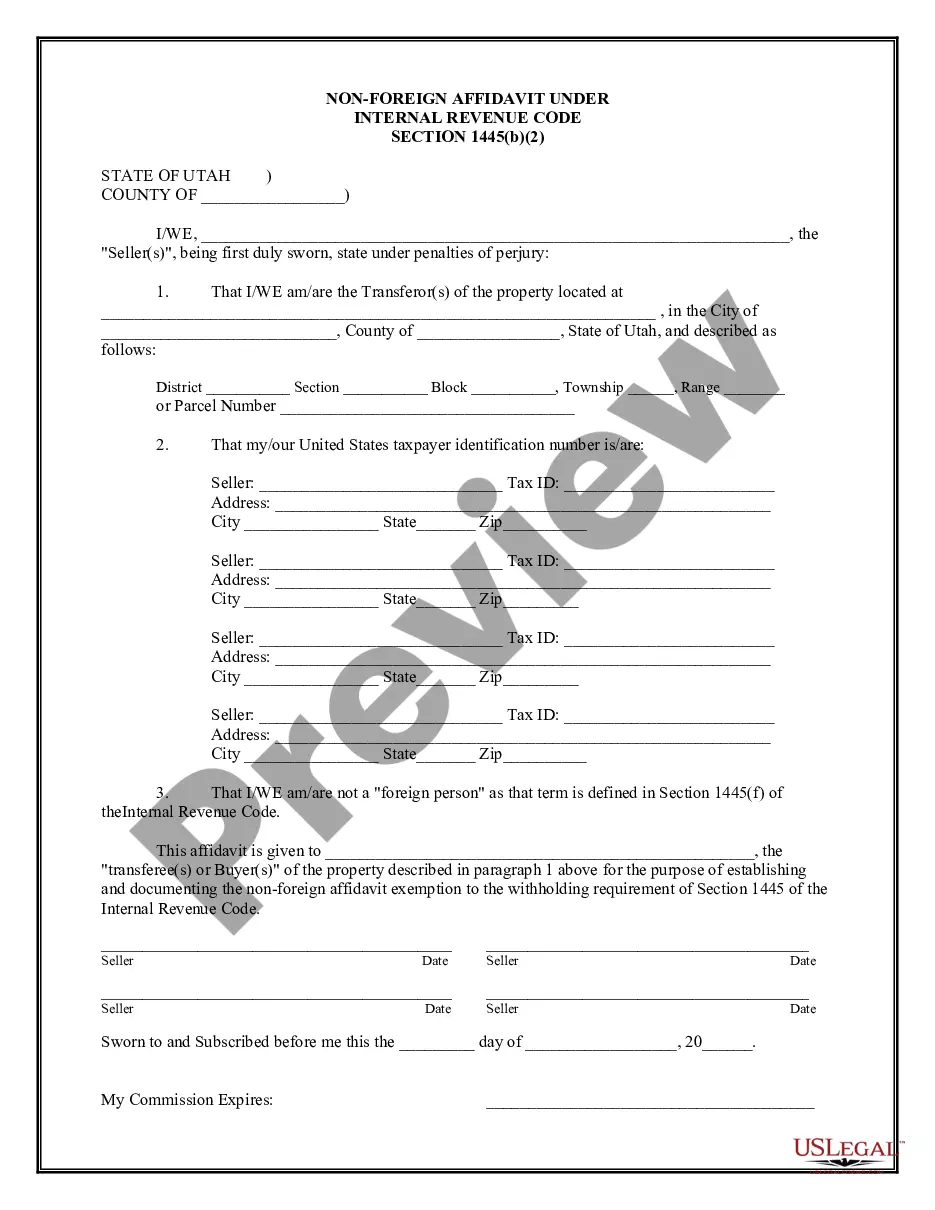

This Non-Foreign Affdavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

Salt Lake City Utah Non-Foreign Affidavit Under IRC 1445 is a legal document that is required in certain real estate transactions involving non-U.S. citizens or non-resident aliens. This affidavit ensures compliance with the Internal Revenue Code (IRC) section 1445, which pertains to the withholding of tax on dispositions of U.S. real property interests by foreign persons. In Salt Lake City, Utah, if a real estate transaction involves a non-U.S. citizen or non-resident alien, the seller or transferor is generally required to provide a Non-Foreign Affidavit Under IRC 1445. This affidavit proves that the transferor is not a foreign person and, therefore, not subject to the withholding tax. The Salt Lake City Utah Non-Foreign Affidavit Under IRC 1445 should contain essential information, including the following relevant keywords: 1. Name and contact information: The affidavit should include the full legal name, current address, email address, and phone number of the transferor. 2. U.S. citizenship or residency status: The affidavit should explicitly state that the transferor is a U.S. citizen or a lawful permanent resident ("green card" holder), exempting them from the IRC 1445 requirements. 3. Taxpayer Identification Number (TIN): The affidavit should provide the transferor's TIN, typically their Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). 4. Property details: Include the specific details of the property being transferred, including its address, legal description, and other identifying information. 5. Statement of non-foreign status: The transferor must unequivocally declare, under penalty of perjury, that they are not a foreign person as defined by the IRC. Different types of Salt Lake City Utah Non-Foreign Affidavit Under IRC 1445: 1. Individual Non-Foreign Affidavit: This is the most common type where an individual seller or transferor provides the required affidavit to show their non-foreign status. 2. Corporate Non-Foreign Affidavit: In cases where the transferor is a corporation or a business entity, a Corporate Non-Foreign Affidavit is required, providing the necessary documentation and information about the entity. 3. Partnership or Trust Non-Foreign Affidavit: If the transferor is a partnership or trust entity, a specific Partnership or Trust Non-Foreign Affidavit should be provided, indicating the non-foreign status of the entity and its partners or beneficiaries. It is crucial to accurately complete and submit the Salt Lake City Utah Non-Foreign Affidavit Under IRC 1445 to comply with the legal requirements and avoid any potential withholding tax obligations. Consulting with a qualified legal professional or tax advisor is recommended to ensure full compliance with relevant laws and regulations.Salt Lake City Utah Non-Foreign Affidavit Under IRC 1445 is a legal document that is required in certain real estate transactions involving non-U.S. citizens or non-resident aliens. This affidavit ensures compliance with the Internal Revenue Code (IRC) section 1445, which pertains to the withholding of tax on dispositions of U.S. real property interests by foreign persons. In Salt Lake City, Utah, if a real estate transaction involves a non-U.S. citizen or non-resident alien, the seller or transferor is generally required to provide a Non-Foreign Affidavit Under IRC 1445. This affidavit proves that the transferor is not a foreign person and, therefore, not subject to the withholding tax. The Salt Lake City Utah Non-Foreign Affidavit Under IRC 1445 should contain essential information, including the following relevant keywords: 1. Name and contact information: The affidavit should include the full legal name, current address, email address, and phone number of the transferor. 2. U.S. citizenship or residency status: The affidavit should explicitly state that the transferor is a U.S. citizen or a lawful permanent resident ("green card" holder), exempting them from the IRC 1445 requirements. 3. Taxpayer Identification Number (TIN): The affidavit should provide the transferor's TIN, typically their Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). 4. Property details: Include the specific details of the property being transferred, including its address, legal description, and other identifying information. 5. Statement of non-foreign status: The transferor must unequivocally declare, under penalty of perjury, that they are not a foreign person as defined by the IRC. Different types of Salt Lake City Utah Non-Foreign Affidavit Under IRC 1445: 1. Individual Non-Foreign Affidavit: This is the most common type where an individual seller or transferor provides the required affidavit to show their non-foreign status. 2. Corporate Non-Foreign Affidavit: In cases where the transferor is a corporation or a business entity, a Corporate Non-Foreign Affidavit is required, providing the necessary documentation and information about the entity. 3. Partnership or Trust Non-Foreign Affidavit: If the transferor is a partnership or trust entity, a specific Partnership or Trust Non-Foreign Affidavit should be provided, indicating the non-foreign status of the entity and its partners or beneficiaries. It is crucial to accurately complete and submit the Salt Lake City Utah Non-Foreign Affidavit Under IRC 1445 to comply with the legal requirements and avoid any potential withholding tax obligations. Consulting with a qualified legal professional or tax advisor is recommended to ensure full compliance with relevant laws and regulations.