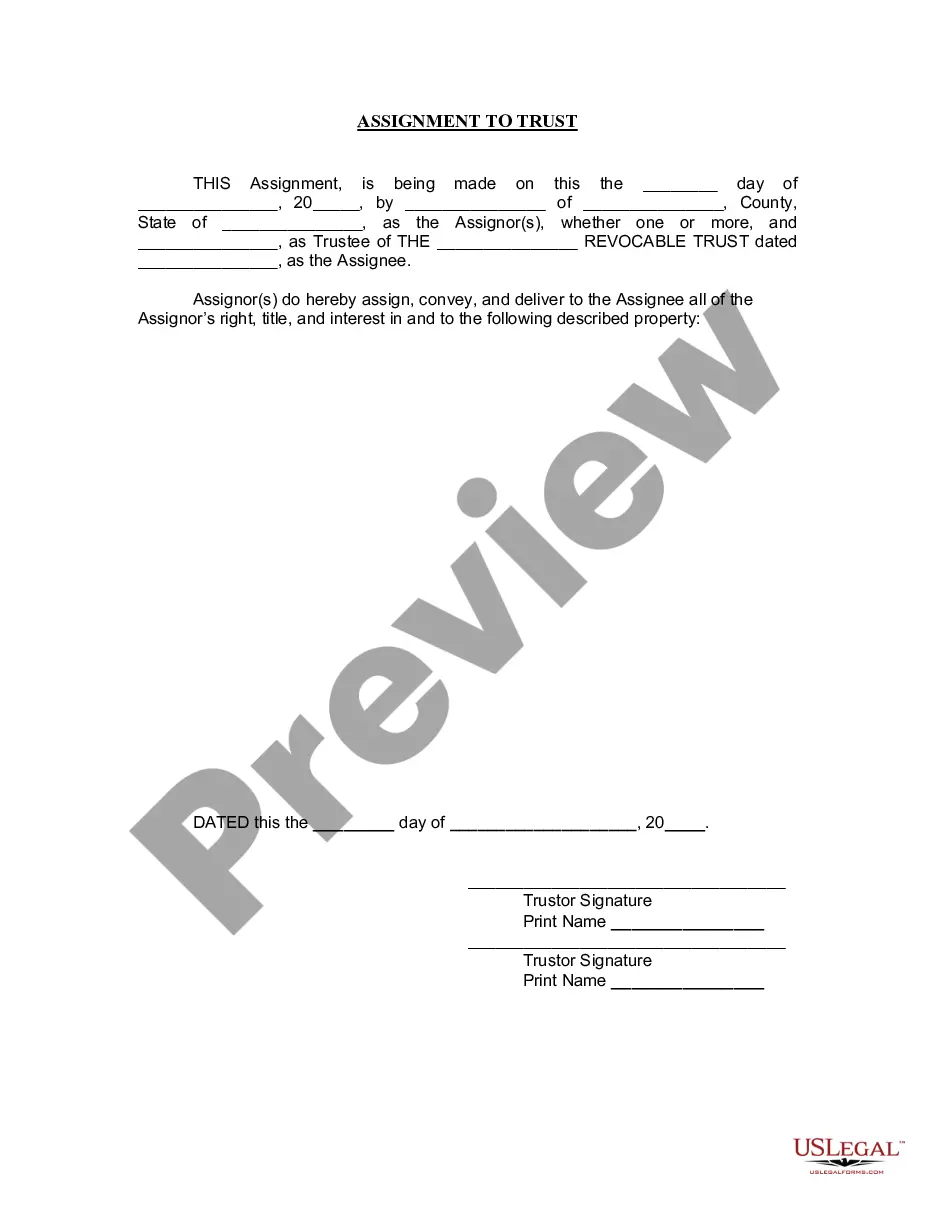

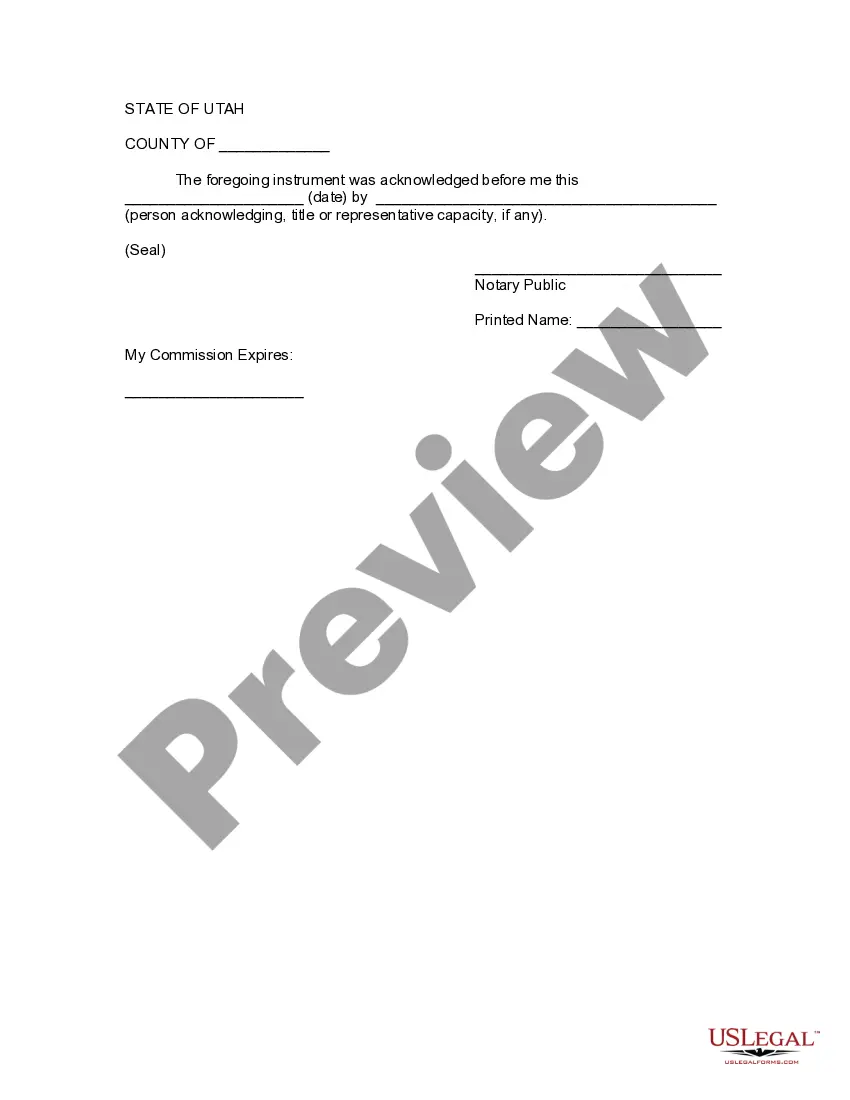

This Assignment to Trust form is used to assign all right, title and interest in specific property to a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public.

Provo Utah Assignment to Living Trust: A Comprehensive Overview In Provo, Utah, Assignment to Living Trust is a legal process that allows individuals to transfer their assets into a trust agreement during their lifetime. By doing so, they can retain control over their assets while also ensuring seamless asset management and distribution in the future. This detailed description will explore the various types of Provo Utah Assignment to Living Trust and their significance, using relevant keywords to provide a comprehensive understanding of this legal concept. Living Trust: A living trust, also known as an inter vivos trust, is a document that designates a trustee to manage assets on behalf of the creator (granter) of the trust during their lifetime. The granter can make changes to the trust or revoke it at any time, ensuring flexibility and control over their assets for the duration of their life. Provo, Utah Assignment to Living Trust: Refers specifically to the legal process of assigning or transferring assets into a living trust in Provo, Utah. It entails the preparation of legal documents and transferring ownership of assets from an individual's name to the trust's name. Revocable Living Trust: This type of living trust allows the granter to modify, amend, or revoke the trust during their lifetime. Assets held within a revocable living trust avoid probate upon the granter's death, providing privacy and efficiency in asset distribution. Irrevocable Living Trust: In contrast to revocable living trusts, an irrevocable living trust cannot be altered or revoked once created. Once assets are transferred to the trust, the granter relinquishes ownership and controls over them. Irrevocable trusts are often used for estate planning purposes, including reducing estate taxes and protecting assets from creditors. Pour-Over Will: A pour-over will is a supplementary document used alongside a living trust. It acts as a safety net, directing any assets not transferred to the trust during the granter's lifetime into the trust upon their death. The will serves as a backup plan to ensure all assets are eventually distributed according to the granter's wishes. Asset Protection Trust: This type of trust aims to safeguard assets from potential creditors or legal claims. By assigning assets to an asset protection trust, individuals can shield their wealth from unforeseen risks, ensuring its preservation for future generations. Asset protection trusts often require careful planning and consideration of legal and financial implications. Special Needs Trust: A special needs trust provides for the financial well-being of individuals with disabilities. It allows them to receive benefits while keeping their eligibility for government assistance programs intact. Assets held in a special needs trust can be used to supplement government benefits, providing essential resources for the beneficiary's care and quality of life. Provo, Utah Assignment to Living Trust serves as a valuable estate planning tool, offering individuals the opportunity to manage their assets efficiently and effectively during their lifetime and beyond. Whether utilizing a revocable living trust, irrevocable living trust, or any other specialized type of living trust, individuals in Provo, Utah, can create a comprehensive plan tailored to their unique circumstances while ensuring that their wishes are carried out with precision and protection.

Provo Utah Assignment to Living Trust: A Comprehensive Overview In Provo, Utah, Assignment to Living Trust is a legal process that allows individuals to transfer their assets into a trust agreement during their lifetime. By doing so, they can retain control over their assets while also ensuring seamless asset management and distribution in the future. This detailed description will explore the various types of Provo Utah Assignment to Living Trust and their significance, using relevant keywords to provide a comprehensive understanding of this legal concept. Living Trust: A living trust, also known as an inter vivos trust, is a document that designates a trustee to manage assets on behalf of the creator (granter) of the trust during their lifetime. The granter can make changes to the trust or revoke it at any time, ensuring flexibility and control over their assets for the duration of their life. Provo, Utah Assignment to Living Trust: Refers specifically to the legal process of assigning or transferring assets into a living trust in Provo, Utah. It entails the preparation of legal documents and transferring ownership of assets from an individual's name to the trust's name. Revocable Living Trust: This type of living trust allows the granter to modify, amend, or revoke the trust during their lifetime. Assets held within a revocable living trust avoid probate upon the granter's death, providing privacy and efficiency in asset distribution. Irrevocable Living Trust: In contrast to revocable living trusts, an irrevocable living trust cannot be altered or revoked once created. Once assets are transferred to the trust, the granter relinquishes ownership and controls over them. Irrevocable trusts are often used for estate planning purposes, including reducing estate taxes and protecting assets from creditors. Pour-Over Will: A pour-over will is a supplementary document used alongside a living trust. It acts as a safety net, directing any assets not transferred to the trust during the granter's lifetime into the trust upon their death. The will serves as a backup plan to ensure all assets are eventually distributed according to the granter's wishes. Asset Protection Trust: This type of trust aims to safeguard assets from potential creditors or legal claims. By assigning assets to an asset protection trust, individuals can shield their wealth from unforeseen risks, ensuring its preservation for future generations. Asset protection trusts often require careful planning and consideration of legal and financial implications. Special Needs Trust: A special needs trust provides for the financial well-being of individuals with disabilities. It allows them to receive benefits while keeping their eligibility for government assistance programs intact. Assets held in a special needs trust can be used to supplement government benefits, providing essential resources for the beneficiary's care and quality of life. Provo, Utah Assignment to Living Trust serves as a valuable estate planning tool, offering individuals the opportunity to manage their assets efficiently and effectively during their lifetime and beyond. Whether utilizing a revocable living trust, irrevocable living trust, or any other specialized type of living trust, individuals in Provo, Utah, can create a comprehensive plan tailored to their unique circumstances while ensuring that their wishes are carried out with precision and protection.