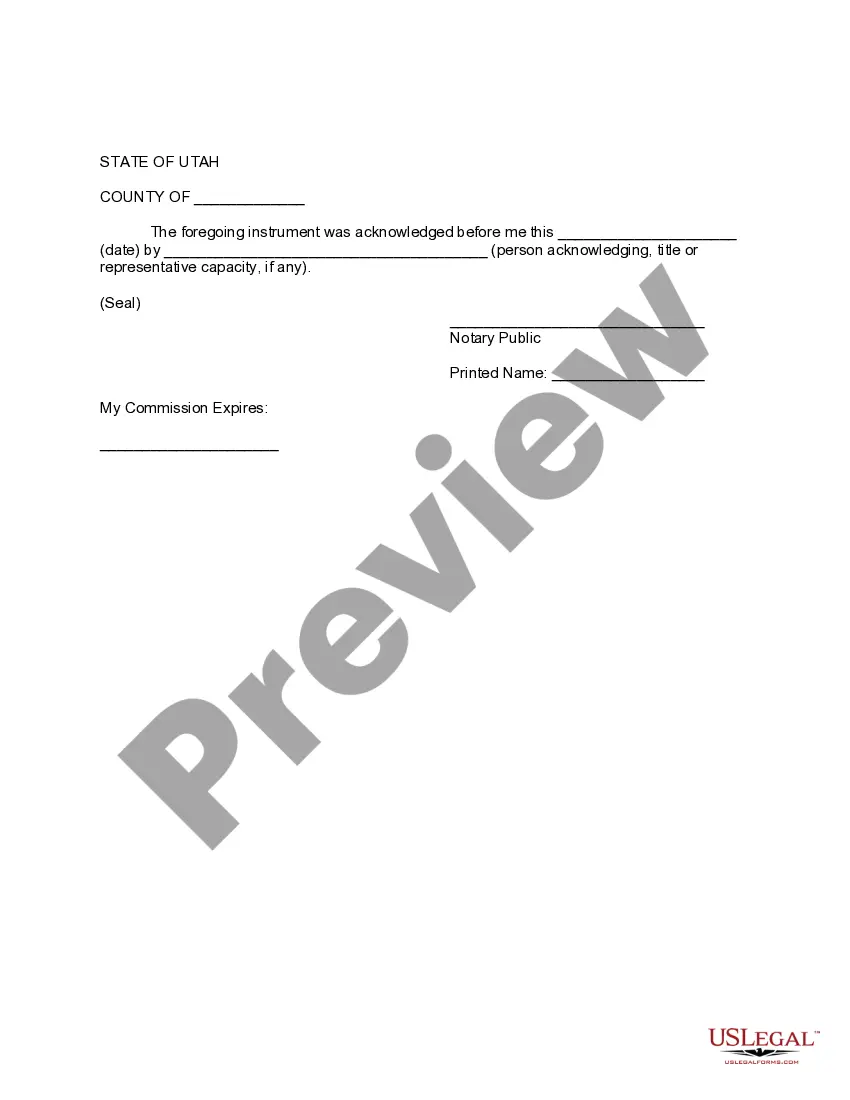

This Financial Account Transfer to Living Trust form is for transferring bank and other financial accounts to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public. Assignor(s) with this form will assign, convey, and deliver to the Assignee all of the Assignors right, title, and interest in and to the described property.The assignment includes, but is not limited to, all cash and securities held in the accounts.

West Jordan Utah Financial Account Transfer to Living Trust: A Comprehensive Guide Are you a resident of West Jordan, Utah, and considering a financial account transfer to a living trust? Look no further! In this detailed description, we will cover all aspects of West Jordan Utah Financial Account Transfer to Living Trust, providing you with essential information, steps, and tips to navigate this process smoothly. What is a Living Trust? A living trust is a legal document that allows you to transfer your assets, including financial accounts, into a trust during your lifetime. Unlike a will, a living trust provides benefits such as avoiding probate, maintaining privacy, and allowing for smoother asset distribution upon your passing. By establishing a living trust, you gain more control over your financial affairs and ensure your assets are managed according to your wishes. Types of West Jordan Utah Financial Account Transfer to Living Trust: 1. Checking and Savings Accounts: Transfer your bank accounts in West Jordan, Utah, to your living trust by updating the account's ownership and beneficiary designation. This will ensure that these assets are directly included in your living trust, providing more efficient management and distribution. 2. Investment Accounts: Whether you have stocks, bonds, mutual funds, or other investment vehicles held in West Jordan, Utah, these accounts can be transferred to your living trust. Consult with your financial advisor and the institution holding your investments to complete the necessary paperwork for the transfer. 3. Retirement Accounts: Involving complex regulations, transferring retirement accounts to a living trust may require additional considerations. Seek advice from a qualified professional to understand the potential tax implications and ensure the transfer aligns with your retirement goals. Steps to Transfer Your West Jordan Utah Financial Accounts to a Living Trust: 1. Identify the accounts: Make a list of all your financial accounts, including bank accounts, investments, and retirement accounts, located in West Jordan, Utah, that you wish to transfer. 2. Consult an attorney: Engage a knowledgeable estate planning attorney with experience in living trusts to guide you through the legal aspects and formalities involved in creating and implementing a living trust. 3. Draft the living trust: Work with your attorney to create a living trust document tailored to your specific needs, including precise provisions related to the transfer of your financial accounts. 4. Fund the trust: Assign your financial accounts as assets of your living trust by updating the ownership and beneficiary designations of each account. Contact the respective institutions, provide them with your living trust details, and complete any required paperwork as per their guidelines. 5. Review and update beneficiaries: Ensure that your living trust incorporates your desired beneficiaries for each financial account. Regularly review and update these designations, particularly in the event of life changes such as marriage, divorce, births, or deaths. 6. Seek professional advice: Consult with financial advisors, tax professionals, and estate planners as needed to navigate potential tax implications and ensure a smooth transfer process. By following these steps, residents of West Jordan, Utah, can effectively transfer their financial accounts to a living trust, ensuring their assets are protected and managed according to their wishes. In summary, a West Jordan Utah Financial Account Transfer to Living Trust involves a strategic and legally binding process of transferring various financial accounts, such as checking and savings accounts, investment accounts, and retirement accounts, into a living trust. Seek professional assistance, tailor a living trust document, update ownership and beneficiary designations, review beneficiaries regularly, and consult experts to achieve a seamless transfer while enjoying the benefits of a living trust.West Jordan Utah Financial Account Transfer to Living Trust: A Comprehensive Guide Are you a resident of West Jordan, Utah, and considering a financial account transfer to a living trust? Look no further! In this detailed description, we will cover all aspects of West Jordan Utah Financial Account Transfer to Living Trust, providing you with essential information, steps, and tips to navigate this process smoothly. What is a Living Trust? A living trust is a legal document that allows you to transfer your assets, including financial accounts, into a trust during your lifetime. Unlike a will, a living trust provides benefits such as avoiding probate, maintaining privacy, and allowing for smoother asset distribution upon your passing. By establishing a living trust, you gain more control over your financial affairs and ensure your assets are managed according to your wishes. Types of West Jordan Utah Financial Account Transfer to Living Trust: 1. Checking and Savings Accounts: Transfer your bank accounts in West Jordan, Utah, to your living trust by updating the account's ownership and beneficiary designation. This will ensure that these assets are directly included in your living trust, providing more efficient management and distribution. 2. Investment Accounts: Whether you have stocks, bonds, mutual funds, or other investment vehicles held in West Jordan, Utah, these accounts can be transferred to your living trust. Consult with your financial advisor and the institution holding your investments to complete the necessary paperwork for the transfer. 3. Retirement Accounts: Involving complex regulations, transferring retirement accounts to a living trust may require additional considerations. Seek advice from a qualified professional to understand the potential tax implications and ensure the transfer aligns with your retirement goals. Steps to Transfer Your West Jordan Utah Financial Accounts to a Living Trust: 1. Identify the accounts: Make a list of all your financial accounts, including bank accounts, investments, and retirement accounts, located in West Jordan, Utah, that you wish to transfer. 2. Consult an attorney: Engage a knowledgeable estate planning attorney with experience in living trusts to guide you through the legal aspects and formalities involved in creating and implementing a living trust. 3. Draft the living trust: Work with your attorney to create a living trust document tailored to your specific needs, including precise provisions related to the transfer of your financial accounts. 4. Fund the trust: Assign your financial accounts as assets of your living trust by updating the ownership and beneficiary designations of each account. Contact the respective institutions, provide them with your living trust details, and complete any required paperwork as per their guidelines. 5. Review and update beneficiaries: Ensure that your living trust incorporates your desired beneficiaries for each financial account. Regularly review and update these designations, particularly in the event of life changes such as marriage, divorce, births, or deaths. 6. Seek professional advice: Consult with financial advisors, tax professionals, and estate planners as needed to navigate potential tax implications and ensure a smooth transfer process. By following these steps, residents of West Jordan, Utah, can effectively transfer their financial accounts to a living trust, ensuring their assets are protected and managed according to their wishes. In summary, a West Jordan Utah Financial Account Transfer to Living Trust involves a strategic and legally binding process of transferring various financial accounts, such as checking and savings accounts, investment accounts, and retirement accounts, into a living trust. Seek professional assistance, tailor a living trust document, update ownership and beneficiary designations, review beneficiaries regularly, and consult experts to achieve a seamless transfer while enjoying the benefits of a living trust.