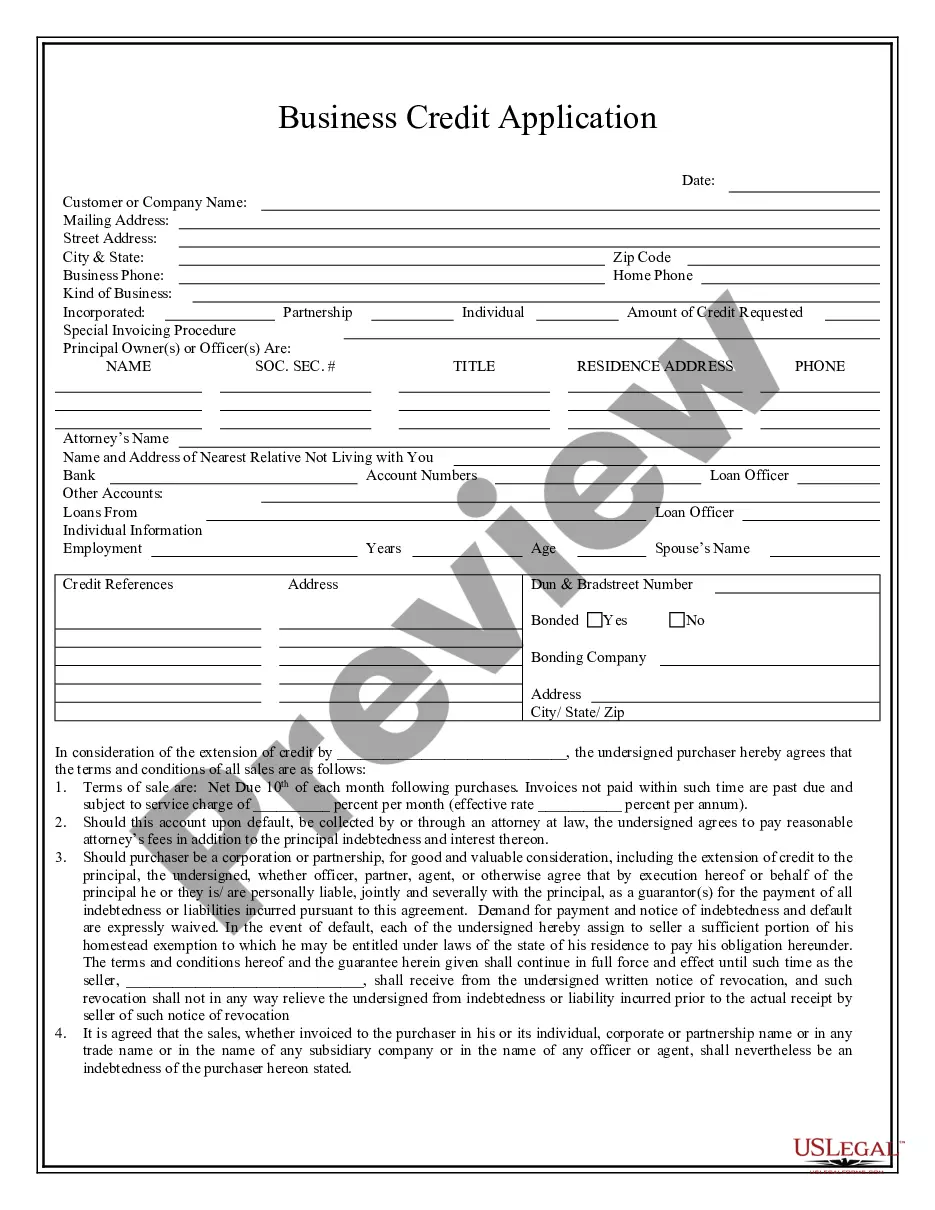

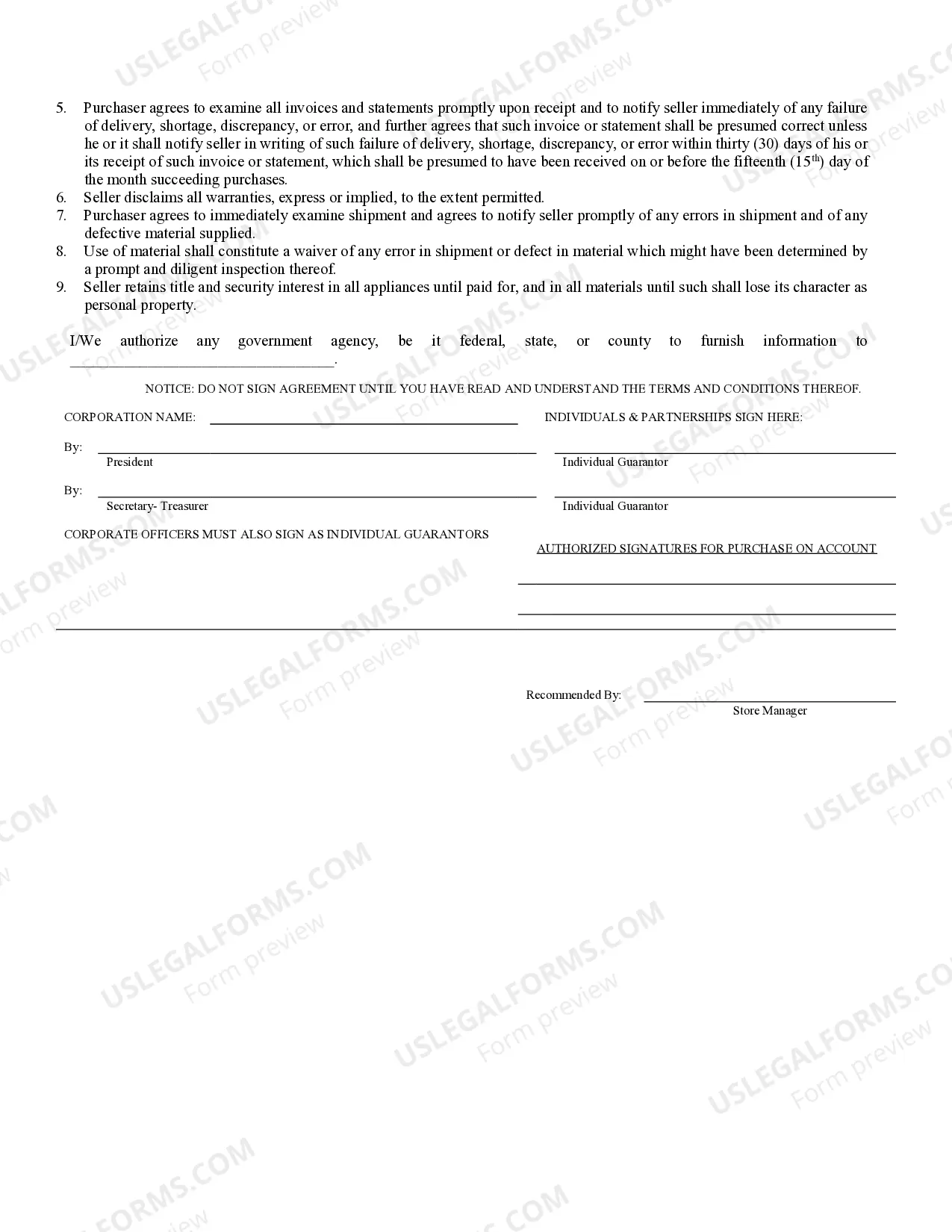

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

West Jordan Utah Business Credit Application is a crucial document that allows businesses in West Jordan, Utah to apply for credit from financial institutions or creditors. This application provides detailed information about the business, its owners, financial standing, and credit history, enabling creditors to assess the creditworthiness and potential risk associated with granting credit. Keywords: West Jordan Utah, business, credit application, financial institutions, creditors, creditworthiness, potential risk, owners, financial standing, credit history. There are several types of West Jordan Utah Business Credit Applications available, tailored to specific business needs and circumstances. These variations include: 1. Traditional Business Credit Application: This is a standard application used by most businesses seeking credit. It includes sections on business details such as legal name, address, nature of the business, and contact information. Additionally, it requires information on the business owner(s), financial statements, bank references, and trade references. Creditors analyze this data to evaluate creditworthiness and determine the credit terms and conditions. 2. Small Business Credit Application: Designed specifically for small businesses in West Jordan, this application takes into account the unique financial circumstances and challenges faced by smaller enterprises. It may require less extensive financial documentation compared to larger businesses, while still assessing creditworthiness and financial stability. 3. Start-up Business Credit Application: This application is intended for newly established businesses in West Jordan that have limited financial history or credit. It focuses on the owner's personal credit history, business plan, projected financial statements, and any collateral available to secure credit. Creditors often consider additional factors such as industry trends and market analysis to compensate for the limited business track record. 4. Line of Credit Application: Unlike traditional business credit that provides a one-time loan, a line of credit allows businesses to access funds as needed, offering greater flexibility. This type of application emphasizes the recurring nature of the credit facility and requires details on the anticipated credit limit, intended usage, and repayment terms. Additionally, it evaluates the business's ability to generate consistent cash flow to service the line of credit. 5. Equipment Financing Credit Application: Specifically for businesses seeking credit to acquire machinery, vehicles, or equipment, this application focuses on the details of the equipment being financed. It may require additional information, such as the purchase agreement, equipment specifications, and planned use. Creditors evaluate the equipment's value, depreciation rate, and the business's ability to repay the loan based on the equipment's expected lifespan. By carefully completing and submitting the appropriate West Jordan Utah Business Credit Application, businesses can increase their chances of securing the credit needed to grow, expand, or address their operational requirements. It is advisable to consult financial professionals, understand the specific creditor's requirements, and provide accurate and up-to-date information to enhance the chances of credit approval.West Jordan Utah Business Credit Application is a crucial document that allows businesses in West Jordan, Utah to apply for credit from financial institutions or creditors. This application provides detailed information about the business, its owners, financial standing, and credit history, enabling creditors to assess the creditworthiness and potential risk associated with granting credit. Keywords: West Jordan Utah, business, credit application, financial institutions, creditors, creditworthiness, potential risk, owners, financial standing, credit history. There are several types of West Jordan Utah Business Credit Applications available, tailored to specific business needs and circumstances. These variations include: 1. Traditional Business Credit Application: This is a standard application used by most businesses seeking credit. It includes sections on business details such as legal name, address, nature of the business, and contact information. Additionally, it requires information on the business owner(s), financial statements, bank references, and trade references. Creditors analyze this data to evaluate creditworthiness and determine the credit terms and conditions. 2. Small Business Credit Application: Designed specifically for small businesses in West Jordan, this application takes into account the unique financial circumstances and challenges faced by smaller enterprises. It may require less extensive financial documentation compared to larger businesses, while still assessing creditworthiness and financial stability. 3. Start-up Business Credit Application: This application is intended for newly established businesses in West Jordan that have limited financial history or credit. It focuses on the owner's personal credit history, business plan, projected financial statements, and any collateral available to secure credit. Creditors often consider additional factors such as industry trends and market analysis to compensate for the limited business track record. 4. Line of Credit Application: Unlike traditional business credit that provides a one-time loan, a line of credit allows businesses to access funds as needed, offering greater flexibility. This type of application emphasizes the recurring nature of the credit facility and requires details on the anticipated credit limit, intended usage, and repayment terms. Additionally, it evaluates the business's ability to generate consistent cash flow to service the line of credit. 5. Equipment Financing Credit Application: Specifically for businesses seeking credit to acquire machinery, vehicles, or equipment, this application focuses on the details of the equipment being financed. It may require additional information, such as the purchase agreement, equipment specifications, and planned use. Creditors evaluate the equipment's value, depreciation rate, and the business's ability to repay the loan based on the equipment's expected lifespan. By carefully completing and submitting the appropriate West Jordan Utah Business Credit Application, businesses can increase their chances of securing the credit needed to grow, expand, or address their operational requirements. It is advisable to consult financial professionals, understand the specific creditor's requirements, and provide accurate and up-to-date information to enhance the chances of credit approval.