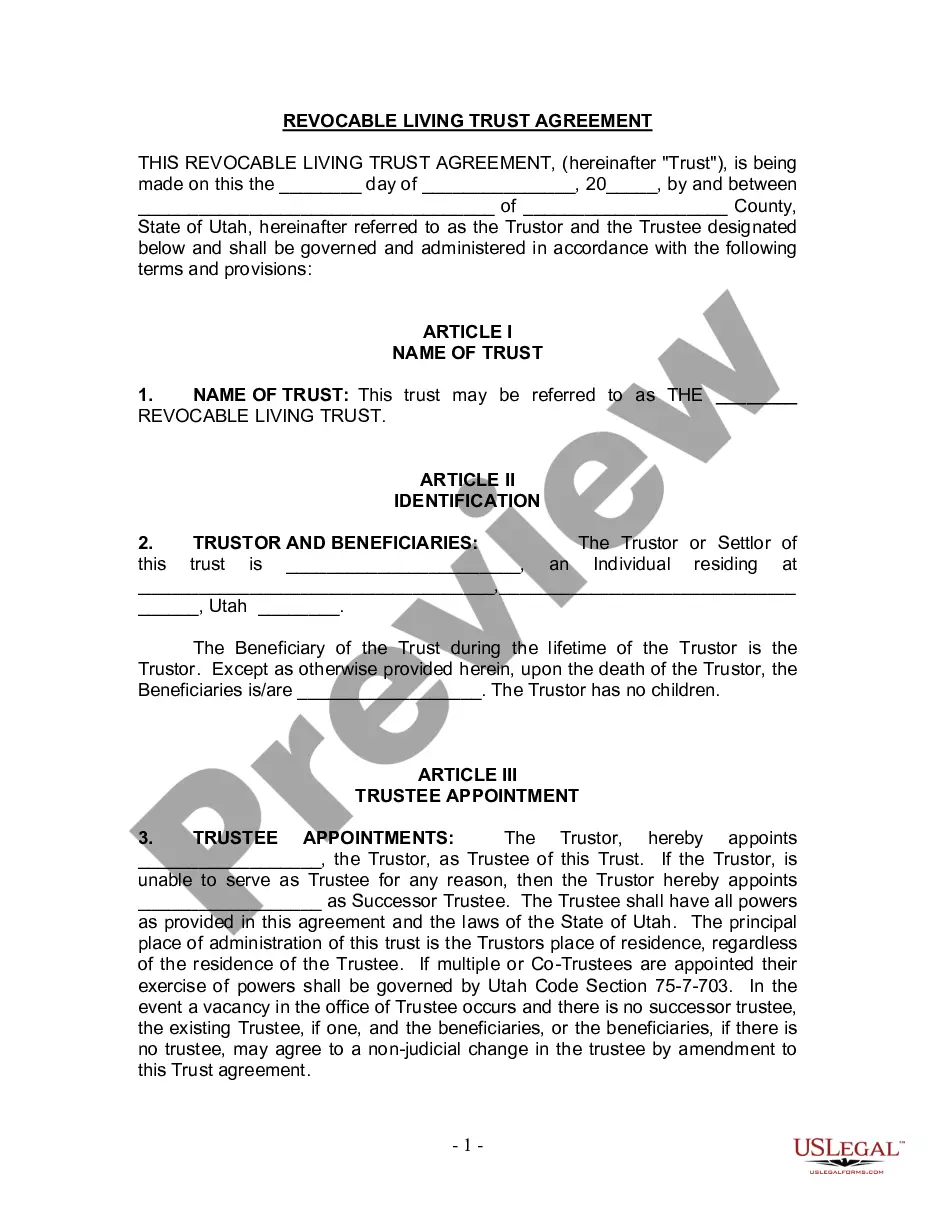

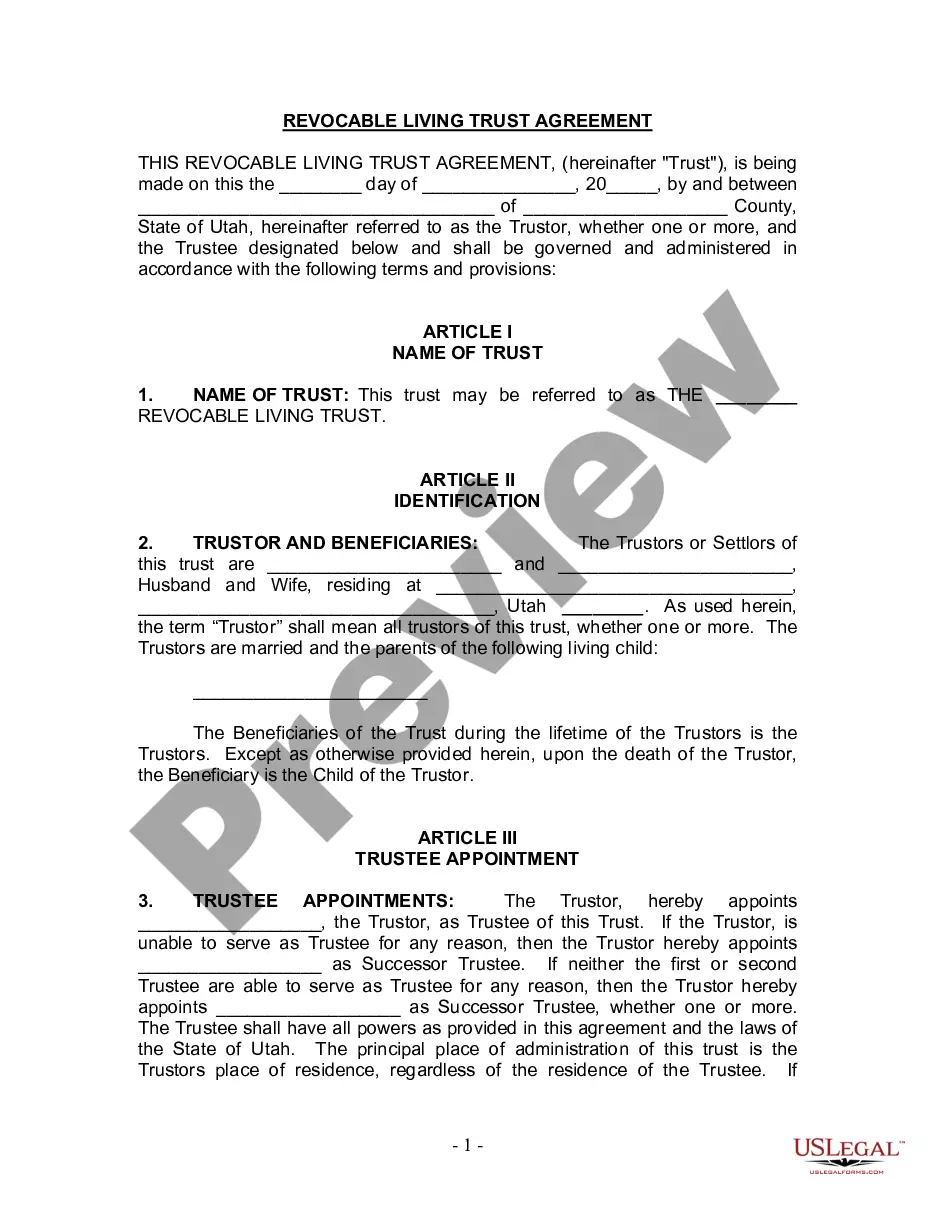

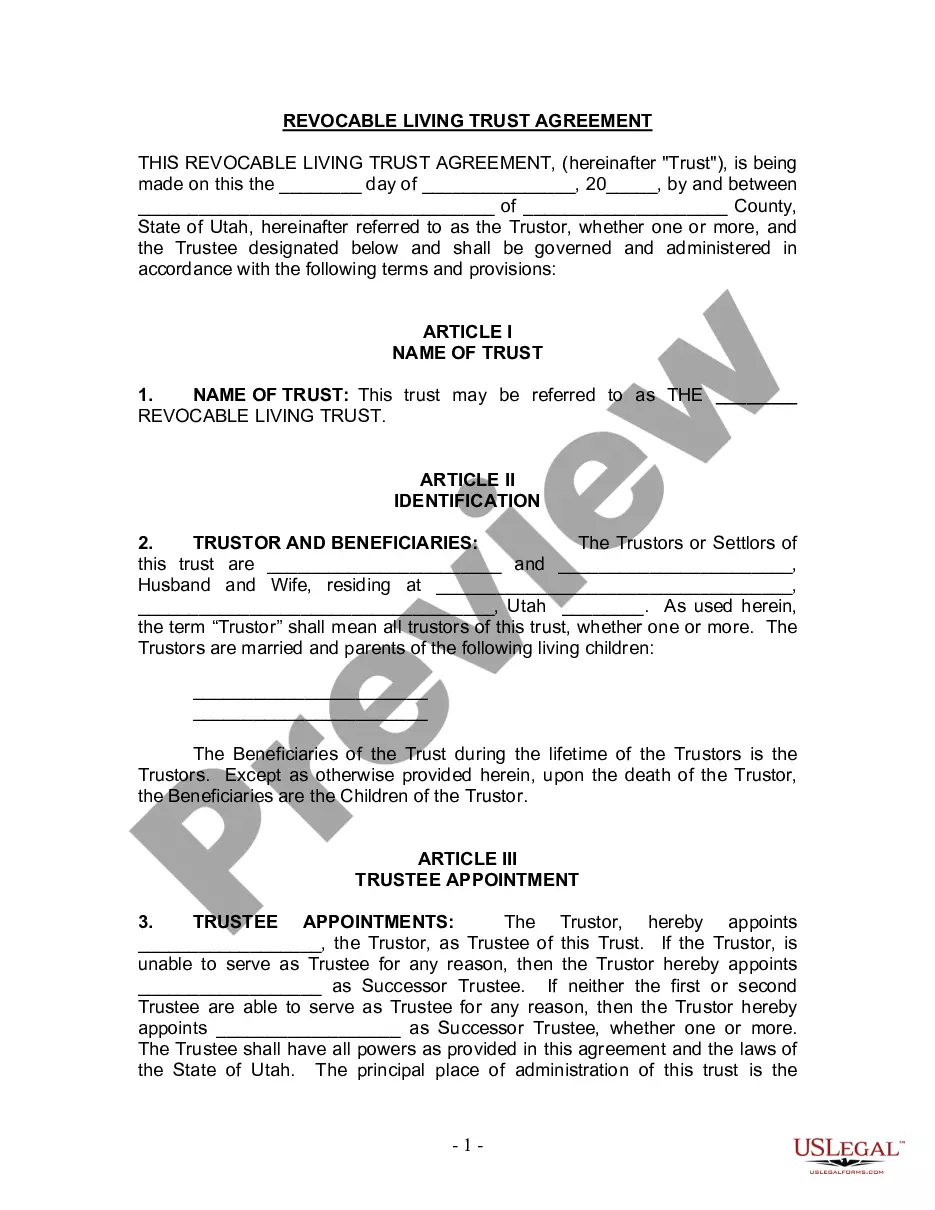

This form is a living trust form prepared for your state. It is for an individual who is either single, divorced or widowed with one or more children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

West Valley City Utah Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children

Description

How to fill out Utah Living Trust For Individual Who Is Single, Divorced Or Widow (or Widower) With Children?

We consistently aim to reduce or avert judicial harm when navigating intricate legal or financial matters.

To achieve this, we enroll in lawyer services that are typically quite costly.

Nonetheless, not every legal matter is similarly intricate.

The majority can be managed by ourselves.

Utilize US Legal Forms whenever you need to obtain and download the West Valley City Utah Living Trust for an Individual who is Single, Divorced or a Widow (or Widower) with Children or any other document swiftly and securely.

- US Legal Forms is an online directory of current DIY legal documents covering everything from wills and powers of attorney to incorporation articles and dissolution petitions.

- Our collection empowers you to take control of your matters without employing an attorney's services.

- We grant access to legal document templates that aren't always accessible to the public.

- Our templates are specific to states and regions, greatly streamlining the search process.

Form popularity

FAQ

To establish a West Valley City Utah Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children, you must meet several key requirements. First, you must be at least 18 years old and of sound mind when creating the trust. Additionally, you need to designate a trustee who will manage the trust assets according to your wishes. Importantly, all documents should be signed and witnessed in compliance with Utah law to ensure valid execution and enforceability.

Yes, you can write your own trust in Utah, but it's important to ensure that it meets all legal requirements. Self-written trusts may lack the necessary language or structure, which can lead to issues down the line. For peace of mind and accuracy, many individuals prefer to use platforms like uslegalforms to create a West Valley City Utah Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children, ensuring compliance with state laws and personal preferences.

When one spouse dies, a living trust can simplify the transfer of assets. The surviving spouse can manage the trust without going through the probate process, which saves time and costs. For individuals using a West Valley City Utah Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children, this feature provides an opportunity to maintain family stability by ensuring children receive their inheritance without delays.

In Utah, trusts must comply with state laws regarding the creation and management of trusts. The basic rules specify that the trust must have a legal purpose, identifiable beneficiaries, and it must be created in writing. For those setting up a West Valley City Utah Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children, understanding these rules ensures proper management of your assets and provides peace of mind.

The minimum amount for a living trust can vary based on what you want to achieve. Generally, there is no strict minimum in Utah for establishing a trust under West Valley City Utah Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children. However, it's wise to consider the assets you have. Creating a trust becomes more beneficial when you have significant assets to protect or manage.

One of the biggest mistakes parents make when setting up a trust fund is not being specific about the distribution of assets to their children. Many assume their children will be able to handle the trust's provisions correctly, which can lead to misunderstandings or misuse of funds. It's essential to clearly outline terms in a West Valley City Utah Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children, ensuring that your intentions are understood and that your children's futures are secure.

When one spouse dies, the living trust typically continues in effect, but its terms may change. The surviving spouse often retains control over the trust's assets, ensuring they are managed according to its purposes. For a West Valley City Utah Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children, this continuity provides security and clarity in handling estate matters, important for the well-being of any children involved.

Yes, a living trust can be changed after one spouse dies, especially in a joint trust setup. The surviving spouse often has the authority to modify the terms or even revoke the trust if it serves their needs better. It's advisable to consult with a professional to ensure these changes align with the overall estate planning strategy, particularly for a West Valley City Utah Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children.

Filling a living trust starts with gathering relevant information about your assets, including property and financial accounts. Next, you must create the trust document, which defines the terms and names the beneficiaries. Utilizing resources from uslegalforms can simplify this process by providing templates specifically designed for a West Valley City Utah Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children.

When one person dies, the assets in a West Valley City Utah Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with Children pass directly to the beneficiaries without going through probate. This process helps streamline the transfer of assets and ensures privacy. Additionally, the trust remains in effect until the final distributions are made, providing continued management of the assets according to the trust's terms.