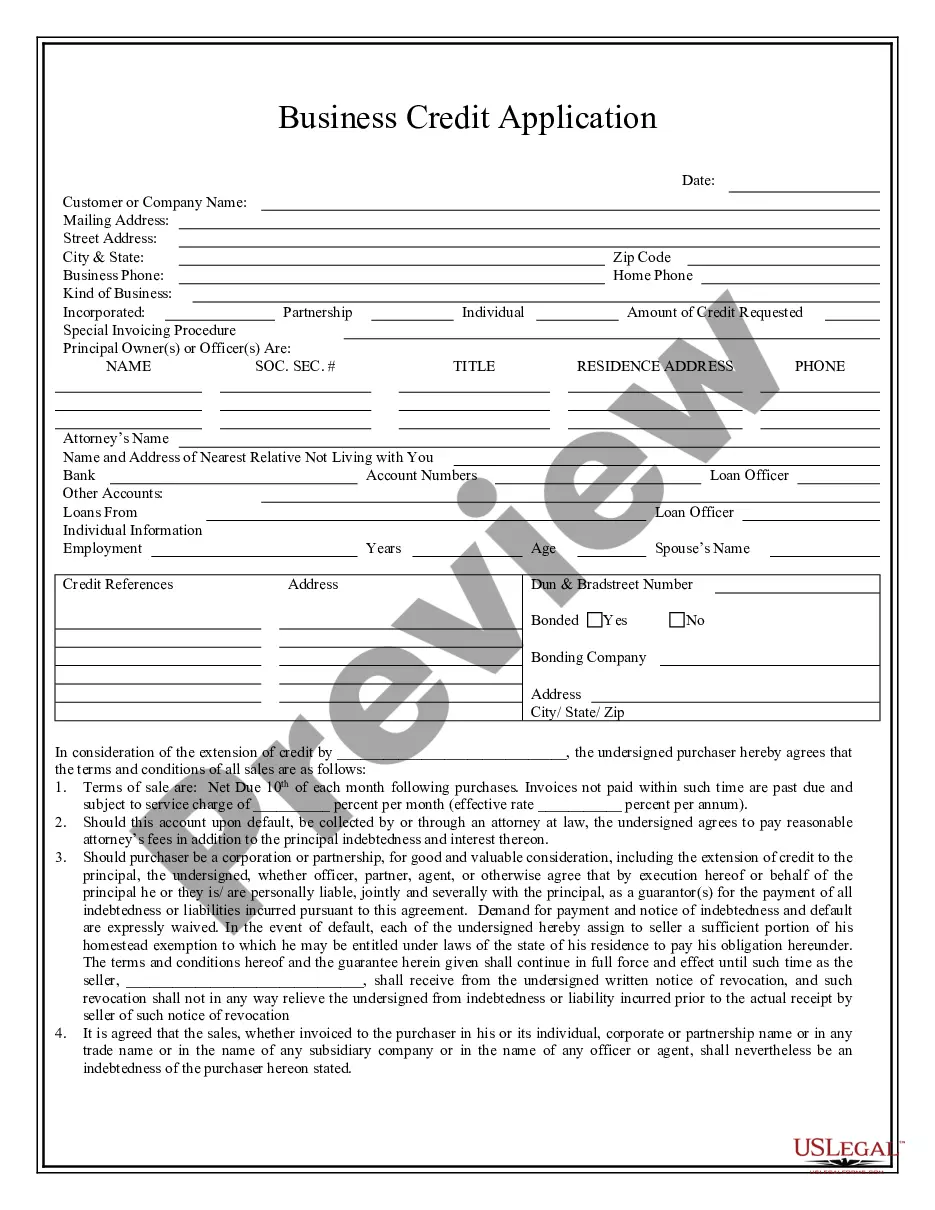

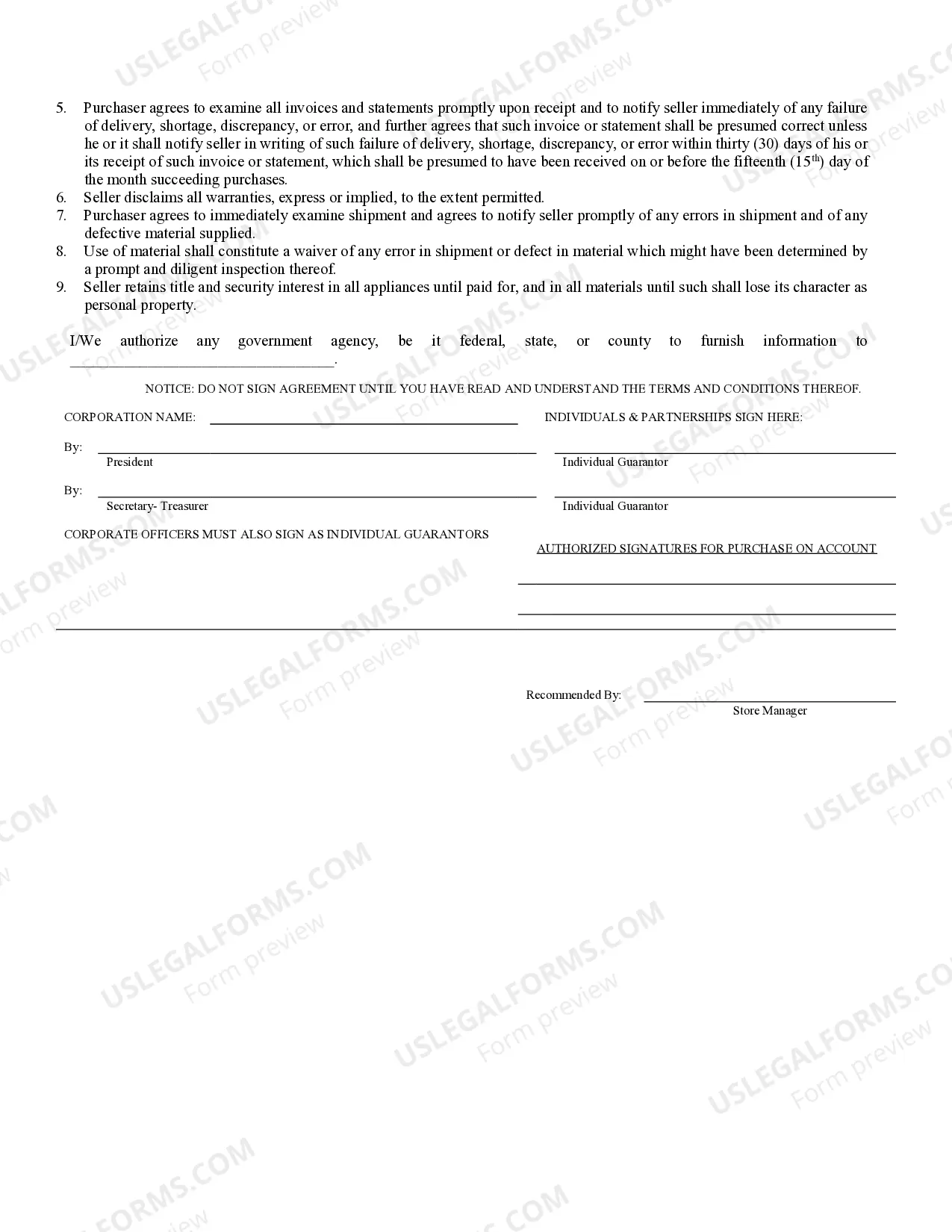

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

Provo Utah Business Credit Application is an essential document used by business owners in Provo, Utah to apply for credit services from financial institutions or credit providers. This application is designed to capture crucial information about the business and its financial history, allowing lenders to evaluate the creditworthiness and determine appropriate loan terms. Keywords: Provo Utah, business credit application, credit services, financial institutions, credit providers, business owners, creditworthiness, loan terms. Types of Provo Utah Business Credit Application: 1. Small Business Credit Application: Specifically tailored for small businesses operating in Provo, Utah, this type of application focuses on the unique financial needs and challenges faced by small business owners. It takes into account their scale of operations, revenue projections, and resources to assess creditworthiness. 2. Start-up Business Credit Application: This application is designed specifically for newly established businesses in Provo, Utah. It aims to provide start-ups with the opportunity to access credit services and acquire the necessary financial resources to fuel their growth. Lenders evaluating these applications often consider factors such as business plans, market potential, and the entrepreneur's experience. 3. Line of Credit Application: This type of application is suitable for businesses in Provo, Utah that require ongoing access to a predetermined amount of credit. A line of credit allows businesses to borrow funds as needed, repay them, and then borrow again, providing a flexible financial resource. The application highlights the business's credit history, cash flow management, and repayment abilities. 4. Commercial Mortgage Application: Provo-based businesses seeking to purchase or refinance commercial properties can utilize this application. Lenders evaluate factors such as property value, business creditworthiness, debt service coverage, and the purpose of the loan in order to determine eligibility and loan terms. 5. Business Credit Card Application: For businesses in Provo, Utah looking for a revolving credit option, a business credit card application is available. This application focuses on the business's ability to meet monthly credit card payments, credit history, and any additional business requirements for card issuance. These different types of Provo Utah Business Credit Applications cater to the specific needs and requirements of businesses operating in the region, ensuring that they can access the appropriate credit services to support growth and financial stability.Provo Utah Business Credit Application is an essential document used by business owners in Provo, Utah to apply for credit services from financial institutions or credit providers. This application is designed to capture crucial information about the business and its financial history, allowing lenders to evaluate the creditworthiness and determine appropriate loan terms. Keywords: Provo Utah, business credit application, credit services, financial institutions, credit providers, business owners, creditworthiness, loan terms. Types of Provo Utah Business Credit Application: 1. Small Business Credit Application: Specifically tailored for small businesses operating in Provo, Utah, this type of application focuses on the unique financial needs and challenges faced by small business owners. It takes into account their scale of operations, revenue projections, and resources to assess creditworthiness. 2. Start-up Business Credit Application: This application is designed specifically for newly established businesses in Provo, Utah. It aims to provide start-ups with the opportunity to access credit services and acquire the necessary financial resources to fuel their growth. Lenders evaluating these applications often consider factors such as business plans, market potential, and the entrepreneur's experience. 3. Line of Credit Application: This type of application is suitable for businesses in Provo, Utah that require ongoing access to a predetermined amount of credit. A line of credit allows businesses to borrow funds as needed, repay them, and then borrow again, providing a flexible financial resource. The application highlights the business's credit history, cash flow management, and repayment abilities. 4. Commercial Mortgage Application: Provo-based businesses seeking to purchase or refinance commercial properties can utilize this application. Lenders evaluate factors such as property value, business creditworthiness, debt service coverage, and the purpose of the loan in order to determine eligibility and loan terms. 5. Business Credit Card Application: For businesses in Provo, Utah looking for a revolving credit option, a business credit card application is available. This application focuses on the business's ability to meet monthly credit card payments, credit history, and any additional business requirements for card issuance. These different types of Provo Utah Business Credit Applications cater to the specific needs and requirements of businesses operating in the region, ensuring that they can access the appropriate credit services to support growth and financial stability.