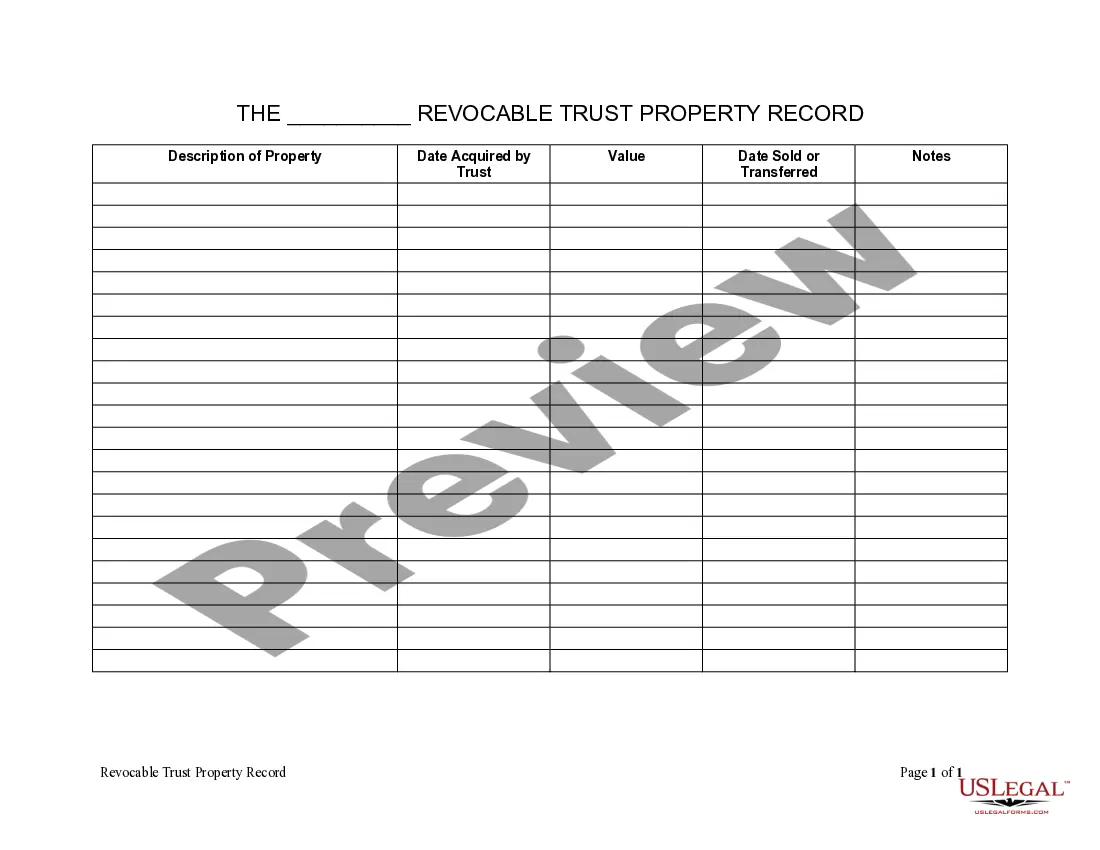

This Financial Account Transfer to Living Trust form is for transferring bank and other financial accounts to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public. Assignor(s) with this form will assign, convey, and deliver to the Assignee all of the Assignors right, title, and interest in and to the described property.The assignment includes, but is not limited to, all cash and securities held in the accounts.

Salt Lake City, Utah Financial Account Transfer to Living Trust: A Comprehensive Guide Introduction In Salt Lake City, Utah, transferring financial accounts to a living trust is a crucial step in estate planning. This process allows individuals to ensure a smooth transition of their assets while avoiding probate and providing for their beneficiaries. This article provides a detailed description of the Salt Lake City, Utah financial account transfer to a living trust, highlighting its importance and various types. 1. Definition and Importance of Salt Lake City, Utah Financial Account Transfer to Living Trust Financial account transfer to a living trust involves moving ownership of bank accounts, investment portfolios, retirement accounts, and other financial assets into a trust. A living trust is a legal entity that holds and distributes assets during the granter's lifetime and after their death. This transfer is crucial because: a) Avoiding Probate: Probate is a court-supervised process that validates a will and distributes assets. By transferring financial accounts to a living trust, individuals can bypass the probate process, saving time and expenses. b) Privacy: Probate proceedings are public, allowing anyone to access details of an individual's estate. A living trust, in contrast, provides privacy, protecting sensitive financial information. c) Incapacity Planning: A living trust allows for the seamless management of financial affairs if the granter becomes incapacitated or unable to handle their finances independently. 2. Different Types of Salt Lake City, Utah Financial Account Transfer to Living Trust a) Bank Account Transfer to Living Trust This type involves transferring ownership of bank accounts, such as checking and savings accounts, money market accounts, and certificates of deposit (CDs), to the living trust. To transfer bank accounts, individuals need to work closely with their financial institution and provide required documentation, including a trust certificate and signature authorization. b) Investment Account Transfer to Living Trust Investment accounts held with brokerage firms, mutual fund companies, or investment advisors can also be transferred to a living trust. The process typically involves completing specific forms provided by the financial institution and updating the account's ownership details to reflect the trust. c) Retirement Account Transfer to Living Trust Retirement accounts, such as individual retirement accounts (IRAs) and employer-sponsored plans like 401(k)s, can also be transferred to a living trust. However, careful consideration must be given to the tax implications and potential limitations on distributions. It is advisable to consult with a financial advisor or tax professional when transferring retirement accounts. d) Life Insurance and Annuities Transfer to Living Trust Individuals can name their living trust as the primary or contingent beneficiary of life insurance policies and annuities. This ensures that the proceeds from these policies are included in the trust and distributed according to its terms. Conclusion In Salt Lake City, Utah, transferring financial accounts to a living trust is a crucial step in estate planning. It allows individuals to control their assets during their lifetime and ensures an efficient distribution upon their passing, all while avoiding the cumbersome probate process. By understanding the importance and different types of financial account transfers to a living trust, individuals in Salt Lake City can make informed decisions to protect their assets and provide for their loved ones.