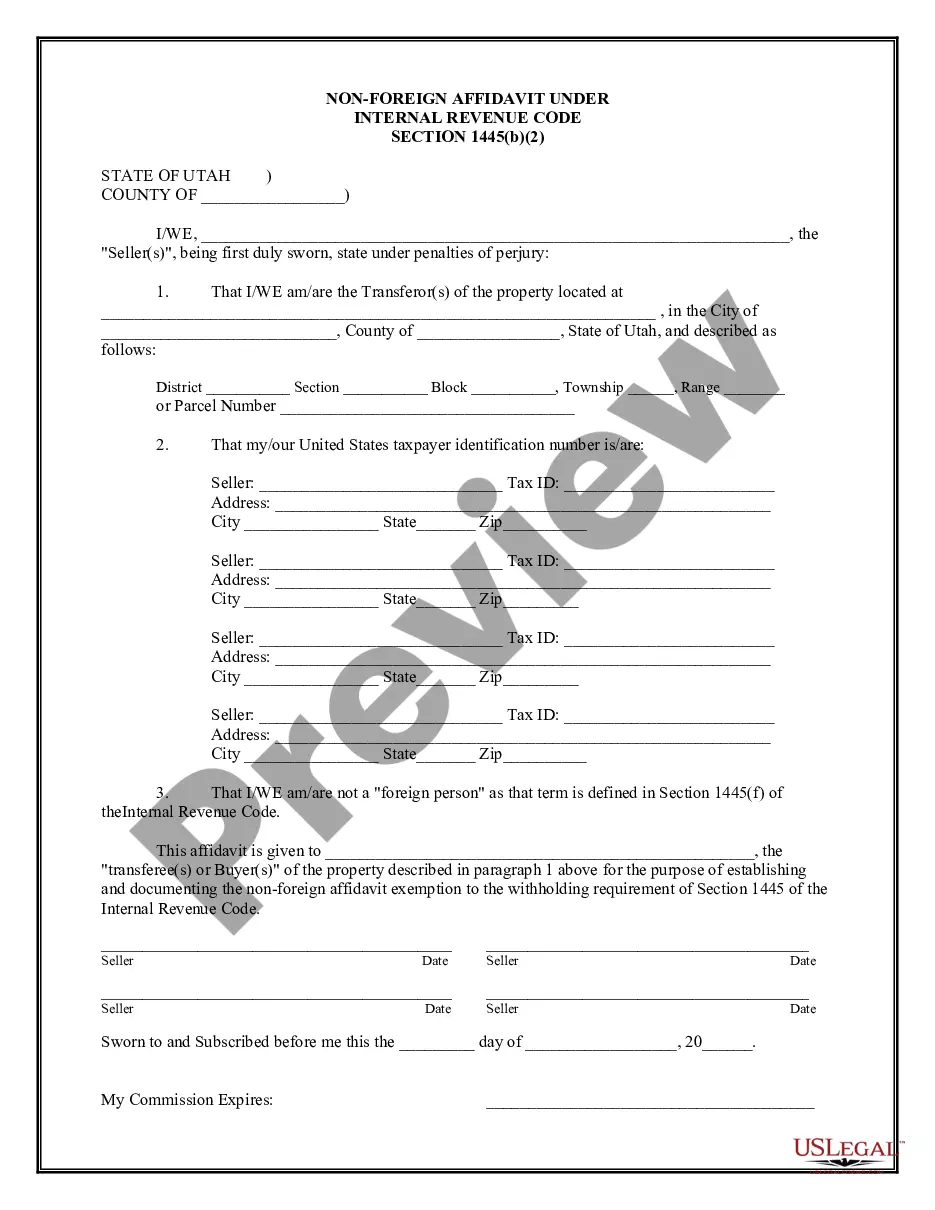

This Non-Foreign Affdavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

Salt Lake Utah Non-Foreign Affidavit Under IRC 1445: A Comprehensive Guide If you are a non-foreign individual or entity considering investment or property transactions within the jurisdiction of Salt Lake, Utah, it is crucial to understand the implications of the Salt Lake Utah Non-Foreign Affidavit Under IRC 1445. This detailed description aims to provide you with key insights into this affidavit, explaining its purpose, requirements, and potential variations. What is the Salt Lake Utah Non-Foreign Affidavit Under IRC 1445? The Salt Lake Utah Non-Foreign Affidavit Under IRC 1445 is a legal document required in certain real estate transactions involving non-U.S. persons within Salt Lake County, Utah. It is mandated by the Internal Revenue Code (IRC) section 1445, which addresses withholding taxes on dispositions of U.S. real property interests (US RPI) by foreign individuals or entities. Purpose and Importance: The primary purpose of the Salt Lake Utah Non-Foreign Affidavit is to establish the seller's non-foreign status, ensuring compliance with federal tax obligations imposed on dispositions of US RPI. By providing this affidavit, the seller affirms their eligibility for reduced or exempt withholding tax rates, thus facilitating a smoother property transfer process. Requirements: To fulfill the requirements of the Salt Lake Utah Non-Foreign Affidavit Under IRC 1445, the seller must provide accurate and truthful information to the concerned parties involved in the transaction. The affidavit typically includes the following details: 1. Identity Verification: The seller must provide their full legal name, address, date of birth, and taxpayer identification number (TIN). 2. Non-Foreign Status: The affidavit should explicitly declare the seller's non-foreign status, affirming that they are not a foreign individual, partnership, corporation, trust, or estate subject to foreign withholding tax. 3. Certifications and Declarations: This section may include affirmations regarding the accuracy of provided information, confirmation of no changes in non-foreign status since the purchase date, and agreement to cooperate with the IRS in case of audit or investigation. 4. Signature and Notarization: The affidavit must be signed by the seller in the presence of a notary public or other authorized individual certifying its validity. Types of Salt Lake Utah Non-Foreign Affidavit Under IRC 1445: While the fundamental purpose remains the same, there might be slight variations of the Salt Lake Utah Non-Foreign Affidavit Under IRC 1445 based on the specific transaction or circumstances. Some notable types include: 1. Individual Seller Affidavit: Used when a non-foreign individual sells a US RPI in Salt Lake, Utah. 2. Corporate Seller Affidavit: Relevant for non-foreign corporations selling US RPI within Salt Lake County. 3. Trust or Estate Seller Affidavit: Applicable when a non-foreign trust or estate is involved in the sale of a US RPI property in Salt Lake, Utah. 4. Partnership Seller Affidavit: Used when a non-foreign partnership is a party to a US RPI sale in Salt Lake County. It is vital to consult with legal experts or tax professionals familiar with Salt Lake Utah Non-Foreign Affidavit requirements to ensure compliance and avoid potential penalties or delays. Proper completion and submission of the required affidavit contribute to a successful and hassle-free real estate transaction for all parties involved in Salt Lake County, Utah.