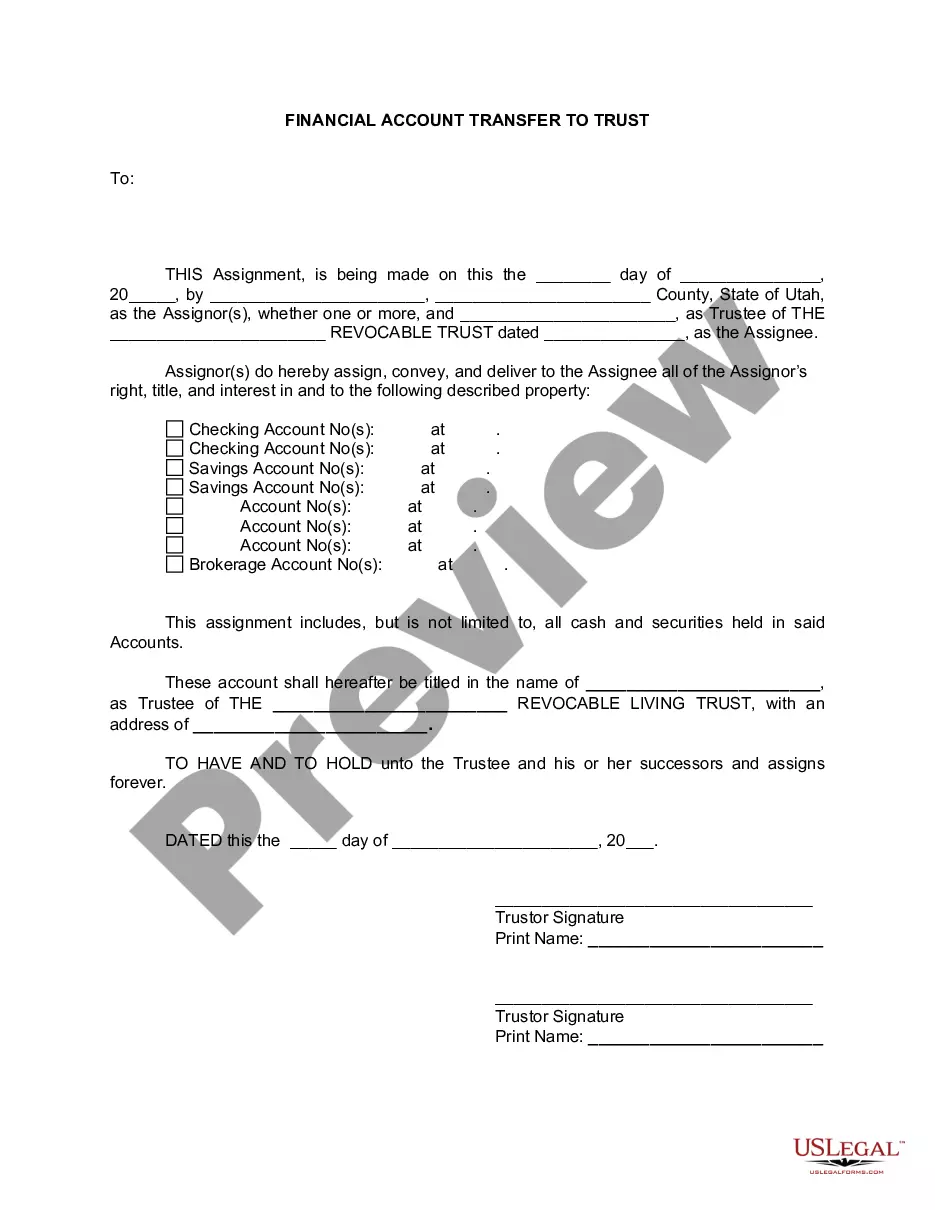

This Financial Account Transfer to Living Trust form is for transferring bank and other financial accounts to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public. Assignor(s) with this form will assign, convey, and deliver to the Assignee all of the Assignors right, title, and interest in and to the described property.The assignment includes, but is not limited to, all cash and securities held in the accounts.

Title: Provo Utah Financial Account Transfer to Living Trust: A Comprehensive Guide to Protecting Your Assets Keywords: Provo Utah, financial account transfer, living trust, asset protection Introduction: Ensuring the security of your assets and the seamless transfer of your financial accounts to a Living Trust is crucial for long-term financial planning. In this detailed guide, we will explain the ins and outs of Provo Utah Financial Account Transfer to Living Trust, including different types of transfers available to residents in the area. 1. Understanding Financial Account Transfer to Living Trust: Financial Account Transfer to Living Trust in Provo Utah refers to the process of moving your accounts, including bank accounts, investment portfolios, retirement accounts, and other financial assets, into a Living Trust. By doing so, you establish a legal structure that protects your assets, provides flexibility in managing them, and ensures their smooth transition to your designated beneficiaries upon your passing. 2. Benefits of Transferring Financial Accounts to a Living Trust: — Asset protection: A Living Trust shields your assets from potential creditors, lawsuits, and probate court, ensuring their preservation for future generations. — Avoiding Probate: By transferring your financial accounts to a Living Trust, you simplify the distribution process, avoiding the time-consuming and costly probate procedure. — Privacy: Unlike a will, a Living Trust is not made public, maintaining the privacy of your financial arrangements. — Management Flexibility: With a Living Trust, you can appoint a trustee to manage your accounts, ensuring that your wishes are followed even in the event of incapacitation. 3. Types of Provo Utah Financial Account Transfers to Living Trust: a. Bank Account Transfer to Living Trust: — Savings account— - Checking accounts - Money market accounts b. Investment Account Transfer to Living Trust: — Brokerage account— - Stocks and bonds portfolios — Mutual funds and exchange-traded funds c. Retirement Account Transfer to Living Trust: — Individual Retirement Accounts (IRA— - 401(k) and 403(b) accounts — Pension plans and profit-sharing plans d. Other Financial Assets Transfer to Living Trust: — Certificates of deposit (CDs— - Life insurance policies — Annuities 4. How to Transfer Financial Accounts to Living Trust in Provo Utah: a. Consult an Attorney: Engaging a qualified estate planning attorney is crucial to understand the legal implications and requirements of the transfer process. b. Create a Living Trust: Establishing a Living Trust document that outlines your wishes and appoints a trustee is the first step. c. Notify Institutions: Inform all relevant financial institutions about your transfer intentions and provide them with the necessary legal documentation. d. Update Account Ownership: Follow the specific procedures of each institution to change the ownership of your financial accounts to the Living Trust. Conclusion: Provo Utah Financial Account Transfer to Living Trust provides individuals and families with enhanced asset protection, simplified distribution, and long-term financial planning. By intelligently transferring various types of financial accounts to a Living Trust, you can secure your assets and guarantee their seamless transfer to your chosen beneficiaries. Seek professional advice to ensure compliance with the legal requirements and enjoy the peace of mind that comes with safeguarding your wealth.Title: Provo Utah Financial Account Transfer to Living Trust: A Comprehensive Guide to Protecting Your Assets Keywords: Provo Utah, financial account transfer, living trust, asset protection Introduction: Ensuring the security of your assets and the seamless transfer of your financial accounts to a Living Trust is crucial for long-term financial planning. In this detailed guide, we will explain the ins and outs of Provo Utah Financial Account Transfer to Living Trust, including different types of transfers available to residents in the area. 1. Understanding Financial Account Transfer to Living Trust: Financial Account Transfer to Living Trust in Provo Utah refers to the process of moving your accounts, including bank accounts, investment portfolios, retirement accounts, and other financial assets, into a Living Trust. By doing so, you establish a legal structure that protects your assets, provides flexibility in managing them, and ensures their smooth transition to your designated beneficiaries upon your passing. 2. Benefits of Transferring Financial Accounts to a Living Trust: — Asset protection: A Living Trust shields your assets from potential creditors, lawsuits, and probate court, ensuring their preservation for future generations. — Avoiding Probate: By transferring your financial accounts to a Living Trust, you simplify the distribution process, avoiding the time-consuming and costly probate procedure. — Privacy: Unlike a will, a Living Trust is not made public, maintaining the privacy of your financial arrangements. — Management Flexibility: With a Living Trust, you can appoint a trustee to manage your accounts, ensuring that your wishes are followed even in the event of incapacitation. 3. Types of Provo Utah Financial Account Transfers to Living Trust: a. Bank Account Transfer to Living Trust: — Savings account— - Checking accounts - Money market accounts b. Investment Account Transfer to Living Trust: — Brokerage account— - Stocks and bonds portfolios — Mutual funds and exchange-traded funds c. Retirement Account Transfer to Living Trust: — Individual Retirement Accounts (IRA— - 401(k) and 403(b) accounts — Pension plans and profit-sharing plans d. Other Financial Assets Transfer to Living Trust: — Certificates of deposit (CDs— - Life insurance policies — Annuities 4. How to Transfer Financial Accounts to Living Trust in Provo Utah: a. Consult an Attorney: Engaging a qualified estate planning attorney is crucial to understand the legal implications and requirements of the transfer process. b. Create a Living Trust: Establishing a Living Trust document that outlines your wishes and appoints a trustee is the first step. c. Notify Institutions: Inform all relevant financial institutions about your transfer intentions and provide them with the necessary legal documentation. d. Update Account Ownership: Follow the specific procedures of each institution to change the ownership of your financial accounts to the Living Trust. Conclusion: Provo Utah Financial Account Transfer to Living Trust provides individuals and families with enhanced asset protection, simplified distribution, and long-term financial planning. By intelligently transferring various types of financial accounts to a Living Trust, you can secure your assets and guarantee their seamless transfer to your chosen beneficiaries. Seek professional advice to ensure compliance with the legal requirements and enjoy the peace of mind that comes with safeguarding your wealth.