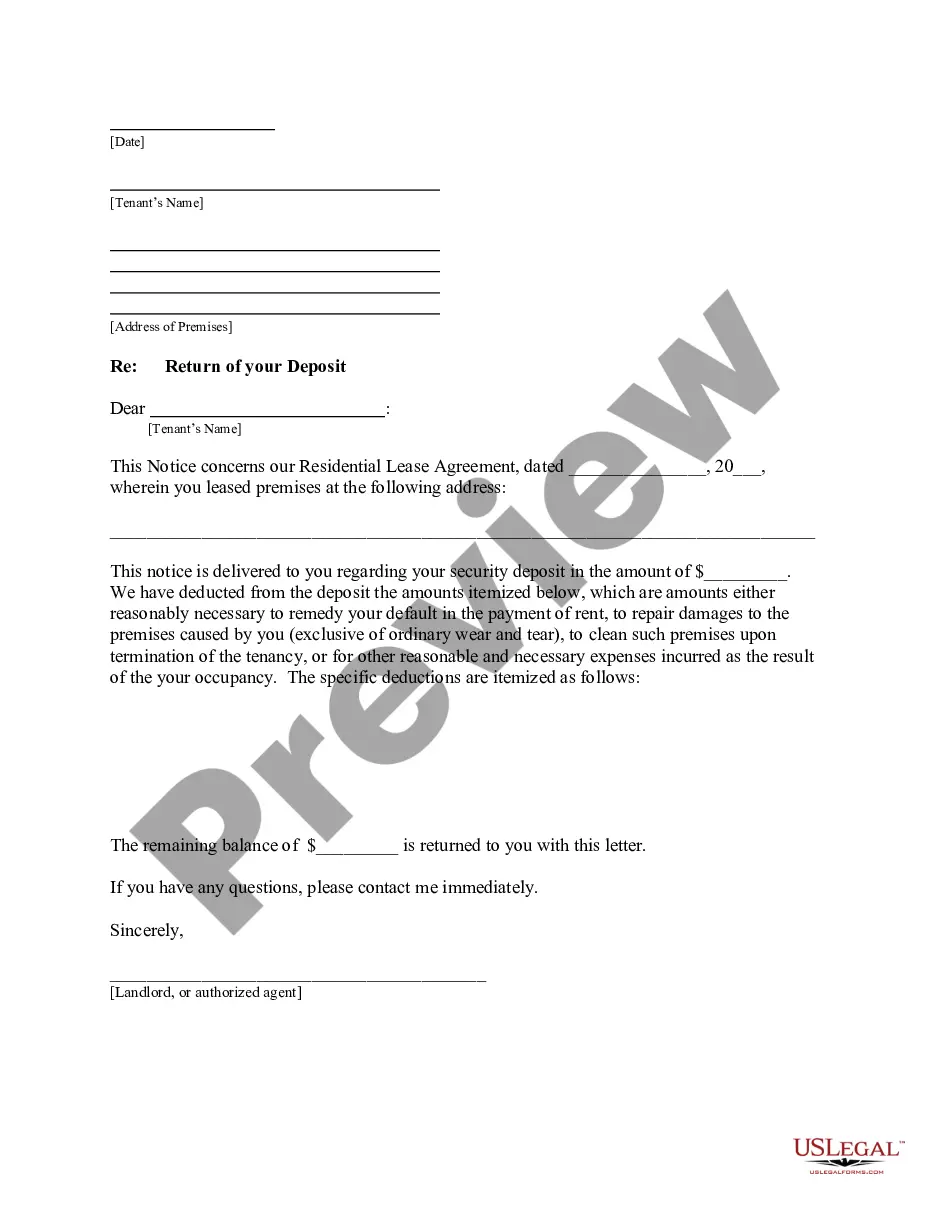

This is a letter informing Tenant that Landlord has deducted from the deposit the amounts itemized which are amounts either reasonably necessary to remedy default in the payment of rent, to repair damages to the premises caused by tenant, to clean such premises upon termination of the tenancy, or for other reasonable and necessary expenses incurred as the result of the tenant's occupancy.

A security deposit is a payment required by a landlord from a tenant to cover the expenses of any repairs of damages to the premises greater than normal "wear and tear." Everyday usage is normal wear and tear, but excess damage is a debated definition. A security deposit is not the same as rent. It is money that actually belongs to the tenant but is held by the landlord for tenant-caused damages and sometimes past-due rent. Without the agreement of the landlord, a security deposit may not legally be used as the last month's rent.

Laws vary by state, but some states place a limit on the amount of a security deposit that a landlord may charge. Some states also regulate where residential security deposits must be kept and when interest payments on the security deposits must be made to the tenant. State laws also define the time period after the tenant vacates within which the deposit must be returned to the tenant.

Title: A Comprehensive Guide: Salt Lake Utah Letter from Landlord to Tenant Returning Security Deposit Less Deductions Introduction: In Salt Lake City, Utah, landlords have certain obligations when returning a tenant's security deposit. This detailed guide will outline the essential elements of a letter from a landlord to a tenant, returning the security deposit after deducting necessary expenses. We will also explore any potential variations or additional types of letters associated with this process. 1. Format and Structure: A Salt Lake Utah Letter from Landlord to Tenant Returning Security Deposit Less Deductions typically follows a structured format that includes the following sections: a) Heading: Identify the landlord, tenant, and property information. b) Introduction: Express your purpose of writing the letter. c) Deductions: Clearly itemize and explain any allowable deductions from the deposit. d) Refund Amount: State the final amount the tenant will receive. e) Manner of Payment: Specify how the refund will be delivered. f) Move-Out Checklist: Encourage tenants to review a move-out checklist, if applicable. g) Forwarding Address: Request the tenant to provide an updated forwarding address for future communication. h) Landlord Contact Information: Provide your contact details for any further inquiries. i) Closing: Offer thanks and a friendly farewell. 2. Examples of Deductible Expenses: Some common deductions that landlords may need to include in the Salt Lake Utah Letter from Landlord to Tenant Returning Security Deposit Less Deductions are: a) Unpaid Rent: Deduct any outstanding rent amounts. b) Cleaning and Repairs: Document and explain charges for cleaning and repairing any damage beyond reasonable wear and tear. c) Utility Bills: If the tenant left any unpaid utility bills, specify those charges. d) Outstanding Fees: Include any unpaid fees for late rent, parking, or other applicable charges. e) Outstanding Utilities: Deduct any unpaid utility bills or fees payable by the tenant. f) Missing/Non-Returned Items: Address any missing or non-returned items outlined in the lease agreement. 3. Additional Types of Letters: Apart from the standard Salt Lake Utah Letter from Landlord to Tenant Returning Security Deposit Less Deductions, there are a few additional variations worth mentioning: a) Partial Security Deposit Refund: If deductions exceed the security deposit, notify the tenant of any remaining amount to be paid. b) Security Deposit Dispute Letter: In the event of a disagreement over deductions, landlords may need to provide a detailed explanation and documentation supporting their claim. c) Security Deposit Interest Statement: If required by local regulations, landlords might need to provide an interest statement highlighting the added interest on the security deposit. Conclusion: Writing a well-structured Salt Lake Utah Letter from Landlord to Tenant Returning Security Deposit Less Deductions is crucial for maintaining transparency and complying with legal obligations. Ensure that the letter includes all relevant details and deductions for a smooth and fair deposit refund process. By adhering to this comprehensive guide, landlords can effectively communicate with their tenants while upholding their responsibilities in Salt Lake City, Utah.Title: A Comprehensive Guide: Salt Lake Utah Letter from Landlord to Tenant Returning Security Deposit Less Deductions Introduction: In Salt Lake City, Utah, landlords have certain obligations when returning a tenant's security deposit. This detailed guide will outline the essential elements of a letter from a landlord to a tenant, returning the security deposit after deducting necessary expenses. We will also explore any potential variations or additional types of letters associated with this process. 1. Format and Structure: A Salt Lake Utah Letter from Landlord to Tenant Returning Security Deposit Less Deductions typically follows a structured format that includes the following sections: a) Heading: Identify the landlord, tenant, and property information. b) Introduction: Express your purpose of writing the letter. c) Deductions: Clearly itemize and explain any allowable deductions from the deposit. d) Refund Amount: State the final amount the tenant will receive. e) Manner of Payment: Specify how the refund will be delivered. f) Move-Out Checklist: Encourage tenants to review a move-out checklist, if applicable. g) Forwarding Address: Request the tenant to provide an updated forwarding address for future communication. h) Landlord Contact Information: Provide your contact details for any further inquiries. i) Closing: Offer thanks and a friendly farewell. 2. Examples of Deductible Expenses: Some common deductions that landlords may need to include in the Salt Lake Utah Letter from Landlord to Tenant Returning Security Deposit Less Deductions are: a) Unpaid Rent: Deduct any outstanding rent amounts. b) Cleaning and Repairs: Document and explain charges for cleaning and repairing any damage beyond reasonable wear and tear. c) Utility Bills: If the tenant left any unpaid utility bills, specify those charges. d) Outstanding Fees: Include any unpaid fees for late rent, parking, or other applicable charges. e) Outstanding Utilities: Deduct any unpaid utility bills or fees payable by the tenant. f) Missing/Non-Returned Items: Address any missing or non-returned items outlined in the lease agreement. 3. Additional Types of Letters: Apart from the standard Salt Lake Utah Letter from Landlord to Tenant Returning Security Deposit Less Deductions, there are a few additional variations worth mentioning: a) Partial Security Deposit Refund: If deductions exceed the security deposit, notify the tenant of any remaining amount to be paid. b) Security Deposit Dispute Letter: In the event of a disagreement over deductions, landlords may need to provide a detailed explanation and documentation supporting their claim. c) Security Deposit Interest Statement: If required by local regulations, landlords might need to provide an interest statement highlighting the added interest on the security deposit. Conclusion: Writing a well-structured Salt Lake Utah Letter from Landlord to Tenant Returning Security Deposit Less Deductions is crucial for maintaining transparency and complying with legal obligations. Ensure that the letter includes all relevant details and deductions for a smooth and fair deposit refund process. By adhering to this comprehensive guide, landlords can effectively communicate with their tenants while upholding their responsibilities in Salt Lake City, Utah.