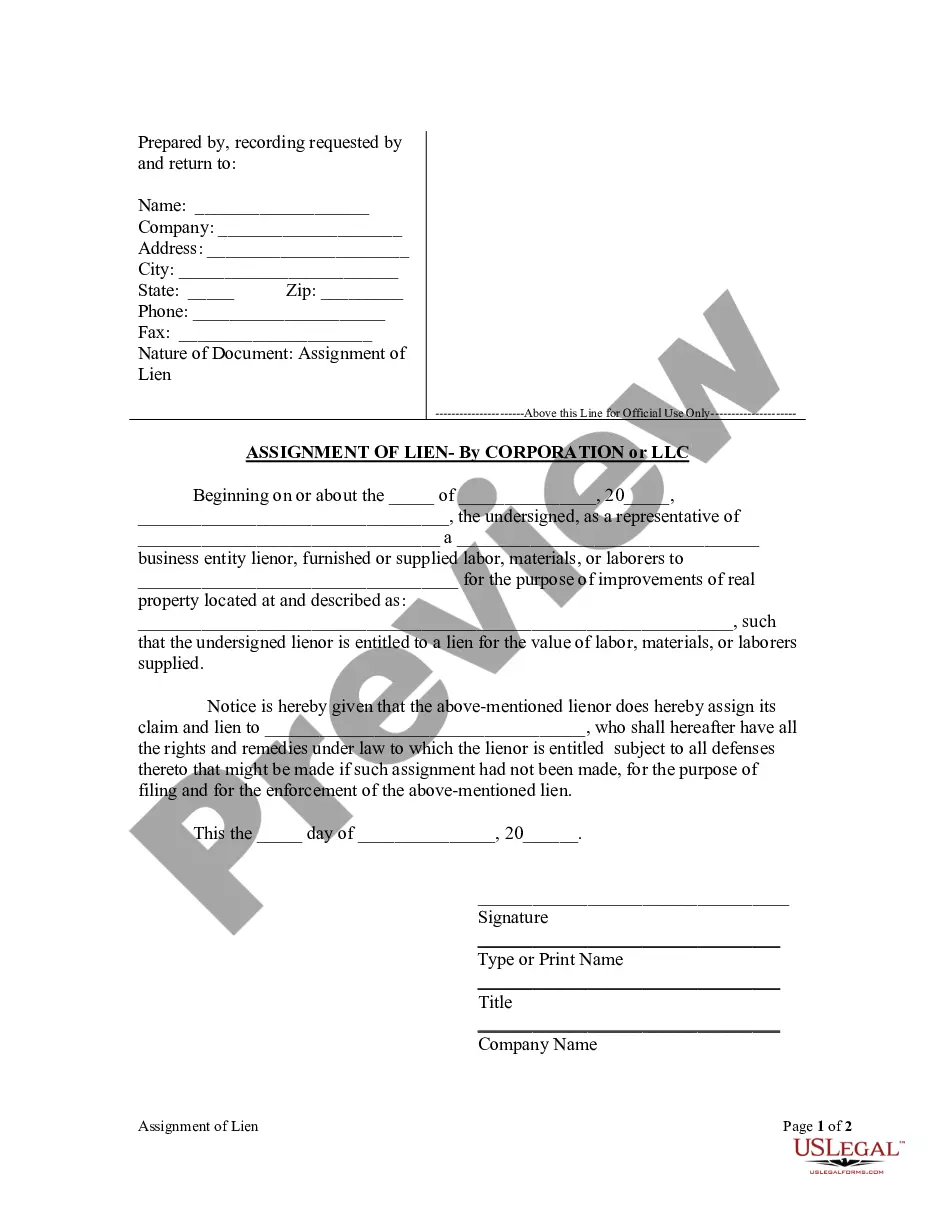

This Assignment of Lien form is for use by a corporate lienor who furnished or supplied labor, materials, or laborers for the purpose of improvements of real property, such that the lienor is entitled to a lien for the value of labor, materials, or laborers supplied to provide notice that the lienor assigns its claim and lien to an individual, who shall have all the rights and remedies under law to which the lienor is entitled subject to all defenses thereto that might be made if such assignment had not been made, for the purpose of filing and for the enforcement of the lien.

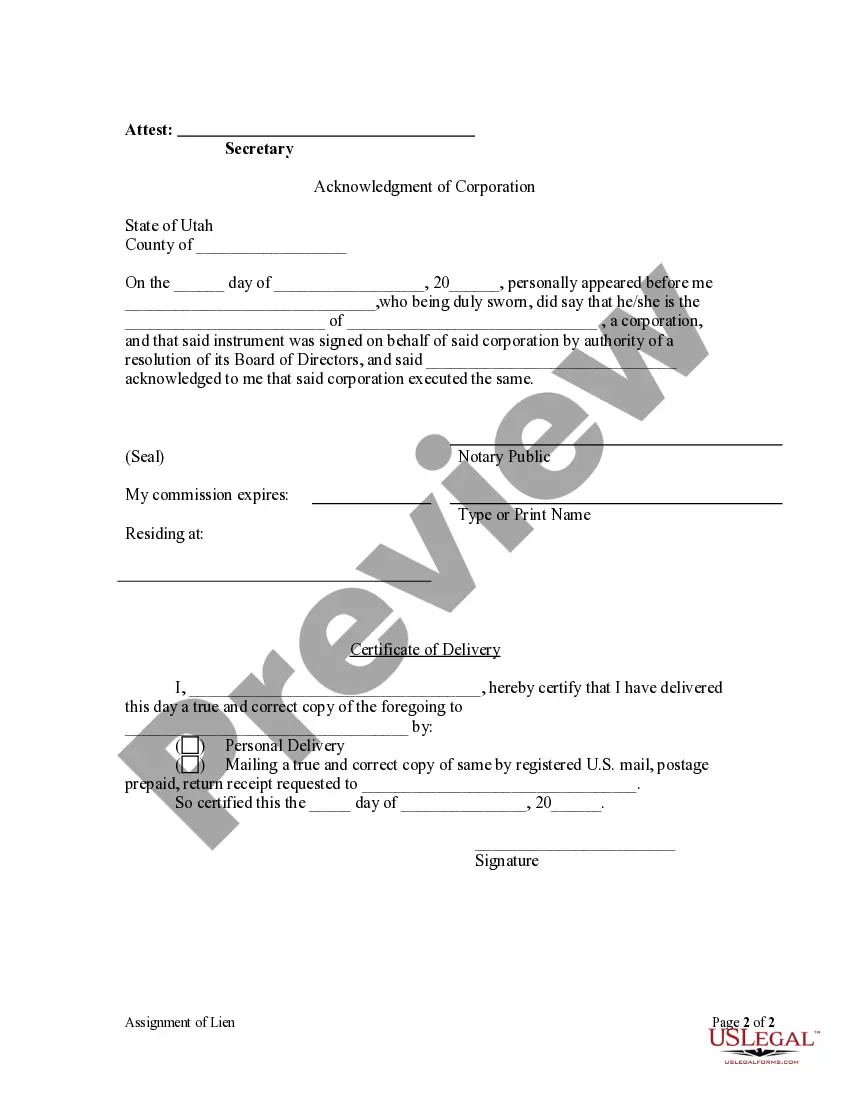

Salt Lake City, Utah Assignment of Lien — Corporation or LLC: Understanding the Basics In Salt Lake City, Utah, when a creditor has a legitimate claim against a debtor's property, they can file a lien. However, there may be situations where the creditor wants to transfer their right to claim that lien to another entity. This is known as an Assignment of Lien. Assignments of Lien for corporations and limited liability companies (LCS) are commonly used in Salt Lake City for this purpose. A Corporation or LLC can hold a lien against a debtor's property for various reasons, such as unpaid debts, failure to fulfill contractual obligations, or judgments awarded after a legal dispute. When a Corporation or LLC decides to assign the lien to another entity, the Assignment of Lien process comes into play. 1. Assignment of Lien — Corporation: When a Corporation chooses to assign a lien, it means they are transferring their rights to claim the debtor's property to another entity. This assignment can be made to another Corporation, an LLC, or any other eligible entity capable of holding a lien. The Assignor (corporation assigning the lien) needs to draft an official Assignment of Lien document, clearly stating the transfer of rights, the assignee (entity receiving the lien), relevant property details, and any other necessary information. Once properly executed and recorded, the assignee becomes the new lien holder, responsible for enforcing the lien on the debtor's property. 2. Assignment of Lien — LLC: Similarly, an LLC in Salt Lake City can also opt to assign a lien to another entity. The process involves drafting an official Assignment of Lien document, just as with a Corporation. The assignor LLC transfers its right to claim the debtor's property to the assignee, who can be another LLC, Corporation, or any eligible entity. The document must accurately describe the assignment, including the parties involved, property details, and any conditions or rights associated with the lien. Once executed and recorded, the assignee becomes responsible for enforcing the lien against the debtor's property. It is important to note that the specific requirements and procedures for the Assignment of Lien — Corporation or LLC may vary depending on the jurisdiction and the nature of the lien involved. Therefore, it's crucial to consult legal professionals well-versed in Salt Lake City's laws and regulations to ensure compliance and proper execution of the Assignment of Lien documents. In conclusion, the Assignment of Lien — Corporation or LLC in Salt Lake City, Utah allows a Corporation or LLC to transfer their rights to claim a debtor's property to another eligible entity. Whether it's a Corporation or an LLC assigning the lien, the process involves creating an official Assignment of Lien document, accurately detailing the transfer and property information. By following the necessary legal steps and consulting with experts, businesses can effectively navigate the Assignment of Lien process in Salt Lake City.Salt Lake City, Utah Assignment of Lien — Corporation or LLC: Understanding the Basics In Salt Lake City, Utah, when a creditor has a legitimate claim against a debtor's property, they can file a lien. However, there may be situations where the creditor wants to transfer their right to claim that lien to another entity. This is known as an Assignment of Lien. Assignments of Lien for corporations and limited liability companies (LCS) are commonly used in Salt Lake City for this purpose. A Corporation or LLC can hold a lien against a debtor's property for various reasons, such as unpaid debts, failure to fulfill contractual obligations, or judgments awarded after a legal dispute. When a Corporation or LLC decides to assign the lien to another entity, the Assignment of Lien process comes into play. 1. Assignment of Lien — Corporation: When a Corporation chooses to assign a lien, it means they are transferring their rights to claim the debtor's property to another entity. This assignment can be made to another Corporation, an LLC, or any other eligible entity capable of holding a lien. The Assignor (corporation assigning the lien) needs to draft an official Assignment of Lien document, clearly stating the transfer of rights, the assignee (entity receiving the lien), relevant property details, and any other necessary information. Once properly executed and recorded, the assignee becomes the new lien holder, responsible for enforcing the lien on the debtor's property. 2. Assignment of Lien — LLC: Similarly, an LLC in Salt Lake City can also opt to assign a lien to another entity. The process involves drafting an official Assignment of Lien document, just as with a Corporation. The assignor LLC transfers its right to claim the debtor's property to the assignee, who can be another LLC, Corporation, or any eligible entity. The document must accurately describe the assignment, including the parties involved, property details, and any conditions or rights associated with the lien. Once executed and recorded, the assignee becomes responsible for enforcing the lien against the debtor's property. It is important to note that the specific requirements and procedures for the Assignment of Lien — Corporation or LLC may vary depending on the jurisdiction and the nature of the lien involved. Therefore, it's crucial to consult legal professionals well-versed in Salt Lake City's laws and regulations to ensure compliance and proper execution of the Assignment of Lien documents. In conclusion, the Assignment of Lien — Corporation or LLC in Salt Lake City, Utah allows a Corporation or LLC to transfer their rights to claim a debtor's property to another eligible entity. Whether it's a Corporation or an LLC assigning the lien, the process involves creating an official Assignment of Lien document, accurately detailing the transfer and property information. By following the necessary legal steps and consulting with experts, businesses can effectively navigate the Assignment of Lien process in Salt Lake City.