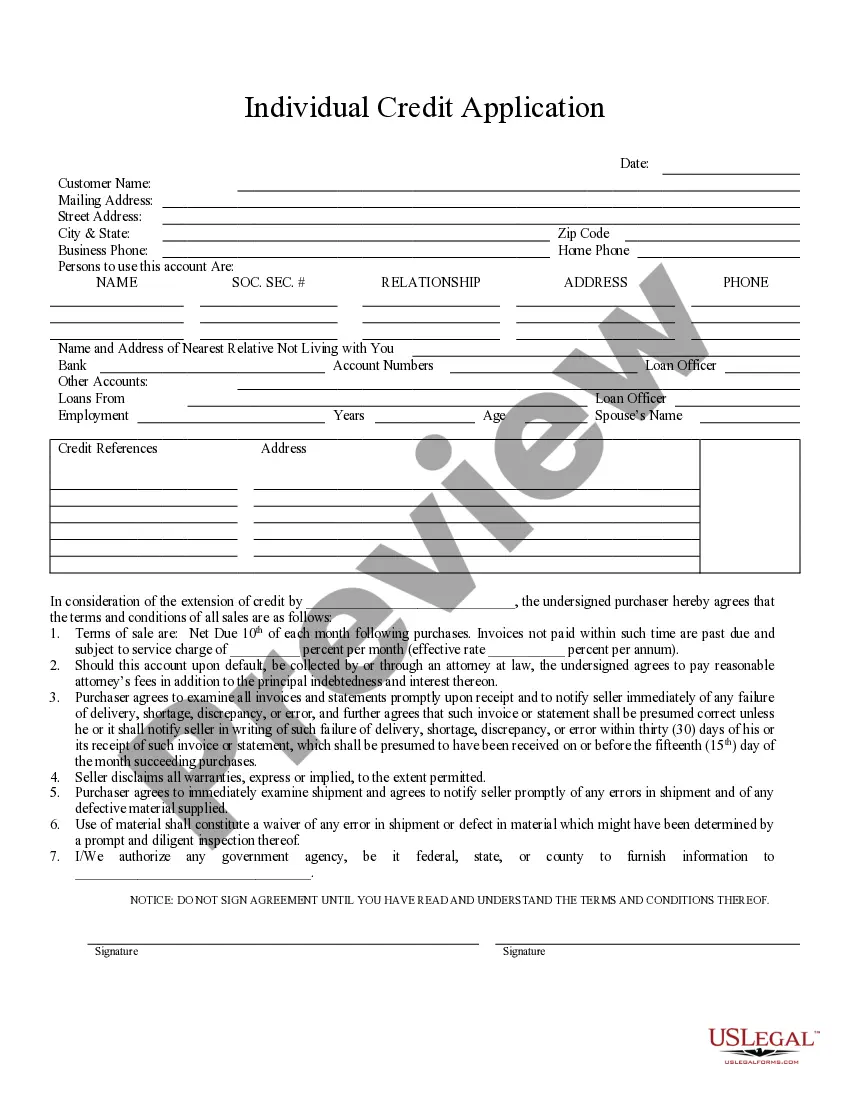

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and permission for Seller to obtain personal information about purchaser from government agencies, if necessary.

West Jordan Utah Individual Credit Application is a document designed to collect personal and financial information from individuals seeking credit or loans in West Jordan, Utah. This application is the first step in the credit approval process and plays a crucial role in determining an individual's creditworthiness. The West Jordan Utah Individual Credit Application gathers essential details such as name, address, contact information, and social security number, to establish the applicant's identity. Additionally, it includes sections that prompt individuals to provide employment history, income details, and existing financial obligations. This comprehensive application form ensures that lenders have a complete picture of an applicant's financial situation before making lending decisions. Analyzing these details enables lenders to assess the applicant's ability to repay debts, evaluate credit risk, and determine suitable borrowing terms, such as loan amount, interest rates, and repayment periods. In West Jordan, Utah, there might be various types of individual credit applications, each tailored to specific financial products or institutions. Some common types of West Jordan Utah Individual Credit Applications include: 1. Mortgage Loan Application: This type of credit application is designed for individuals seeking loans to purchase or refinance homes in West Jordan, Utah. It requires detailed information about the property, employment history, income, and existing debts. 2. Auto Loan Application: Designed for individuals looking to finance a vehicle purchase, this credit application gathers information about the desired car, employment details, income, and other factors that determine creditworthiness. 3. Personal Loan Application: Individuals seeking unsecured loans for personal expenses, such as medical bills or home renovations, submit this type of application. It typically requires information about income, employment, existing debts, and the purpose of the loan. 4. Credit Card Application: This type of credit application is specific to individuals applying for a credit card in West Jordan, Utah. It collects personal information, financial details, and helps determine the credit limit and other card features. 5. Business Loan Application: For entrepreneurs or business owners in West Jordan, Utah, this credit application enables them to seek financing for business-related purposes. It requires providing business details, financial statements, income projections, and personal financial information. 6. Student Loan Application: Geared towards students pursuing higher education in West Jordan, Utah, this application collects personal information, details about educational institutions, cost of tuition, and the desired loan amount. These various types of individual credit applications adhere to legal and regulatory requirements while ensuring accurate and comprehensive information is gathered for credit evaluation purposes.West Jordan Utah Individual Credit Application is a document designed to collect personal and financial information from individuals seeking credit or loans in West Jordan, Utah. This application is the first step in the credit approval process and plays a crucial role in determining an individual's creditworthiness. The West Jordan Utah Individual Credit Application gathers essential details such as name, address, contact information, and social security number, to establish the applicant's identity. Additionally, it includes sections that prompt individuals to provide employment history, income details, and existing financial obligations. This comprehensive application form ensures that lenders have a complete picture of an applicant's financial situation before making lending decisions. Analyzing these details enables lenders to assess the applicant's ability to repay debts, evaluate credit risk, and determine suitable borrowing terms, such as loan amount, interest rates, and repayment periods. In West Jordan, Utah, there might be various types of individual credit applications, each tailored to specific financial products or institutions. Some common types of West Jordan Utah Individual Credit Applications include: 1. Mortgage Loan Application: This type of credit application is designed for individuals seeking loans to purchase or refinance homes in West Jordan, Utah. It requires detailed information about the property, employment history, income, and existing debts. 2. Auto Loan Application: Designed for individuals looking to finance a vehicle purchase, this credit application gathers information about the desired car, employment details, income, and other factors that determine creditworthiness. 3. Personal Loan Application: Individuals seeking unsecured loans for personal expenses, such as medical bills or home renovations, submit this type of application. It typically requires information about income, employment, existing debts, and the purpose of the loan. 4. Credit Card Application: This type of credit application is specific to individuals applying for a credit card in West Jordan, Utah. It collects personal information, financial details, and helps determine the credit limit and other card features. 5. Business Loan Application: For entrepreneurs or business owners in West Jordan, Utah, this credit application enables them to seek financing for business-related purposes. It requires providing business details, financial statements, income projections, and personal financial information. 6. Student Loan Application: Geared towards students pursuing higher education in West Jordan, Utah, this application collects personal information, details about educational institutions, cost of tuition, and the desired loan amount. These various types of individual credit applications adhere to legal and regulatory requirements while ensuring accurate and comprehensive information is gathered for credit evaluation purposes.