This Complex Will with Credit Shelter Trust for Large Estates form is a complex Will designed to enable a couple to maximize the amount of property that can pass free of estate taxes. The Will leaves the maximum tax free amount allowed (i.e. 1,000,000.00 as of 2001) to a trust and the remainder of property to the surviving spouse. All of the property passing to the Spouse is estate tax free. Therefore, no estate taxes are due at the death of the first Spouse. Since the trust has 1 million dollars that can pass to the children tax free, the surviving spouse can also leave 1 million to a similar trust or children and thereby enable 2 million dollars instead of 1 to pass to the children estate tax free. Income from the trust can be disbursed to the surviving spouse and children.

Salt Lake Utah Complex Will with Credit Shelter Marital Trust for Large Estates

Description

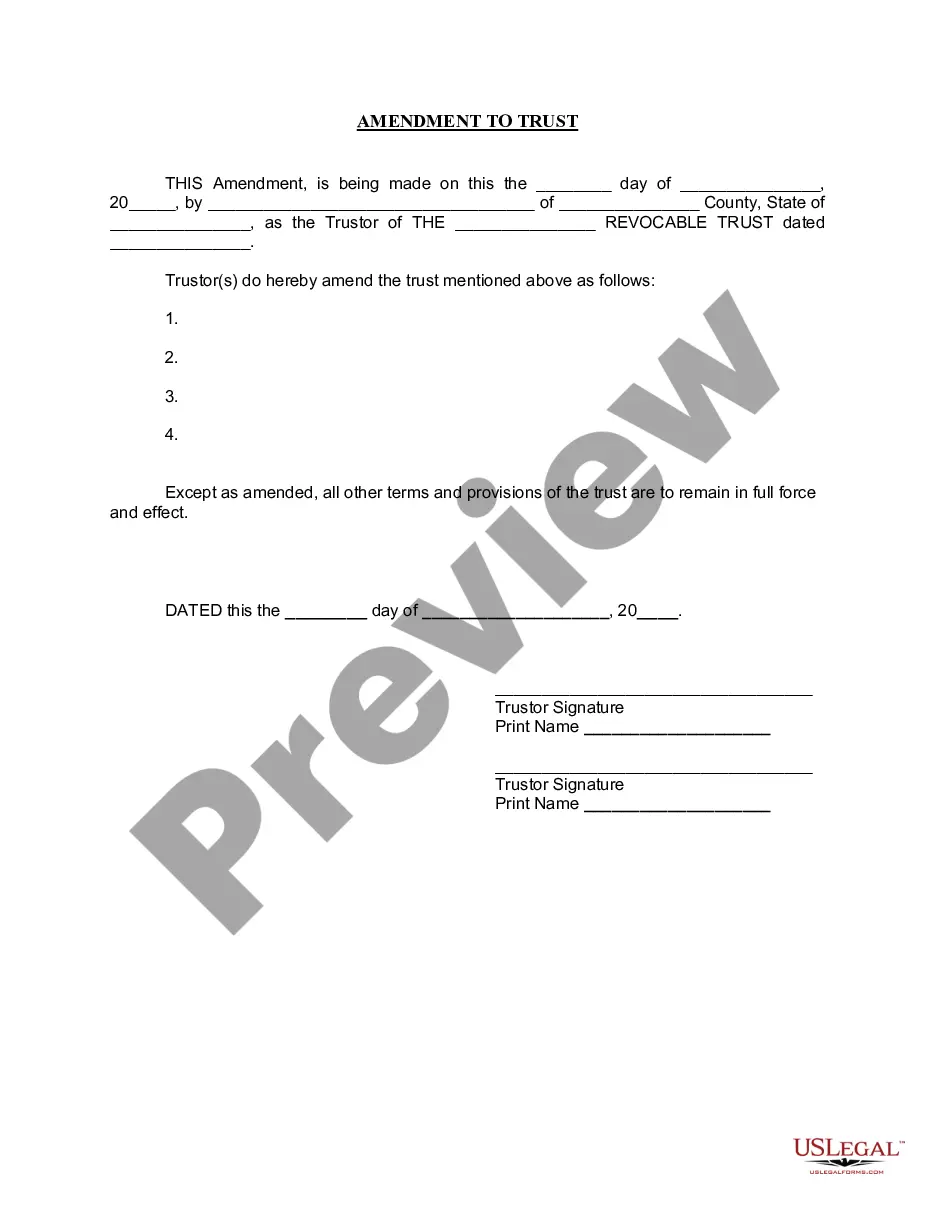

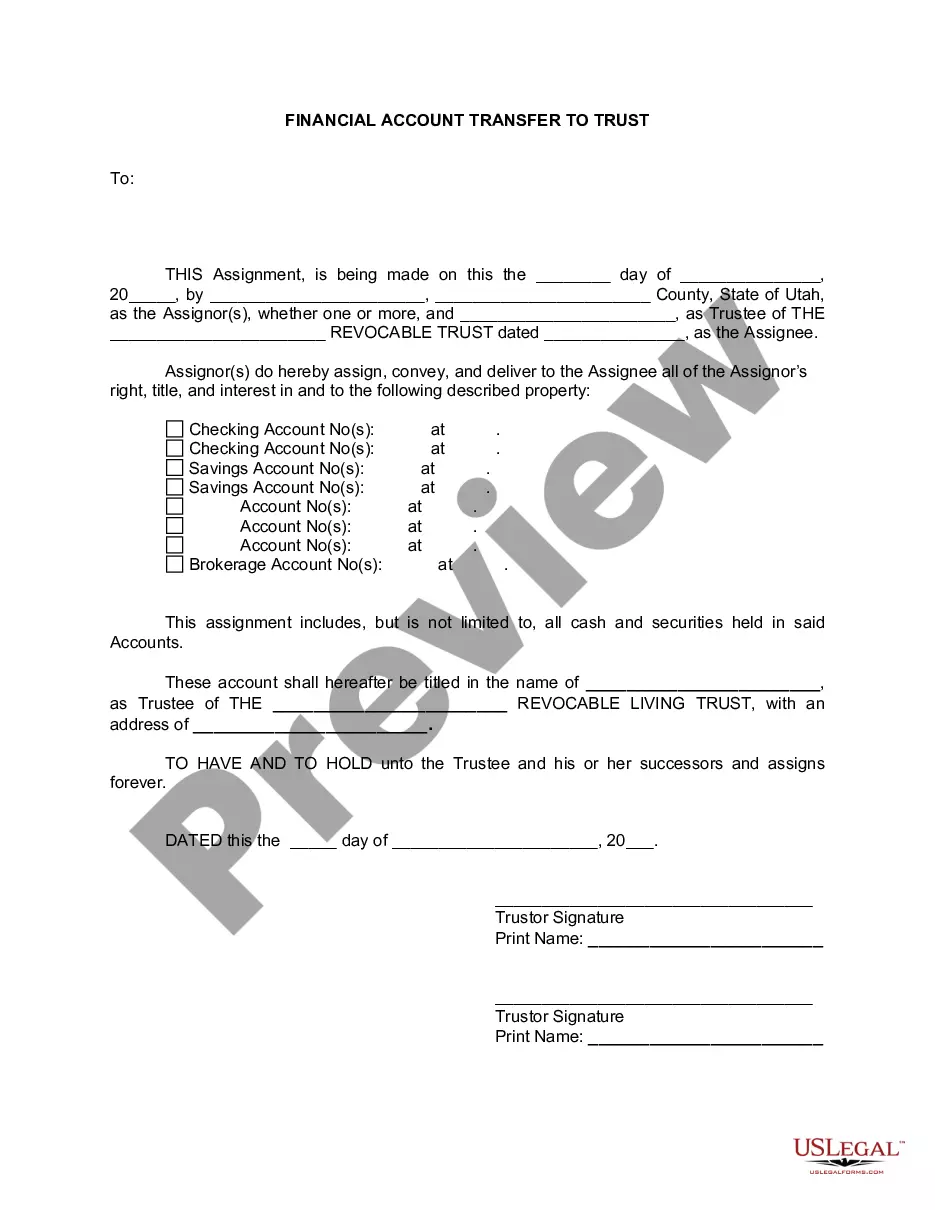

How to fill out Utah Complex Will With Credit Shelter Marital Trust For Large Estates?

If you are looking for an applicable form template, it’s unfeasible to select a superior service than the US Legal Forms site – likely the most comprehensive online collections.

With this collection, you can discover thousands of templates for organizational and personal purposes by categories and states, or keywords.

With our sophisticated search feature, locating the most recent Salt Lake Utah Complex Will with Credit Shelter Marital Trust for Large Estates is as simple as 1-2-3.

Complete the payment. Use your credit card or PayPal account to finalize the registration process.

Obtain the form. Choose the file format and download it to your device.

- Furthermore, the pertinence of each document is validated by a group of proficient lawyers who routinely examine the templates on our platform and update them in line with the latest state and county regulations.

- If you are already familiar with our system and possess an account, all you need to obtain the Salt Lake Utah Complex Will with Credit Shelter Marital Trust for Large Estates is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, simply adhere to the instructions outlined below.

- Ensure you have located the sample you need. Review its description and utilize the Preview option to view its content. If it doesn’t satisfy your needs, use the Search field at the top of the screen to find the required document.

- Confirm your choice. Click the Buy now button. Then, select the desired subscription plan and provide information to register for an account.

Form popularity

FAQ

When one spouse passes away, the trust typically becomes irrevocable and starts to function according to the terms outlined in the trust document. This means that assets placed in the trust will be managed according to the deceased spouse's wishes, protecting those assets from estate taxes. In a Salt Lake Utah Complex Will with Credit Shelter Marital Trust for Large Estates, this arrangement can help ensure that the surviving spouse and future generations are financially secure. It is advisable to consult with estate planning professionals to navigate the specifics of trust administration after death.

After the death of the first spouse, the credit shelter trust becomes irrevocable and begins to operate under its intended terms. The trust's assets are usually distributed to beneficiaries, such as children or other family members, and any income generated is typically taxed to the trust. This structure ensures that the assets remain separate from the surviving spouse's estate, which is a key advantage of using a Salt Lake Utah Complex Will with Credit Shelter Marital Trust for Large Estates. Consulting with professionals can help clarify how these trusts work post-death.

A marital trust, also known as a QTIP trust, provides benefits to a surviving spouse and defers estate taxes until their death. In contrast, a credit shelter trust, often utilized in a Salt Lake Utah Complex Will with Credit Shelter Marital Trust for Large Estates, allows portions of an estate to bypass the estate tax upon the death of the first spouse. This means that the assets allocated to the credit shelter trust are not included in the surviving spouse's estate for tax purposes. Understanding these differences can significantly affect your estate planning strategy.

Typically, the credit shelter trust itself is responsible for paying taxes on any income it generates. If the trust earns income, it will need to file a tax return. However, beneficiaries of the trust may also have some tax responsibilities, depending on how the trust is structured. Understanding these tax implications within a Salt Lake Utah Complex Will with Credit Shelter Marital Trust for Large Estates is essential for proper estate planning.

The best trust for a married couple often depends on their specific financial situation and goals. Many might benefit from a combination of a marital trust and a credit shelter trust, such as through a Salt Lake Utah Complex Will with Credit Shelter Marital Trust for Large Estates. This combination can offer the benefits of tax savings while ensuring that both spouses are financially supported. Engaging with an estate planning professional can help determine the right structure for your needs.

A credit trust primarily focuses on minimizing estate taxes, while a marital trust is designed to provide financial support to a surviving spouse. The credit trust keeps assets sheltered from taxes, ensuring that more wealth can be passed down to heirs. In contrast, a Salt Lake Utah Complex Will with Credit Shelter Marital Trust for Large Estates allows for both types of trusts to be utilized, giving flexibility regarding tax efficiency and spousal support.

When the surviving spouse passes away, the credit shelter trust typically becomes irrevocable. This means that the assets within the trust are distributed according to the terms set forth in the trust document, rather than being combined into the surviving spouse’s estate. It is crucial to have a well-structured Salt Lake Utah Complex Will with Credit Shelter Marital Trust for Large Estates to ensure a smooth transition of assets to the intended beneficiaries. This approach helps avoid potential estate taxes and secures your family’s wealth.

While credit shelter trusts offer many advantages, they also have some disadvantages to consider. These trusts can require more administrative work and may incur additional legal fees. Additionally, they might restrict the surviving spouse's access to assets in certain situations. However, when you create a Salt Lake Utah Complex Will with Credit Shelter Marital Trust for Large Estates, you can address these disadvantages effectively through careful planning.

No, a marital trust and a credit shelter trust are not the same, although they work together in estate planning. A marital trust is designed to benefit the surviving spouse, while a credit shelter trust helps protect assets from estate taxes. By using a Salt Lake Utah Complex Will with Credit Shelter Marital Trust for Large Estates, you can combine the benefits of both trusts. This dual approach can effectively secure your family's financial future.

The maximum amount for a credit shelter trust typically aligns with the federal estate tax exemption limit, which changes over time. Currently, this limit can be several million dollars, depending on individual tax regulations. For residents of Salt Lake, establishing a Salt Lake Utah Complex Will with Credit Shelter Marital Trust for Large Estates can help you navigate this threshold effectively. Make sure to consult an expert to stay updated on the latest regulations that affect your estate.