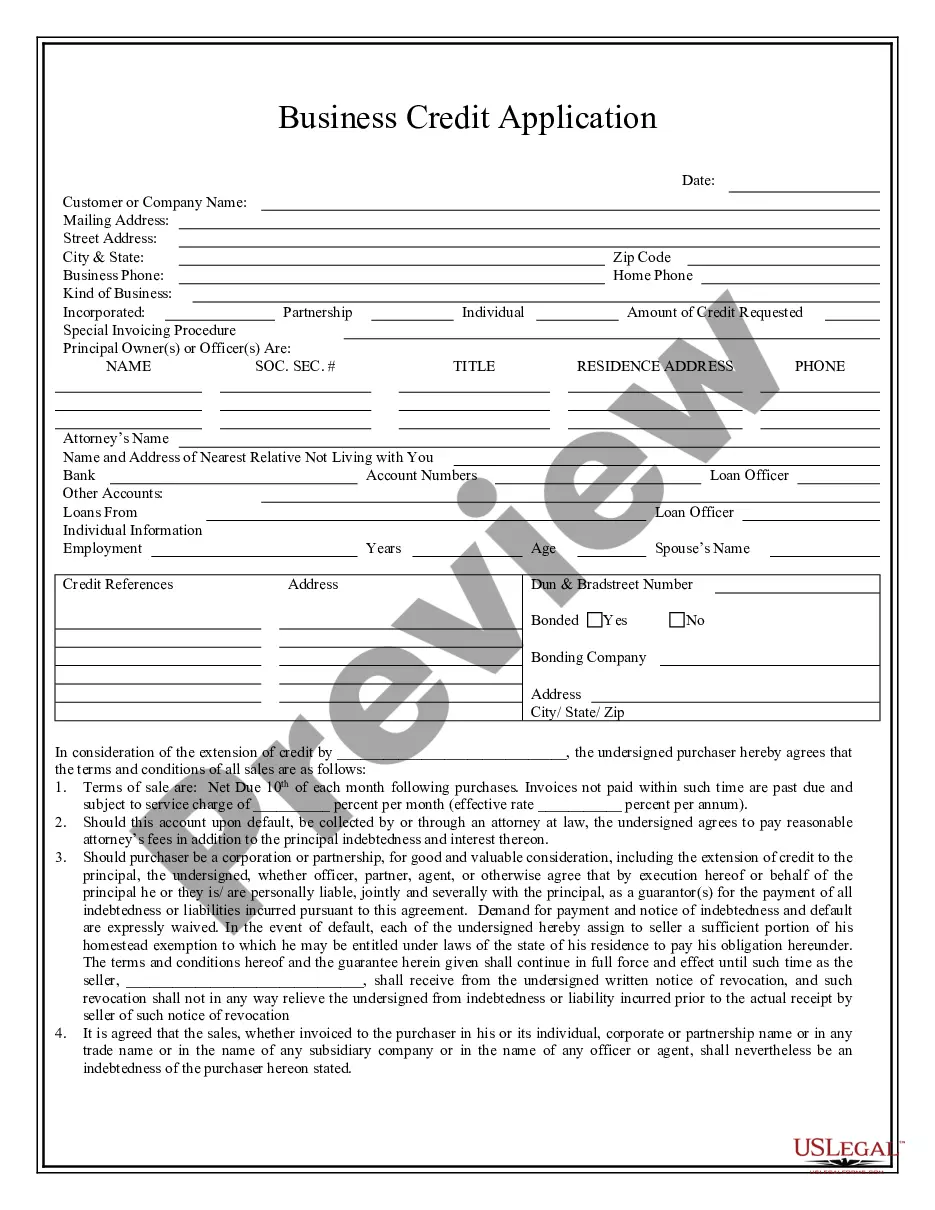

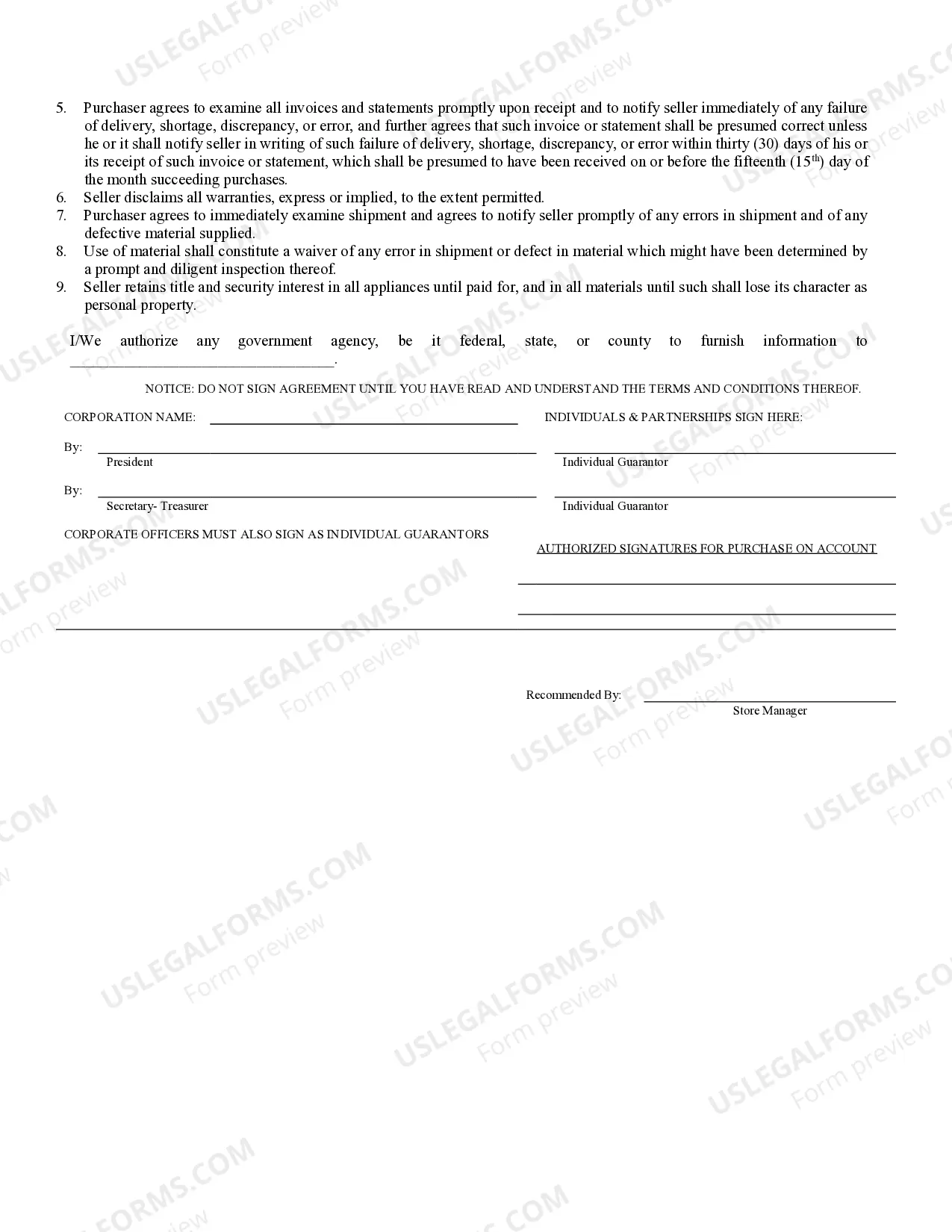

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

Salt Lake Utah Business Credit Application is a specialized tool designed for businesses operating in Salt Lake City, Utah, to apply for credit services offered by financial institutions or credit card providers. This application serves as a formal request by a business to obtain credit, which can be used for various purposes such as purchasing inventory, financing equipment, or funding short-term cash flow needs. The Salt Lake Utah Business Credit Application typically requires detailed information about the business, including its legal name, contact information, industry type, annual revenue, number of employees, and years in operation. Additional information may be requested, such as a business plan, tax identification number, financial statements, and bank references. These details help lenders or credit card companies assess the creditworthiness and financial stability of the business before granting credit. There are various types of Salt Lake Utah Business Credit Applications available, depending on the credit services required and the specific financial institution or credit card provider. Some common types include: 1. Salt Lake Utah Small Business Credit Application: Specifically tailored for small businesses, this type of credit application is suitable for startups or small enterprises looking to establish credit or expand their existing credit limit. It may have specific requirements or benefits aimed at assisting small businesses in their growth. 2. Salt Lake Utah Corporate Credit Application: Geared towards larger corporations, this credit application is suited for established businesses with higher annual revenues and more extensive credit needs. It may involve a more thorough evaluation process and offer higher credit limits compared to small business credit applications. 3. Salt Lake Utah Business Credit Card Application: This type of credit application focuses on obtaining a business credit card, which allows businesses to make purchases and access credit for their day-to-day operations. Business credit cards often offer certain benefits such as rewards programs, expense management tools, and business-specific perks. 4. Salt Lake Utah Line of Credit Application: Designed for businesses seeking a flexible credit arrangement, this application is used to apply for a line of credit. A line of credit provides businesses with access to funds up to a predetermined limit, allowing them to borrow as needed and repay as they generate income. This can be an excellent solution for managing cash flow fluctuations or unexpected expenses. 5. Salt Lake Utah Trade Credit Application: This credit application is focused on establishing credit terms with suppliers or vendors. It allows a business to purchase goods or services on credit and pay within an agreed-upon period, commonly 30, 60, or 90 days. Trade credit is beneficial in managing inventory or operational expenses without needing immediate cash payments. In conclusion, the Salt Lake Utah Business Credit Application is a comprehensive request document that enables businesses in Salt Lake City, Utah, to apply for credit services. It serves as a gateway for businesses to access valuable credit resources, manage finances, and support growth opportunities.Salt Lake Utah Business Credit Application is a specialized tool designed for businesses operating in Salt Lake City, Utah, to apply for credit services offered by financial institutions or credit card providers. This application serves as a formal request by a business to obtain credit, which can be used for various purposes such as purchasing inventory, financing equipment, or funding short-term cash flow needs. The Salt Lake Utah Business Credit Application typically requires detailed information about the business, including its legal name, contact information, industry type, annual revenue, number of employees, and years in operation. Additional information may be requested, such as a business plan, tax identification number, financial statements, and bank references. These details help lenders or credit card companies assess the creditworthiness and financial stability of the business before granting credit. There are various types of Salt Lake Utah Business Credit Applications available, depending on the credit services required and the specific financial institution or credit card provider. Some common types include: 1. Salt Lake Utah Small Business Credit Application: Specifically tailored for small businesses, this type of credit application is suitable for startups or small enterprises looking to establish credit or expand their existing credit limit. It may have specific requirements or benefits aimed at assisting small businesses in their growth. 2. Salt Lake Utah Corporate Credit Application: Geared towards larger corporations, this credit application is suited for established businesses with higher annual revenues and more extensive credit needs. It may involve a more thorough evaluation process and offer higher credit limits compared to small business credit applications. 3. Salt Lake Utah Business Credit Card Application: This type of credit application focuses on obtaining a business credit card, which allows businesses to make purchases and access credit for their day-to-day operations. Business credit cards often offer certain benefits such as rewards programs, expense management tools, and business-specific perks. 4. Salt Lake Utah Line of Credit Application: Designed for businesses seeking a flexible credit arrangement, this application is used to apply for a line of credit. A line of credit provides businesses with access to funds up to a predetermined limit, allowing them to borrow as needed and repay as they generate income. This can be an excellent solution for managing cash flow fluctuations or unexpected expenses. 5. Salt Lake Utah Trade Credit Application: This credit application is focused on establishing credit terms with suppliers or vendors. It allows a business to purchase goods or services on credit and pay within an agreed-upon period, commonly 30, 60, or 90 days. Trade credit is beneficial in managing inventory or operational expenses without needing immediate cash payments. In conclusion, the Salt Lake Utah Business Credit Application is a comprehensive request document that enables businesses in Salt Lake City, Utah, to apply for credit services. It serves as a gateway for businesses to access valuable credit resources, manage finances, and support growth opportunities.