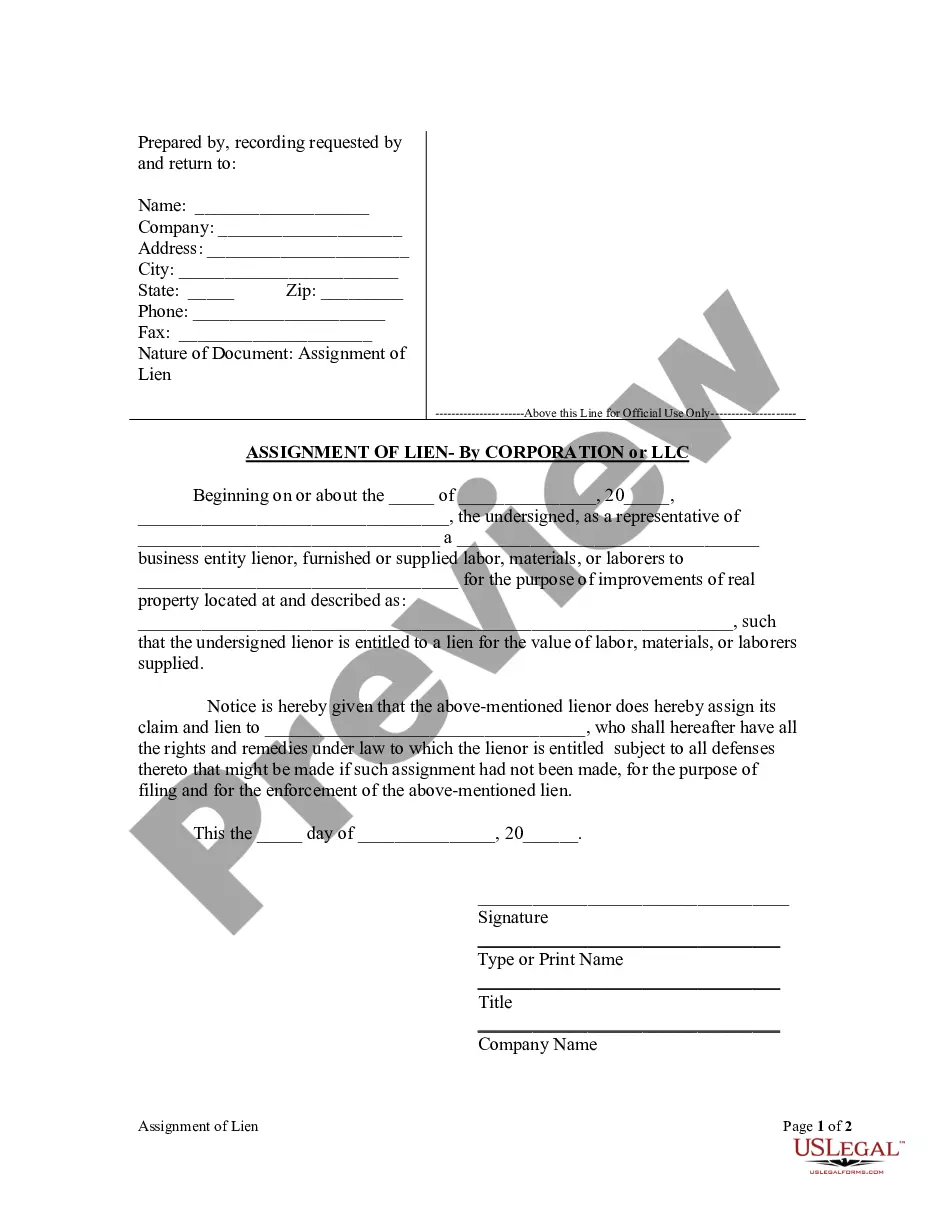

This Assignment of Lien form is for use by a corporate lienor who furnished or supplied labor, materials, or laborers for the purpose of improvements of real property, such that the lienor is entitled to a lien for the value of labor, materials, or laborers supplied to provide notice that the lienor assigns its claim and lien to an individual, who shall have all the rights and remedies under law to which the lienor is entitled subject to all defenses thereto that might be made if such assignment had not been made, for the purpose of filing and for the enforcement of the lien.

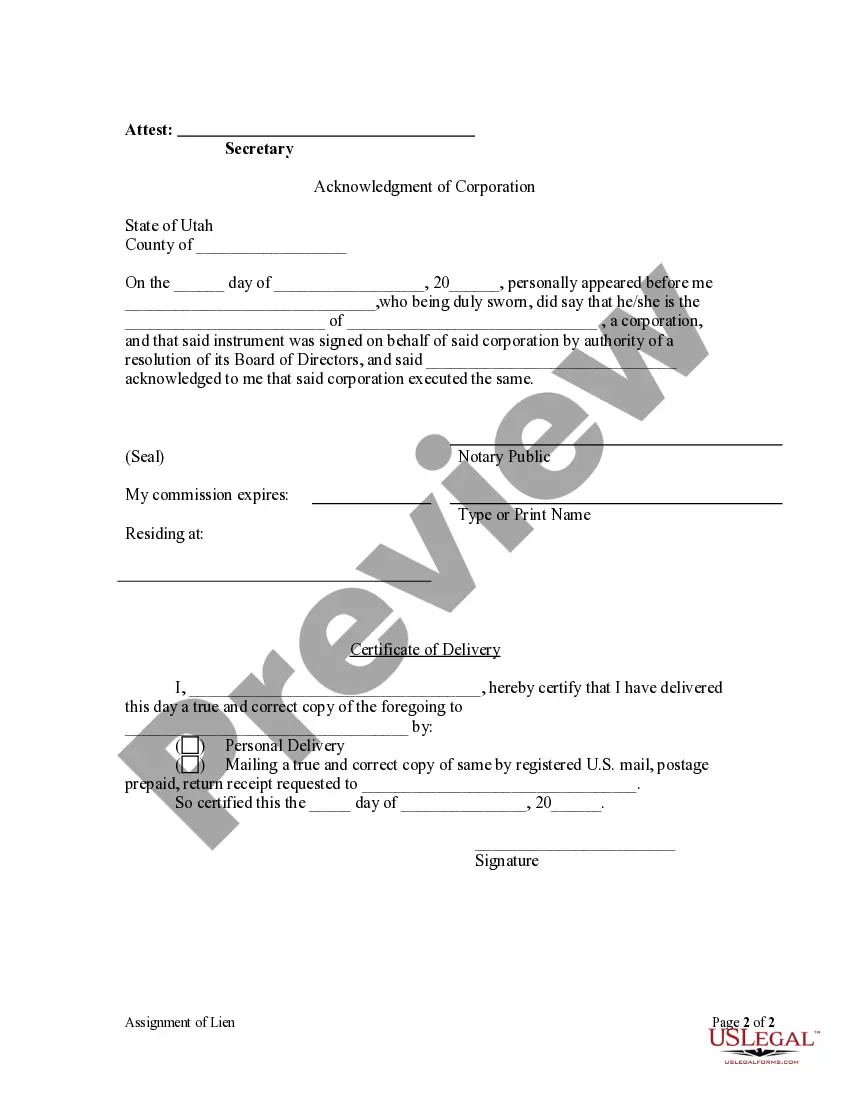

West Valley City, Utah Assignment of Lien — Corporation or LLC: A Comprehensive Overview In West Valley City, Utah, an Assignment of Lien refers to the legal process by which a Corporation or Limited Liability Company (LLC) transfers its ownership or interest in a lien to another entity or party. This assignment typically occurs when a corporation or LLC is liquidating assets, restructuring its business operations, or entering into a business transaction that requires the transfer of liens. There are various types of Assignment of Lien applicable to Corporations or LCS in West Valley City, Utah. Some of the most common ones include: 1. General Assignment of Lien — Corporation or LLC: This type of assignment enables a Corporation or LLC to transfer its lien rights on a broad category of properties or assets. It may involve the transfer of multiple liens simultaneously. 2. Specific Assignment of Lien — Corporation or LLC: A Specific Assignment of Lien is more focused and targets a particular property or asset held by the Corporation or LLC. This type of assignment often occurs when companies want to single out a specific asset for transfer or sale. 3. Partial Assignment of Lien — Corporation or LLC: When a Corporation or LLC wants to retain partial lien ownership while transferring the remaining share, they utilize a Partial Assignment of Lien. This assignment allows for the division of lien rights between multiple entities or parties. 4. Absolute Assignment of Lien — Corporation or LLC: An Absolute Assignment of Lien involves a complete transfer of lien rights from the Corporation or LLC to another entity or party. This means that the liens and all associated rights and responsibilities are entirely passed on to the assignee. 5. Conditional Assignment of Lien — Corporation or LLC: In certain cases, a Corporation or LLC may impose specific conditions on the Assignment of Lien. This type of assignment ensures that certain obligations or prerequisites must be met before the transfer of lien ownership is finalized. It is important to note that Assignment of Lien procedures for Corporations or LCS operating in West Valley City, Utah, must comply with state laws and regulations. These assignments typically require the preparation of a legal document that outlines the terms and conditions of the transfer, including the identification of the parties involved and the detailed description of the lien being assigned. When engaging in an Assignment of Lien, it is recommended to seek legal advice and assistance to ensure compliance with all applicable laws and to protect the interests of both the assigning and receiving parties.West Valley City, Utah Assignment of Lien — Corporation or LLC: A Comprehensive Overview In West Valley City, Utah, an Assignment of Lien refers to the legal process by which a Corporation or Limited Liability Company (LLC) transfers its ownership or interest in a lien to another entity or party. This assignment typically occurs when a corporation or LLC is liquidating assets, restructuring its business operations, or entering into a business transaction that requires the transfer of liens. There are various types of Assignment of Lien applicable to Corporations or LCS in West Valley City, Utah. Some of the most common ones include: 1. General Assignment of Lien — Corporation or LLC: This type of assignment enables a Corporation or LLC to transfer its lien rights on a broad category of properties or assets. It may involve the transfer of multiple liens simultaneously. 2. Specific Assignment of Lien — Corporation or LLC: A Specific Assignment of Lien is more focused and targets a particular property or asset held by the Corporation or LLC. This type of assignment often occurs when companies want to single out a specific asset for transfer or sale. 3. Partial Assignment of Lien — Corporation or LLC: When a Corporation or LLC wants to retain partial lien ownership while transferring the remaining share, they utilize a Partial Assignment of Lien. This assignment allows for the division of lien rights between multiple entities or parties. 4. Absolute Assignment of Lien — Corporation or LLC: An Absolute Assignment of Lien involves a complete transfer of lien rights from the Corporation or LLC to another entity or party. This means that the liens and all associated rights and responsibilities are entirely passed on to the assignee. 5. Conditional Assignment of Lien — Corporation or LLC: In certain cases, a Corporation or LLC may impose specific conditions on the Assignment of Lien. This type of assignment ensures that certain obligations or prerequisites must be met before the transfer of lien ownership is finalized. It is important to note that Assignment of Lien procedures for Corporations or LCS operating in West Valley City, Utah, must comply with state laws and regulations. These assignments typically require the preparation of a legal document that outlines the terms and conditions of the transfer, including the identification of the parties involved and the detailed description of the lien being assigned. When engaging in an Assignment of Lien, it is recommended to seek legal advice and assistance to ensure compliance with all applicable laws and to protect the interests of both the assigning and receiving parties.