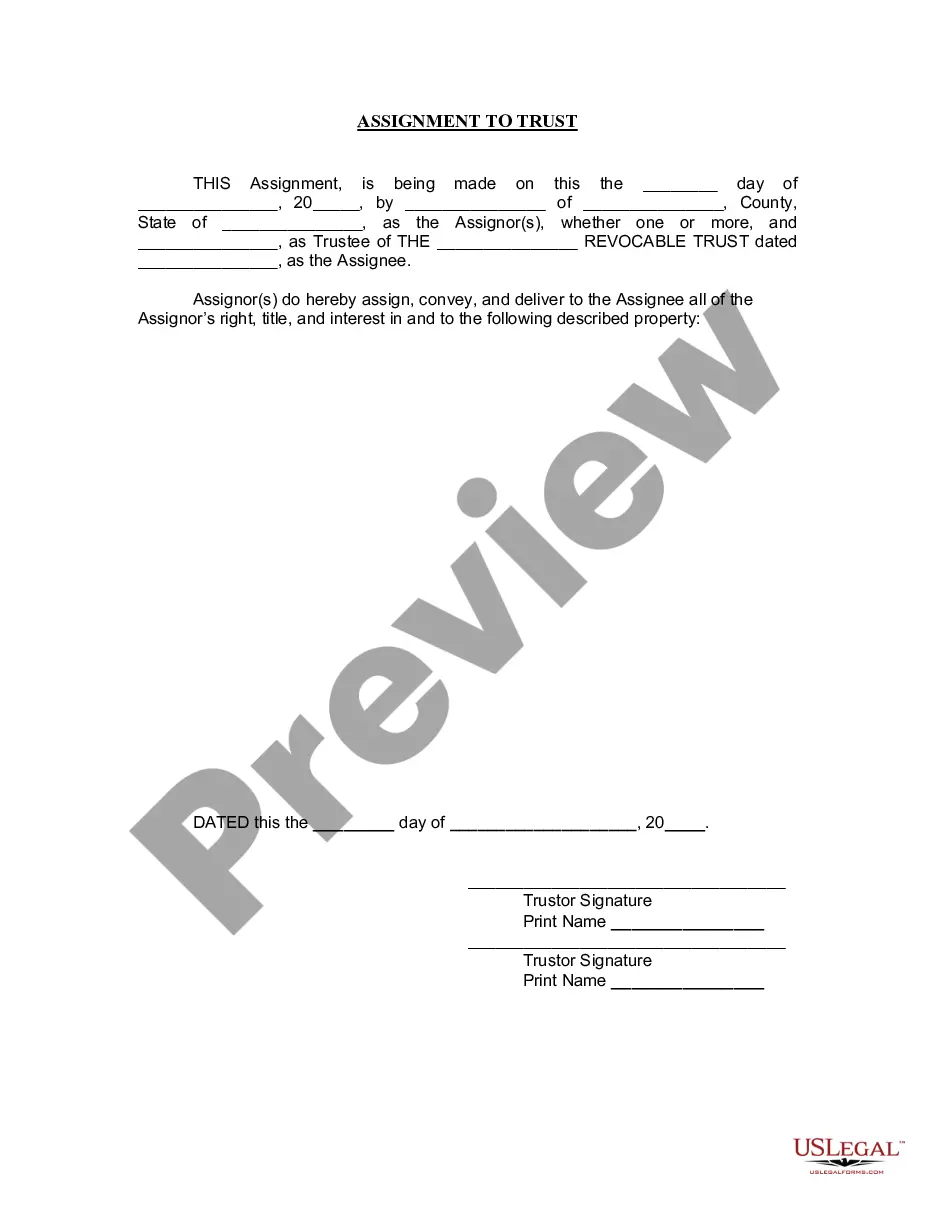

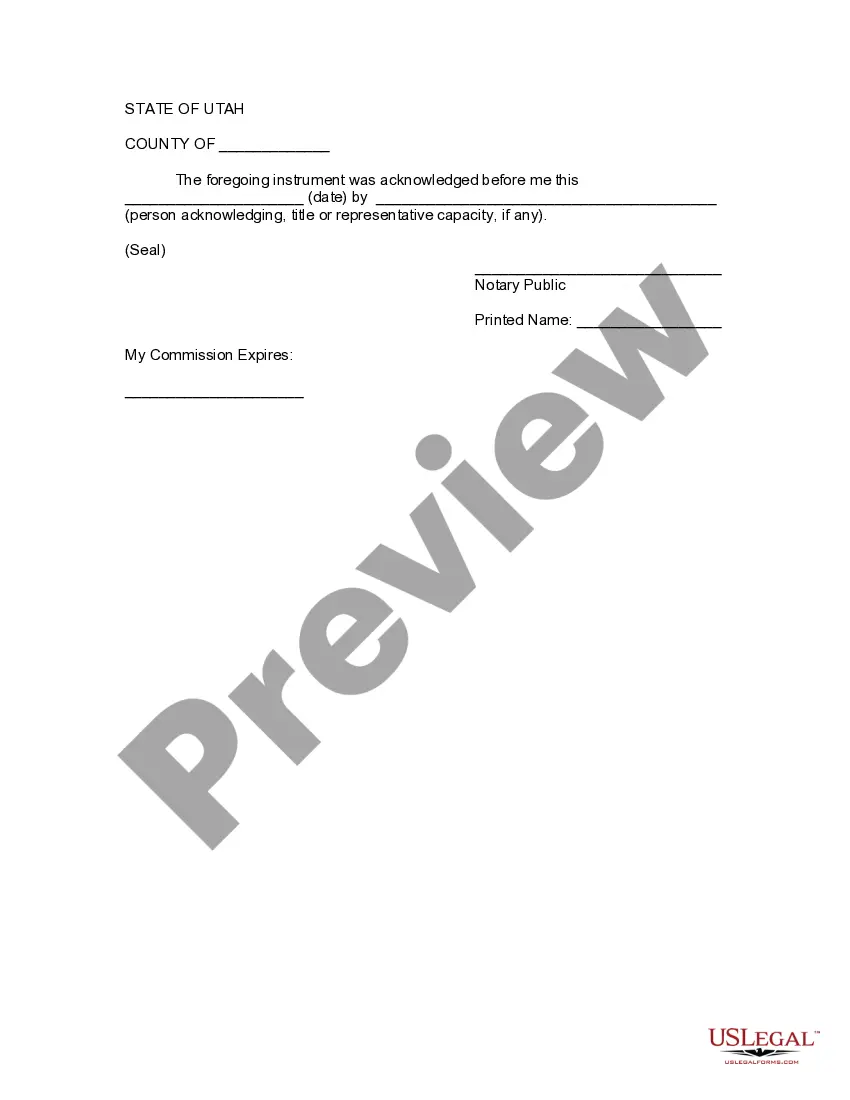

This Assignment to Trust form is used to assign all right, title and interest in specific property to a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public.

West Valley City, Utah Assignment to Living Trust: Exploring the Benefits and Process In West Valley City, Utah, an assignment to living trust is a legal document that enables individuals to transfer their property and assets into a trust during their lifetime, with the assurance that it will be distributed according to their wishes after they pass away. This process offers numerous advantages for estate planning and inheritance purposes, providing a seamless transition of wealth to beneficiaries, while helping to avoid complications and delays associated with probate. Types of West Valley City, Utah Assignment to Living Trust: 1. Revocable Living Trust: This is the most common type of living trust, allowing the granter (the person creating the trust) to maintain control over their assets during their lifetime. The trust can be modified or revoked at any time, and any income generated from the trust assets is typically taxed under the granter's name. 2. Irrevocable Living Trust: In contrast to a revocable trust, an irrevocable living trust permanently transfers ownership of the assets to the trust, relinquishing the granter's control. This type of trust provides potential tax benefits and can offer protection against creditors and certain estate taxes, as the assets no longer belong to the granter. Benefits of West Valley City, Utah Assignment to Living Trust: 1. Avoidance of Probate: One of the key benefits is the ability to bypass probate, the legal process of validating a will and distributing assets after an individual's death. By placing assets in a living trust, they are no longer subject to probate, saving time and reducing associated costs. 2. Privacy: Unlike a will that becomes a public record during probate, an assignment to living trust keeps the distribution of assets private. This can be particularly useful for individuals who prefer to maintain the confidentiality of their estate. 3. Control and Flexibility: With a revocable living trust, the granter retains control over their assets and can easily make changes or adjustments as circumstances evolve. This flexibility ensures that the granter's wishes are carried out precisely. 4. Incapacity Planning: A living trust allows for effective management of assets in case of the granter's incapacity, ensuring that a designated successor trustee can take over management seamlessly. This helps avoid the need for court-appointed guardianship or conservatorship. 5. Minimization of Estate Taxes: For individuals with substantial estates, an irrevocable living trust can reduce estate taxes by removing assets from the granter's taxable estate, potentially resulting in significant tax savings for beneficiaries. Process of West Valley City, Utah Assignment to Living Trust: 1. Consultation: Begin by consulting with an experienced estate planning attorney in West Valley City, Utah. They will assess your unique circumstances and guide you in determining whether a living trust is suitable for your needs. 2. Creating the Trust: With the assistance of your attorney, you will draft the trust document, which includes provisions outlining how your assets will be managed and distributed. 3. Funding the Trust: Transfer ownership of your assets into the trust by re-titling them in the trust's name. This includes real estate, bank accounts, investments, and personal property. 4. Appointing a Trustee: Designate a trustee, who can be a family member, trusted friend, or professional entity, to oversee the trust and manage the assets according to your instructions. 5. Review and Update: Regularly review and update your living trust as circumstances change, such as the acquisition or sale of assets, changes in beneficiaries, or if your wishes evolve over time. By understanding the different types of West Valley City, Utah Assignment to Living Trust and the benefits it offers, individuals can make informed decisions regarding their estate planning strategies. Seeking advice from a knowledgeable attorney will ensure that your assets are safeguarded, your wishes are respected, and your loved ones are provided for after your passing.West Valley City, Utah Assignment to Living Trust: Exploring the Benefits and Process In West Valley City, Utah, an assignment to living trust is a legal document that enables individuals to transfer their property and assets into a trust during their lifetime, with the assurance that it will be distributed according to their wishes after they pass away. This process offers numerous advantages for estate planning and inheritance purposes, providing a seamless transition of wealth to beneficiaries, while helping to avoid complications and delays associated with probate. Types of West Valley City, Utah Assignment to Living Trust: 1. Revocable Living Trust: This is the most common type of living trust, allowing the granter (the person creating the trust) to maintain control over their assets during their lifetime. The trust can be modified or revoked at any time, and any income generated from the trust assets is typically taxed under the granter's name. 2. Irrevocable Living Trust: In contrast to a revocable trust, an irrevocable living trust permanently transfers ownership of the assets to the trust, relinquishing the granter's control. This type of trust provides potential tax benefits and can offer protection against creditors and certain estate taxes, as the assets no longer belong to the granter. Benefits of West Valley City, Utah Assignment to Living Trust: 1. Avoidance of Probate: One of the key benefits is the ability to bypass probate, the legal process of validating a will and distributing assets after an individual's death. By placing assets in a living trust, they are no longer subject to probate, saving time and reducing associated costs. 2. Privacy: Unlike a will that becomes a public record during probate, an assignment to living trust keeps the distribution of assets private. This can be particularly useful for individuals who prefer to maintain the confidentiality of their estate. 3. Control and Flexibility: With a revocable living trust, the granter retains control over their assets and can easily make changes or adjustments as circumstances evolve. This flexibility ensures that the granter's wishes are carried out precisely. 4. Incapacity Planning: A living trust allows for effective management of assets in case of the granter's incapacity, ensuring that a designated successor trustee can take over management seamlessly. This helps avoid the need for court-appointed guardianship or conservatorship. 5. Minimization of Estate Taxes: For individuals with substantial estates, an irrevocable living trust can reduce estate taxes by removing assets from the granter's taxable estate, potentially resulting in significant tax savings for beneficiaries. Process of West Valley City, Utah Assignment to Living Trust: 1. Consultation: Begin by consulting with an experienced estate planning attorney in West Valley City, Utah. They will assess your unique circumstances and guide you in determining whether a living trust is suitable for your needs. 2. Creating the Trust: With the assistance of your attorney, you will draft the trust document, which includes provisions outlining how your assets will be managed and distributed. 3. Funding the Trust: Transfer ownership of your assets into the trust by re-titling them in the trust's name. This includes real estate, bank accounts, investments, and personal property. 4. Appointing a Trustee: Designate a trustee, who can be a family member, trusted friend, or professional entity, to oversee the trust and manage the assets according to your instructions. 5. Review and Update: Regularly review and update your living trust as circumstances change, such as the acquisition or sale of assets, changes in beneficiaries, or if your wishes evolve over time. By understanding the different types of West Valley City, Utah Assignment to Living Trust and the benefits it offers, individuals can make informed decisions regarding their estate planning strategies. Seeking advice from a knowledgeable attorney will ensure that your assets are safeguarded, your wishes are respected, and your loved ones are provided for after your passing.