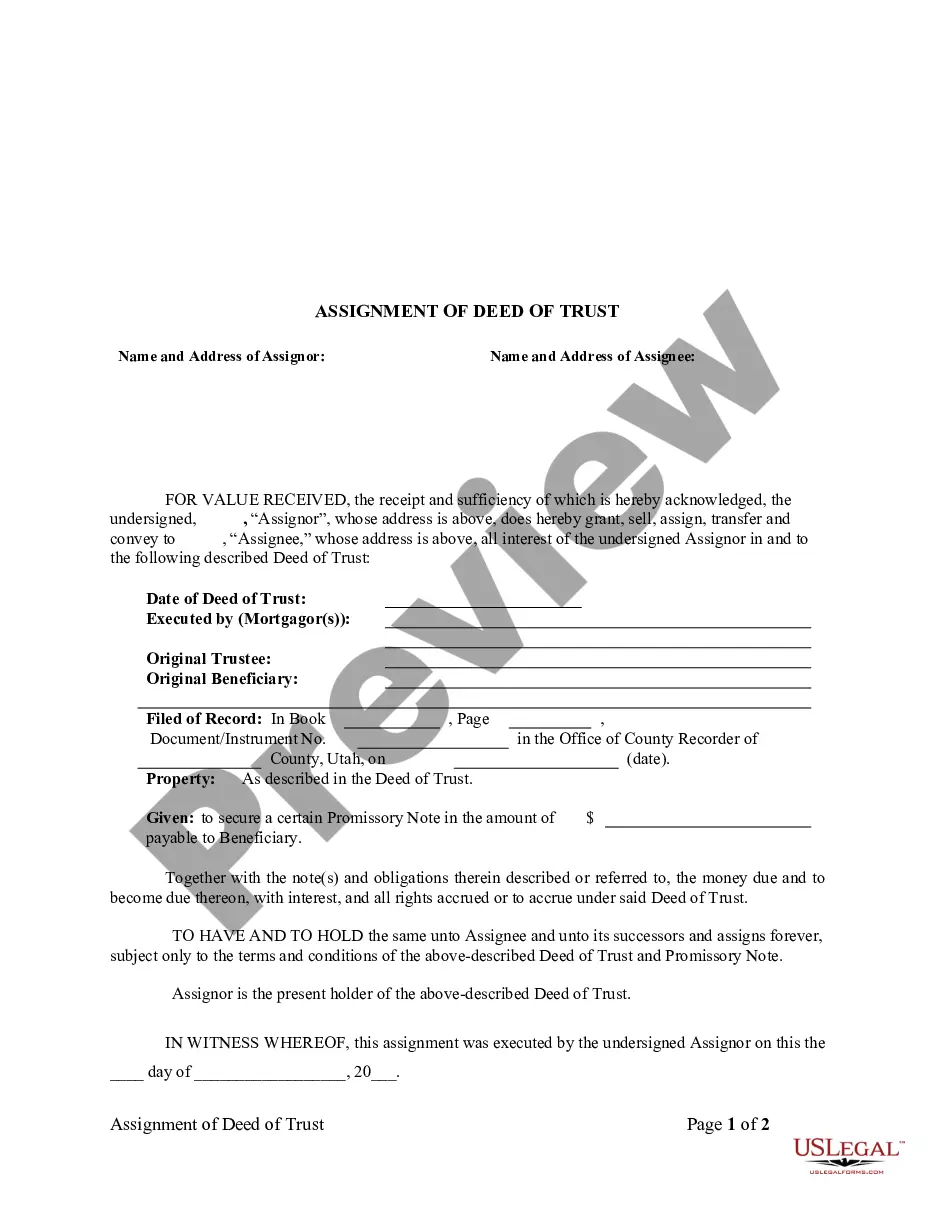

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

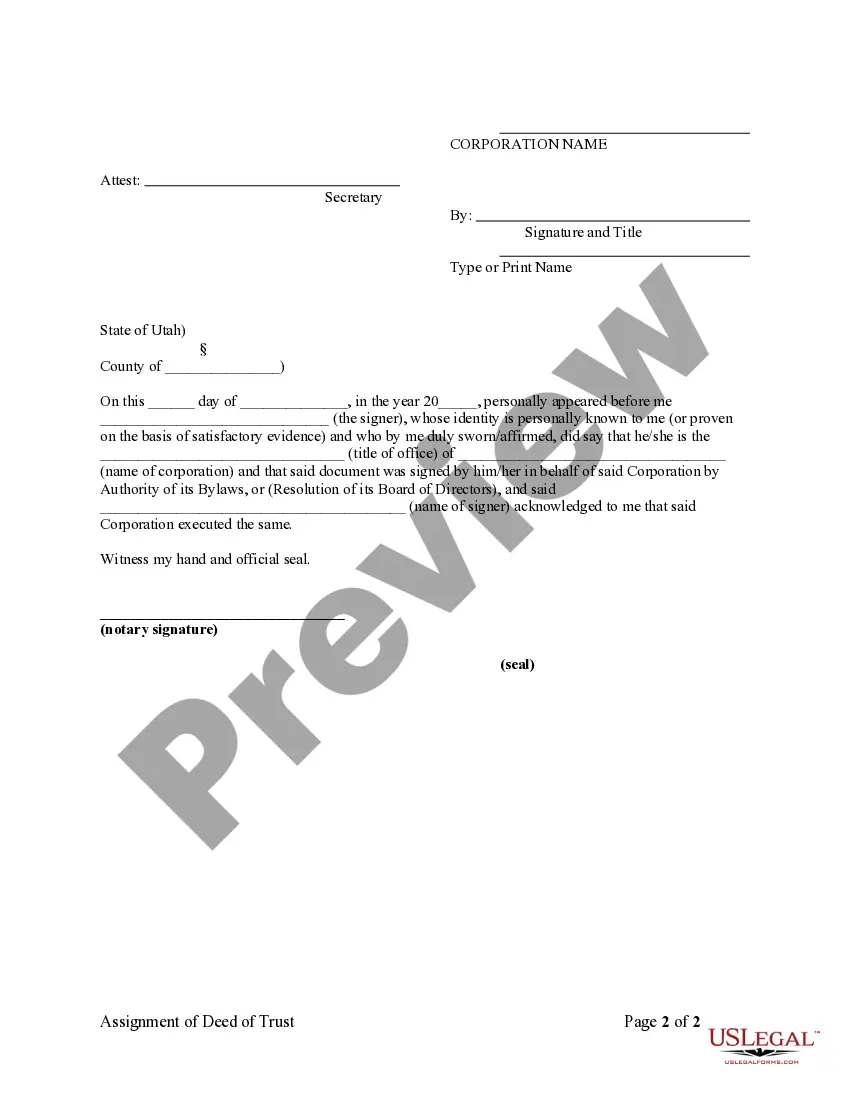

Title: Understanding Salt Lake Utah Assignment of Deed of Trust by Corporate Mortgage Holder Introduction: In Salt Lake, Utah, when a property owner grants a loan using real estate as collateral, a Deed of Trust is created. However, in certain situations, the mortgage holder may need to transfer the rights of the Deed of Trust. This process is known as the Assignment of Deed of Trust by Corporate Mortgage Holder. This article will provide a detailed description of this procedure, its significance, and touch upon different types of such assignments. 1. Definition and Significance: The Assignment of Deed of Trust by Corporate Mortgage Holder refers to the legal transfer of the lender's interest in the original Deed of Trust to another party, usually another corporate mortgage holder. This assignment allows the new mortgage holder to enforce the terms and conditions of the loan, including receiving payments and foreclosing on the property if necessary. It is a critical process that ensures the change in ownership of the debt and preserves the lien on the property. 2. Types of Salt Lake Utah Assignment of Deed of Trust by Corporate Mortgage Holder: a. Full Assignment: In a full assignment, the entire interest of the original mortgage holder is transferred to the new entity. This includes all rights, title, and interest in the Deed of Trust, along with the mortgage note and other related documents. b. Partial Assignment: A partial assignment occurs when the corporate mortgage holder transfers a portion of its interest in the Deed of Trust to another party, while still retaining ownership of the remaining portion. This type of assignment is typically seen when a lender wants to diversify risk or facilitate loan syndication. c. Collateral Assignment: In certain scenarios, a corporate mortgage holder may choose to assign only the security interest in the Deed of Trust, rather than the entire interest. This type of assignment allows the assignee to step in and protect their interests if the borrower defaults, while the original lender remains responsible for loan servicing. 3. Process of Assignment: a. Drafting an Assignment Agreement: The corporate mortgage holder, known as the assignor, creates an assignment agreement outlining the terms of transfer, including the assignment fee, transfer date, and details of the property. b. Decoration: The assignment agreement is then recorded in the Salt Lake County recorder's office to establish the new assignee's rights and interests in the property. This ensures that the transfer is legally recognized and visible to the public. c. Notification: Once recorded, both the assignor and assignee must notify the borrower about the transfer of the Deed of Trust. This ensures transparency and enables the borrower to direct future payments to the correct mortgage holder. 4. Conclusion: The Salt Lake Utah Assignment of Deed of Trust by Corporate Mortgage Holder is a critical legal process that allows for the transfer of a lender's interests in a property loan to another party. Understanding the various types of assignments and the steps involved in the process is important for property owners, lenders, and borrowers alike. Seeking legal advice and guidance throughout the process can help ensure a smooth transition and protect the rights and interests of all parties involved.Title: Understanding Salt Lake Utah Assignment of Deed of Trust by Corporate Mortgage Holder Introduction: In Salt Lake, Utah, when a property owner grants a loan using real estate as collateral, a Deed of Trust is created. However, in certain situations, the mortgage holder may need to transfer the rights of the Deed of Trust. This process is known as the Assignment of Deed of Trust by Corporate Mortgage Holder. This article will provide a detailed description of this procedure, its significance, and touch upon different types of such assignments. 1. Definition and Significance: The Assignment of Deed of Trust by Corporate Mortgage Holder refers to the legal transfer of the lender's interest in the original Deed of Trust to another party, usually another corporate mortgage holder. This assignment allows the new mortgage holder to enforce the terms and conditions of the loan, including receiving payments and foreclosing on the property if necessary. It is a critical process that ensures the change in ownership of the debt and preserves the lien on the property. 2. Types of Salt Lake Utah Assignment of Deed of Trust by Corporate Mortgage Holder: a. Full Assignment: In a full assignment, the entire interest of the original mortgage holder is transferred to the new entity. This includes all rights, title, and interest in the Deed of Trust, along with the mortgage note and other related documents. b. Partial Assignment: A partial assignment occurs when the corporate mortgage holder transfers a portion of its interest in the Deed of Trust to another party, while still retaining ownership of the remaining portion. This type of assignment is typically seen when a lender wants to diversify risk or facilitate loan syndication. c. Collateral Assignment: In certain scenarios, a corporate mortgage holder may choose to assign only the security interest in the Deed of Trust, rather than the entire interest. This type of assignment allows the assignee to step in and protect their interests if the borrower defaults, while the original lender remains responsible for loan servicing. 3. Process of Assignment: a. Drafting an Assignment Agreement: The corporate mortgage holder, known as the assignor, creates an assignment agreement outlining the terms of transfer, including the assignment fee, transfer date, and details of the property. b. Decoration: The assignment agreement is then recorded in the Salt Lake County recorder's office to establish the new assignee's rights and interests in the property. This ensures that the transfer is legally recognized and visible to the public. c. Notification: Once recorded, both the assignor and assignee must notify the borrower about the transfer of the Deed of Trust. This ensures transparency and enables the borrower to direct future payments to the correct mortgage holder. 4. Conclusion: The Salt Lake Utah Assignment of Deed of Trust by Corporate Mortgage Holder is a critical legal process that allows for the transfer of a lender's interests in a property loan to another party. Understanding the various types of assignments and the steps involved in the process is important for property owners, lenders, and borrowers alike. Seeking legal advice and guidance throughout the process can help ensure a smooth transition and protect the rights and interests of all parties involved.