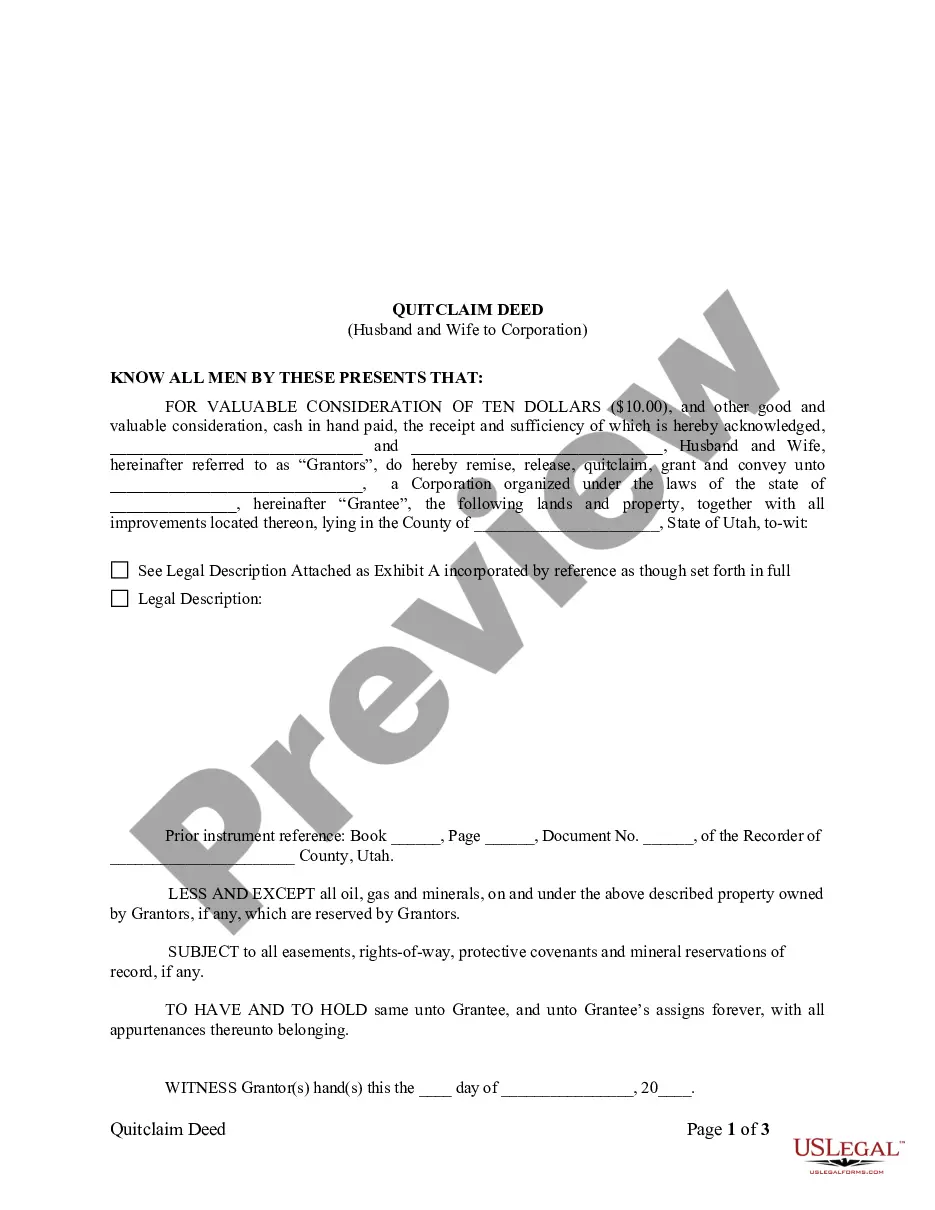

This Quitclaim Deed from Husband and Wife to Corporation form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a corporation. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

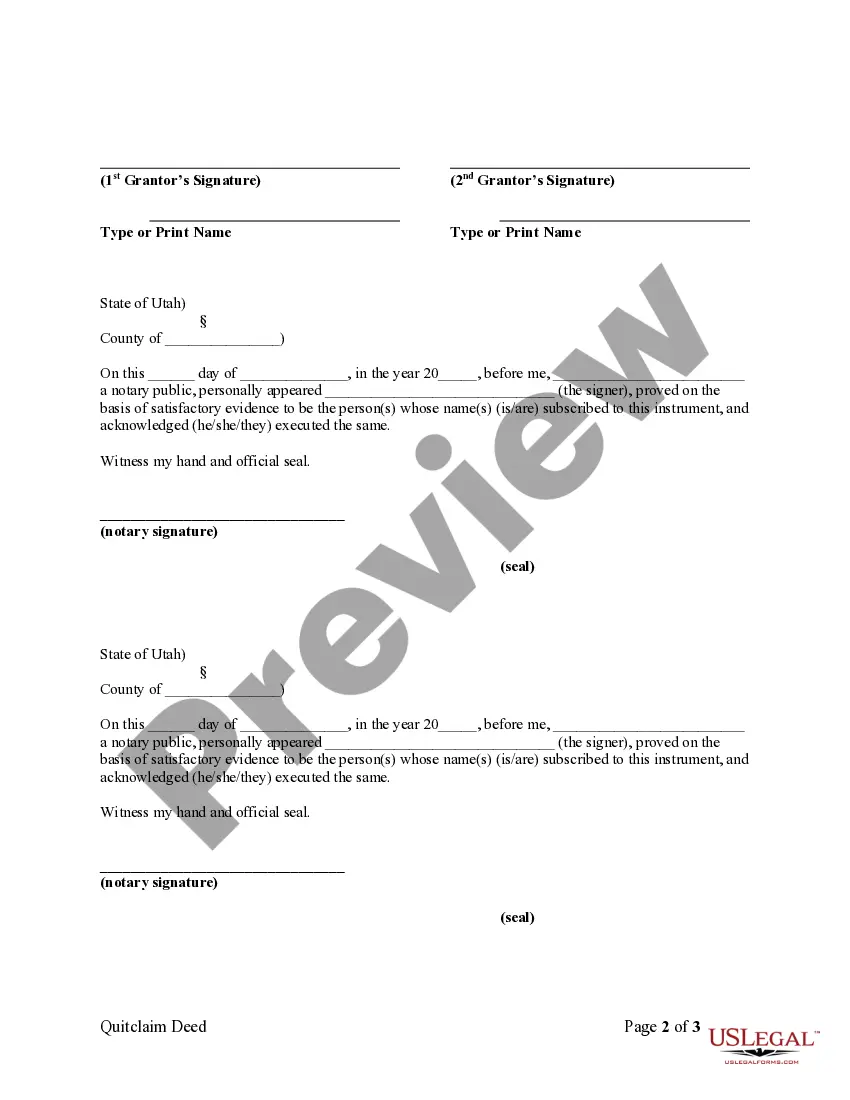

A Salt Lake Utah Quitclaim Deed from Husband and Wife to Corporation is a legal document that transfers the ownership of a property from a married couple to a corporation using a quitclaim deed form. This type of transfer is commonly utilized for various reasons, such as asset protection, estate planning, or business reorganization. In this specific case, a quitclaim deed is executed by both spouses, known as granters, to convey their joint interest in a property to a corporation, referred to as the grantee. The primary purpose of this transaction is to transfer the property's legal title, including any rights and responsibilities associated with it, to the corporate entity. Several types of Salt Lake Utah Quitclaim Deeds from Husband and Wife to Corporation can be identified, based on specific circumstances and the desired outcomes. These variations include: 1. Standard Salt Lake Utah Quitclaim Deed from Husband and Wife to Corporation: This refers to a straightforward transfer of the property's ownership from a married couple to a corporation, without any additional conditions or restrictions. 2. Salt Lake Utah Quitclaim Deed from Husband and Wife to Corporation for Asset Protection: This type of transfer is carried out to shield the property from potential liabilities associated with personal or business matters. By transferring ownership to a corporation, the couple aims to protect their assets from legal claims or judgments. 3. Salt Lake Utah Quitclaim Deed from Husband and Wife to Corporation for Estate Planning: In this scenario, the married couple transfers their property to a corporation as part of their estate planning strategy. This may involve minimizing estate taxes, ensuring smooth succession of the property to heirs, or facilitating charitable giving. 4. Salt Lake Utah Quitclaim Deed from Husband and Wife to Corporation for Business Purposes: This type of deed transfer is performed when a couple wants to incorporate their real estate assets into their existing or newly formed business entity. It allows for easier management, financing, or restructuring of the property within the corporate framework. 5. Salt Lake Utah Quitclaim Deed from Husband and Wife to Corporation with Reserved Interests: This variant involves the transfer of the property's ownership while reserving certain interests in the granting spouses, such as the right to live in the property or receive rental income for a specific period. It is important to note that each specific type of Quitclaim Deed from Husband and Wife to Corporation may have unique legal requirements, tax implications, and potential limitations. Professional advice from attorneys and tax specialists is recommended when considering such transactions to ensure compliance with relevant laws and regulations.A Salt Lake Utah Quitclaim Deed from Husband and Wife to Corporation is a legal document that transfers the ownership of a property from a married couple to a corporation using a quitclaim deed form. This type of transfer is commonly utilized for various reasons, such as asset protection, estate planning, or business reorganization. In this specific case, a quitclaim deed is executed by both spouses, known as granters, to convey their joint interest in a property to a corporation, referred to as the grantee. The primary purpose of this transaction is to transfer the property's legal title, including any rights and responsibilities associated with it, to the corporate entity. Several types of Salt Lake Utah Quitclaim Deeds from Husband and Wife to Corporation can be identified, based on specific circumstances and the desired outcomes. These variations include: 1. Standard Salt Lake Utah Quitclaim Deed from Husband and Wife to Corporation: This refers to a straightforward transfer of the property's ownership from a married couple to a corporation, without any additional conditions or restrictions. 2. Salt Lake Utah Quitclaim Deed from Husband and Wife to Corporation for Asset Protection: This type of transfer is carried out to shield the property from potential liabilities associated with personal or business matters. By transferring ownership to a corporation, the couple aims to protect their assets from legal claims or judgments. 3. Salt Lake Utah Quitclaim Deed from Husband and Wife to Corporation for Estate Planning: In this scenario, the married couple transfers their property to a corporation as part of their estate planning strategy. This may involve minimizing estate taxes, ensuring smooth succession of the property to heirs, or facilitating charitable giving. 4. Salt Lake Utah Quitclaim Deed from Husband and Wife to Corporation for Business Purposes: This type of deed transfer is performed when a couple wants to incorporate their real estate assets into their existing or newly formed business entity. It allows for easier management, financing, or restructuring of the property within the corporate framework. 5. Salt Lake Utah Quitclaim Deed from Husband and Wife to Corporation with Reserved Interests: This variant involves the transfer of the property's ownership while reserving certain interests in the granting spouses, such as the right to live in the property or receive rental income for a specific period. It is important to note that each specific type of Quitclaim Deed from Husband and Wife to Corporation may have unique legal requirements, tax implications, and potential limitations. Professional advice from attorneys and tax specialists is recommended when considering such transactions to ensure compliance with relevant laws and regulations.