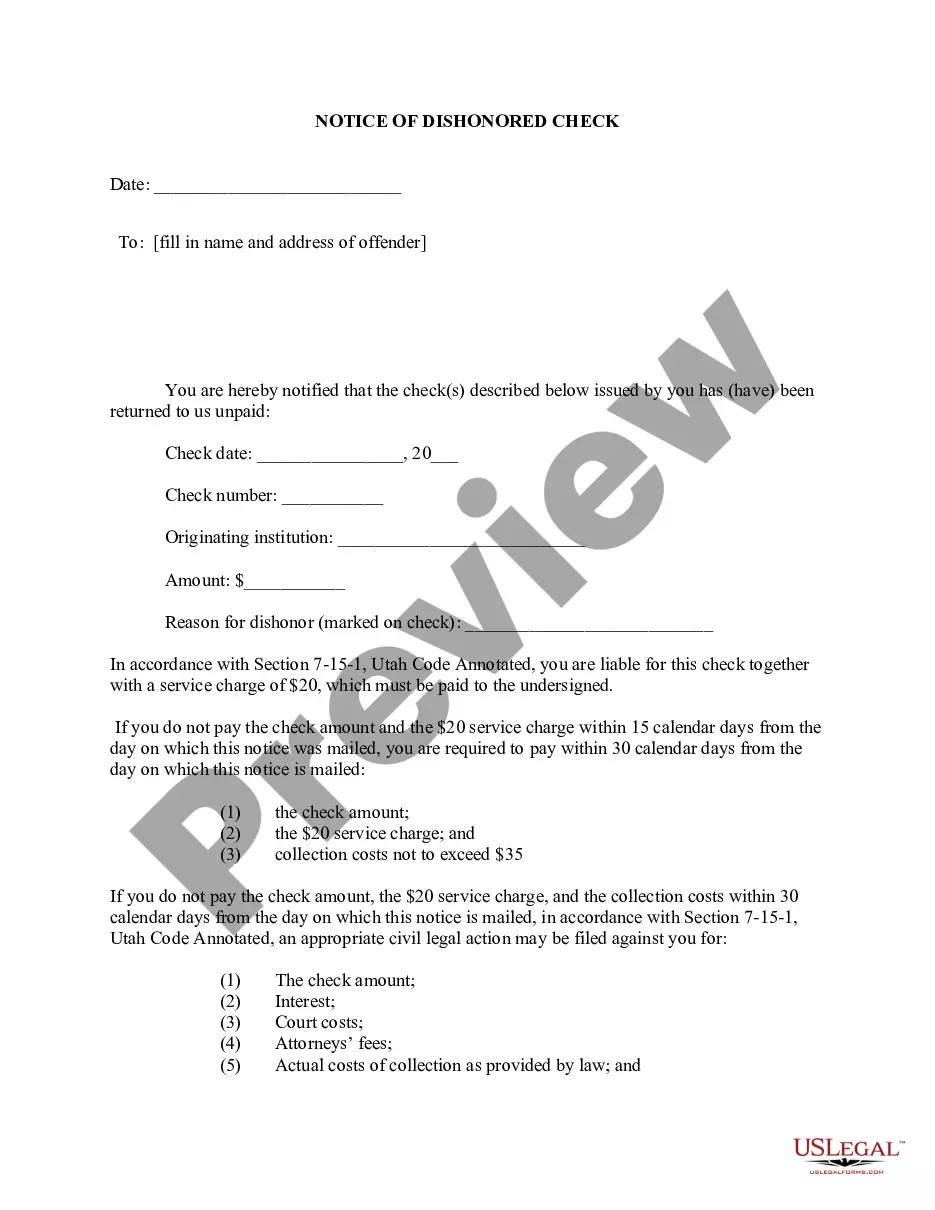

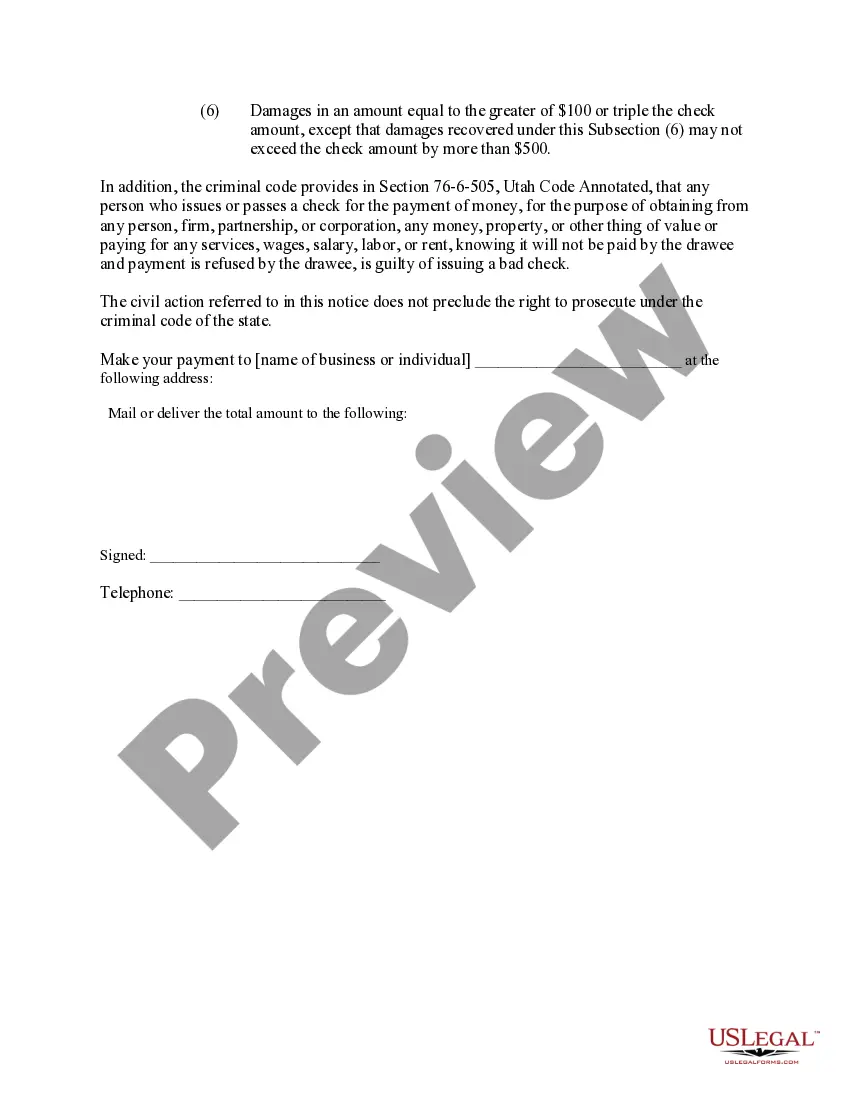

This is a Notice of Dishonored Check - Civil. A "dishonored check" (also known as a "bounced check" or "bad check") is a check which the bank will not pay because there is no such checking account, or there are insufficient funds in the account to pay the check. In order to attempt the greatest possible recovery on a dishonored check, the business owner, or any other person given a dishonored check, may be required by state law to notify the debtor that the check was dishonored.

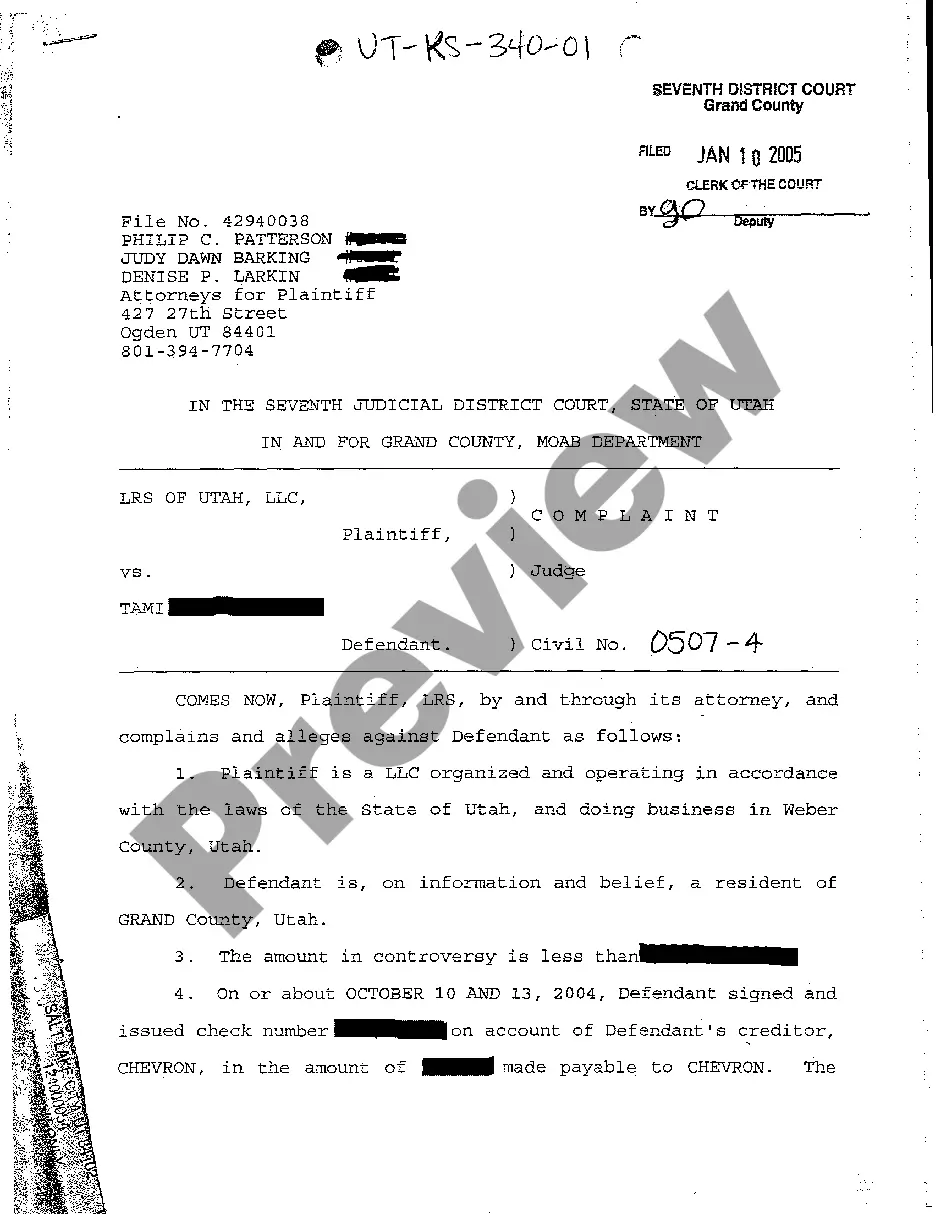

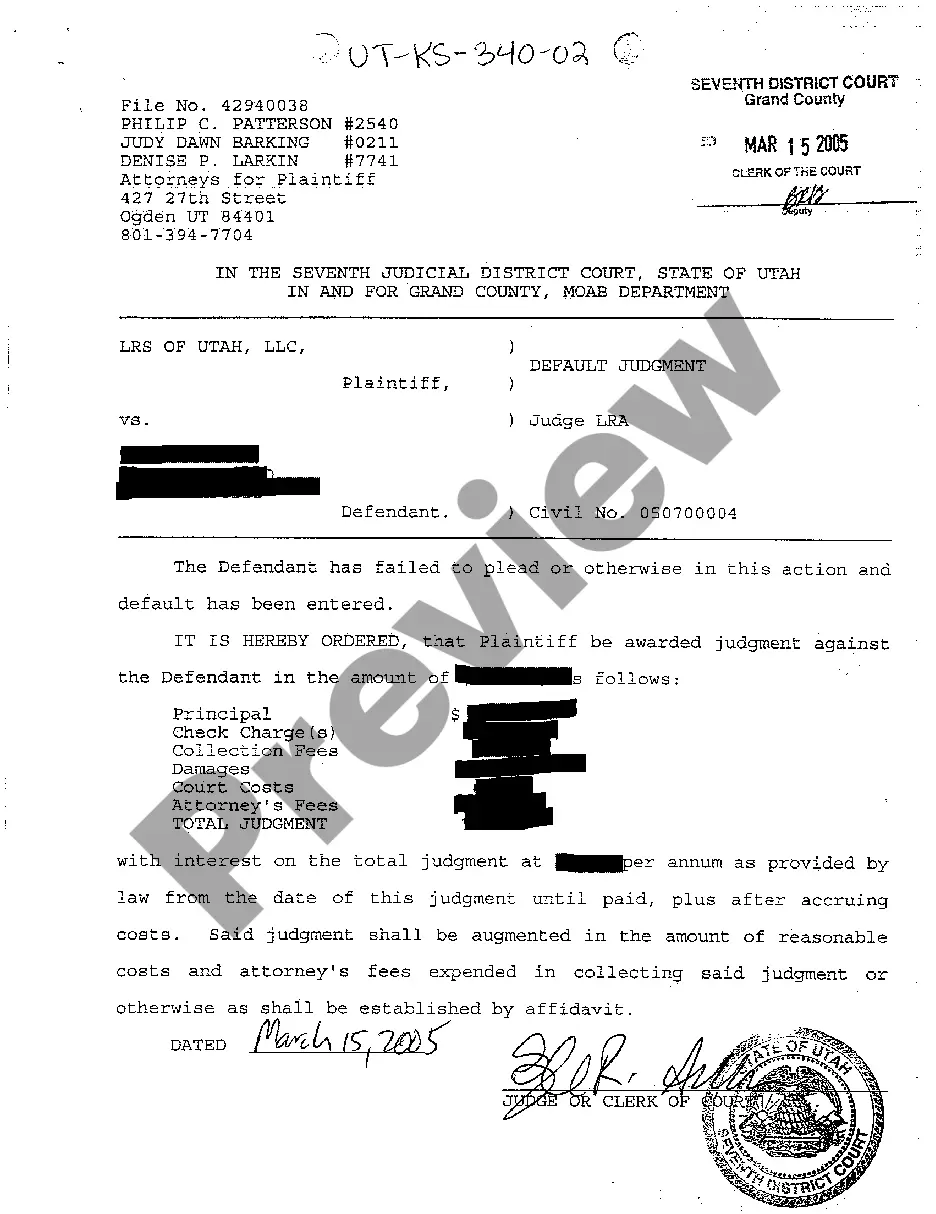

Title: Understanding Salt Lake City Utah Notice of Dishonored Check — Criminal Introduction: In Salt Lake City, Utah, the issuance of a bad check or a bounced check is a criminal offense. When a check is dishonored due to insufficient funds, the recipient can initiate legal proceedings by sending a Salt Lake City Utah Notice of Dishonored Check — Criminal to the check issuer. This article aims to provide a detailed description of what this notice entails, the legal implications associated with bad checks, and the consequences that individuals may face for their actions. 1. Definition of a Bad Check: A bad check, also known as a dishonored or bounced check, refers to a check that is returned unpaid by the bank due to insufficient funds in the issuer's account or for other reasons that prohibit the payment. This situation may occur unintentionally or deliberately, but regardless, it is considered an offense under Utah law. 2. Salt Lake City Utah Notice of Dishonored Check — Criminal: When a recipient of a bad check wants to pursue legal action, they must issue a Salt Lake City Utah Notice of Dishonored Check — Criminal to the check writer. This notice serves as a formal notification to alert the issuer of the unpaid check, providing them an opportunity to rectify the situation before legal recourse is pursued. 3. Mandatory Information in the Notice: To ensure the notice serves its purpose, it must contain specific information. This typically includes: — The date the notice is issue— - The recipient's details (name, address, contact information) — The issuer's details (name, address, contact information) — A clear statement stating the reason for the notice (check dishonored due to insufficient funds) — A demand for immediate payment of the check amount, plus any additional fees related to the dishonored check — A warning about the potential legal consequences if the payment is not made within a specified timeframe (usually a few days) — Instructions on how to contact and make payment to the recipient — A statement indicating that the recipient will pursue legal action if payment is not received within the specified timeframe 4. Potential Legal Consequences: Failure to address the dishonored check can result in various legal consequences for the issuer, including: — A criminal charge for writing a bad check, which may lead to fines and possible imprisonment, depending on the severity of the offense — A negative impact on the issuer's credit score — Potential difficulty in opening new bank accounts or obtaining credit in the future — Legal fees and court costs if the recipient pursues legal action Conclusion: Understanding the Salt Lake City Utah Notice of Dishonored Check — Criminal is crucial for both recipients seeking recourse and check writers facing potential legal consequences. It is essential to resolve any issues related to dishonored checks promptly to avoid further legal complications and maintain financial integrity. Always ensure sufficient funds are available before issuing checks to prevent unintentional dishonoring and potential legal troubles.Title: Understanding Salt Lake City Utah Notice of Dishonored Check — Criminal Introduction: In Salt Lake City, Utah, the issuance of a bad check or a bounced check is a criminal offense. When a check is dishonored due to insufficient funds, the recipient can initiate legal proceedings by sending a Salt Lake City Utah Notice of Dishonored Check — Criminal to the check issuer. This article aims to provide a detailed description of what this notice entails, the legal implications associated with bad checks, and the consequences that individuals may face for their actions. 1. Definition of a Bad Check: A bad check, also known as a dishonored or bounced check, refers to a check that is returned unpaid by the bank due to insufficient funds in the issuer's account or for other reasons that prohibit the payment. This situation may occur unintentionally or deliberately, but regardless, it is considered an offense under Utah law. 2. Salt Lake City Utah Notice of Dishonored Check — Criminal: When a recipient of a bad check wants to pursue legal action, they must issue a Salt Lake City Utah Notice of Dishonored Check — Criminal to the check writer. This notice serves as a formal notification to alert the issuer of the unpaid check, providing them an opportunity to rectify the situation before legal recourse is pursued. 3. Mandatory Information in the Notice: To ensure the notice serves its purpose, it must contain specific information. This typically includes: — The date the notice is issue— - The recipient's details (name, address, contact information) — The issuer's details (name, address, contact information) — A clear statement stating the reason for the notice (check dishonored due to insufficient funds) — A demand for immediate payment of the check amount, plus any additional fees related to the dishonored check — A warning about the potential legal consequences if the payment is not made within a specified timeframe (usually a few days) — Instructions on how to contact and make payment to the recipient — A statement indicating that the recipient will pursue legal action if payment is not received within the specified timeframe 4. Potential Legal Consequences: Failure to address the dishonored check can result in various legal consequences for the issuer, including: — A criminal charge for writing a bad check, which may lead to fines and possible imprisonment, depending on the severity of the offense — A negative impact on the issuer's credit score — Potential difficulty in opening new bank accounts or obtaining credit in the future — Legal fees and court costs if the recipient pursues legal action Conclusion: Understanding the Salt Lake City Utah Notice of Dishonored Check — Criminal is crucial for both recipients seeking recourse and check writers facing potential legal consequences. It is essential to resolve any issues related to dishonored checks promptly to avoid further legal complications and maintain financial integrity. Always ensure sufficient funds are available before issuing checks to prevent unintentional dishonoring and potential legal troubles.