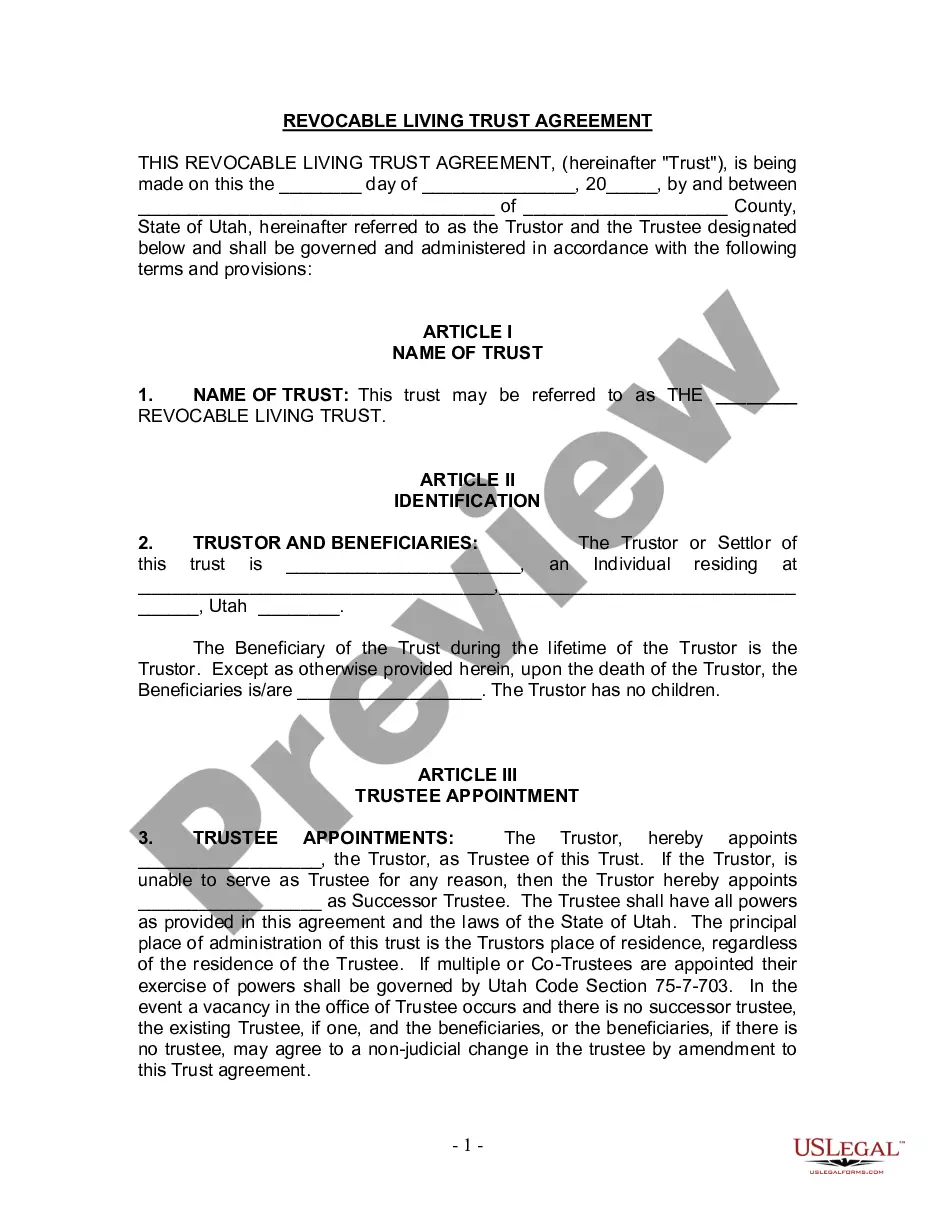

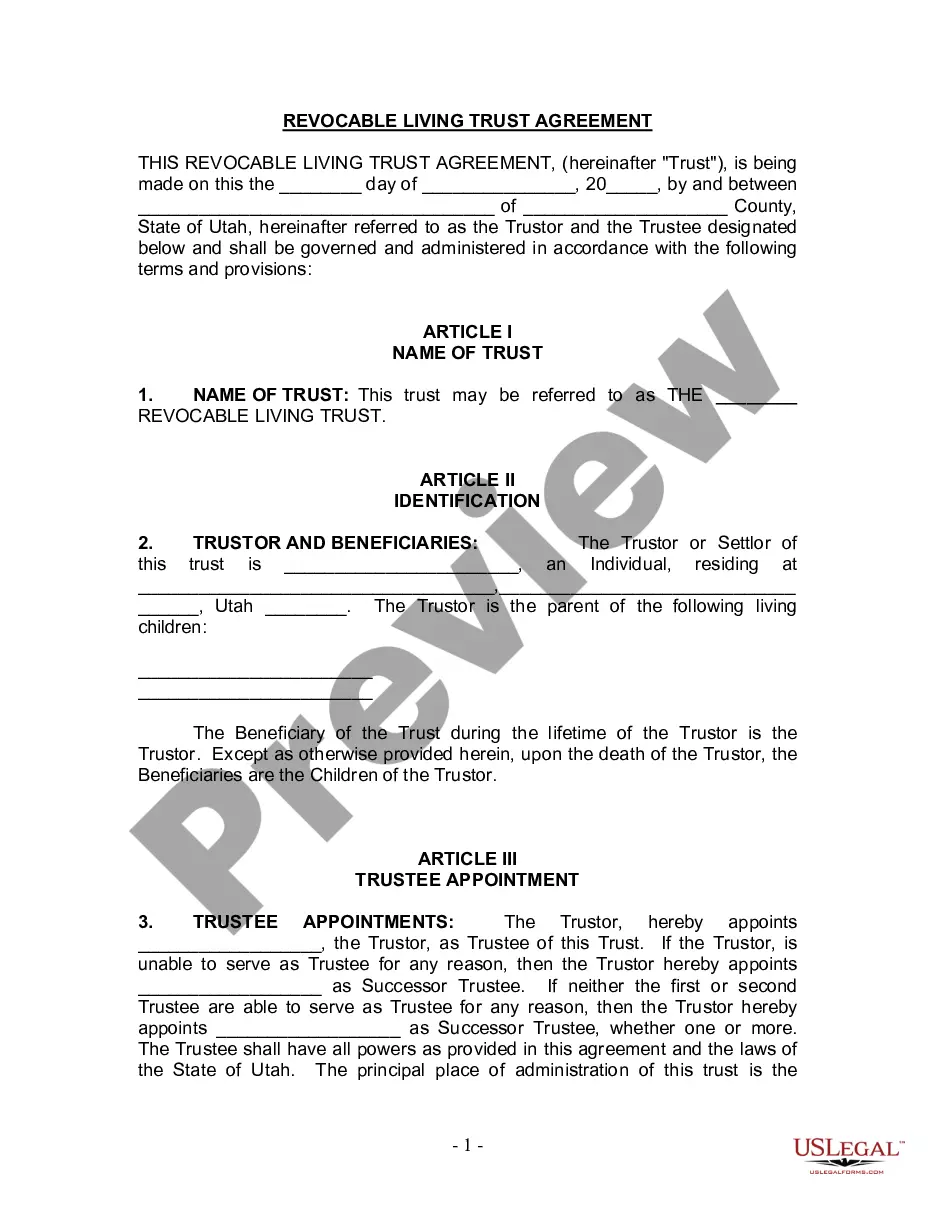

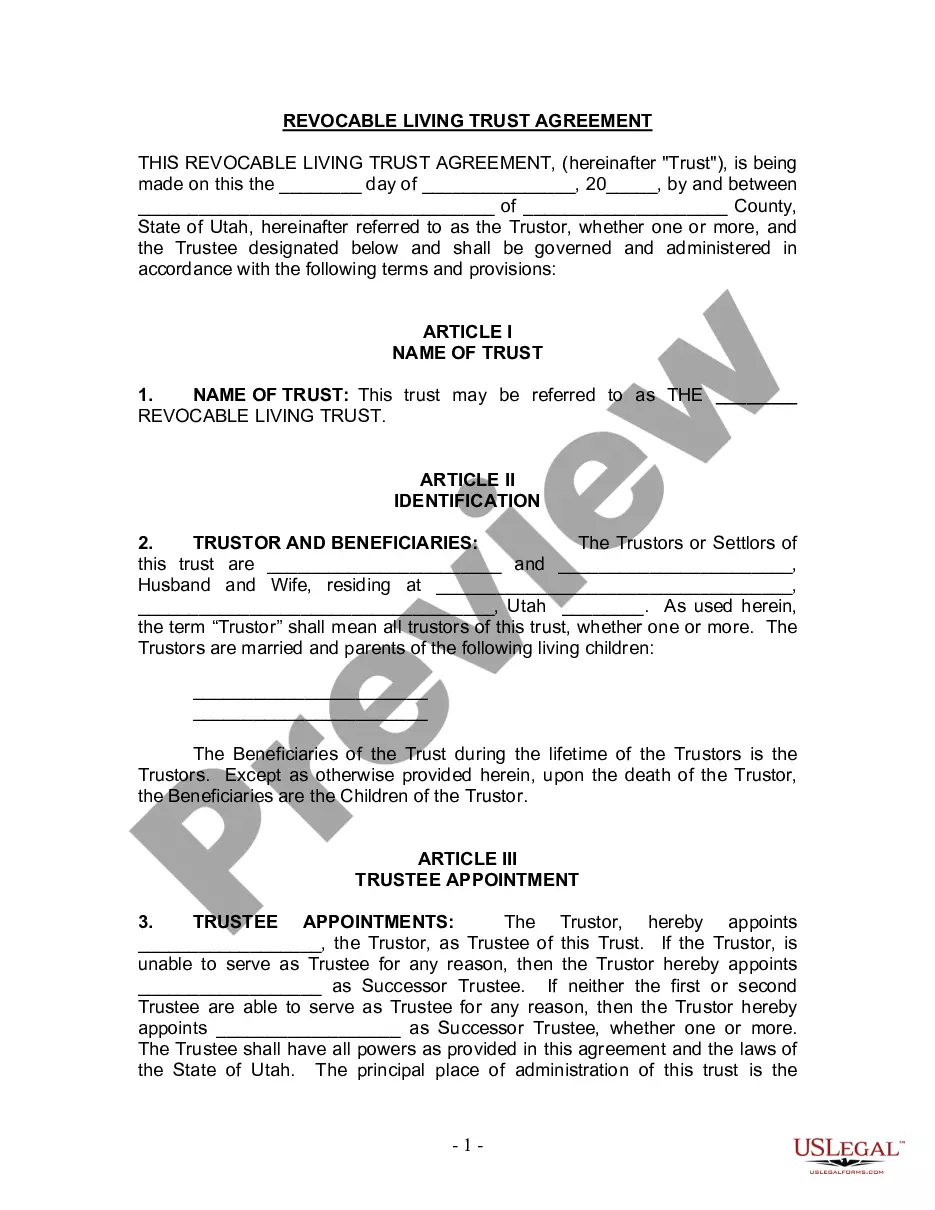

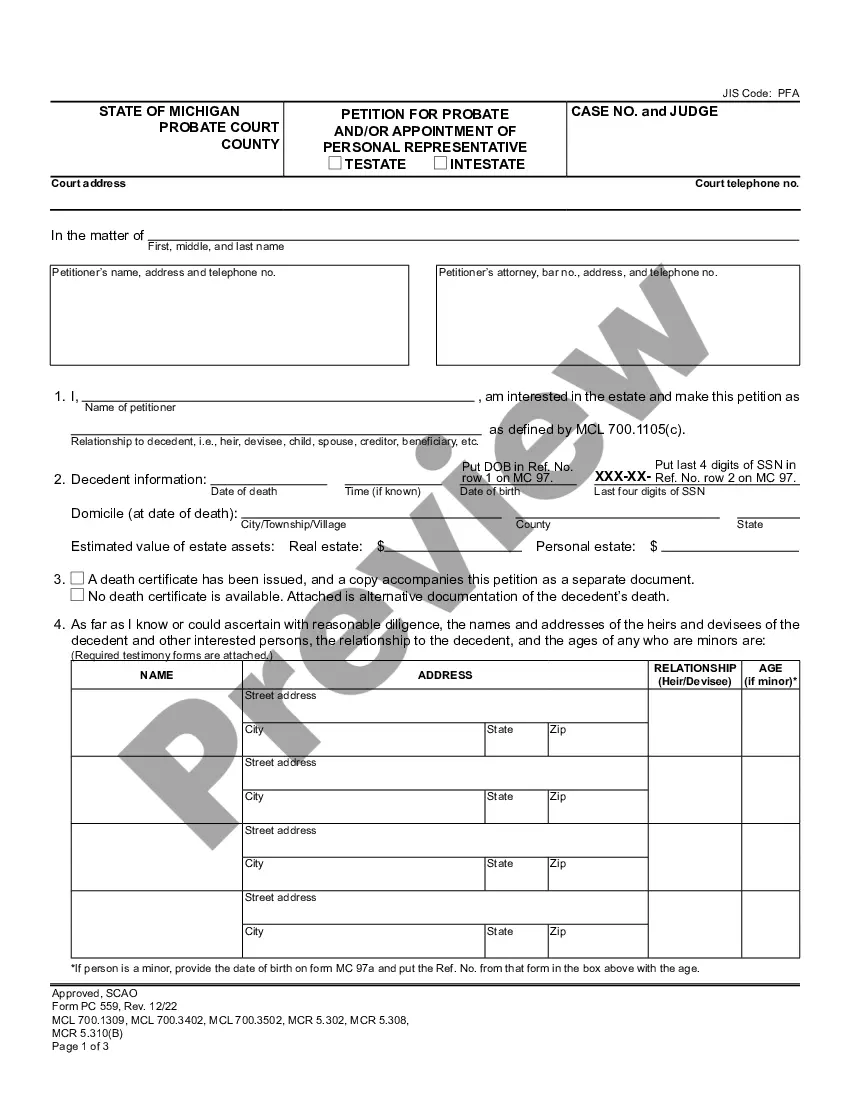

This form is a living trust form prepared for your state. It is for a husband and wife with one child. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Salt Lake Utah Living Trust for Husband and Wife with One Child

Description

How to fill out Utah Living Trust For Husband And Wife With One Child?

We consistently aim to lessen or evade legal risks when handling intricate law-related or financial matters.

To achieve this, we engage attorney services that are often quite expensive.

However, not every legal issue is as complicated.

The majority of them can be managed by us independently.

Make use of US Legal Forms whenever you need to quickly and securely find and download the Salt Lake Utah Living Trust for Husband and Wife with One Child or any other document. Simply Log In to your account and click the Get button next to it. If you’ve misplaced the document, you can always download it again from the My documents tab. The procedure is just as straightforward if you are new to the platform! You can create your account in a matter of minutes. Ensure to verify if the Salt Lake Utah Living Trust for Husband and Wife with One Child complies with the laws and regulations of your state and locality. Additionally, it's essential to review the form’s description (if available), and if you discover any inconsistencies with your initial requirements, look for an alternative template. Once you confirm that the Salt Lake Utah Living Trust for Husband and Wife with One Child suits your situation, you can select the subscription option and complete the payment. You can then download the document in any format that is available. For over 24 years in the industry, we have assisted millions of individuals by providing ready-to-customize and updated legal documents. Take full advantage of US Legal Forms now to conserve time and resources!

- US Legal Forms is an online repository of current DIY legal documents ranging from wills and powers of attorney to articles of incorporation and dissolution petitions.

- Our platform empowers you to take control of your affairs without needing to consult an attorney.

- We provide access to legal document templates that are not always readily available.

- Our templates are tailored to specific states and regions, which significantly eases the search process.

Form popularity

FAQ

A family trust, like the Salt Lake Utah Living Trust for Husband and Wife with One Child, can sometimes lead to a loss of direct control over assets. Once assets are in the trust, navigating changes can be challenging without legal help. Despite these potential drawbacks, a family trust can provide significant advantages, including protection from probate and clarity in asset distribution.

One downside of a Salt Lake Utah Living Trust for Husband and Wife with One Child includes the initial setup complexities and associated costs. Families may face legal fees when establishing the trust, and they must keep it updated as their circumstances change. However, these upfront investments often lead to long-term benefits, simplifying asset distribution and enhancing security for loved ones.

Some may view trusts, including a Salt Lake Utah Living Trust for Husband and Wife with One Child, as complex or burdensome to manage. Misunderstandings can arise regarding ongoing maintenance and potential costs involved. However, these concerns can often be addressed with proper guidance, making trusts a valuable tool for estate planning.

Creating a Salt Lake Utah Living Trust for Husband and Wife with One Child can help your parents manage their assets more effectively. It allows them to maintain control over how their assets are distributed, ensuring that their child benefits from their estate without delays caused by probate. Additionally, a trust can provide peace of mind, knowing that their wishes will be honored and their loved ones are protected.

The best type of trust for a married couple often depends on their unique circumstances and goals. A Salt Lake Utah Living Trust for Husband and Wife with One Child is a popular choice, as it combines the benefits of flexibility and control while addressing the specific needs of their child. This type of trust allows both spouses to work together in managing assets, ensuring that they align with their family's long-term financial aspirations. Consulting with a professional can help couples determine the most suitable trust for their situation.

Husbands and wives may choose to establish separate trusts for various reasons. Separate trusts can offer unique control over individual assets and help tailor estate planning to meet specific needs. For instance, a Salt Lake Utah Living Trust for Husband and Wife with One Child can provide benefits such as asset protection from creditors or a clear distribution strategy in case of unforeseen circumstances. Ultimately, separate trusts can serve as a financial safeguard, giving each spouse the power to manage their portion of the estate.

Suze Orman advocates for the creation of trusts as a smart strategy for asset protection and estate planning. She emphasizes that a Salt Lake Utah Living Trust for Husband and Wife with One Child can help ensure a smooth transition of assets while minimizing tax implications. Trusts provide clarity and control over how your assets are distributed, which is vital for any couple considering their child's future. Additionally, Orman highlights the importance of discussing these matters openly with your spouse.

You have the option to write your own trust in Utah, but it requires understanding estate laws. Creating a Salt Lake Utah Living Trust for Husband and Wife with One Child on your own might seem straightforward, yet professional insight ensures all legal requirements are met. Platforms like uslegalforms can provide templates and guidance to help you draft a trust that fits your family's needs.

Yes, you can establish a trust in your own name, typically referred to as a revocable living trust. When creating a Salt Lake Utah Living Trust for Husband and Wife with One Child, this structure allows you to maintain control over assets while designating beneficiaries for the future. This flexibility ensures your wishes are honored during your lifetime and after.

Whether to establish separate living trusts or a joint trust depends on your family's structure and needs. A Salt Lake Utah Living Trust for Husband and Wife with One Child can simplify management and ensure seamless distribution to your child. However, separate trusts may be beneficial for asset protection or individual estate planning strategies.