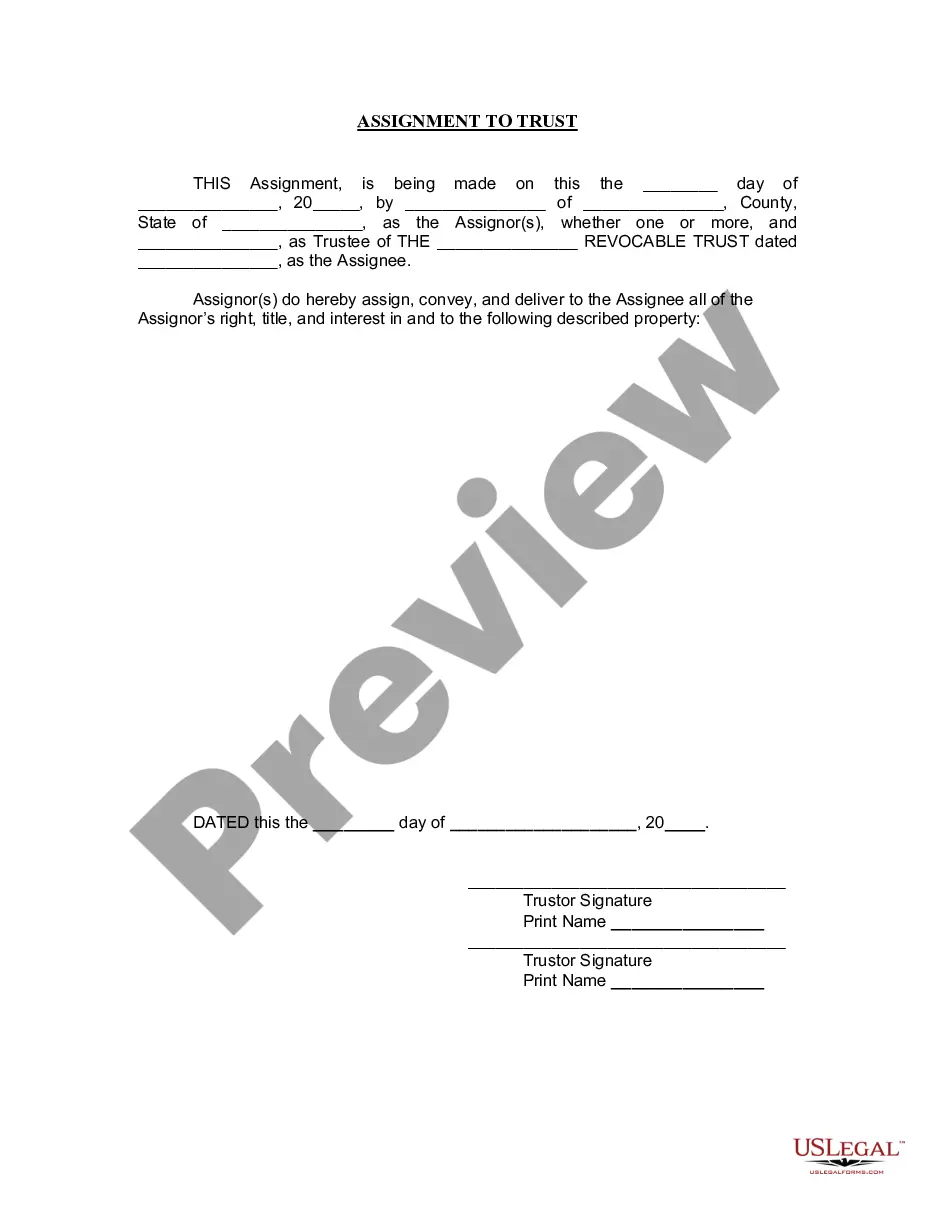

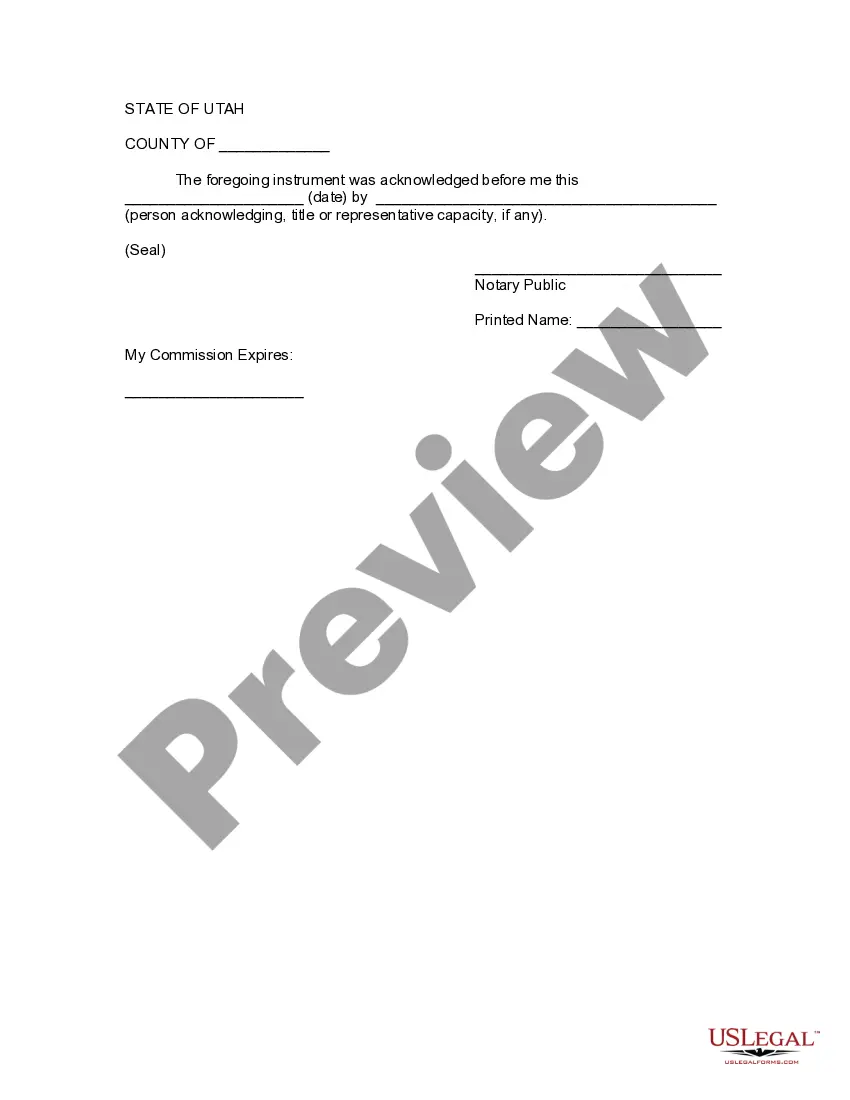

This Assignment to Trust form is used to assign all right, title and interest in specific property to a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public.

Title: Understanding the West Jordan Utah Assignment to Living Trust: A Comprehensive Overview Introduction: In the realm of estate planning, a living trust plays a crucial role in protecting and distributing assets efficiently. This article aims to provide an in-depth description of what the West Jordan Utah Assignment to Living Trust entails, exploring its features, benefits, and different types available to individuals and families residing in the West Jordan region. 1. Definition and Purpose of a Living Trust: A living trust is a legal document that allows individuals to transfer their assets into a trust during their lifetime, ensuring their efficient management and distribution upon death or incapacity. It enables individuals to maintain control over their assets and avoid the probate process, providing a smooth and private transition of wealth to their beneficiaries. 2. Unique Features of the West Jordan Utah Assignment to Living Trust: The West Jordan Utah Assignment to Living Trust is specifically tailored to meet the legal requirements and preferences of residents in West Jordan. It encompasses the following key features: a) Revocability: The West Jordan Assignment to Living Trust allows individuals to amend or revoke the trust at any time during their lifetime, providing flexibility and ensuring the trust can adapt to changing circumstances. b) Asset Protection: This trust offers safeguards to protect assets from potential creditors, lawsuits, or other financial threats, helping to preserve wealth for the designated beneficiaries. c) Privacy and Confidentiality: By avoiding probate, the West Jordan Assignment to Living Trust ensures confidentiality and privacy, as the trust is not publicly recorded, offering a higher level of protection for individuals and their beneficiaries. d) Incapacity Planning: The trust includes provisions for handling assets and appointing a successor trustee in the event of the granter's incapacity, ensuring a smooth transition of management without the need for court intervention. 3. Types of West Jordan Utah Assignment to Living Trust: West Jordan residents have access to several types of living trusts, designed to cater to varying preferences and estate planning needs. These include: a) Revocable Living Trust: The most common type, allowing granters to retain complete control and ownership of their assets while providing the flexibility to modify or revoke the trust as needed. b) Irrevocable Living Trust: This type of trust relinquishes the granter's control over assets once transferred, offering potential tax benefits and protection against estate taxes and creditors. c) AB Living Trust (Revocable): Also known as a "Marital and Family Trust," this type of trust is often used by couples to minimize estate taxes upon the death of the first spouse, ensuring the seamless transfer of assets to the surviving spouse while preserving the intended beneficiaries' inheritance. Conclusion: The West Jordan Utah Assignment to Living Trust offers residents an effective and flexible estate planning tool to address their specific needs. By utilizing the trust's unique features and understanding the different types available, individuals and families can protect their assets, maintain privacy, and ensure a smooth transition of wealth to their loved ones in accordance with their wishes. Seek professional legal advice to understand the intricate details and implications of the West Jordan Utah Assignment to Living Trust for optimal estate planning.Title: Understanding the West Jordan Utah Assignment to Living Trust: A Comprehensive Overview Introduction: In the realm of estate planning, a living trust plays a crucial role in protecting and distributing assets efficiently. This article aims to provide an in-depth description of what the West Jordan Utah Assignment to Living Trust entails, exploring its features, benefits, and different types available to individuals and families residing in the West Jordan region. 1. Definition and Purpose of a Living Trust: A living trust is a legal document that allows individuals to transfer their assets into a trust during their lifetime, ensuring their efficient management and distribution upon death or incapacity. It enables individuals to maintain control over their assets and avoid the probate process, providing a smooth and private transition of wealth to their beneficiaries. 2. Unique Features of the West Jordan Utah Assignment to Living Trust: The West Jordan Utah Assignment to Living Trust is specifically tailored to meet the legal requirements and preferences of residents in West Jordan. It encompasses the following key features: a) Revocability: The West Jordan Assignment to Living Trust allows individuals to amend or revoke the trust at any time during their lifetime, providing flexibility and ensuring the trust can adapt to changing circumstances. b) Asset Protection: This trust offers safeguards to protect assets from potential creditors, lawsuits, or other financial threats, helping to preserve wealth for the designated beneficiaries. c) Privacy and Confidentiality: By avoiding probate, the West Jordan Assignment to Living Trust ensures confidentiality and privacy, as the trust is not publicly recorded, offering a higher level of protection for individuals and their beneficiaries. d) Incapacity Planning: The trust includes provisions for handling assets and appointing a successor trustee in the event of the granter's incapacity, ensuring a smooth transition of management without the need for court intervention. 3. Types of West Jordan Utah Assignment to Living Trust: West Jordan residents have access to several types of living trusts, designed to cater to varying preferences and estate planning needs. These include: a) Revocable Living Trust: The most common type, allowing granters to retain complete control and ownership of their assets while providing the flexibility to modify or revoke the trust as needed. b) Irrevocable Living Trust: This type of trust relinquishes the granter's control over assets once transferred, offering potential tax benefits and protection against estate taxes and creditors. c) AB Living Trust (Revocable): Also known as a "Marital and Family Trust," this type of trust is often used by couples to minimize estate taxes upon the death of the first spouse, ensuring the seamless transfer of assets to the surviving spouse while preserving the intended beneficiaries' inheritance. Conclusion: The West Jordan Utah Assignment to Living Trust offers residents an effective and flexible estate planning tool to address their specific needs. By utilizing the trust's unique features and understanding the different types available, individuals and families can protect their assets, maintain privacy, and ensure a smooth transition of wealth to their loved ones in accordance with their wishes. Seek professional legal advice to understand the intricate details and implications of the West Jordan Utah Assignment to Living Trust for optimal estate planning.