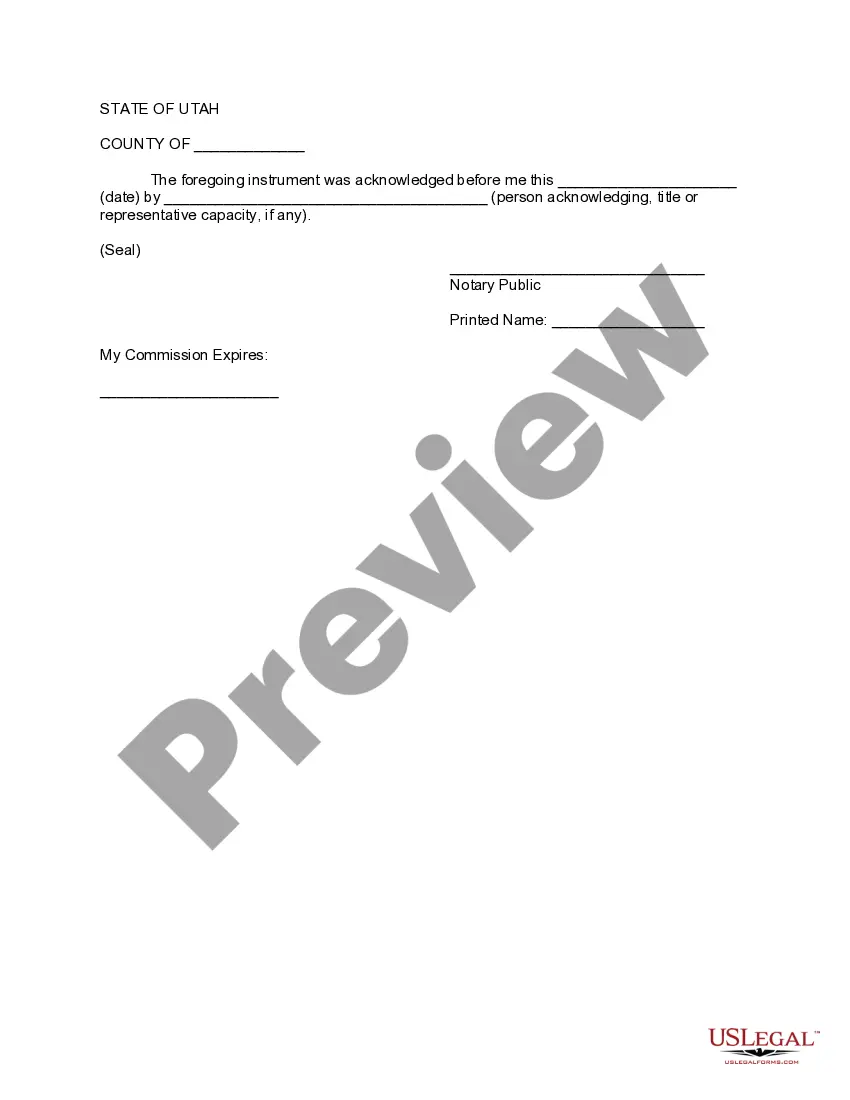

This form is for amending a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form permits the Trustor to amend certain properties of the trust without changing the purpose or nature of the trust. Except for the amended provisions, all other parts of the trust will remain in full force and effect. The Trustor(s) signature(s) is needed, and it must be signed in front of a notary public.

The Salt Lake Utah Amendment to Living Trust is a legal document that allows individuals in Salt Lake City, Utah, to make changes or revisions to their existing living trust. A living trust is a type of estate planning tool that helps an individual manage and distribute their assets during their lifetime and after their death, avoiding the need for probate court. The amendment serves as an important instrument for individuals who have undergone significant life changes or wish to modify certain aspects of their trust. It allows them to add or remove beneficiaries, change trustees or successor trustees, alter the distribution of assets, or revise any other provisions outlined in their original trust document. The Salt Lake Utah Amendment to Living Trust provides individuals with the flexibility and control needed to adapt their estate planning strategies to evolving circumstances. It enables trust holders to ensure their assets are distributed according to their current wishes, safeguarding the financial future of their loved ones and protecting their wealth from unnecessary taxes and legal complications. Though there might not be specific types of Salt Lake Utah Amendments to Living Trust, individuals can draft various amendments based on their particular needs. Some possible amendments might include: 1. Beneficiary Amendment: This type of amendment allows the trust holder to add or remove beneficiaries from their living trust based on changes in family dynamics or personal circumstances. 2. Amendment of Trustees: The trust holder may choose to modify the designated trustees or appoint new successor trustees to manage the trust if the original trustee is no longer available or if a more suitable candidate emerges. 3. Asset Distribution Amendment: Changes in financial situations or preferences may prompt the trust holder to modify the way their assets will be distributed among beneficiaries, ensuring fairness and meeting the new financial goals. 4. Amendment of Terms and Conditions: This amendment allows the trust holder to revise any specific terms and conditions stated in the original living trust, such as provisions relating to special needs beneficiaries, charitable donations, or the establishment of sub-trusts. The Salt Lake Utah Amendment to Living Trust provides the framework for individuals to make necessary adjustments to their living trust, ensuring it remains aligned with their current wishes and intentions. Seeking legal advice before drafting an amendment is crucial to ensure compliance with Utah state laws and to address any potential tax implications or complications.