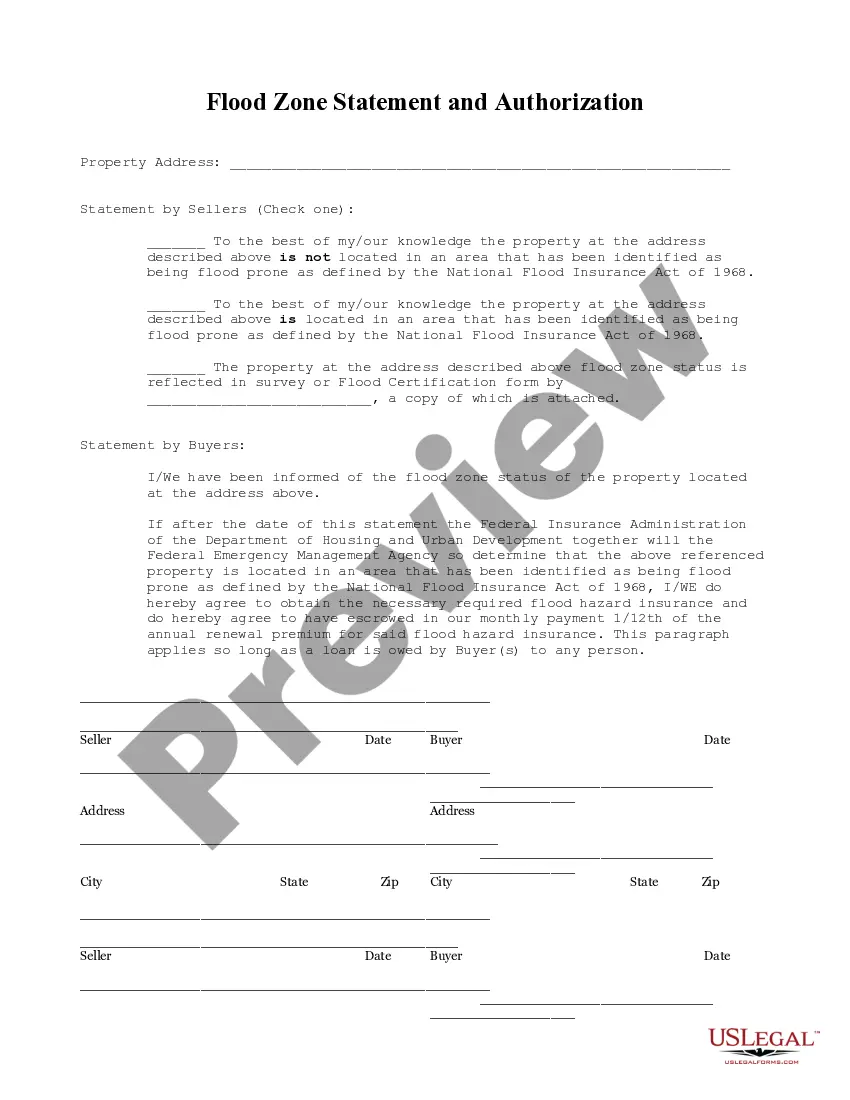

This Flood Zone Statement and Authorization form is for seller(s) to sign, stating the flood zone status of the property and for the buyers to acknowledge the same and state that should the property ever be determined to be in a flood zone, that they will obtain flood insurance.

Salt Lake City, Utah is prone to occasional flooding due to its geographical location and weather patterns. In order to mitigate risks and protect properties, the Salt Lake Utah Flood Zone Statement and Authorization plays a crucial role. This detailed description will provide insight into what this statement entails and how it helps address flood-related concerns. The Salt Lake Utah Flood Zone Statement and Authorization is a legal document used by residents, property owners, and insurers to obtain information about an area's flood risk and authorize certain actions related to flood protection. The document serves to identify properties located within designated flood zones, as well as outline specific guidelines and measures to minimize potential damages. One of the primary purposes of this statement is to determine whether a property is located within a high-risk flood zone, moderate-risk flood zone, or low-risk flood zone. This classification is based on the Flood Insurance Rate Map (FIRM) provided by the Federal Emergency Management Agency (FEMA). By identifying the flood zone, property owners can assess their specific level of flood risk and make informed decisions regarding insurance coverage and property development. Moreover, the Salt Lake Utah Flood Zone Statement and Authorization outlines the steps required to secure flood insurance for properties located in flood-prone areas. It highlights the necessity for property owners to comply with FEMA's guidelines and regulations when obtaining flood insurance policies. This ensures that property owners receive adequate coverage and are prepared financially in the event of a flood-related incident. The document may also contain authorization clauses which grant permission for specific activities within designated flood zones. For instance, property owners seeking to construct or renovate buildings located within these zones may need to obtain authorization from local authorities before proceeding. This helps ensure that construction activities do not exacerbate flood risks or impede natural drainage patterns. In Salt Lake City, there might be different types of Salt Lake Utah Flood Zone Statement and Authorization documents depending on the specific flood zones and their corresponding risks. These documents could include Flood Zone A statement and authorization, Flood Zone B statement and authorization, Flood Zone C statement and authorization, and so on. The precise classification and naming may vary based on local regulations and FEMA's floodplain management guidelines. In conclusion, the Salt Lake Utah Flood Zone Statement and Authorization is a key document used to assess flood risks, secure appropriate insurance coverage, and authorize activities within designated flood zones. By diligently following the guidelines outlined in this statement, residents and property owners in Salt Lake City can mitigate flood-related risks and protect their investments.Salt Lake City, Utah is prone to occasional flooding due to its geographical location and weather patterns. In order to mitigate risks and protect properties, the Salt Lake Utah Flood Zone Statement and Authorization plays a crucial role. This detailed description will provide insight into what this statement entails and how it helps address flood-related concerns. The Salt Lake Utah Flood Zone Statement and Authorization is a legal document used by residents, property owners, and insurers to obtain information about an area's flood risk and authorize certain actions related to flood protection. The document serves to identify properties located within designated flood zones, as well as outline specific guidelines and measures to minimize potential damages. One of the primary purposes of this statement is to determine whether a property is located within a high-risk flood zone, moderate-risk flood zone, or low-risk flood zone. This classification is based on the Flood Insurance Rate Map (FIRM) provided by the Federal Emergency Management Agency (FEMA). By identifying the flood zone, property owners can assess their specific level of flood risk and make informed decisions regarding insurance coverage and property development. Moreover, the Salt Lake Utah Flood Zone Statement and Authorization outlines the steps required to secure flood insurance for properties located in flood-prone areas. It highlights the necessity for property owners to comply with FEMA's guidelines and regulations when obtaining flood insurance policies. This ensures that property owners receive adequate coverage and are prepared financially in the event of a flood-related incident. The document may also contain authorization clauses which grant permission for specific activities within designated flood zones. For instance, property owners seeking to construct or renovate buildings located within these zones may need to obtain authorization from local authorities before proceeding. This helps ensure that construction activities do not exacerbate flood risks or impede natural drainage patterns. In Salt Lake City, there might be different types of Salt Lake Utah Flood Zone Statement and Authorization documents depending on the specific flood zones and their corresponding risks. These documents could include Flood Zone A statement and authorization, Flood Zone B statement and authorization, Flood Zone C statement and authorization, and so on. The precise classification and naming may vary based on local regulations and FEMA's floodplain management guidelines. In conclusion, the Salt Lake Utah Flood Zone Statement and Authorization is a key document used to assess flood risks, secure appropriate insurance coverage, and authorize activities within designated flood zones. By diligently following the guidelines outlined in this statement, residents and property owners in Salt Lake City can mitigate flood-related risks and protect their investments.