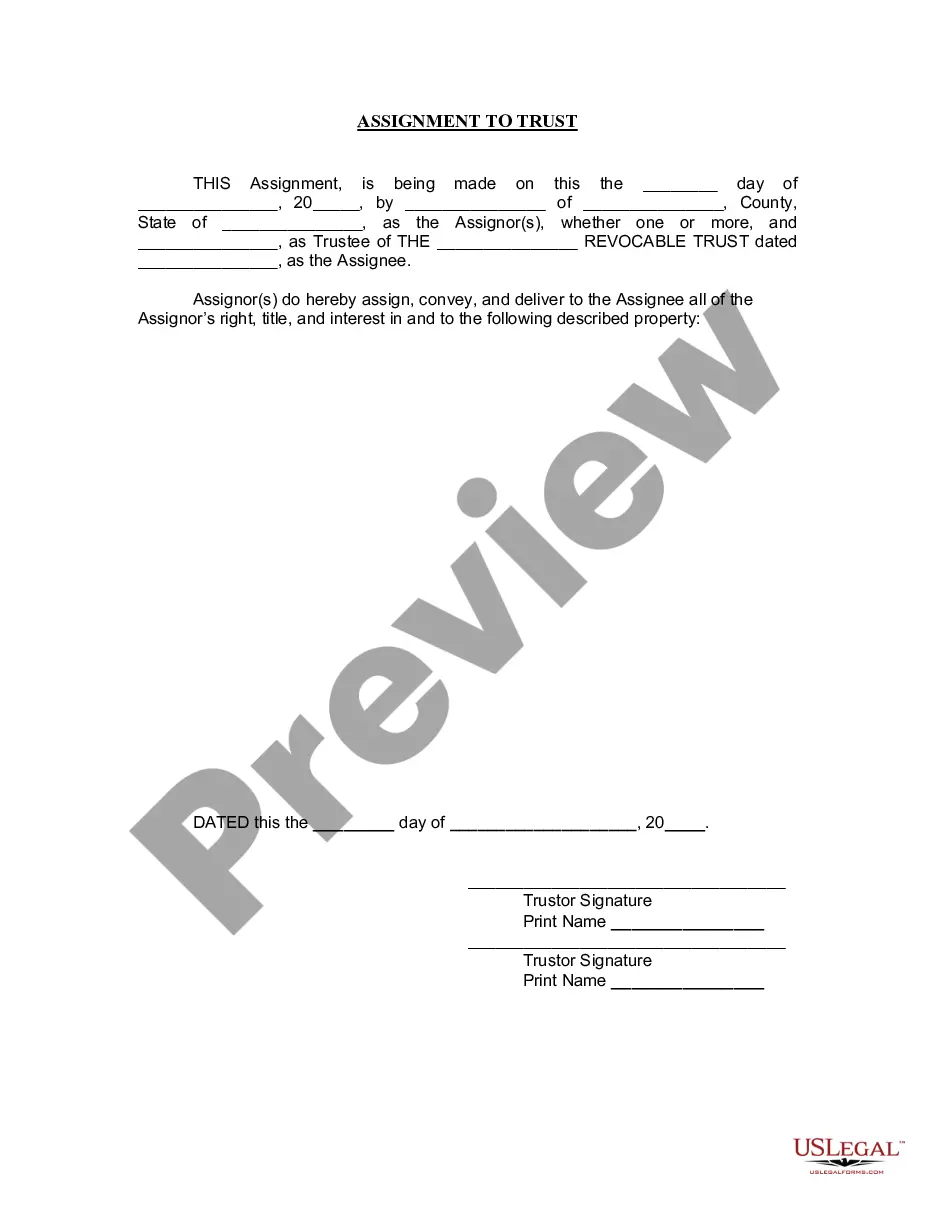

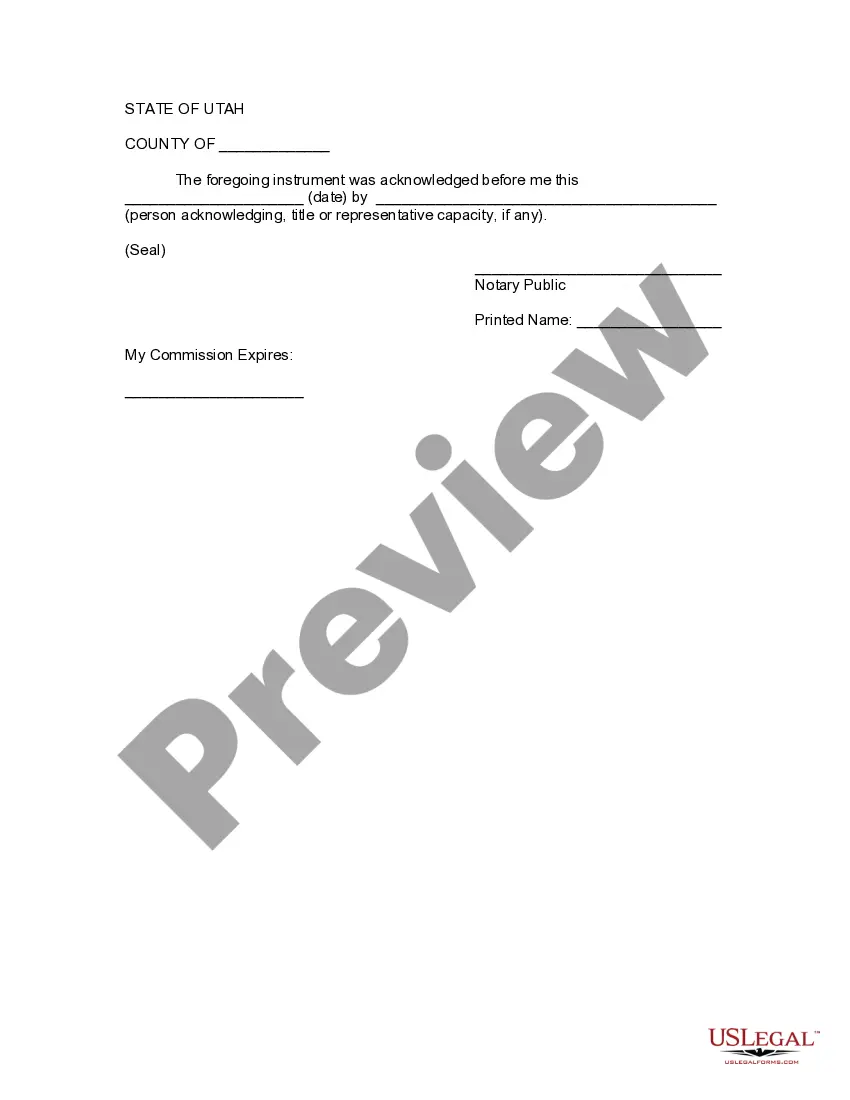

This Assignment to Trust form is used to assign all right, title and interest in specific property to a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public.

Salt Lake City Utah Assignment to Living Trust is a legal document that allows individuals in Salt Lake City, Utah, to transfer their assets into a living trust. This assignment ensures that assets held by an individual, such as property, investments, bank accounts, and personal belongings, are properly managed and distributed according to their wishes after they pass away. A living trust is established by the granter, who is the person creating the trust and transferring their assets into it. The granter may appoint themselves as the trustee, or they can select a trusted family member, friend, or a professional trustee to manage the trust on their behalf. The trustee is responsible for safeguarding the assets and making sure that they are disbursed according to the granter's instructions. There are several types of Salt Lake City Utah Assignment to Living Trust, including: 1. Revocable Living Trust: This type of trust allows the granter to amend, modify, or revoke the trust during their lifetime. It provides flexibility and control over the assets held in the trust, allowing changes to be made as circumstances or wishes evolve. 2. Irrevocable Living Trust: Unlike a revocable trust, an irrevocable living trust cannot be changed or revoked once it has been established. This type of trust is often used for estate planning purposes, as it provides asset protection and may offer certain tax benefits. 3. Testamentary Living Trust: This trust is created through a will and does not become effective until the granter passes away. It allows individuals to specify how their assets should be managed and distributed after their death. 4. Special Needs Trust: This type of trust is designed for individuals with disabilities or special needs. It ensures that the beneficiary's eligibility for government benefits is not affected while still providing supplemental support for their care and well-being. 5. Charitable Living Trust: A charitable trust allows individuals to leave a portion of their assets to a charitable organization or cause of their choice. This type of trust provides tax benefits while supporting philanthropic endeavors. Creating an Assignment to Living Trust in Salt Lake City, Utah, offers individuals the opportunity to protect their assets, minimize probate costs, maintain privacy, and ensure that their wishes are carried out after their passing. It is essential to consult with an experienced attorney familiar with Utah state laws to establish a living trust that aligns with individual circumstances and goals.Salt Lake City Utah Assignment to Living Trust is a legal document that allows individuals in Salt Lake City, Utah, to transfer their assets into a living trust. This assignment ensures that assets held by an individual, such as property, investments, bank accounts, and personal belongings, are properly managed and distributed according to their wishes after they pass away. A living trust is established by the granter, who is the person creating the trust and transferring their assets into it. The granter may appoint themselves as the trustee, or they can select a trusted family member, friend, or a professional trustee to manage the trust on their behalf. The trustee is responsible for safeguarding the assets and making sure that they are disbursed according to the granter's instructions. There are several types of Salt Lake City Utah Assignment to Living Trust, including: 1. Revocable Living Trust: This type of trust allows the granter to amend, modify, or revoke the trust during their lifetime. It provides flexibility and control over the assets held in the trust, allowing changes to be made as circumstances or wishes evolve. 2. Irrevocable Living Trust: Unlike a revocable trust, an irrevocable living trust cannot be changed or revoked once it has been established. This type of trust is often used for estate planning purposes, as it provides asset protection and may offer certain tax benefits. 3. Testamentary Living Trust: This trust is created through a will and does not become effective until the granter passes away. It allows individuals to specify how their assets should be managed and distributed after their death. 4. Special Needs Trust: This type of trust is designed for individuals with disabilities or special needs. It ensures that the beneficiary's eligibility for government benefits is not affected while still providing supplemental support for their care and well-being. 5. Charitable Living Trust: A charitable trust allows individuals to leave a portion of their assets to a charitable organization or cause of their choice. This type of trust provides tax benefits while supporting philanthropic endeavors. Creating an Assignment to Living Trust in Salt Lake City, Utah, offers individuals the opportunity to protect their assets, minimize probate costs, maintain privacy, and ensure that their wishes are carried out after their passing. It is essential to consult with an experienced attorney familiar with Utah state laws to establish a living trust that aligns with individual circumstances and goals.