically for business operations, this type of quitclaim deed is relevant. The LLC can then utilize the property for office space, warehousing, or other commercial activities. 3. West Valley City Utah Quitclaim Deed by Two Individuals to LLC for Estate Planning: This type of quitclaim deed is used when individuals want to transfer property ownership to an LLC as part of their estate planning strategy. It allows them to retain control over the property during their lifetime while ensuring a seamless transfer of ownership to the LLC upon their passing. In conclusion, a West Valley City Utah Quitclaim Deed by Two Individuals to LLC serves as a legal instrument for transferring property ownership rights from two individuals to an LLC. It is a flexible tool that can be customized to suit various purposes such as real estate investment, business operations, or estate planning. However, it is advisable to consult with a legal professional or real estate attorney to ensure all legal requirements are met and to address any unique circumstances of the property transfer.