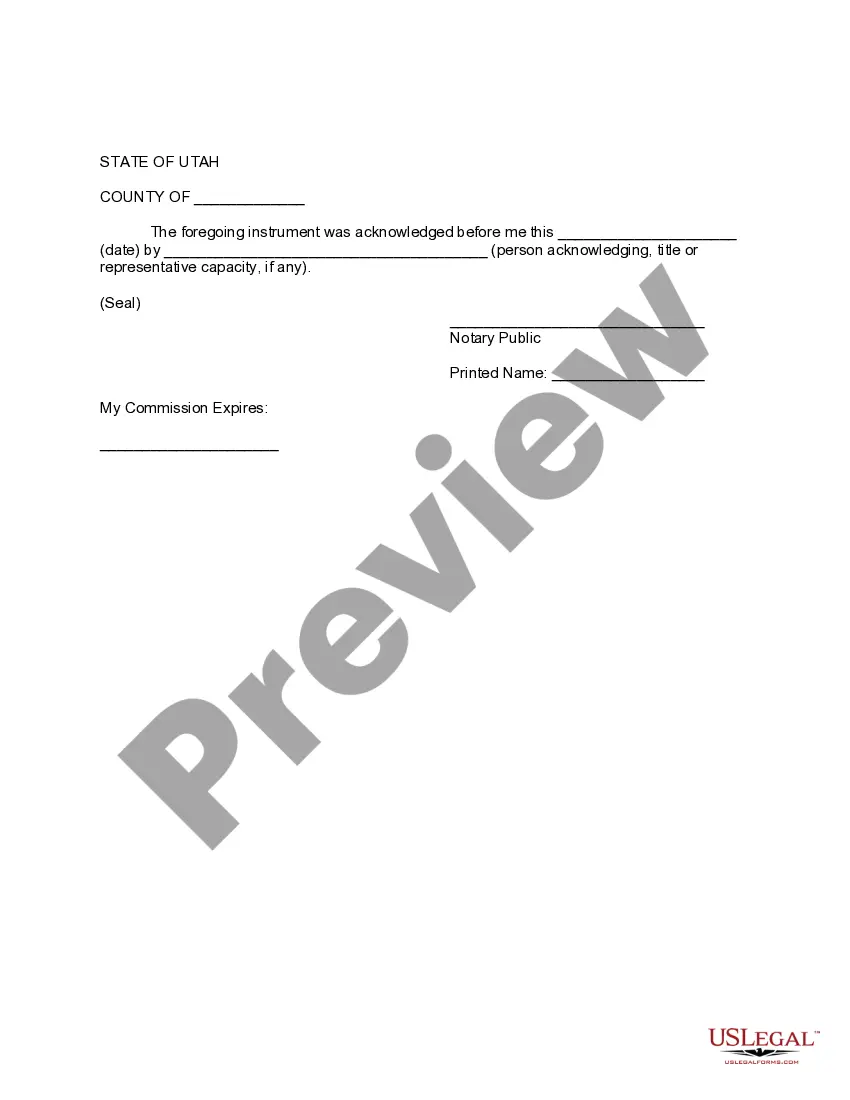

This Financial Account Transfer to Living Trust form is for transferring bank and other financial accounts to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public. Assignor(s) with this form will assign, convey, and deliver to the Assignee all of the Assignors right, title, and interest in and to the described property.The assignment includes, but is not limited to, all cash and securities held in the accounts.

Title: Comprehensive Guide: West Valley City Utah Financial Account Transfer to Living Trust Introduction: The process of transferring financial accounts to a living trust in West Valley City, Utah, offers individuals the opportunity to protect their assets, streamline inheritance procedures, and ensure the smooth transfer of wealth to their beneficiaries. In this comprehensive guide, we will delve into the details of different types of financial account transfers to living trusts, addressing their significance and the legal considerations involved. Types of West Valley City Utah Financial Account Transfer to Living Trust: 1. Checking and Savings Accounts: Securely transferring these accounts to a living trust allows for efficient management and uninterrupted access to funds for both the granter and beneficiaries. 2. Investment Accounts: From individual brokerage accounts to stocks, bonds, and mutual funds, transferring investment accounts to a living trust ensures that asset distribution follows predetermined provisions and minimizes the delays associated with probate. 3. Retirement Accounts: By designating a living trust as the beneficiary of an IRA (Individual Retirement Account), 401(k), or similar retirement accounts, individuals can control the posthumous distribution, maximize tax benefits, and potentially extend the tax-deferred growth for beneficiaries. 4. Marketable Securities: Transferring marketable securities such as stocks and bonds to a living trust streamlines the transfer process, eliminates the hassles of probate, and simplifies the management of these assets for the trustee. 5. Real Estate: While not classified as a financial account, transferring properties to a living trust is essential for a complete estate plan. West Valley City residents can transfer ownership of real estate into their trust, ensuring efficient property distribution and potential tax benefits. 6. Business Accounts: Business owners in West Valley City can transfer financial accounts associated with their enterprises to a living trust, providing continuity, protection, and clarity regarding business succession plans. Key Considerations and Benefits: 1. Probate Avoidance: Transferring financial accounts to a living trust helps bypass the time-consuming and costly probate process, allowing beneficiaries to access funds more quickly. 2. Privacy: Unlike probate, which is a public process, financial account transfers to a living trust offer greater privacy by keeping the transfer details confidential. 3. Incapacity Planning: Living trusts enable individuals to plan for potential incapacity, as they can appoint a successor trustee to manage their financial affairs seamlessly if they become unable to do so themselves. 4. Flexibility and Control: Individuals can modify or revoke the living trust during their lifetime, granting them the flexibility to adjust beneficiary designations and asset allocations as needed. 5. Estate Tax Planning: Carefully planned financial account transfers to a living trust can help mitigate estate taxes and provide potential benefits for high-net-worth individuals. Conclusion: In experiencing the peace of mind that comes with ensuring a smooth transfer of financial accounts to a living trust in West Valley City, Utah, individuals safeguard their assets, protect their beneficiaries, and simplify the estate settlement process. Familiarity with the various types of financial account transfers and their legal considerations empowers individuals to make informed decisions as they craft an effective estate plan. Seek guidance from a qualified estate planning attorney to navigate this process with confidence.Title: Comprehensive Guide: West Valley City Utah Financial Account Transfer to Living Trust Introduction: The process of transferring financial accounts to a living trust in West Valley City, Utah, offers individuals the opportunity to protect their assets, streamline inheritance procedures, and ensure the smooth transfer of wealth to their beneficiaries. In this comprehensive guide, we will delve into the details of different types of financial account transfers to living trusts, addressing their significance and the legal considerations involved. Types of West Valley City Utah Financial Account Transfer to Living Trust: 1. Checking and Savings Accounts: Securely transferring these accounts to a living trust allows for efficient management and uninterrupted access to funds for both the granter and beneficiaries. 2. Investment Accounts: From individual brokerage accounts to stocks, bonds, and mutual funds, transferring investment accounts to a living trust ensures that asset distribution follows predetermined provisions and minimizes the delays associated with probate. 3. Retirement Accounts: By designating a living trust as the beneficiary of an IRA (Individual Retirement Account), 401(k), or similar retirement accounts, individuals can control the posthumous distribution, maximize tax benefits, and potentially extend the tax-deferred growth for beneficiaries. 4. Marketable Securities: Transferring marketable securities such as stocks and bonds to a living trust streamlines the transfer process, eliminates the hassles of probate, and simplifies the management of these assets for the trustee. 5. Real Estate: While not classified as a financial account, transferring properties to a living trust is essential for a complete estate plan. West Valley City residents can transfer ownership of real estate into their trust, ensuring efficient property distribution and potential tax benefits. 6. Business Accounts: Business owners in West Valley City can transfer financial accounts associated with their enterprises to a living trust, providing continuity, protection, and clarity regarding business succession plans. Key Considerations and Benefits: 1. Probate Avoidance: Transferring financial accounts to a living trust helps bypass the time-consuming and costly probate process, allowing beneficiaries to access funds more quickly. 2. Privacy: Unlike probate, which is a public process, financial account transfers to a living trust offer greater privacy by keeping the transfer details confidential. 3. Incapacity Planning: Living trusts enable individuals to plan for potential incapacity, as they can appoint a successor trustee to manage their financial affairs seamlessly if they become unable to do so themselves. 4. Flexibility and Control: Individuals can modify or revoke the living trust during their lifetime, granting them the flexibility to adjust beneficiary designations and asset allocations as needed. 5. Estate Tax Planning: Carefully planned financial account transfers to a living trust can help mitigate estate taxes and provide potential benefits for high-net-worth individuals. Conclusion: In experiencing the peace of mind that comes with ensuring a smooth transfer of financial accounts to a living trust in West Valley City, Utah, individuals safeguard their assets, protect their beneficiaries, and simplify the estate settlement process. Familiarity with the various types of financial account transfers and their legal considerations empowers individuals to make informed decisions as they craft an effective estate plan. Seek guidance from a qualified estate planning attorney to navigate this process with confidence.