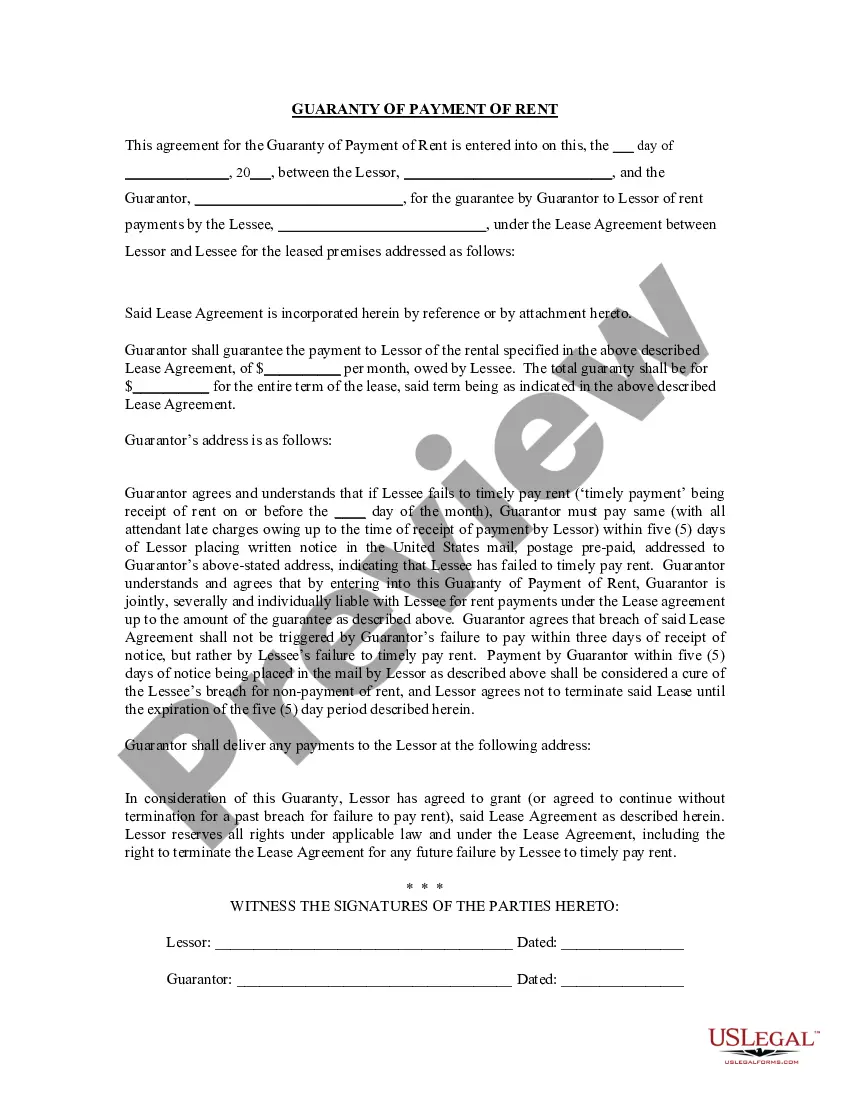

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor). Provo Utah Guaranty or Guarantee of Payment of Rent is a legal agreement that provides assurance to landlords or property owners regarding the timely payment of rent by the tenant. This document acts as a safeguard against potential rental payment defaults or non-payment situations, ensuring the landlord's financial security. The Provo Utah Guaranty or Guarantee of Payment of Rent serves as a well-defined contract between the tenant, landlord, and the guarantor, who is usually a third party. The guarantor pledges to be responsible for the payment of rent in case the tenant fails to fulfill their obligations. This agreement adds an extra layer of protection for landlords in Provo, Utah, and helps minimize financial risks associated with rental properties. There are different types of Provo Utah Guaranty or Guarantee of Payment of Rent, namely: 1. Individual Guarantor: This type involves a specific person who guarantees the timely payment of rent as a secondary party to the lease agreement. The individual guarantor's creditworthiness and financial stability are critical factors considered during the evaluation process. 2. Corporate Guarantor: In certain cases, a corporation or business entity assumes the responsibility of payment guarantee on behalf of the tenant. The landlord may require a corporate guarantor when dealing with commercial leases or tenants lacking sufficient personal creditworthiness. 3. Co-Signer Guarantor: This type involves having an additional person, usually a family member or close friend of the tenant, sign the guaranty agreement. The co-signer guarantees payment of rent in case the tenant is unable to meet their obligations. Co-signers are typically required when the tenant has a limited credit history or inadequate income. 4. Lease Deposit Guaranty: Rather than relying on a third-party guarantor, this type allows the landlord to retain a larger security deposit from the tenant. The increased deposit acts as a form of guarantee against potential non-payment situations, providing the landlord with financial protection. The Provo Utah Guaranty or Guarantee of Payment of Rent is a critical aspect of lease agreements, ensuring landlords and property owners receive their rental income consistently. However, it is advisable for both tenants and guarantors to carefully review and understand the terms and conditions outlined in the agreement before entering into any commitments.

Provo Utah Guaranty or Guarantee of Payment of Rent is a legal agreement that provides assurance to landlords or property owners regarding the timely payment of rent by the tenant. This document acts as a safeguard against potential rental payment defaults or non-payment situations, ensuring the landlord's financial security. The Provo Utah Guaranty or Guarantee of Payment of Rent serves as a well-defined contract between the tenant, landlord, and the guarantor, who is usually a third party. The guarantor pledges to be responsible for the payment of rent in case the tenant fails to fulfill their obligations. This agreement adds an extra layer of protection for landlords in Provo, Utah, and helps minimize financial risks associated with rental properties. There are different types of Provo Utah Guaranty or Guarantee of Payment of Rent, namely: 1. Individual Guarantor: This type involves a specific person who guarantees the timely payment of rent as a secondary party to the lease agreement. The individual guarantor's creditworthiness and financial stability are critical factors considered during the evaluation process. 2. Corporate Guarantor: In certain cases, a corporation or business entity assumes the responsibility of payment guarantee on behalf of the tenant. The landlord may require a corporate guarantor when dealing with commercial leases or tenants lacking sufficient personal creditworthiness. 3. Co-Signer Guarantor: This type involves having an additional person, usually a family member or close friend of the tenant, sign the guaranty agreement. The co-signer guarantees payment of rent in case the tenant is unable to meet their obligations. Co-signers are typically required when the tenant has a limited credit history or inadequate income. 4. Lease Deposit Guaranty: Rather than relying on a third-party guarantor, this type allows the landlord to retain a larger security deposit from the tenant. The increased deposit acts as a form of guarantee against potential non-payment situations, providing the landlord with financial protection. The Provo Utah Guaranty or Guarantee of Payment of Rent is a critical aspect of lease agreements, ensuring landlords and property owners receive their rental income consistently. However, it is advisable for both tenants and guarantors to carefully review and understand the terms and conditions outlined in the agreement before entering into any commitments.