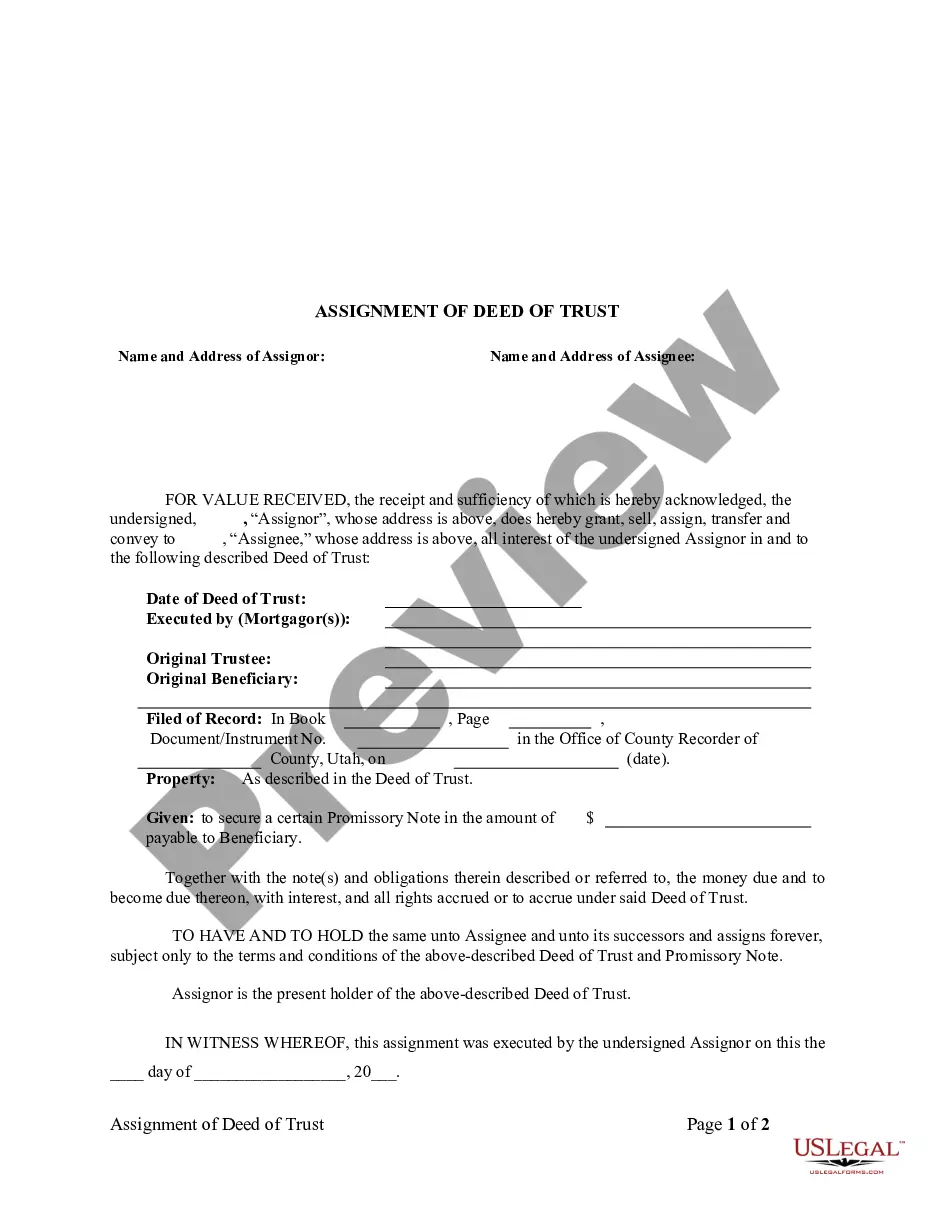

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

Provo Utah Assignment of Deed of Trust by Corporate Mortgage Holder: A Comprehensive Overview In Provo, Utah, the assignment of a deed of trust by a corporate mortgage holder is a legal process that allows a corporation to transfer the secured interest in a property to another party. This transfer can occur due to various reasons such as the sale of the loan, the transfer of servicing rights, or the consolidation of loans. The assignment effectively transfers the rights, benefits, and obligations associated with the mortgage from the corporate mortgage holder to the assignee. Keywords: Provo Utah, assignment of deed of trust, corporate mortgage holder, secured interest, transfer, sale of loan, transfer of servicing rights, consolidation, rights and obligations, assignee. Types of Provo Utah Assignment of Deed of Trust by Corporate Mortgage Holder: 1. Sale of Loan Assignment: In this type of assignment, the corporate mortgage holder sells the loan along with the underlying deed of trust to another party. This is a common practice in the mortgage industry, allowing lenders to free up capital or manage risks associated with the loan. 2. Transfer of Servicing Rights Assignment: In some cases, the corporate mortgage holder chooses to assign the servicing rights of the loan while still retaining the ownership of the loan itself. This means that another party would take over responsibilities such as collecting payments, managing escrow accounts, and addressing borrower inquiries, while the corporate mortgage holder maintains the ownership of the loan. 3. Consolidation Assignment: When a corporation holds multiple loans secured by deeds of trust, it may decide to consolidate them into one loan. This process involves assigning the existing deeds of trust to a new entity, effectively merging the loans into a single obligation. Consolidation can help simplify loan management and potentially offer more favorable terms for the borrower. 4. Substitution of Lender Assignment: This type of assignment occurs when the corporate mortgage holder replaces itself with a different corporate entity as the lender. The new lender assumes all rights, benefits, and obligations associated with the loan, while the original corporate mortgage holder is released from its position as the lender. Provo Utah Assignment of Deed of Trust by Corporate Mortgage Holder involves a thorough documentation process that includes preparing and recording the necessary legal forms and ensuring compliance with state and federal regulations. It is crucial for all parties involved, including the assignee and the borrower, to review the assignment documents carefully and seek legal advice if needed to ensure a smooth and legally valid transfer. By understanding the different types of assignment and the associated terminology, individuals involved in Provo Utah Assignment of Deed of Trust by Corporate Mortgage Holder can navigate the process more effectively, protect their interests, and ensure the transfer is conducted in accordance with the local laws and regulations.Provo Utah Assignment of Deed of Trust by Corporate Mortgage Holder: A Comprehensive Overview In Provo, Utah, the assignment of a deed of trust by a corporate mortgage holder is a legal process that allows a corporation to transfer the secured interest in a property to another party. This transfer can occur due to various reasons such as the sale of the loan, the transfer of servicing rights, or the consolidation of loans. The assignment effectively transfers the rights, benefits, and obligations associated with the mortgage from the corporate mortgage holder to the assignee. Keywords: Provo Utah, assignment of deed of trust, corporate mortgage holder, secured interest, transfer, sale of loan, transfer of servicing rights, consolidation, rights and obligations, assignee. Types of Provo Utah Assignment of Deed of Trust by Corporate Mortgage Holder: 1. Sale of Loan Assignment: In this type of assignment, the corporate mortgage holder sells the loan along with the underlying deed of trust to another party. This is a common practice in the mortgage industry, allowing lenders to free up capital or manage risks associated with the loan. 2. Transfer of Servicing Rights Assignment: In some cases, the corporate mortgage holder chooses to assign the servicing rights of the loan while still retaining the ownership of the loan itself. This means that another party would take over responsibilities such as collecting payments, managing escrow accounts, and addressing borrower inquiries, while the corporate mortgage holder maintains the ownership of the loan. 3. Consolidation Assignment: When a corporation holds multiple loans secured by deeds of trust, it may decide to consolidate them into one loan. This process involves assigning the existing deeds of trust to a new entity, effectively merging the loans into a single obligation. Consolidation can help simplify loan management and potentially offer more favorable terms for the borrower. 4. Substitution of Lender Assignment: This type of assignment occurs when the corporate mortgage holder replaces itself with a different corporate entity as the lender. The new lender assumes all rights, benefits, and obligations associated with the loan, while the original corporate mortgage holder is released from its position as the lender. Provo Utah Assignment of Deed of Trust by Corporate Mortgage Holder involves a thorough documentation process that includes preparing and recording the necessary legal forms and ensuring compliance with state and federal regulations. It is crucial for all parties involved, including the assignee and the borrower, to review the assignment documents carefully and seek legal advice if needed to ensure a smooth and legally valid transfer. By understanding the different types of assignment and the associated terminology, individuals involved in Provo Utah Assignment of Deed of Trust by Corporate Mortgage Holder can navigate the process more effectively, protect their interests, and ensure the transfer is conducted in accordance with the local laws and regulations.