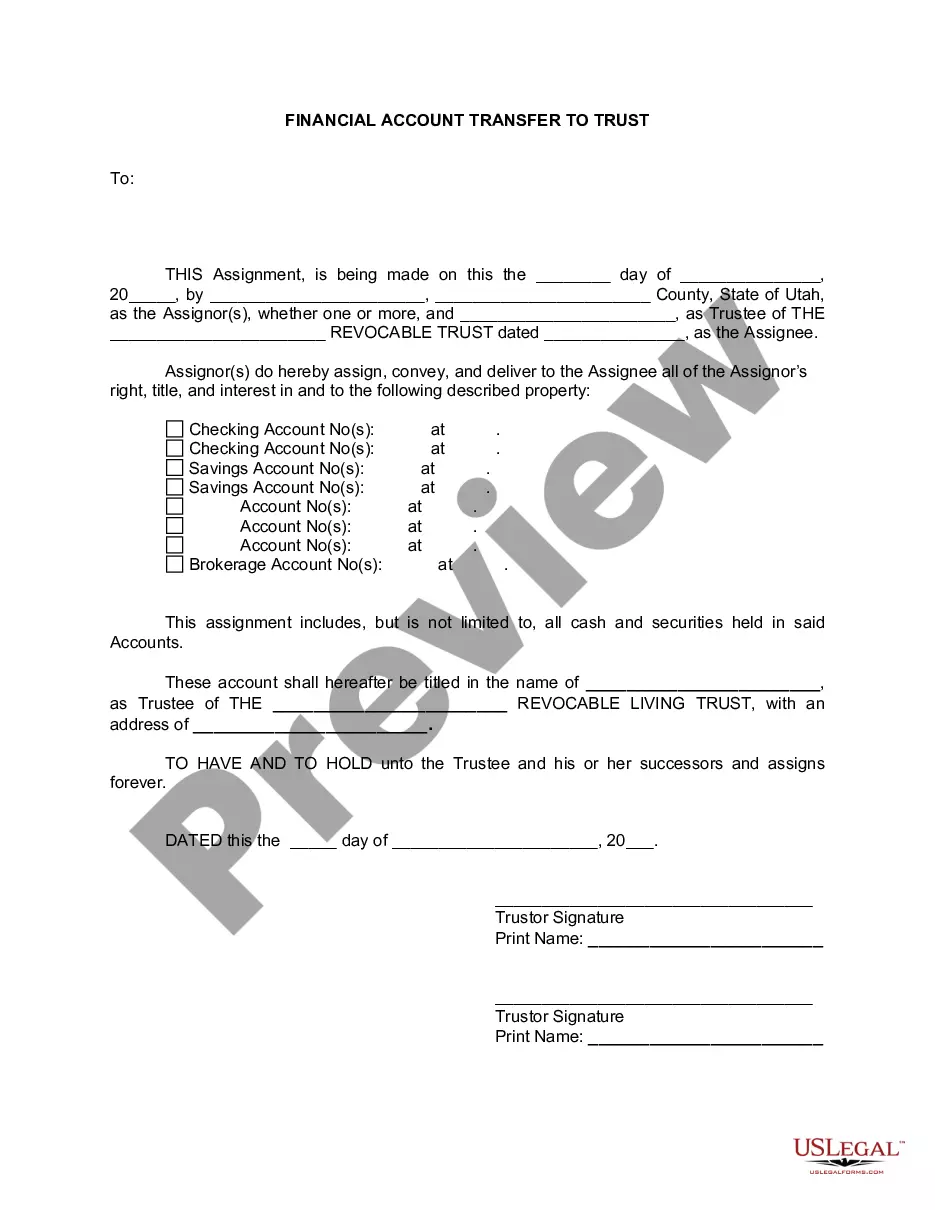

This Financial Account Transfer to Living Trust form is for transferring bank and other financial accounts to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public. Assignor(s) with this form will assign, convey, and deliver to the Assignee all of the Assignors right, title, and interest in and to the described property.The assignment includes, but is not limited to, all cash and securities held in the accounts.

Salt Lake Utah Financial Account Transfer to Living Trust: A Comprehensive Guide In Salt Lake City, Utah, individuals often turn to Living Trusts as an effective estate planning tool, enabling them to efficiently transfer their financial accounts upon their death. A Salt Lake Utah Financial Account Transfer to Living Trust ensures that your hard-earned assets are protected, managed, and distributed according to your wishes, without the need for probate court involvement. Types of Salt Lake Utah Financial Account Transfers to Living Trust: 1. Checking and Savings Accounts: Through a Salt Lake Utah Financial Account Transfer to a Living Trust, you can seamlessly transfer your checking and savings accounts held at various financial institutions into the trust. By doing so, you ensure that these assets are not subjected to lengthy probate processes and can be promptly accessed by your designated beneficiaries. 2. Investment Accounts: From Individual Retirement Accounts (IRAs) to brokerage accounts and mutual funds, transferring your investment accounts into a Salt Lake Utah Living Trust provides a streamlined process for managing your investments during your lifetime and distributing them upon your passing. This enables your beneficiaries to receive the assets without incurring significant tax burdens. 3. Real Estate Holdings: If you own property in Salt Lake City or other areas of Utah, a Financial Account Transfer to a Living Trust allows you to place these assets under the management of the trust. This ensures that the property's ownership is promptly transferred to the designated beneficiaries upon your demise, bypassing probate. 4. Business Interests: If you have an ownership stake in a Utah-based business, a Salt Lake Utah Financial Account Transfer to Living Trust can also help safeguard your business interests. By placing your shares or ownership rights into the trust, you can dictate how these assets will be handled after your passing, providing a smoother transition for your successors. Key Considerations for Salt Lake Utah Financial Account Transfer to Living Trust: 1. Establishing a Living Trust: Setting up a Living Trust requires the expertise of an experienced estate planning attorney in Salt Lake City. They will guide you through the process, ensuring the legal validity of your trust and helping you define how your financial accounts will be transferred into it accurately. 2. Designating Trustees and Beneficiaries: When creating a Living Trust, it is essential to designate trustees (individuals or institutions responsible for managing the trust) and beneficiaries (individuals who will receive the trust's assets). Choose trustworthy individuals who are capable of executing your intentions faithfully. 3. Updating the Trust: As your financial accounts change over time, it's important to ensure that your Living Trust remains up to date. Regularly review and update the trust documents, including account details, to reflect any modifications in your financial situation. 4. Consult Professionals: The process of Salt Lake Utah Financial Account Transfer to Living Trust can be complex, requiring legal and financial expertise. Consult with trusted professionals, such as attorneys specializing in estate planning and financial advisors, to navigate the nuances and maximize the benefits of a Living Trust. In summary, a Salt Lake Utah Financial Account Transfer to Living Trust allows individuals in Salt Lake City and throughout Utah to protect and manage their financial accounts during their lifetime while ensuring a smooth transfer to beneficiaries. Whether it's checking and savings accounts, investment accounts, real estate holdings, or business interests, a Living Trust provides a comprehensive solution for effective estate planning. Seek professional guidance to ensure your Living Trust accurately reflects your intent and covers all relevant assets.Salt Lake Utah Financial Account Transfer to Living Trust: A Comprehensive Guide In Salt Lake City, Utah, individuals often turn to Living Trusts as an effective estate planning tool, enabling them to efficiently transfer their financial accounts upon their death. A Salt Lake Utah Financial Account Transfer to Living Trust ensures that your hard-earned assets are protected, managed, and distributed according to your wishes, without the need for probate court involvement. Types of Salt Lake Utah Financial Account Transfers to Living Trust: 1. Checking and Savings Accounts: Through a Salt Lake Utah Financial Account Transfer to a Living Trust, you can seamlessly transfer your checking and savings accounts held at various financial institutions into the trust. By doing so, you ensure that these assets are not subjected to lengthy probate processes and can be promptly accessed by your designated beneficiaries. 2. Investment Accounts: From Individual Retirement Accounts (IRAs) to brokerage accounts and mutual funds, transferring your investment accounts into a Salt Lake Utah Living Trust provides a streamlined process for managing your investments during your lifetime and distributing them upon your passing. This enables your beneficiaries to receive the assets without incurring significant tax burdens. 3. Real Estate Holdings: If you own property in Salt Lake City or other areas of Utah, a Financial Account Transfer to a Living Trust allows you to place these assets under the management of the trust. This ensures that the property's ownership is promptly transferred to the designated beneficiaries upon your demise, bypassing probate. 4. Business Interests: If you have an ownership stake in a Utah-based business, a Salt Lake Utah Financial Account Transfer to Living Trust can also help safeguard your business interests. By placing your shares or ownership rights into the trust, you can dictate how these assets will be handled after your passing, providing a smoother transition for your successors. Key Considerations for Salt Lake Utah Financial Account Transfer to Living Trust: 1. Establishing a Living Trust: Setting up a Living Trust requires the expertise of an experienced estate planning attorney in Salt Lake City. They will guide you through the process, ensuring the legal validity of your trust and helping you define how your financial accounts will be transferred into it accurately. 2. Designating Trustees and Beneficiaries: When creating a Living Trust, it is essential to designate trustees (individuals or institutions responsible for managing the trust) and beneficiaries (individuals who will receive the trust's assets). Choose trustworthy individuals who are capable of executing your intentions faithfully. 3. Updating the Trust: As your financial accounts change over time, it's important to ensure that your Living Trust remains up to date. Regularly review and update the trust documents, including account details, to reflect any modifications in your financial situation. 4. Consult Professionals: The process of Salt Lake Utah Financial Account Transfer to Living Trust can be complex, requiring legal and financial expertise. Consult with trusted professionals, such as attorneys specializing in estate planning and financial advisors, to navigate the nuances and maximize the benefits of a Living Trust. In summary, a Salt Lake Utah Financial Account Transfer to Living Trust allows individuals in Salt Lake City and throughout Utah to protect and manage their financial accounts during their lifetime while ensuring a smooth transfer to beneficiaries. Whether it's checking and savings accounts, investment accounts, real estate holdings, or business interests, a Living Trust provides a comprehensive solution for effective estate planning. Seek professional guidance to ensure your Living Trust accurately reflects your intent and covers all relevant assets.