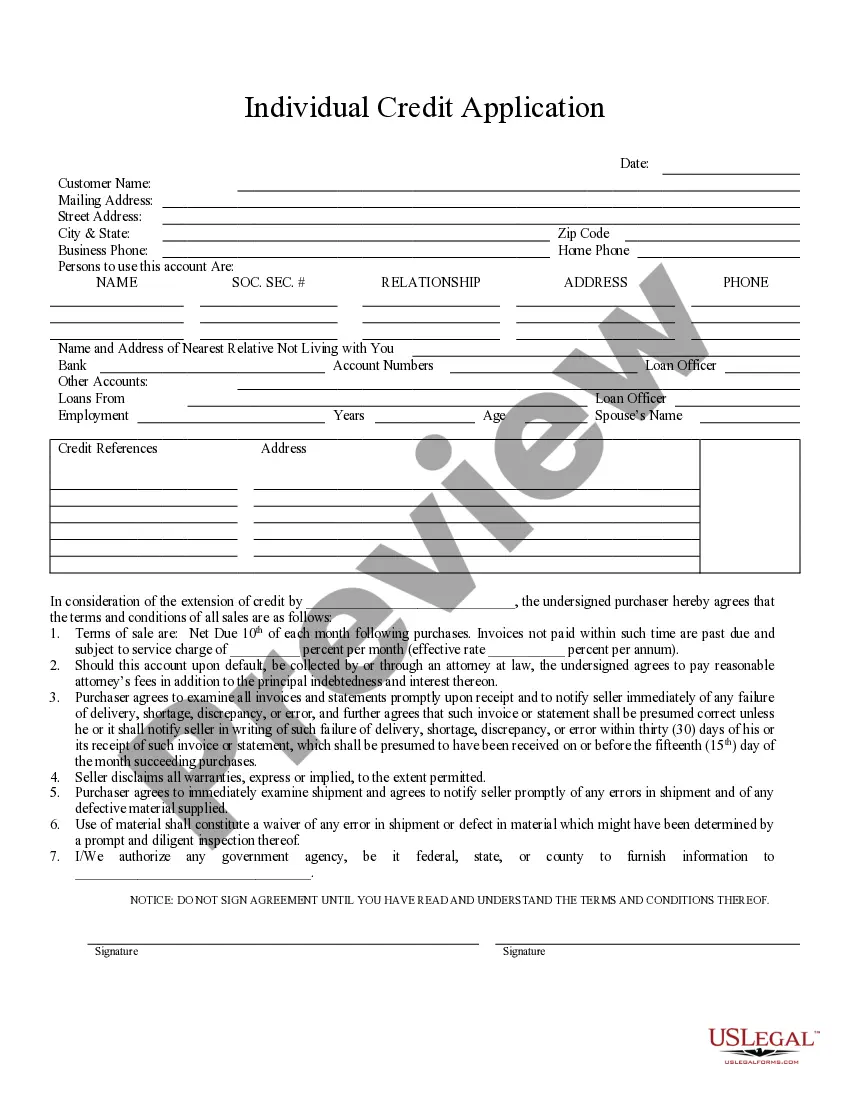

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and permission for Seller to obtain personal information about purchaser from government agencies, if necessary.

Salt Lake Utah Individual Credit Application refers to the process by which individuals in the Salt Lake City, Utah area apply for credit from various financial institutions or lenders. This application allows individuals to request credit for personal needs such as buying a house, car, or obtaining a personal loan. Keywords: Salt Lake Utah, individual credit application, Salt Lake City, Utah area, financial institutions, lenders, personal needs, buying a house, buying a car, personal loan. There may be various types of Salt Lake Utah Individual Credit Applications available depending on the specific requirements and purposes. Some common types may include: 1. Mortgage Credit Application: This type of credit application is specifically used for individuals seeking a loan to buy a house or refinance an existing mortgage in the Salt Lake City area. Mortgage credit applications involve providing detailed information about income, employment, assets, and liabilities. 2. Auto Loan Credit Application: Salt Lake Utah residents looking to finance the purchase of a vehicle can use an auto loan credit application. This application requires information about the vehicle being purchased, as well as the borrower's income, employment, and credit history. 3. Personal Loan Credit Application: Individuals needing funds for personal expenses, debt consolidation, or other purposes can apply for a personal loan through a personal loan credit application. This application typically requires details about the borrower's income, expenses, and credit history. 4. Credit Card Application: Salt Lake Utah residents can also apply for credit cards through a credit card application. Credit card applications often require information about income, employment, and credit history to determine the applicant's creditworthiness. These various types of Salt Lake Utah Individual Credit Applications cater to specific financial needs and help individuals access funds for different purposes. It is essential to provide accurate and detailed information in each application to increase the chances of approval and secure favorable credit terms.Salt Lake Utah Individual Credit Application refers to the process by which individuals in the Salt Lake City, Utah area apply for credit from various financial institutions or lenders. This application allows individuals to request credit for personal needs such as buying a house, car, or obtaining a personal loan. Keywords: Salt Lake Utah, individual credit application, Salt Lake City, Utah area, financial institutions, lenders, personal needs, buying a house, buying a car, personal loan. There may be various types of Salt Lake Utah Individual Credit Applications available depending on the specific requirements and purposes. Some common types may include: 1. Mortgage Credit Application: This type of credit application is specifically used for individuals seeking a loan to buy a house or refinance an existing mortgage in the Salt Lake City area. Mortgage credit applications involve providing detailed information about income, employment, assets, and liabilities. 2. Auto Loan Credit Application: Salt Lake Utah residents looking to finance the purchase of a vehicle can use an auto loan credit application. This application requires information about the vehicle being purchased, as well as the borrower's income, employment, and credit history. 3. Personal Loan Credit Application: Individuals needing funds for personal expenses, debt consolidation, or other purposes can apply for a personal loan through a personal loan credit application. This application typically requires details about the borrower's income, expenses, and credit history. 4. Credit Card Application: Salt Lake Utah residents can also apply for credit cards through a credit card application. Credit card applications often require information about income, employment, and credit history to determine the applicant's creditworthiness. These various types of Salt Lake Utah Individual Credit Applications cater to specific financial needs and help individuals access funds for different purposes. It is essential to provide accurate and detailed information in each application to increase the chances of approval and secure favorable credit terms.