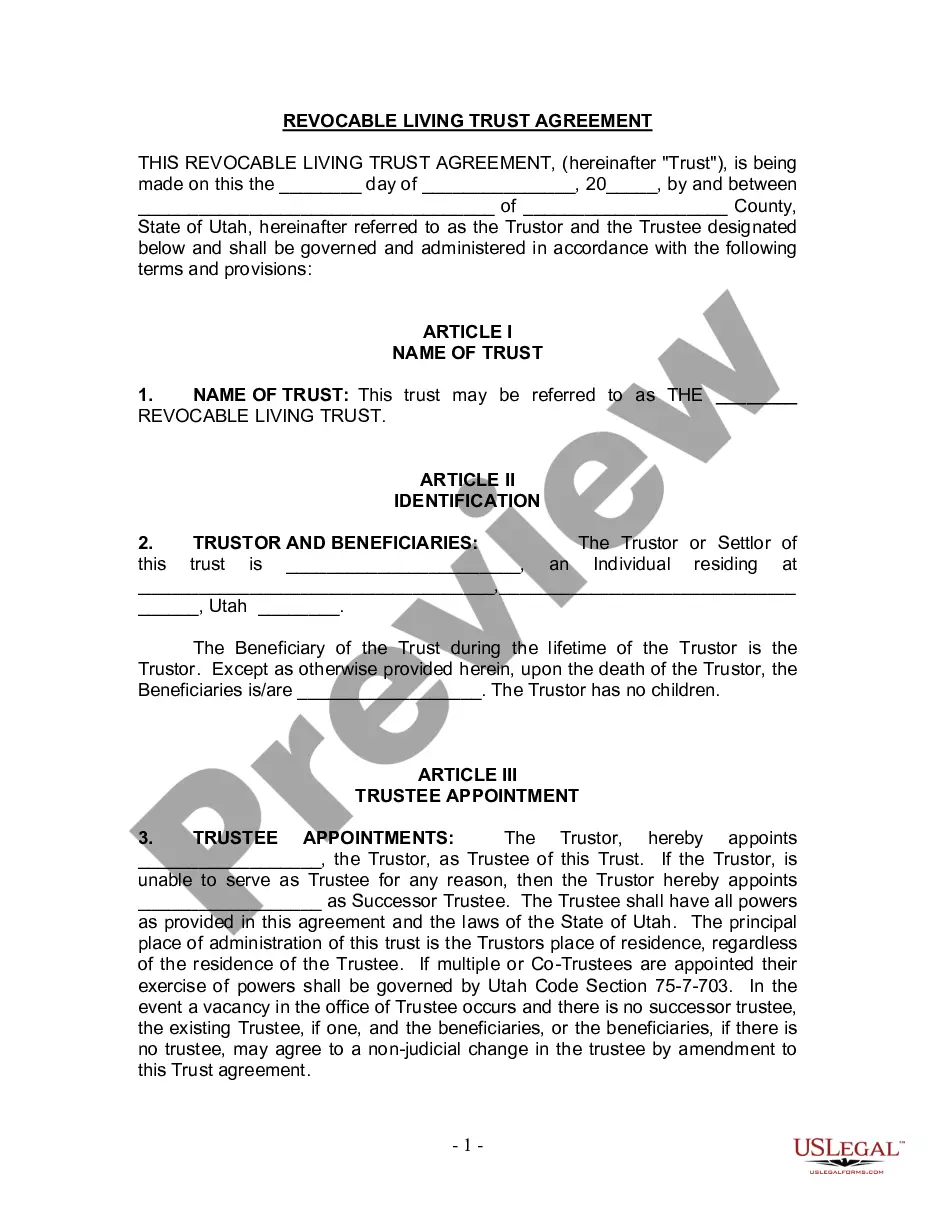

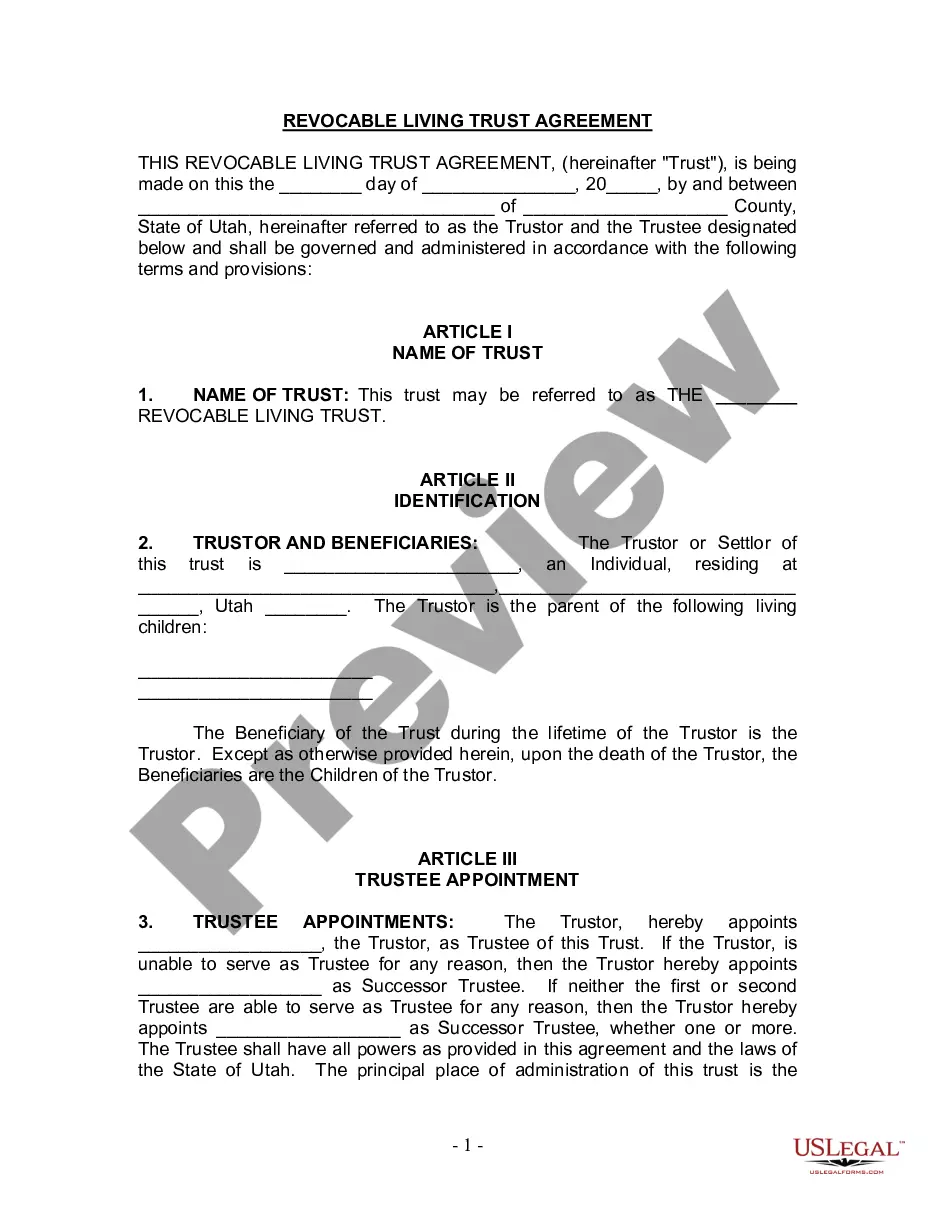

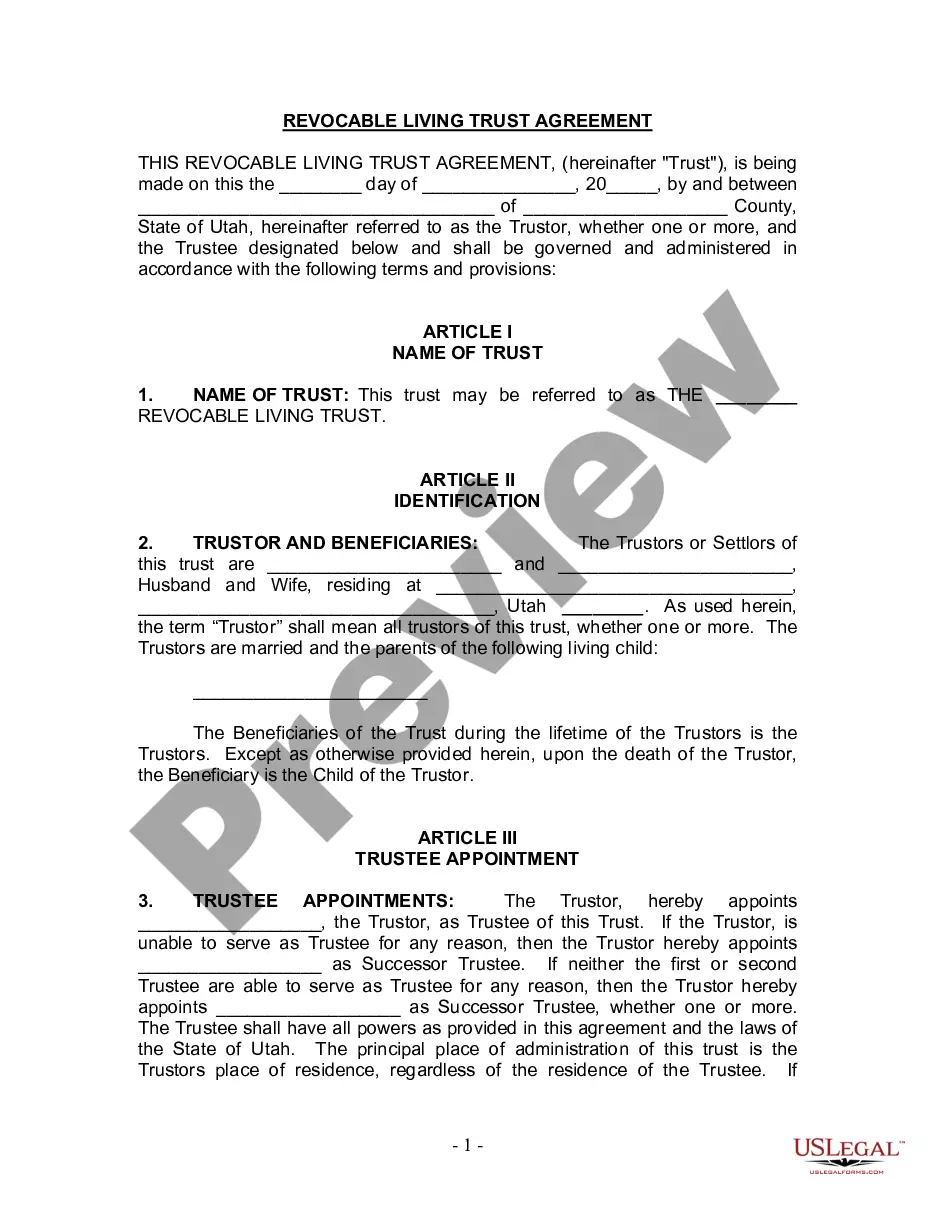

This form is a living trust form prepared for your state. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Salt Lake Utah Living Trust for Husband and Wife with Minor and or Adult Children

Description

How to fill out Utah Living Trust For Husband And Wife With Minor And Or Adult Children?

Regardless of one's social or professional standing, completing legal-related documents is a regrettable requirement in the current professional landscape.

Often, it is nearly impossible for an individual lacking legal expertise to draft such documents from the ground up, mainly due to the intricate terminology and legal specifics they involve.

This is where US Legal Forms proves to be useful.

Ensure the template you've selected is tailored to your region as the regulations of one state do not apply to another.

Review the document and, if available, read a brief summary of scenarios for which the paper can be used.

- Our platform offers an extensive assortment of over 85,000 ready-to-use forms that are state-specific and applicable to nearly any legal situation.

- US Legal Forms serves as an invaluable resource for practitioners or legal advisors looking to save time by using our DIY papers.

- Whether you're in need of the Salt Lake Utah Living Trust for Married Couples with Minor or Adult Children or any other document valid in your jurisdiction, with US Legal Forms, everything is easily accessible.

- Here’s how to efficiently obtain the Salt Lake Utah Living Trust for Married Couples with Minor or Adult Children using our trustworthy service.

- If you're already a subscriber, you can proceed to Log In to access your account and download the required form.

- However, if you are new to our collection, please make sure to follow these steps before acquiring the Salt Lake Utah Living Trust for Married Couples with Minor or Adult Children.

Form popularity

FAQ

In Utah, certain requirements must be met to create a valid trust. You must have a clear intention to create a trust, identifiable property, and a named beneficiary, such as your spouse and children in a Salt Lake Utah Living Trust for Husband and Wife with Minor and or Adult Children. Additionally, a written document outlining the terms of the trust is necessary. For detailed guidance, uslegalforms can provide the resources you need to establish your trust correctly.

Yes, you can put a trust in your own name. This is common practice, especially when establishing a Salt Lake Utah Living Trust for Husband and Wife with Minor and or Adult Children. By naming yourself as the trustee, you retain control over the assets during your lifetime. Utilizing platforms like uslegalforms can assist you in creating a trust that meets your needs and those of your family.

You can indeed write your own will in Utah and have it notarized. This is a straightforward process that allows you to convey your wishes regarding your estate. When creating your Salt Lake Utah Living Trust for Husband and Wife with Minor and or Adult Children, remember that a will can complement trust provisions. For added assurance, uslegalforms offers templates to help you craft proper legal documents.

Yes, you can write your own trust in Utah. However, it's essential to ensure that your Salt Lake Utah Living Trust for Husband and Wife with Minor and or Adult Children complies with state laws. A well-drafted trust can protect your assets and provide for your family. If you seek guidance, consider using platforms like uslegalforms that can simplify the process.

Yes, an irrevocable trust is subject to the 5-year rule, particularly regarding Medicaid eligibility. This means that assets placed in a Salt Lake Utah Living Trust for Husband and Wife with Minor and or Adult Children cannot be accessed by you after the trust is established, impacting your eligibility for benefits. However, this trust structure also provides asset protection and can reduce estate taxes, making it a favorable option for many families. Using services like uslegalforms can assist you in properly setting up this trust to navigate such complexities.

The 5 year rule for trusts generally refers to the period during which certain transfers made to irrevocable trusts may affect Medicaid eligibility. For a Salt Lake Utah Living Trust for Husband and Wife with Minor and or Adult Children, this means that any assets transferred into the trust may be subject to a penalty period if applied for Medicaid within five years of the transfer. Understanding this rule is crucial when planning your estate, as it helps ensure you meet your long-term care needs while protecting your family's inheritance. You should consult with a professional to navigate these regulations effectively.

To avoid inheritance tax with a Salt Lake Utah Living Trust for Husband and Wife with Minor and or Adult Children, you can place your assets into the trust. This structure allows for a seamless transfer of assets upon death, bypassing probate and thus reducing tax implications. Additionally, by carefully planning your trust, you can utilize exemptions and deductions that minimize overall tax obligations. This proactive approach ensures your loved ones receive their inheritance with minimal financial burden.

Deciding whether a husband and wife should have separate living trusts is a significant consideration when setting up a Salt Lake Utah Living Trust for Husband and Wife with Minor and or Adult Children. While separate trusts can provide distinct benefits, such as asset protection, joint living trusts may simplify the estate planning process. It's crucial to weigh your individual circumstances and tax implications. Consulting with a professional or using US Legal Forms can provide clarity and assist in making the best choice.

One of the biggest mistakes parents often make when establishing a Salt Lake Utah Living Trust for Husband and Wife with Minor and or Adult Children is not fully understanding their family's needs. Many parents overlook the importance of clear terms and conditions, which can lead to confusion later. Additionally, failing to designate the right trustees can hinder the effectiveness of the trust. Utilizing a reliable resource like US Legal Forms can help you navigate these complexities.

A notable downside of a living trust, such as the Salt Lake Utah Living Trust for Husband and Wife with Minor and or Adult Children, is that it does not provide the same level of asset protection as certain other legal arrangements. This means your assets may still be vulnerable to creditors. Furthermore, you must ensure all eligible assets are transferred, as anything outside the trust may not benefit from the trust's provisions. Understanding these limitations can help you make informed decisions for your family's future.