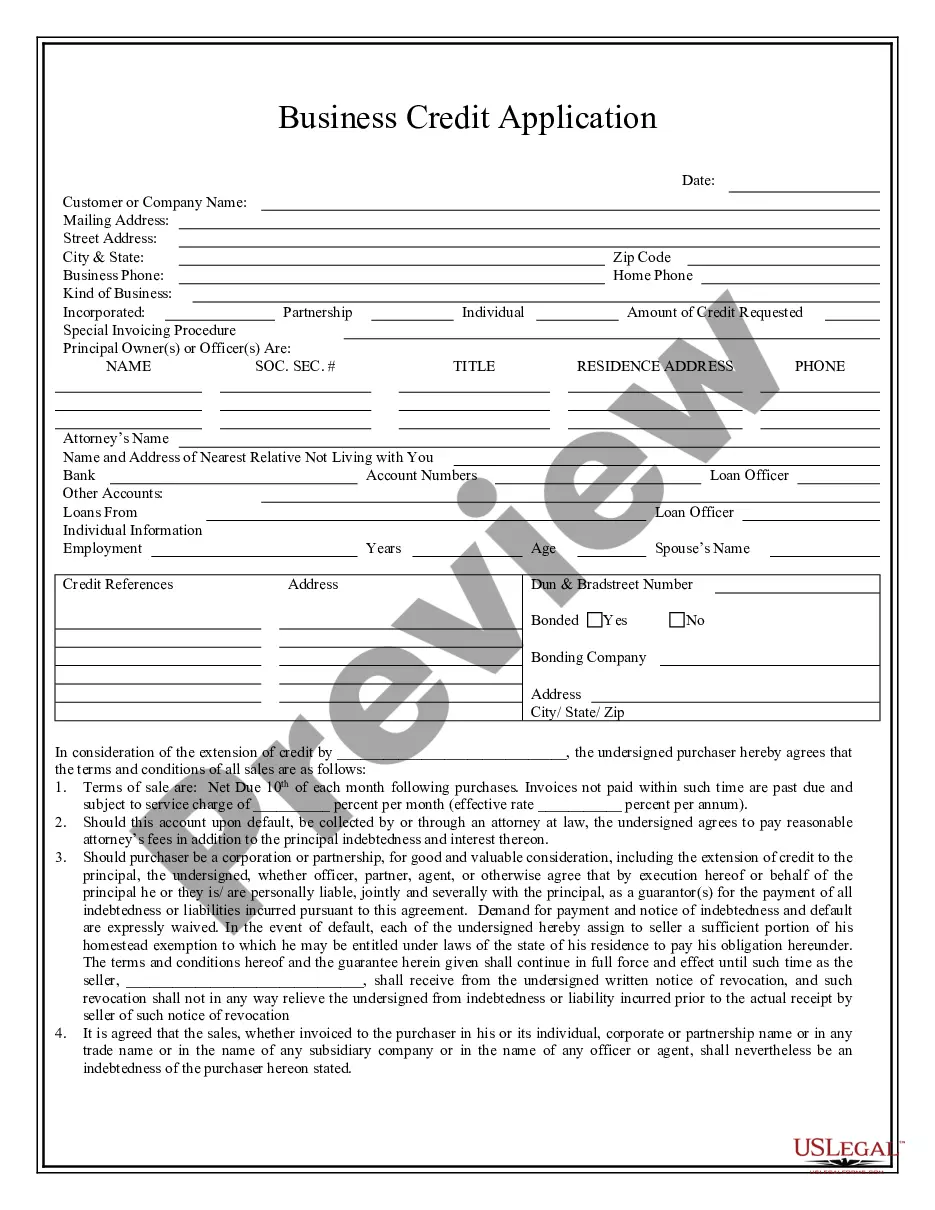

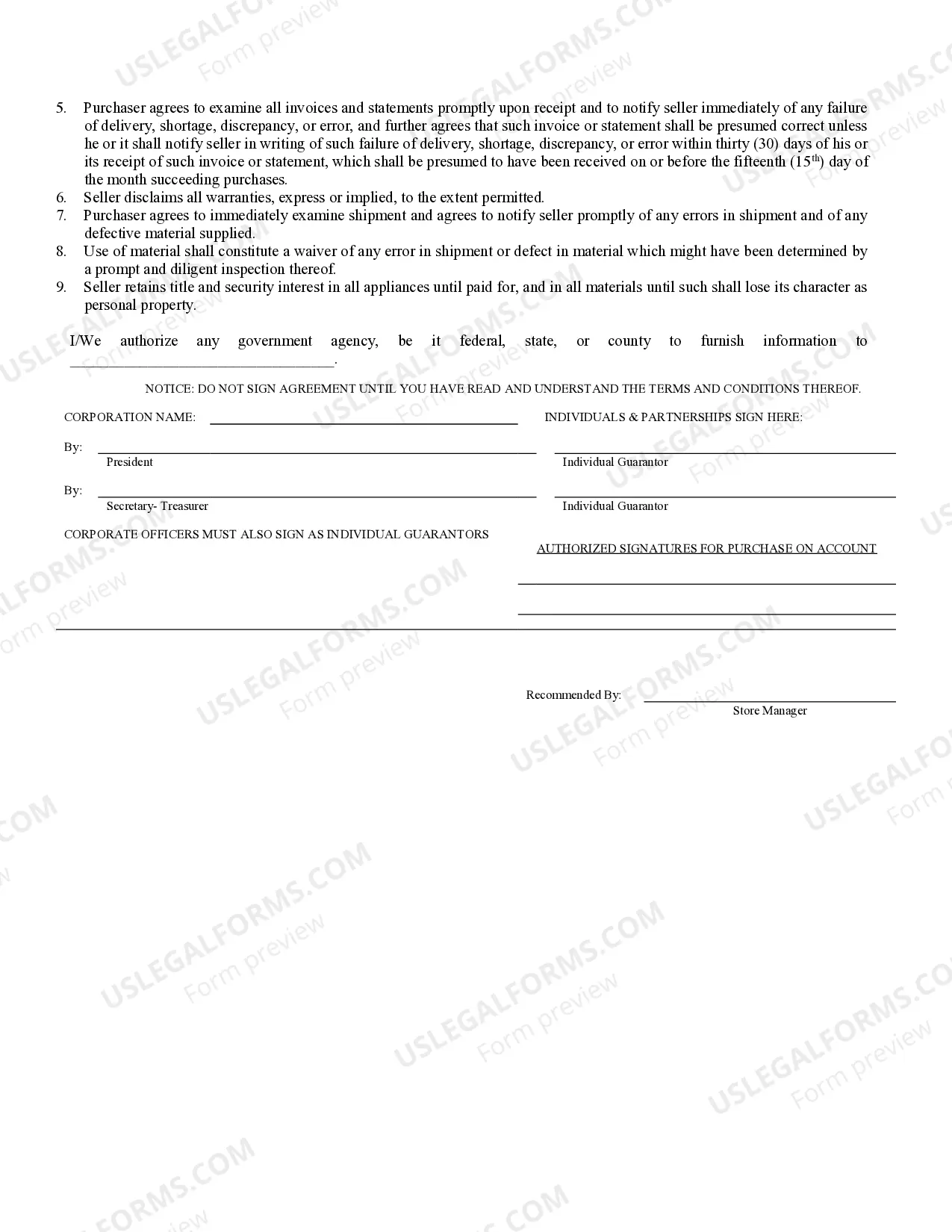

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

Salt Lake City, Utah Business Credit Application: A Detailed Description In Salt Lake City, Utah, businesses have the opportunity to apply for a business credit application, which is a crucial part of the financial process. This application enables businesses to access credit options, providing them with the necessary funds to support their growth and expansion. When applying for a business credit in Salt Lake City, it is essential to understand the requirements, process, and various types available. The business credit application process in Salt Lake City involves filling out a comprehensive form, providing detailed information about the organization, its owner(s), financial statements, and future projections. This information helps lenders evaluate the creditworthiness of the applicant and assess the potential risks associated with extending credit. Keywords: Salt Lake City, Utah, business credit application, financial process, credit options, growth, expansion, requirements, process, types, lenders, creditworthiness, risks, extending credit. Types of Salt Lake City, Utah Business Credit Applications: 1. Small Business Line of Credit: This type of credit application is designed for relatively small-scale businesses in Salt Lake City. It provides a predetermined credit limit that businesses can use as needed, offering flexibility in managing cash flow fluctuations and addressing unexpected expenses. 2. Business Credit Card: Similar to personal credit cards, business credit cards allow Salt Lake City businesses to make purchases and payments while separating personal and business expenses. The credit limit is determined based on the organization's creditworthiness and can be adjusted over time. 3. Equipment Financing: This credit application focuses specifically on acquiring new equipment or upgrading existing machinery in Salt Lake City businesses. It provides funds to purchase equipment outright, and the equipment itself often serves as collateral for the loan. 4. Business Loans: Salt Lake City businesses can apply for traditional business loans, which provide a lump sum of money to be repaid over a specified period. These loans are generally used for significant expenses such as expansion, inventory purchase, or launching new products/services. 5. Business Line of Credit: This type of credit application offers a revolving line of credit, typically with a more substantial maximum credit limit. Salt Lake City businesses can withdraw funds as needed, repay them, and use them again, making it suitable for ongoing operational expenses. Keywords: small business line of credit, business credit card, equipment financing, business loans, business line of credit, Salt Lake City businesses, cash flow, personal expenses, credit limit, collateral, inventory purchase, significant expenses, revolving line of credit, operational expenses. By understanding the specific types of business credit applications available in Salt Lake City, businesses can choose the one that best suits their needs. Regardless of the chosen type, it is crucial to provide accurate and up-to-date information in the application to increase the chances of approval and secure the desired credit limit.Salt Lake City, Utah Business Credit Application: A Detailed Description In Salt Lake City, Utah, businesses have the opportunity to apply for a business credit application, which is a crucial part of the financial process. This application enables businesses to access credit options, providing them with the necessary funds to support their growth and expansion. When applying for a business credit in Salt Lake City, it is essential to understand the requirements, process, and various types available. The business credit application process in Salt Lake City involves filling out a comprehensive form, providing detailed information about the organization, its owner(s), financial statements, and future projections. This information helps lenders evaluate the creditworthiness of the applicant and assess the potential risks associated with extending credit. Keywords: Salt Lake City, Utah, business credit application, financial process, credit options, growth, expansion, requirements, process, types, lenders, creditworthiness, risks, extending credit. Types of Salt Lake City, Utah Business Credit Applications: 1. Small Business Line of Credit: This type of credit application is designed for relatively small-scale businesses in Salt Lake City. It provides a predetermined credit limit that businesses can use as needed, offering flexibility in managing cash flow fluctuations and addressing unexpected expenses. 2. Business Credit Card: Similar to personal credit cards, business credit cards allow Salt Lake City businesses to make purchases and payments while separating personal and business expenses. The credit limit is determined based on the organization's creditworthiness and can be adjusted over time. 3. Equipment Financing: This credit application focuses specifically on acquiring new equipment or upgrading existing machinery in Salt Lake City businesses. It provides funds to purchase equipment outright, and the equipment itself often serves as collateral for the loan. 4. Business Loans: Salt Lake City businesses can apply for traditional business loans, which provide a lump sum of money to be repaid over a specified period. These loans are generally used for significant expenses such as expansion, inventory purchase, or launching new products/services. 5. Business Line of Credit: This type of credit application offers a revolving line of credit, typically with a more substantial maximum credit limit. Salt Lake City businesses can withdraw funds as needed, repay them, and use them again, making it suitable for ongoing operational expenses. Keywords: small business line of credit, business credit card, equipment financing, business loans, business line of credit, Salt Lake City businesses, cash flow, personal expenses, credit limit, collateral, inventory purchase, significant expenses, revolving line of credit, operational expenses. By understanding the specific types of business credit applications available in Salt Lake City, businesses can choose the one that best suits their needs. Regardless of the chosen type, it is crucial to provide accurate and up-to-date information in the application to increase the chances of approval and secure the desired credit limit.