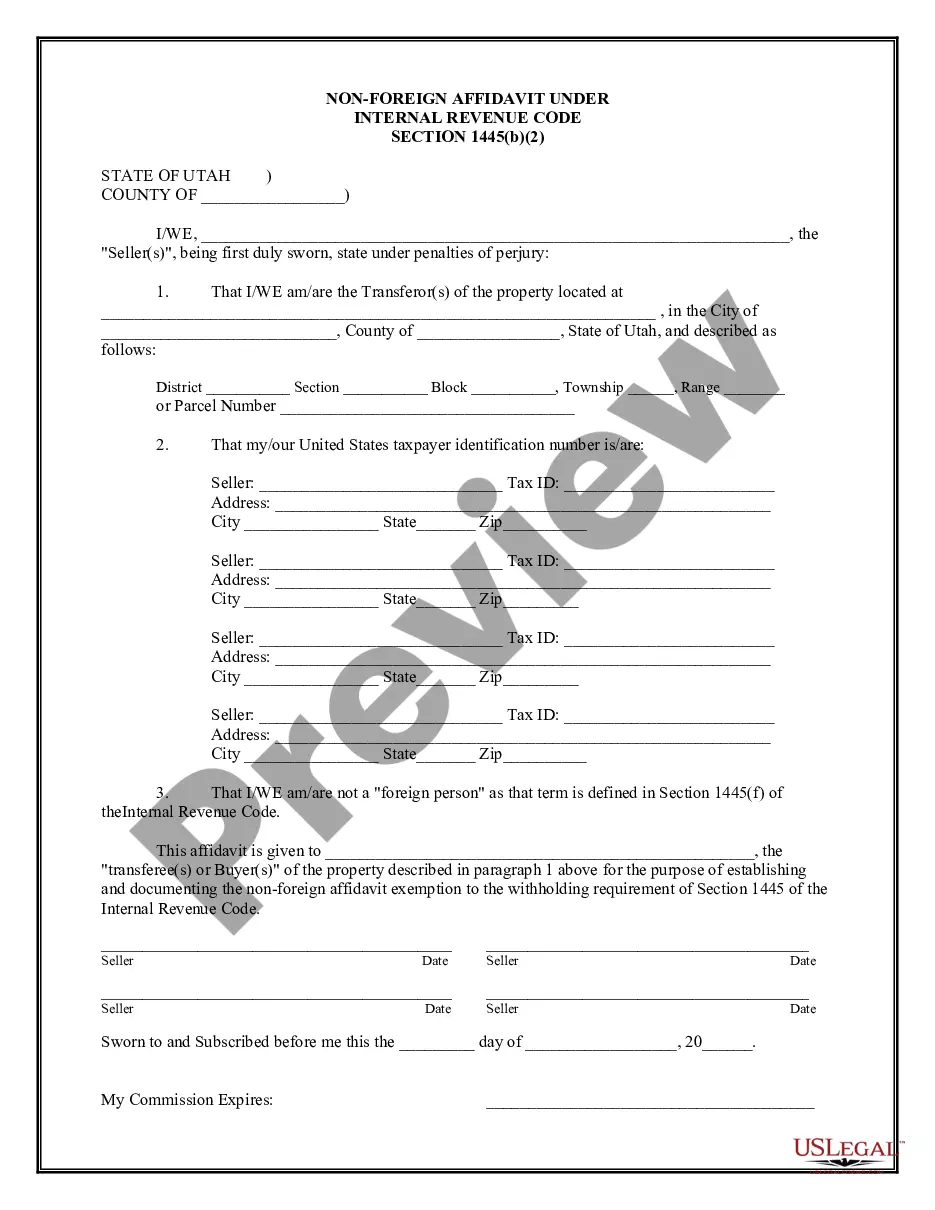

This Non-Foreign Affdavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

West Valley City Utah Non-Foreign Affidavit Under IRC 1445: A Comprehensive Guide In West Valley City, Utah, when selling or transferring real property by a non-U.S. person, it is crucial to be aware of the Non-Foreign Affidavit requirements under Internal Revenue Code (IRC) section 1445. This article aims to provide a detailed description of what this affidavit entails, its significance, and the different types that may exist. What is a West Valley City Utah Non-Foreign Affidavit Under IRC 1445? A Non-Foreign Affidavit Under IRC 1445 is a legal document executed by a non-U.S. person involved in the sale or transfer of real property located in West Valley City, Utah. The affidavit is submitted to the buyer or the buyer's agent to affirm the non-foreign status of the seller, thereby addressing federal tax withholding obligations. Significance of West Valley City Utah Non-Foreign Affidavit Under IRC 1445: The Non-Foreign Affidavit serves as proof that the seller is not a foreign person for U.S. tax purposes. By completing this affidavit, the seller certifies their status and declares their exemption from federal tax withholding requirements before the property transaction is completed. This affidavit helps ensure compliance with the provisions of IRC section 1445 and prevents unnecessary tax withholding. Types of West Valley City Utah Non-Foreign Affidavit Under IRC 1445: While there are no specific types of Non-Foreign Affidavit defined by the IRS, variations may exist based on individual circumstances or specific requirements demanded by buyer's agents, title companies, or lenders involved. It is advisable to consult with a qualified attorney or real estate professional to obtain the appropriate form or document relevant to each unique transaction. Key Elements of a West Valley City Utah Non-Foreign Affidavit Under IRC 1445: 1. Identification of the property: The affidavit should clearly identify the real property subject to the transaction, including its address, legal description, and any other relevant details provided by the parties involved. 2. Seller's information: The affidavit includes the seller's full legal name, mailing address, contact information, social security number or Individual Taxpayer Identification Number (ITIN), and their citizenship status. 3. Certification and declaration: The affidavit provides space for the seller to certify their non-foreign status, affirming that they are not a foreign person under U.S. tax law. Additionally, the seller may declare their residency status if applicable. 4. Buyer's acknowledgment: The document usually includes a section allowing the buyer or buyer's agent to acknowledge receipt of the Non-Foreign Affidavit and confirm their understanding of the seller's status. 5. Signatures and notarization: The affidavit requires the seller's signature, which should be notarized for validity. The notary public attests to the authenticity of the signature and the acknowledgment of the seller's identity. Conclusion: In West Valley City, Utah, the Non-Foreign Affidavit Under IRC 1445 is a vital document in real property transactions involving non-U.S. sellers. It ensures compliance with federal tax withholding requirements and exempts qualifying sellers from unnecessary tax withholding. While there may be no predefined types of this affidavit, it's essential to obtain the correct form or document tailored to the specific requirements of each transaction. Working with a qualified attorney or real estate professional is highly recommended navigating the intricacies of this process effectively.West Valley City Utah Non-Foreign Affidavit Under IRC 1445: A Comprehensive Guide In West Valley City, Utah, when selling or transferring real property by a non-U.S. person, it is crucial to be aware of the Non-Foreign Affidavit requirements under Internal Revenue Code (IRC) section 1445. This article aims to provide a detailed description of what this affidavit entails, its significance, and the different types that may exist. What is a West Valley City Utah Non-Foreign Affidavit Under IRC 1445? A Non-Foreign Affidavit Under IRC 1445 is a legal document executed by a non-U.S. person involved in the sale or transfer of real property located in West Valley City, Utah. The affidavit is submitted to the buyer or the buyer's agent to affirm the non-foreign status of the seller, thereby addressing federal tax withholding obligations. Significance of West Valley City Utah Non-Foreign Affidavit Under IRC 1445: The Non-Foreign Affidavit serves as proof that the seller is not a foreign person for U.S. tax purposes. By completing this affidavit, the seller certifies their status and declares their exemption from federal tax withholding requirements before the property transaction is completed. This affidavit helps ensure compliance with the provisions of IRC section 1445 and prevents unnecessary tax withholding. Types of West Valley City Utah Non-Foreign Affidavit Under IRC 1445: While there are no specific types of Non-Foreign Affidavit defined by the IRS, variations may exist based on individual circumstances or specific requirements demanded by buyer's agents, title companies, or lenders involved. It is advisable to consult with a qualified attorney or real estate professional to obtain the appropriate form or document relevant to each unique transaction. Key Elements of a West Valley City Utah Non-Foreign Affidavit Under IRC 1445: 1. Identification of the property: The affidavit should clearly identify the real property subject to the transaction, including its address, legal description, and any other relevant details provided by the parties involved. 2. Seller's information: The affidavit includes the seller's full legal name, mailing address, contact information, social security number or Individual Taxpayer Identification Number (ITIN), and their citizenship status. 3. Certification and declaration: The affidavit provides space for the seller to certify their non-foreign status, affirming that they are not a foreign person under U.S. tax law. Additionally, the seller may declare their residency status if applicable. 4. Buyer's acknowledgment: The document usually includes a section allowing the buyer or buyer's agent to acknowledge receipt of the Non-Foreign Affidavit and confirm their understanding of the seller's status. 5. Signatures and notarization: The affidavit requires the seller's signature, which should be notarized for validity. The notary public attests to the authenticity of the signature and the acknowledgment of the seller's identity. Conclusion: In West Valley City, Utah, the Non-Foreign Affidavit Under IRC 1445 is a vital document in real property transactions involving non-U.S. sellers. It ensures compliance with federal tax withholding requirements and exempts qualifying sellers from unnecessary tax withholding. While there may be no predefined types of this affidavit, it's essential to obtain the correct form or document tailored to the specific requirements of each transaction. Working with a qualified attorney or real estate professional is highly recommended navigating the intricacies of this process effectively.