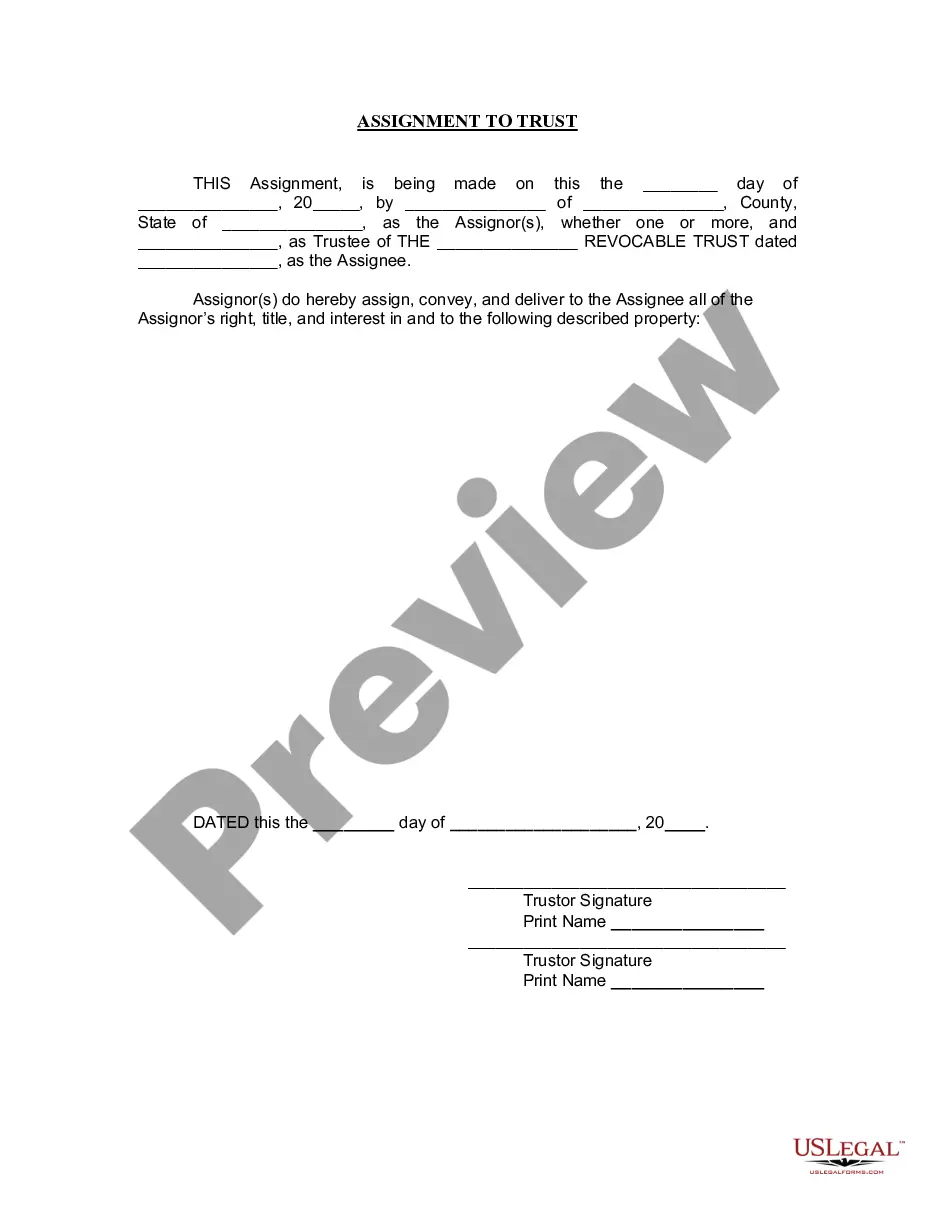

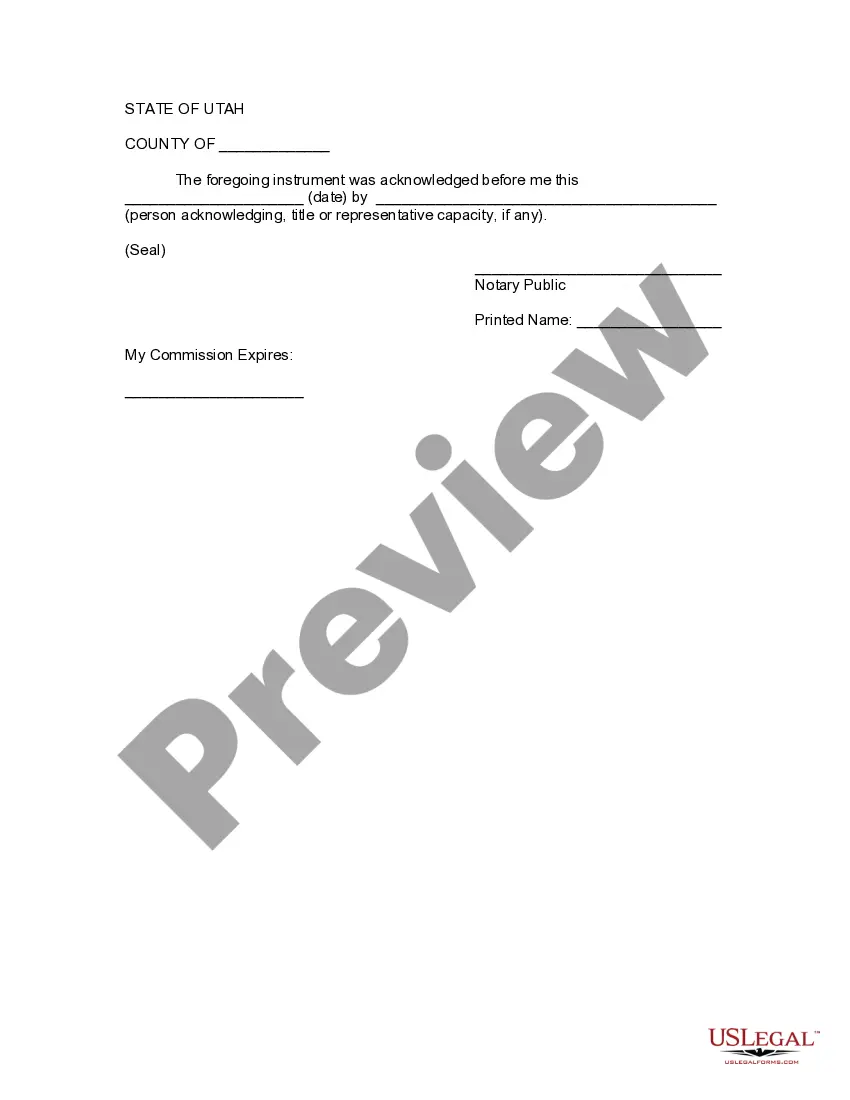

This Assignment to Trust form is used to assign all right, title and interest in specific property to a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public.

Salt Lake Utah Assignment to Living Trust is a legal process in which individuals or families transfer their assets to a trust for management and distribution purposes. This assignment is specifically related to residents of Salt Lake City, Utah, ensuring that their assets and property are handled according to their wishes. A living trust is a legal document established during an individual's lifetime to manage their assets. It allows them to transfer ownership of their property, investments, bank accounts, and other assets into the trust. This enables them to retain control over those assets while also providing for smooth management and distribution of these assets after their passing. The Salt Lake Utah Assignment to Living Trust offers several benefits to residents of Salt Lake City. Firstly, it allows for privacy as the assets placed in the trust are not subjected to probate court proceedings, eliminating the public scrutiny and potential delays associated with the probate process. Secondly, it provides flexibility and control, allowing individuals to define specific instructions and conditions regarding the distribution of their assets. This includes stating who will inherit the property, how it will be distributed among beneficiaries, and even setting up provisions for minor children or individuals with special needs. Furthermore, Salt Lake Utah Assignment to Living Trust enables individuals to plan for incapacity. In the event of disability or incapacity, a trust can designate a successor trustee to manage and distribute assets on the individual's behalf, avoiding the need for conservatorship or guardianship proceedings. Types of Salt Lake Utah Assignment to Living Trust can include: 1. Revocable Living Trust: This type of trust is the most common and allows the individual who established it (granter) to maintain control and make changes or revoke the trust during their lifetime. The granter can also act as the trustee initially and appoint a successor trustee to manage the trust after their passing or incapacity. 2. Irrevocable Living Trust: Unlike a revocable trust, an irrevocable living trust cannot be changed or revoked once established. Assets transferred to this trust are considered separate from the granter's estate, potentially providing certain tax advantages. It is important to note that the transfer of assets to an irrevocable trust is permanent. 3. Testamentary Trust: This type of trust is established through a will and comes into effect after the granter's passing. Unlike a living trust, a testamentary trust does not avoid probate but provides instructions on how the assets should be distributed to beneficiaries after probate proceedings. 4. Special Needs Trust: A special needs trust is designed to protect the interests of individuals with special needs while allowing them to receive government assistance, such as Medicaid or Supplemental Security Income (SSI). This type of trust ensures that assets left for the benefit of the person with special needs to not disqualify them for vital government support. In conclusion, Salt Lake Utah Assignment to Living Trust is a crucial legal process that enables Salt Lake City residents to effectively manage and distribute their assets according to their wishes. By establishing a living trust, individuals can protect their privacy, maintain control, plan for incapacity, and ensure seamless asset distribution to their chosen beneficiaries. The different types of trusts available, such as revocable, irrevocable, testamentary, and special needs trusts, provide various options to tailor the trust to individual circumstances and goals.Salt Lake Utah Assignment to Living Trust is a legal process in which individuals or families transfer their assets to a trust for management and distribution purposes. This assignment is specifically related to residents of Salt Lake City, Utah, ensuring that their assets and property are handled according to their wishes. A living trust is a legal document established during an individual's lifetime to manage their assets. It allows them to transfer ownership of their property, investments, bank accounts, and other assets into the trust. This enables them to retain control over those assets while also providing for smooth management and distribution of these assets after their passing. The Salt Lake Utah Assignment to Living Trust offers several benefits to residents of Salt Lake City. Firstly, it allows for privacy as the assets placed in the trust are not subjected to probate court proceedings, eliminating the public scrutiny and potential delays associated with the probate process. Secondly, it provides flexibility and control, allowing individuals to define specific instructions and conditions regarding the distribution of their assets. This includes stating who will inherit the property, how it will be distributed among beneficiaries, and even setting up provisions for minor children or individuals with special needs. Furthermore, Salt Lake Utah Assignment to Living Trust enables individuals to plan for incapacity. In the event of disability or incapacity, a trust can designate a successor trustee to manage and distribute assets on the individual's behalf, avoiding the need for conservatorship or guardianship proceedings. Types of Salt Lake Utah Assignment to Living Trust can include: 1. Revocable Living Trust: This type of trust is the most common and allows the individual who established it (granter) to maintain control and make changes or revoke the trust during their lifetime. The granter can also act as the trustee initially and appoint a successor trustee to manage the trust after their passing or incapacity. 2. Irrevocable Living Trust: Unlike a revocable trust, an irrevocable living trust cannot be changed or revoked once established. Assets transferred to this trust are considered separate from the granter's estate, potentially providing certain tax advantages. It is important to note that the transfer of assets to an irrevocable trust is permanent. 3. Testamentary Trust: This type of trust is established through a will and comes into effect after the granter's passing. Unlike a living trust, a testamentary trust does not avoid probate but provides instructions on how the assets should be distributed to beneficiaries after probate proceedings. 4. Special Needs Trust: A special needs trust is designed to protect the interests of individuals with special needs while allowing them to receive government assistance, such as Medicaid or Supplemental Security Income (SSI). This type of trust ensures that assets left for the benefit of the person with special needs to not disqualify them for vital government support. In conclusion, Salt Lake Utah Assignment to Living Trust is a crucial legal process that enables Salt Lake City residents to effectively manage and distribute their assets according to their wishes. By establishing a living trust, individuals can protect their privacy, maintain control, plan for incapacity, and ensure seamless asset distribution to their chosen beneficiaries. The different types of trusts available, such as revocable, irrevocable, testamentary, and special needs trusts, provide various options to tailor the trust to individual circumstances and goals.