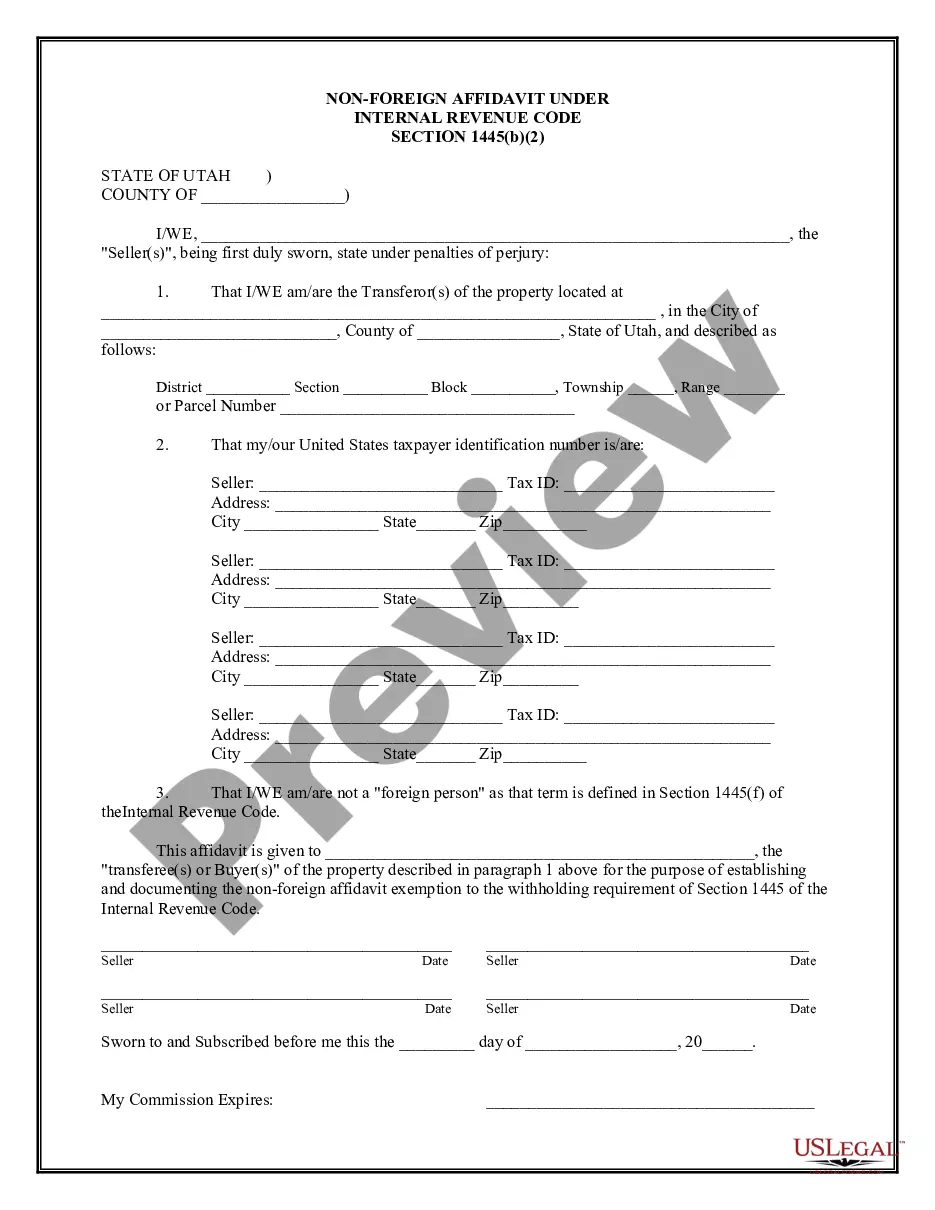

This Non-Foreign Affdavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

Title: Understanding West Jordan Utah Non-Foreign Affidavit Under IRC 1445: Types and Detailed Description Introduction: The West Jordan Utah Non-Foreign Affidavit Under IRC 1445 is a crucial legal document that pertains to the taxation of non-U.S. citizens or foreign investors who sell real property within the United States. This detailed description aims to provide a comprehensive understanding of this affidavit, its purpose, and different types, using relevant keywords to assist readers seeking specific information on the topic. 1. Purpose of West Jordan Utah Non-Foreign Affidavit Under IRC 1445: The West Jordan Utah Non-Foreign Affidavit Under IRC 1445 is required by the Internal Revenue Code (IRC) section 1445 to help ensure the proper withholding of taxes on the sale or disposition of U.S. real property interests by non-U.S. citizens or foreign investors. It serves as a declaration that the seller is not a "foreign person" as defined by the IRC. 2. Definition of "Foreign Person": A "foreign person" refers to an individual who is not a U.S. citizen, a non-resident alien, or a foreign corporation, partnership, estate, or trust. Such foreign persons are subject to certain withholding tax obligations to ensure tax compliance. 3. Types of West Jordan Utah Non-Foreign Affidavit Under IRC 1445: a. Single Purchase Affidavit: This affidavit is used when an individual non-U.S. citizen or foreign investor sells a single U.S. real property interest requiring withholding under IRC 1445. b. Multiple Purchase Affidavit: This affidavit is utilized when an entity, such as a foreign corporation or partnership, sells multiple U.S. real property interests necessitating withholding under IRC 1445. c. Exchange Affidavit (1031 Exchange): This affidavit is applied during a 1031 exchange, where a non-U.S. citizen or foreign investor sells a U.S. property and intends to reinvest the proceeds in another U.S. property within a specified timeframe, deferring capital gains tax. The affidavit verifies that the seller satisfies the non-foreign status requirement. 4. Contents and Execution of West Jordan Utah Non-Foreign Affidavit Under IRC 1445: The affidavit typically comprises several key elements: — Seller's identification information: name, address, tax identification number, and citizenship details. — Property details: address, legal description, sale/purchase contract, and closing date. — Certification statements: explicit declaration of non-foreign status, disclosure of any exceptions or disqualifications. — Signature and notarization: the affidavit must be signed by the seller, acknowledging the penalties for providing false statements, and notarized for authentication. Conclusion: The West Jordan Utah Non-Foreign Affidavit Under IRC 1445 is a vital document required in real estate transactions involving non-U.S. citizens or foreign investors. This comprehensive description has shed light on its purpose, various types, and key elements, using relevant keywords to aid readers in obtaining specific information on this topic. It is essential for sellers and individuals involved in such transactions to understand and comply with the IRS regulations to ensure smooth property transfers and tax compliance.Title: Understanding West Jordan Utah Non-Foreign Affidavit Under IRC 1445: Types and Detailed Description Introduction: The West Jordan Utah Non-Foreign Affidavit Under IRC 1445 is a crucial legal document that pertains to the taxation of non-U.S. citizens or foreign investors who sell real property within the United States. This detailed description aims to provide a comprehensive understanding of this affidavit, its purpose, and different types, using relevant keywords to assist readers seeking specific information on the topic. 1. Purpose of West Jordan Utah Non-Foreign Affidavit Under IRC 1445: The West Jordan Utah Non-Foreign Affidavit Under IRC 1445 is required by the Internal Revenue Code (IRC) section 1445 to help ensure the proper withholding of taxes on the sale or disposition of U.S. real property interests by non-U.S. citizens or foreign investors. It serves as a declaration that the seller is not a "foreign person" as defined by the IRC. 2. Definition of "Foreign Person": A "foreign person" refers to an individual who is not a U.S. citizen, a non-resident alien, or a foreign corporation, partnership, estate, or trust. Such foreign persons are subject to certain withholding tax obligations to ensure tax compliance. 3. Types of West Jordan Utah Non-Foreign Affidavit Under IRC 1445: a. Single Purchase Affidavit: This affidavit is used when an individual non-U.S. citizen or foreign investor sells a single U.S. real property interest requiring withholding under IRC 1445. b. Multiple Purchase Affidavit: This affidavit is utilized when an entity, such as a foreign corporation or partnership, sells multiple U.S. real property interests necessitating withholding under IRC 1445. c. Exchange Affidavit (1031 Exchange): This affidavit is applied during a 1031 exchange, where a non-U.S. citizen or foreign investor sells a U.S. property and intends to reinvest the proceeds in another U.S. property within a specified timeframe, deferring capital gains tax. The affidavit verifies that the seller satisfies the non-foreign status requirement. 4. Contents and Execution of West Jordan Utah Non-Foreign Affidavit Under IRC 1445: The affidavit typically comprises several key elements: — Seller's identification information: name, address, tax identification number, and citizenship details. — Property details: address, legal description, sale/purchase contract, and closing date. — Certification statements: explicit declaration of non-foreign status, disclosure of any exceptions or disqualifications. — Signature and notarization: the affidavit must be signed by the seller, acknowledging the penalties for providing false statements, and notarized for authentication. Conclusion: The West Jordan Utah Non-Foreign Affidavit Under IRC 1445 is a vital document required in real estate transactions involving non-U.S. citizens or foreign investors. This comprehensive description has shed light on its purpose, various types, and key elements, using relevant keywords to aid readers in obtaining specific information on this topic. It is essential for sellers and individuals involved in such transactions to understand and comply with the IRS regulations to ensure smooth property transfers and tax compliance.