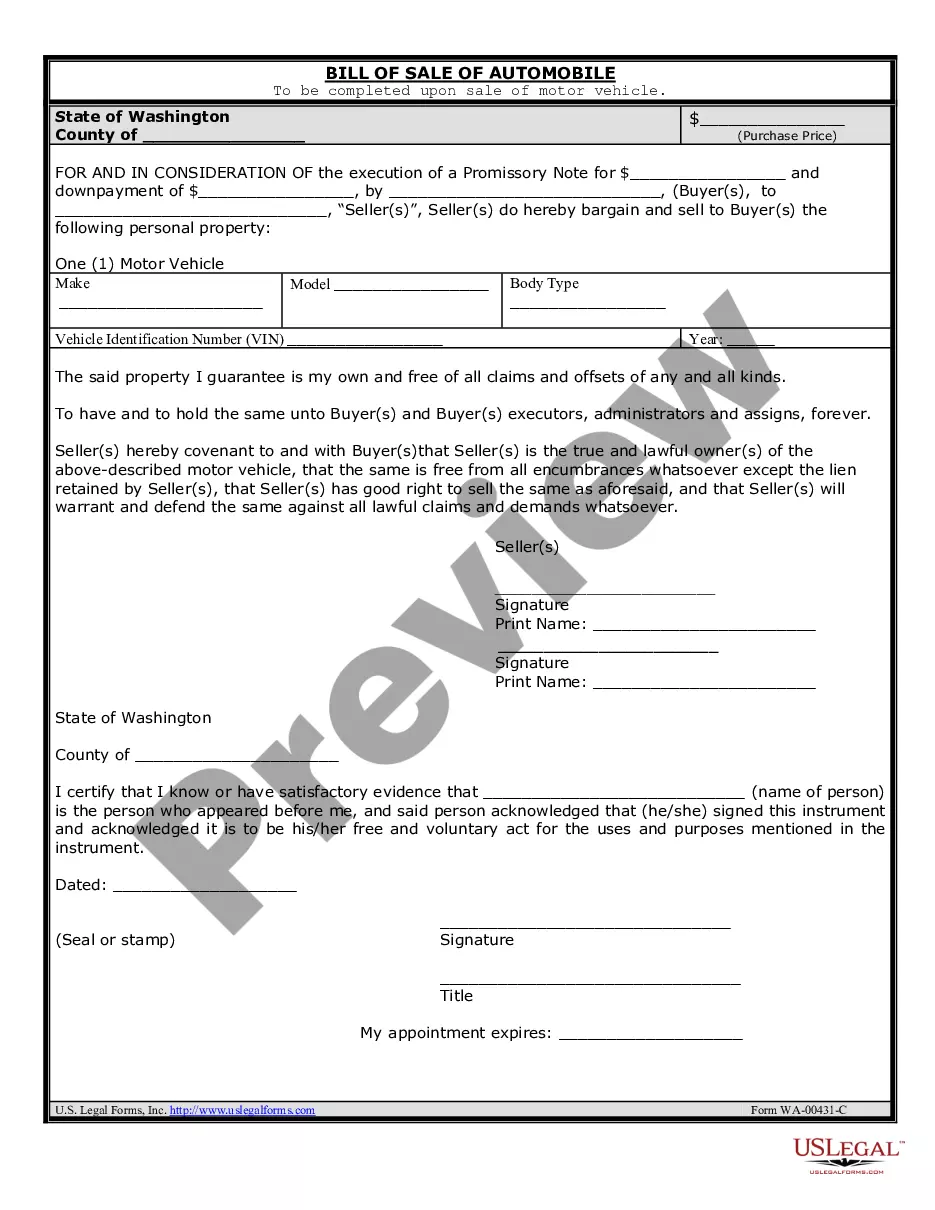

The West Jordan Utah Assumption and Loan Modification Agreement is a legal contract that outlines the terms and conditions for assuming a loan and modifying its terms in the city of West Jordan, Utah. This agreement is typically entered into when a borrower wishes to transfer their loan obligation to another party or when modifications need to be made to the existing loan terms. In West Jordan, Utah, there are various types of Assumption and Loan Modification Agreements available to borrowers, depending on their specific needs and circumstances. These can include: 1. Residential Assumption and Loan Modification Agreement: This type of agreement is commonly used in West Jordan, Utah, for residential properties. It allows a new buyer (assuming party) to take over the existing mortgage and modify its terms as agreed upon by both parties. 2. Commercial Assumption and Loan Modification Agreement: This agreement is specifically tailored for commercial properties in West Jordan, Utah. It enables the transfer of a commercial loan to a new borrower, who then modifies the loan terms, such as interest rate, repayment period, or principal amount. 3. Assumption and Loan Modification Agreement for Distressed Properties: This particular agreement is designed to help borrowers facing financial difficulties in West Jordan, Utah. It facilitates the assumption of a distressed property loan by a new responsible party while modifying the loan terms to make it more manageable for the borrower. During the process of executing a West Jordan Utah Assumption and Loan Modification Agreement, several crucial elements must be addressed. These include: a. Parties involved: Identifying the original borrower, the assuming party, and the lender. b. Loan details: Specifying the loan amount, the interest rate, the original loan terms, and any outstanding balances. c. Assumption terms: Outlining the terms and conditions for the assumption of the loan, including any fees associated with the transfer. d. Modification terms: Describing the modifications to be made to the loan, such as changes to the interest rate, extending or shortening the loan term, or adjusting the monthly payment amount. e. Legal obligations: Addressing the responsibilities of each party involved, including loan repayment, insurance requirements, and compliance with applicable laws and regulations. f. Execution and notarization: The agreement must be signed by all parties involved and notarized to ensure its authenticity and legal validity. In conclusion, the West Jordan Utah Assumption and Loan Modification Agreement is a vital legal document that allows for the assumption of loans and the modification of loan terms in the city of West Jordan, Utah. This agreement serves various purposes, encompassing residential, commercial, and distressed property transactions. It guarantees that all parties involved agree upon the terms and conditions for the loan assumption and modification, promoting transparency and clarity in the loan transfer process.

West Jordan Utah Assumption and Loan Modification Agreement

Description

How to fill out West Jordan Utah Assumption And Loan Modification Agreement?

If you are searching for a relevant form template, it’s impossible to choose a better place than the US Legal Forms site – one of the most considerable online libraries. Here you can get a huge number of templates for organization and individual purposes by categories and states, or keywords. Using our high-quality search feature, getting the most recent West Jordan Utah Assumption and Loan Modification Agreement is as elementary as 1-2-3. Additionally, the relevance of each and every record is proved by a team of skilled attorneys that regularly check the templates on our website and revise them in accordance with the newest state and county regulations.

If you already know about our system and have an account, all you need to get the West Jordan Utah Assumption and Loan Modification Agreement is to log in to your user profile and click the Download option.

If you utilize US Legal Forms for the first time, just follow the guidelines below:

- Make sure you have chosen the form you require. Check its explanation and make use of the Preview feature (if available) to check its content. If it doesn’t meet your requirements, use the Search field near the top of the screen to find the appropriate file.

- Confirm your choice. Select the Buy now option. Next, select your preferred pricing plan and provide credentials to sign up for an account.

- Make the purchase. Use your bank card or PayPal account to finish the registration procedure.

- Receive the template. Indicate the format and save it on your device.

- Make changes. Fill out, edit, print, and sign the acquired West Jordan Utah Assumption and Loan Modification Agreement.

Each template you add to your user profile does not have an expiration date and is yours permanently. You can easily access them via the My Forms menu, so if you need to receive an extra duplicate for modifying or creating a hard copy, feel free to come back and save it once again anytime.

Take advantage of the US Legal Forms professional catalogue to get access to the West Jordan Utah Assumption and Loan Modification Agreement you were seeking and a huge number of other professional and state-specific templates in one place!

Form popularity

FAQ

Tips for Home Loan Assumptions Until the seller is released from liability by the lender, they are responsible for the debt, and nonpayment by the would-be assumer of the loan could negatively impact their credit score. It's also important to accurately value the property before assuming the loan.

You can only appeal when you're denied for a loan modification program. You can ask for a review of a denied loan modification if: You sent in a complete mortgage assistance application at least 90 days before your foreclosure sale; and. Your servicer denied you for any trial or permanent loan modification it offers.

Assumption Loans: An assumption agreement is prepared by the existing lender of record and signed by the buyer as part of the escrow process. The seller may also be required to sign the assumption agreement and the terms may release the seller from responsibility.

Why Was I Denied for a Loan Modification? An incomplete or untimely loan modification application. Insufficient finances to afford a modified payment. ?Lack of hardship,? or ability to pay the current mortgage payments without issue. You have already received the maximum number of loan modifications the lender allows.

The borrower gets a lower rate and the lender doesn't risk losing the loan to refinance. Modifications are usually available at any time. However, if your mortgage contains an assumption provision, the lender will not agree to modify it once the process of assuming the mortgage begins.

Standards and guidelines vary, most lenders like to see a DTI below 35?36% but some mortgage lenders allow up to 43?45% DTI, with some FHA-insured loans allowing a 50% DTI.

An assumable mortgage allows someone to find a house they want to buy and take over the seller's existing home loan without applying for a new mortgage. This means the remaining balance, mortgage rate, repayment period and other loan terms stay the same, but the responsibility for the debt is transferred to the buyer.

To assume a loan, the buyer must qualify with the lender. If the price of the house exceeds the remaining mortgage, the buyer must remit a down payment that is the difference between the sale price and the mortgage. If the difference is substantial, the buyer may need to secure a second mortgage.

Simply put, no, the mortgage company is not required under any state or federal law to modify your home loan. Due to all of the government talk about helping homeowners, many people assume that their mortgage company is bound to provide a loan modification. This is not the case.

You could receive your mortgage loan modification in as little as 30 days. Or you could be left waiting upwards of 90 days for everything to go through. It really comes down to the individual lender and their ability to quickly process mortgage modifications.