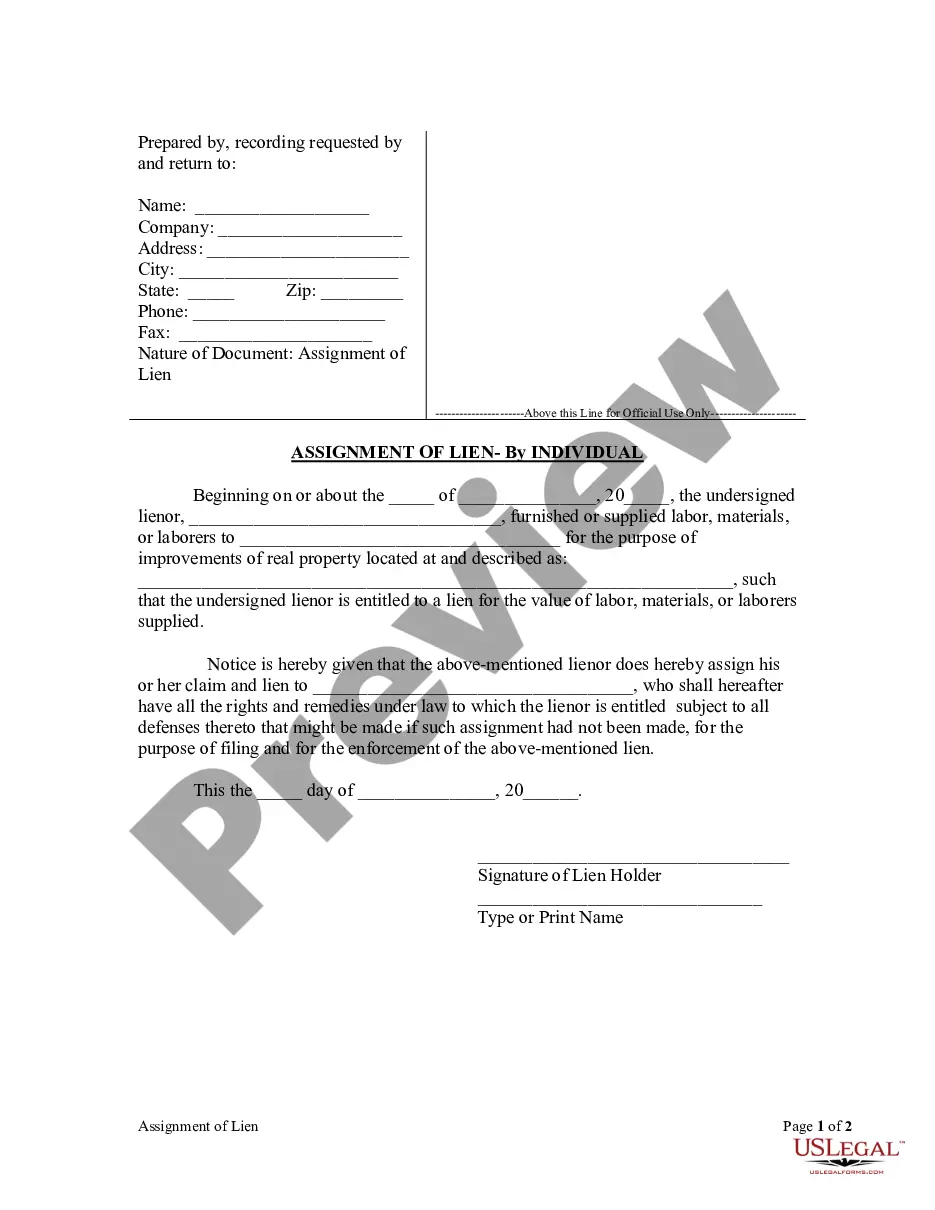

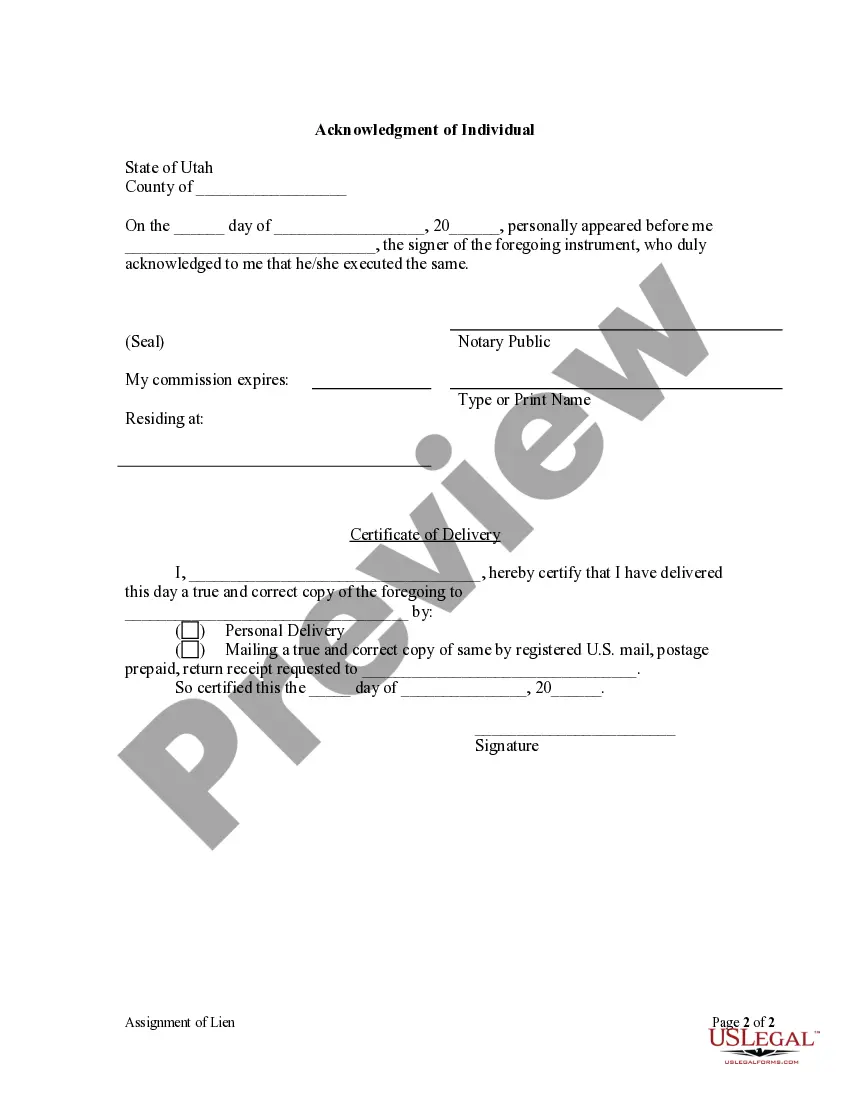

This Assignment of Lien form is for use by an individual lienor who furnished or supplied labor, materials, or laborers for the purpose of improvements of real property, such that the lienor is entitled to a lien for the value of labor, materials, or laborers supplied to provide notice that he or she assigns his or her claim and lien to an individual, who shall have all the rights and remedies under law to which the lienor is entitled subject to all defenses thereto that might be made if such assignment had not been made, for the purpose of filing and for the enforcement of the lien.

Salt Lake Utah Assignment of Lien — Individual refers to the legal process in which an individual property owner in Salt Lake County, Utah transfers or assigns a lien against their property to another individual or entity. This assignment of lien is often done to satisfy a debt or obligation the property owner owes to the assignee. The Assignment of Lien — Individual process is governed by specific laws and regulations in Utah and provides a formal mechanism for transferring the rights and interests associated with a lien on a property. This legal document outlines the details of the transfer, including the identification of the property, the amount owed, and the terms of the assignment. There are several types of Salt Lake Utah Assignment of Lien — Individual that can occur: 1. Assignment of Mechanic's Lien: This type of assignment commonly occurs when a property owner seeks to transfer the lien rights of a contractor or subcontractor who provided labor or materials for construction or repair work on the property. 2. Assignment of Tax Lien: Property owners who have outstanding tax debts may choose to assign their tax liens to individual investors or government entities, which can then seek repayment through various means, such as collecting interest or foreclosing on the property. 3. Assignment of Judgment Lien: When a court awards a judgment against a property owner, the creditor (often an individual or business) may choose to assign the judgment lien to another individual or entity. This allows the assignee to pursue collection efforts on behalf of the original creditor. 4. Assignment of Mortgage Lien: In circumstances where a homeowner is unable to fulfill their mortgage obligations, they may assign their mortgage lien to an individual or financial institution. This transfer of the lien allows the assignee to assume the rights and responsibilities associated with the mortgage, such as collecting payments or initiating foreclosure proceedings. It is vital for both the assignor (property owner) and the assignee (individual or entity receiving the lien) to engage in a legally binding Assignment of Lien — Individual agreement to ensure proper documentation and protection of their respective rights and interests. Legal advice is usually recommended throughout the process to ensure compliance with Utah laws and to protect the involved parties' interests.Salt Lake Utah Assignment of Lien — Individual refers to the legal process in which an individual property owner in Salt Lake County, Utah transfers or assigns a lien against their property to another individual or entity. This assignment of lien is often done to satisfy a debt or obligation the property owner owes to the assignee. The Assignment of Lien — Individual process is governed by specific laws and regulations in Utah and provides a formal mechanism for transferring the rights and interests associated with a lien on a property. This legal document outlines the details of the transfer, including the identification of the property, the amount owed, and the terms of the assignment. There are several types of Salt Lake Utah Assignment of Lien — Individual that can occur: 1. Assignment of Mechanic's Lien: This type of assignment commonly occurs when a property owner seeks to transfer the lien rights of a contractor or subcontractor who provided labor or materials for construction or repair work on the property. 2. Assignment of Tax Lien: Property owners who have outstanding tax debts may choose to assign their tax liens to individual investors or government entities, which can then seek repayment through various means, such as collecting interest or foreclosing on the property. 3. Assignment of Judgment Lien: When a court awards a judgment against a property owner, the creditor (often an individual or business) may choose to assign the judgment lien to another individual or entity. This allows the assignee to pursue collection efforts on behalf of the original creditor. 4. Assignment of Mortgage Lien: In circumstances where a homeowner is unable to fulfill their mortgage obligations, they may assign their mortgage lien to an individual or financial institution. This transfer of the lien allows the assignee to assume the rights and responsibilities associated with the mortgage, such as collecting payments or initiating foreclosure proceedings. It is vital for both the assignor (property owner) and the assignee (individual or entity receiving the lien) to engage in a legally binding Assignment of Lien — Individual agreement to ensure proper documentation and protection of their respective rights and interests. Legal advice is usually recommended throughout the process to ensure compliance with Utah laws and to protect the involved parties' interests.