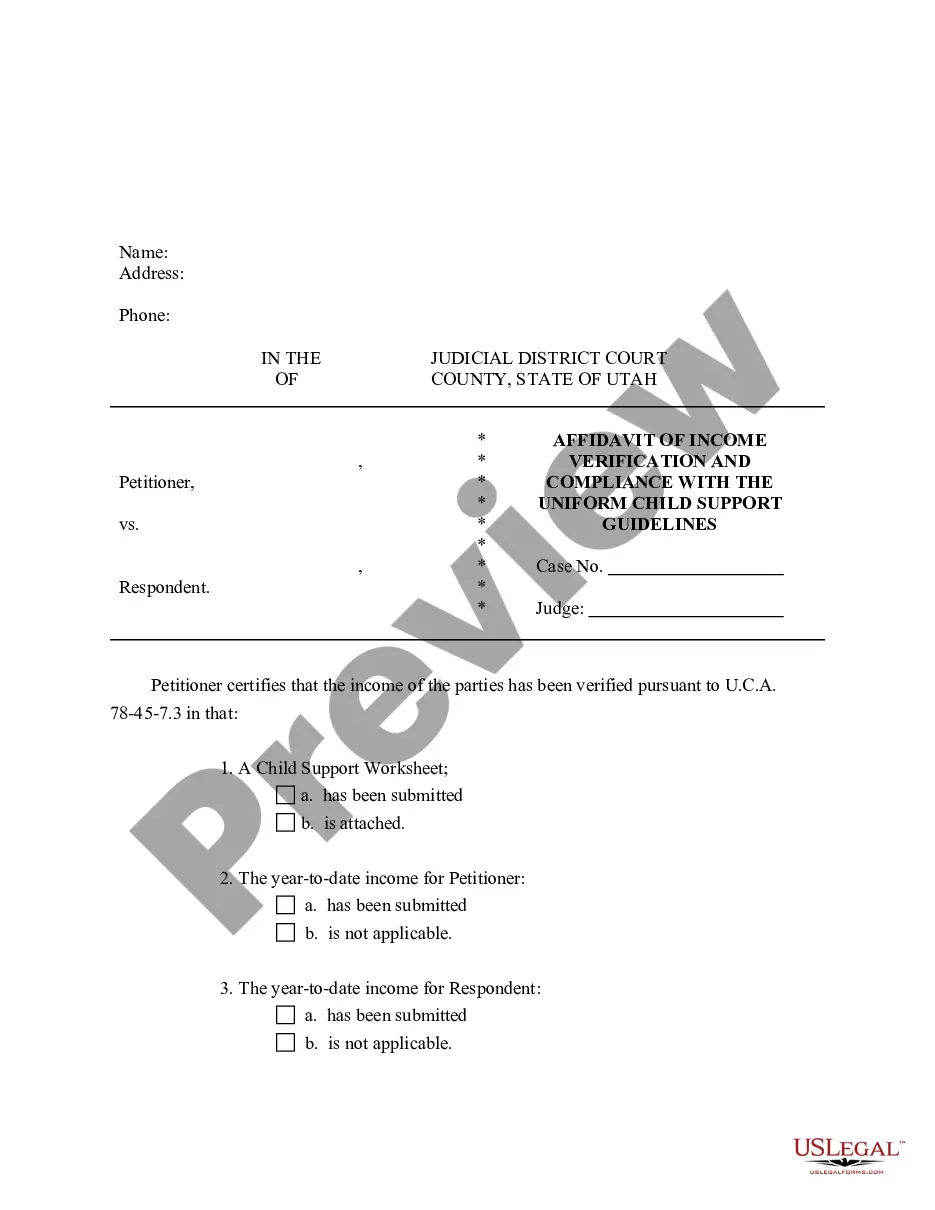

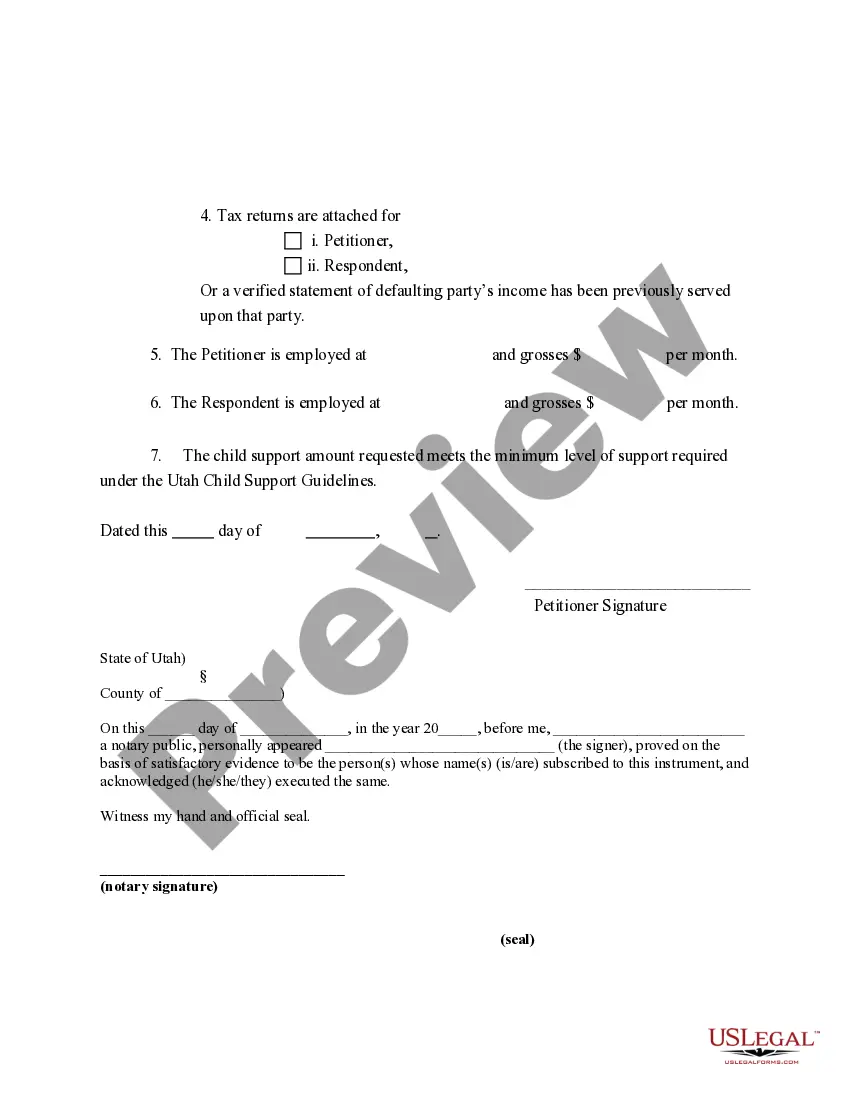

An Affidavit of Income Verification and Compliance with Child Support Guidelines is a form used to certify that the income of both parties has been verified. In addition, it states that the child support amount requested meets the minimum requirements under the child support guidelines.

The Salt Lake Utah Affidavit of Income Verification and Compliance with Child Support Guidelines is an essential legal document used in the state of Utah to determine and ensure accurate income reporting and compliance with child support guidelines. This affidavit serves as a tool to evaluate the financial capacity of individuals involved in child support cases, including parents and custodial guardians. By providing a comprehensive overview of a person's income, it aids in establishing fair child support obligations based on the guidelines set by law. Key features of the Salt Lake Utah Affidavit of Income Verification and Compliance with Child Support Guidelines include: 1. Income Disclosure: The affidavit requires individuals to disclose detailed information about their sources of income, including employment wages, self-employment earnings, rental income, investments, government benefits, and any other relevant financial resources. Providing accurate and complete income details is vital to ensure the child support determination is fair and just. 2. Employment and Payroll Information: This section of the affidavit requires disclosure of employment details such as the employer's name, address, contact information, job title, and regular work hours. Additionally, individuals are required to furnish payroll information, including pay stubs, wage statements, and other relevant payroll records. 3. Deductions and Allowances: This section allows individuals to declare any allowable deductions or allowances that could impact the calculation of child support. These may include tax obligations, health insurance premiums, mandatory retirement contributions, and other justified expenses that affect disposable income. 4. Non-Income-Generating Assets: This component requires individuals to disclose details about assets that do not directly generate income, such as real estate holdings, vehicles, valuable personal property, and any other assets that could contribute to the financial well-being of the child indirectly. 5. Additional Income Streams: The affidavit also includes a section to report any additional income streams beyond regular employment. This might include income from side businesses, freelance work, royalties, dividends, or capital gains from investments. Different types of Salt Lake Utah Affidavit of Income Verification and Compliance with Child Support Guidelines may exist to cater to specific situations or individuals involved in child support cases. These variations might include: 1. Modified Affidavit for Self-Employed Individuals: This version of the affidavit might contain additional sections and requirements specific to self-employed individuals who earn income through their own businesses, freelancing, or contracting work. 2. Affidavit for Unemployed or Underemployed Individuals: This version of the affidavit might be used by individuals who are currently unemployed or underemployed and require special considerations in determining child support obligations. 3. Affidavit for Various Income Sources: This version of the affidavit might be designed to accommodate individuals with complex income structures, such as those receiving income from multiple sources, investments, government benefits, or other unique financial arrangements. 4. Affidavit for High-Income Individuals: This type of affidavit might be utilized in cases where the income of one or both parents exceeds a certain threshold, requiring more detailed financial disclosures and specialized calculations to determine child support obligations accurately. Overall, the Salt Lake Utah Affidavit of Income Verification and Compliance with Child Support Guidelines plays a crucial role in ensuring fairness and transparency in child support cases. By providing accurate income information, individuals can contribute to the well-being and financial stability of their children.The Salt Lake Utah Affidavit of Income Verification and Compliance with Child Support Guidelines is an essential legal document used in the state of Utah to determine and ensure accurate income reporting and compliance with child support guidelines. This affidavit serves as a tool to evaluate the financial capacity of individuals involved in child support cases, including parents and custodial guardians. By providing a comprehensive overview of a person's income, it aids in establishing fair child support obligations based on the guidelines set by law. Key features of the Salt Lake Utah Affidavit of Income Verification and Compliance with Child Support Guidelines include: 1. Income Disclosure: The affidavit requires individuals to disclose detailed information about their sources of income, including employment wages, self-employment earnings, rental income, investments, government benefits, and any other relevant financial resources. Providing accurate and complete income details is vital to ensure the child support determination is fair and just. 2. Employment and Payroll Information: This section of the affidavit requires disclosure of employment details such as the employer's name, address, contact information, job title, and regular work hours. Additionally, individuals are required to furnish payroll information, including pay stubs, wage statements, and other relevant payroll records. 3. Deductions and Allowances: This section allows individuals to declare any allowable deductions or allowances that could impact the calculation of child support. These may include tax obligations, health insurance premiums, mandatory retirement contributions, and other justified expenses that affect disposable income. 4. Non-Income-Generating Assets: This component requires individuals to disclose details about assets that do not directly generate income, such as real estate holdings, vehicles, valuable personal property, and any other assets that could contribute to the financial well-being of the child indirectly. 5. Additional Income Streams: The affidavit also includes a section to report any additional income streams beyond regular employment. This might include income from side businesses, freelance work, royalties, dividends, or capital gains from investments. Different types of Salt Lake Utah Affidavit of Income Verification and Compliance with Child Support Guidelines may exist to cater to specific situations or individuals involved in child support cases. These variations might include: 1. Modified Affidavit for Self-Employed Individuals: This version of the affidavit might contain additional sections and requirements specific to self-employed individuals who earn income through their own businesses, freelancing, or contracting work. 2. Affidavit for Unemployed or Underemployed Individuals: This version of the affidavit might be used by individuals who are currently unemployed or underemployed and require special considerations in determining child support obligations. 3. Affidavit for Various Income Sources: This version of the affidavit might be designed to accommodate individuals with complex income structures, such as those receiving income from multiple sources, investments, government benefits, or other unique financial arrangements. 4. Affidavit for High-Income Individuals: This type of affidavit might be utilized in cases where the income of one or both parents exceeds a certain threshold, requiring more detailed financial disclosures and specialized calculations to determine child support obligations accurately. Overall, the Salt Lake Utah Affidavit of Income Verification and Compliance with Child Support Guidelines plays a crucial role in ensuring fairness and transparency in child support cases. By providing accurate income information, individuals can contribute to the well-being and financial stability of their children.