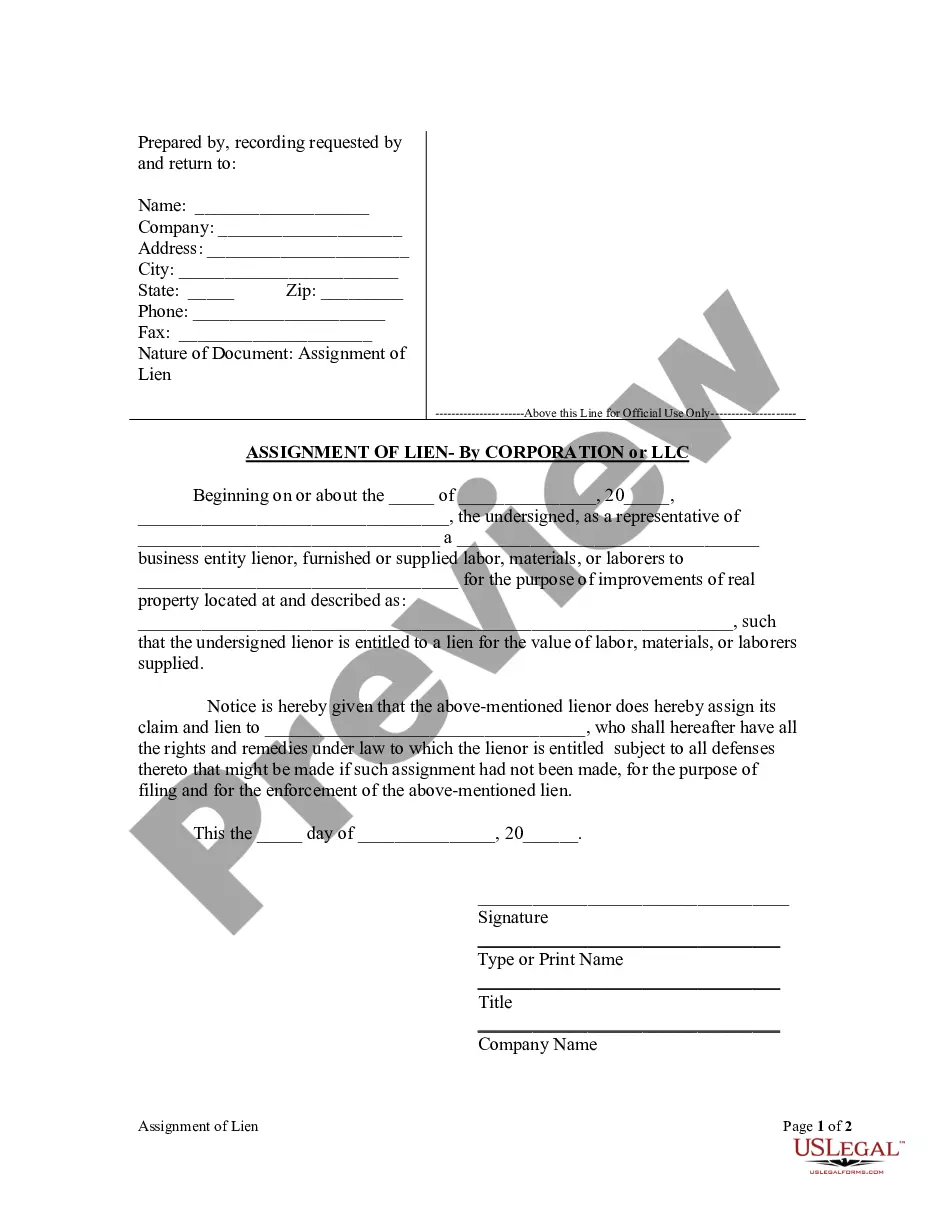

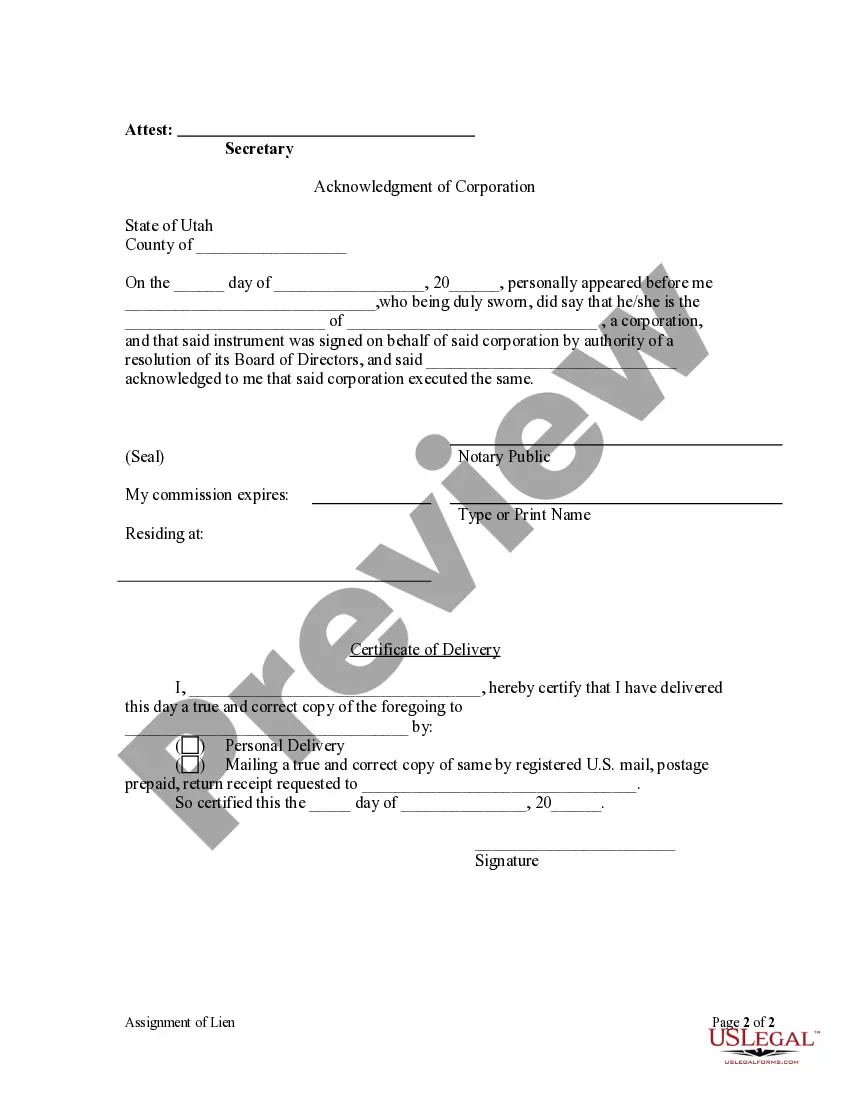

This Assignment of Lien form is for use by a corporate lienor who furnished or supplied labor, materials, or laborers for the purpose of improvements of real property, such that the lienor is entitled to a lien for the value of labor, materials, or laborers supplied to provide notice that the lienor assigns its claim and lien to an individual, who shall have all the rights and remedies under law to which the lienor is entitled subject to all defenses thereto that might be made if such assignment had not been made, for the purpose of filing and for the enforcement of the lien.

Provo Utah Assignment of Lien — Corporation or LLC: A Comprehensive Overview In Provo, Utah, an assignment of lien is a legal document used to transfer the rights and interests of a lien from one party to another. This process commonly occurs when corporations or limited liability companies (LCS) are involved. Understanding the intricacies of the Provo Utah Assignment of Lien — Corporation or LLC is crucial for businesses and individuals engaging in these transactions. Corporations and LCS, being distinct legal entities, have certain requirements and procedures when it comes to the assignment of liens in Provo, Utah. There are several types of assignment of lien specific to these entities, including: 1. Assignment of Lien by a Corporation: When a corporation holds a lien on a property or asset, it may choose to assign that lien to another party. This could occur, for example, when a corporation sells its interests in a property to a different corporation or individual. The assignment of lien by a corporation involves the transfer of all lien rights, interests, and claims related to the property in question. 2. Assignment of Lien by an LLC: Similar to a corporation, an LLC may hold a lien on a property or asset. When an LLC wishes to transfer its lien to a different party, an assignment of lien is utilized. For instance, an LLC might assign its lien to a new lender who will assume the responsibilities and rights associated with the lien. It is essential to remember that the Provo Utah Assignment of Lien — Corporation or LLC must adhere to legal requirements to ensure its validity. These requirements may include proper documentation, signatures from authorized representatives of the corporation or LLC, and compliance with applicable state and local laws governing lien assignments. Additionally, it is highly recommended consulting with an experienced attorney or legal professional to navigate the process smoothly. They can provide guidance and ensure that all necessary steps are followed correctly, preventing any potential legal issues or disputes. In summary, the Provo Utah Assignment of Lien — Corporation or LLC involves the transfer of lien rights and interests from a corporation or LLC to another party. Understanding the specific requirements and procedures for corporations and LCS is crucial when engaging in such transactions. Seek professional legal advice when dealing with assignment of lien matters to ensure legal compliance and a seamless transfer of lien rights.

Provo Utah Assignment of Lien — Corporation or LLC: A Comprehensive Overview In Provo, Utah, an assignment of lien is a legal document used to transfer the rights and interests of a lien from one party to another. This process commonly occurs when corporations or limited liability companies (LCS) are involved. Understanding the intricacies of the Provo Utah Assignment of Lien — Corporation or LLC is crucial for businesses and individuals engaging in these transactions. Corporations and LCS, being distinct legal entities, have certain requirements and procedures when it comes to the assignment of liens in Provo, Utah. There are several types of assignment of lien specific to these entities, including: 1. Assignment of Lien by a Corporation: When a corporation holds a lien on a property or asset, it may choose to assign that lien to another party. This could occur, for example, when a corporation sells its interests in a property to a different corporation or individual. The assignment of lien by a corporation involves the transfer of all lien rights, interests, and claims related to the property in question. 2. Assignment of Lien by an LLC: Similar to a corporation, an LLC may hold a lien on a property or asset. When an LLC wishes to transfer its lien to a different party, an assignment of lien is utilized. For instance, an LLC might assign its lien to a new lender who will assume the responsibilities and rights associated with the lien. It is essential to remember that the Provo Utah Assignment of Lien — Corporation or LLC must adhere to legal requirements to ensure its validity. These requirements may include proper documentation, signatures from authorized representatives of the corporation or LLC, and compliance with applicable state and local laws governing lien assignments. Additionally, it is highly recommended consulting with an experienced attorney or legal professional to navigate the process smoothly. They can provide guidance and ensure that all necessary steps are followed correctly, preventing any potential legal issues or disputes. In summary, the Provo Utah Assignment of Lien — Corporation or LLC involves the transfer of lien rights and interests from a corporation or LLC to another party. Understanding the specific requirements and procedures for corporations and LCS is crucial when engaging in such transactions. Seek professional legal advice when dealing with assignment of lien matters to ensure legal compliance and a seamless transfer of lien rights.